Setting the power price: the merit order effect

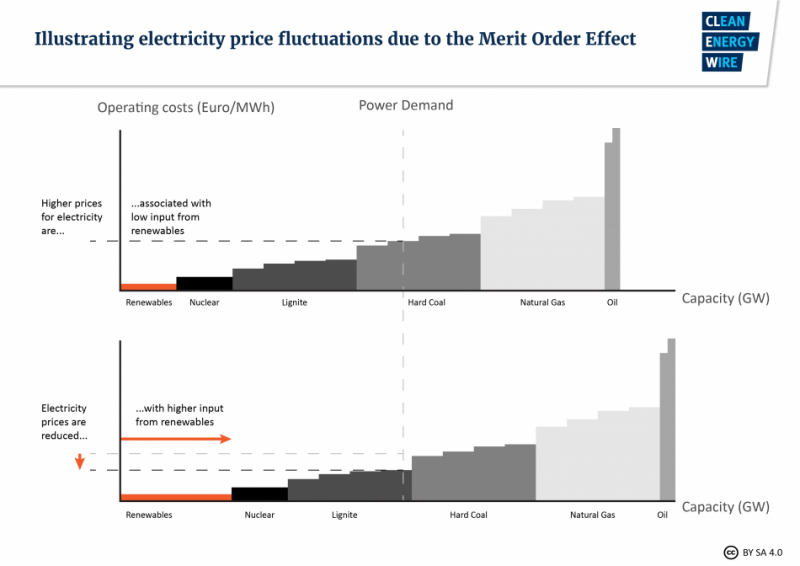

In the energy only market, the merit order effect describes the lowering of power prices at the electricity exchange due to an increased supply of renewable energies. The power price is determined by the “merit order” – the sequence in which power stations contribute power to the market, with the cheapest offer made by the power station with the smallest running costs setting the starting point. Power from renewable installations such as wind turbines and photovoltaic installations has to be sold on the exchange too, but these suppliers have almost no operating costs (since they do not need fuel or much manpower). That means they lower the entrance price and push more expensive conventional producers down the merit order (See Figure 1).

The intersection of the power demand and power supply determines the clearing price and the clearing volume. All electricity generators participating in the market will receive this clearing price for the electricity they produce for the grid. Equally, the buyers of electricity at the wholesale market will all pay that same price (clearing price).

Power stations with high generation costs such as gas-fired and hard coal-fired plants (often owned by the large utilities or municipal utilities) are vulnerable to being pushed out of the market as they cannot compete at the lower prices.

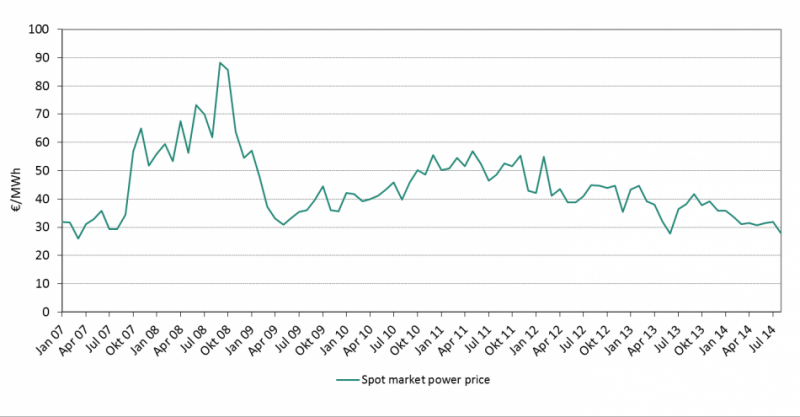

The average wholesale price for power on the spot market fell 11 percent from 42.60 euro/MWh in 2012 to 37.78 euros per megawatt-hour in 2013. In 2014, the average spot market price fell to an even lower 33 euro/MWh. (Also see Figure 2).

In October 2014, three gigawatts of gas power capacity were registered with the national grid agency (Bundesnetzagentur) as preliminary retired while overall net capacity of power stations – conventional and renewable – that feed their power into the German grid increased from 179.7 GW in 2012 to 188.1 GW (Bundesnetzagentur Monitoring Report, p. 35).

Shaving the lunchtime peak

Another effect of increased supply from renewables, particularly solar power, is the flattening out of the daily lunchtime peak price at the power exchange. At this time of high demand, gas- and coal-fired plants used to be able to achieve high returns but with solar power production also peaking around noon, conventional power plants lost this important advantage.