Germany bets on green hydrogen in quest for climate neutrality

A rapidly growing number of countries striving for climate-neutrality have placed large bets on hydrogen made with renewable electricity to reduce emissions in industries where it is most difficult. But producing the extremely energy-rich gas requires huge amounts of electricity, making it more expensive than conventional fuels. This is why decisive government action is needed to kick-start an international "hydrogen economy”. But, despite the high hopes of many, experts warn that hydrogen is not a cure-all in the fight against climate change, and call for doubling down on other steps to slash emissions.

"There is no doubt that we will need renewable hydrogen on a large scale if we want to decarbonise the economy properly. But there are disagreements over the details – for example, where it should be used, and whether to include 'blue' hydrogen made with carbon capture and storage (CCS)," Felix Heilmann, researcher at climate think tank E3G, told Clean Energy Wire.

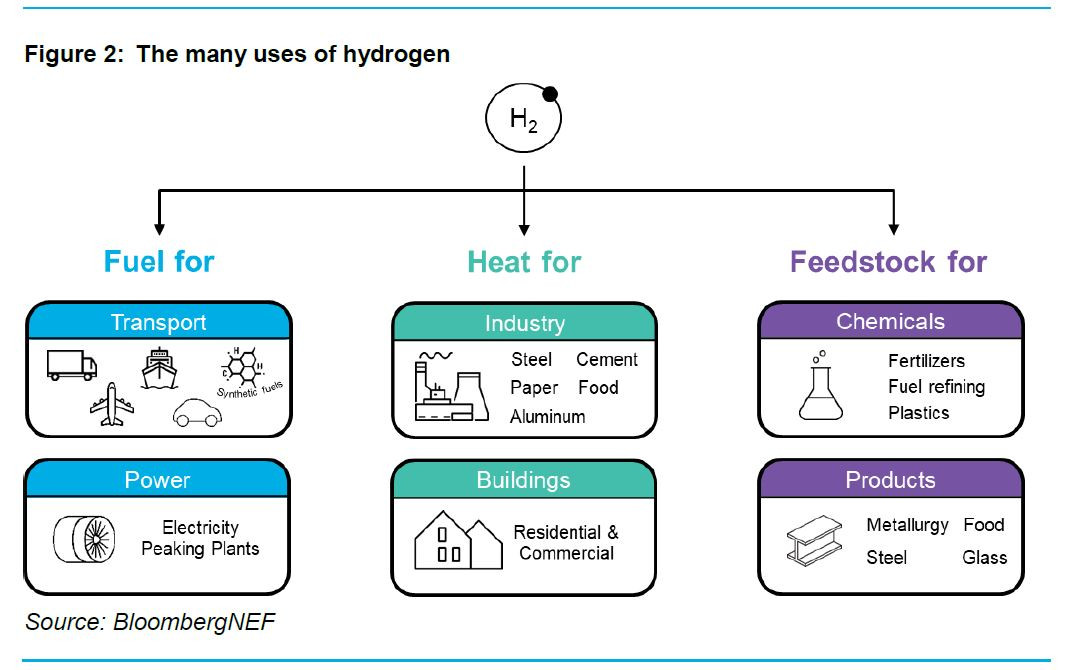

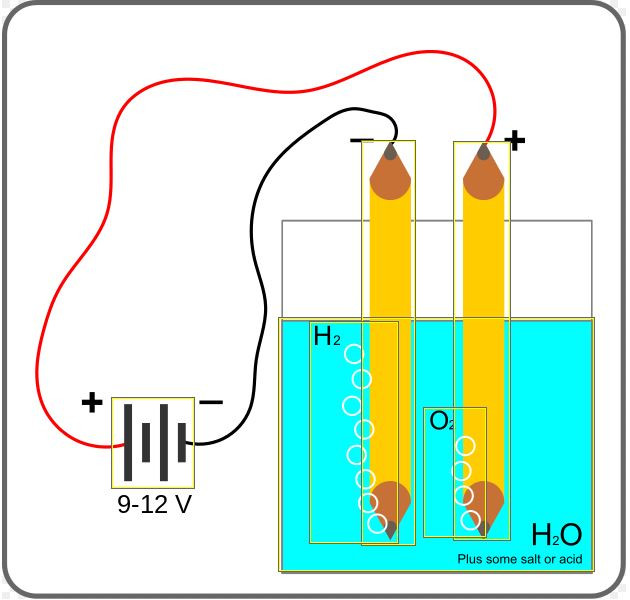

A lion’s share of current greenhouse gas emissions can be avoided by increasing efficiency, and by replacing fossil fuels with clean electricity directly – for example, using electric cars instead of combustion-engine models. But there are a number of activities where this approach doesn't work. For example, there is no technology on the horizon that could enable to power large planes and ships with batteries, because they are much to heavy. This strategy will also fail in many industrial sectors – for example, chemicals or steelmaking, where entirely new production methods are required because current processes cause unavoidable CO2 emissions. Here green hydrogen made in electrolysers has emerged as the leading candidate to deliver the deep emission cuts needed to achieve carbon-neutrality.

Hydrogen promises to be an extremely versatile tool in the race to decarbonise. It can be used to store energy for an unlimited time, and as an energy source for sector coupling, for example in the transport sector. It also can be used to make synthetic fuels that can replace fossil fuels as a feedstock, for example to make plastics. A further advantage is that it can be traded internationally. The World Energy Council estimates that the demand for green synthetic fuels could equal around 50 percent of today's global demand for crude oil from mid-century onwards.

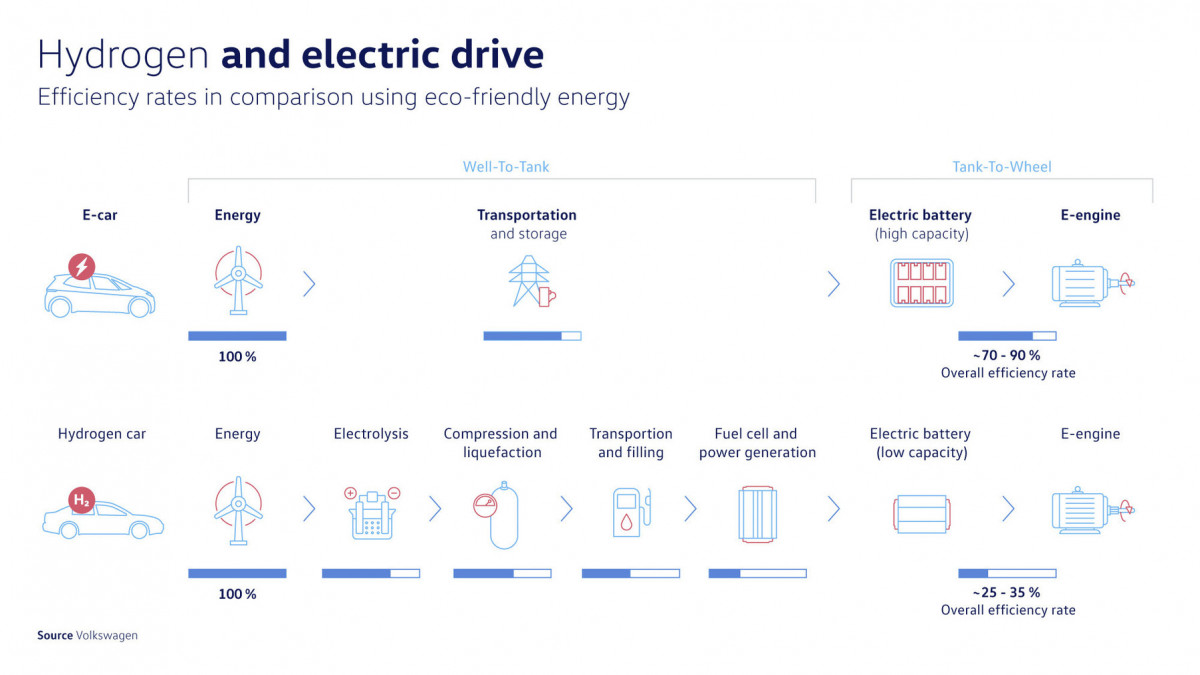

But hydrogen has a big downside. It is dangerously explosive – after all it's used as rocket fuel. This means that it requires a complicated infrastructure. A further drawback is that its use can be highly inefficient, because a lot of energy is lost while it is being made.

Germany sets out to harness the potential of "tomorrow's oil"

Energy transition pioneer Germany, which wants to become climate-neutral by 2050, has set out to harness hydrogen's potential to further its Energiewende, and to make clean hydrogen technology made in Germany an export success. It plans to lay the cornerstone for realising these ambitions with a highly anticipated National Hydrogen Strategy, which is due to be approved by government in the coming weeks.

The government says the climate-neutral gas will play a central role in powering tomorrow's clean economies around the globe, creating huge export opportunities for the country's famed engineering companies.

"Green hydrogen is tomorrow's oil. The flexible energy carrier is indispensable for the energy transition and opens up new markets for us," states the country's research ministry. "The energy of sun and wind can thus be stored, transported and used as required with a versatile energy source […] We must seize the unique opportunity to use our know-how to become the supplier of a global energy transition."

The government has said Germany could create hundreds of thousands of jobs by the middle of the century if it can hold onto its current share of the global market for electrolysers that produce hydrogen, which stands at around 20 percent.

German industry has also become a cheerleader for hydrogen. Ramping up this technology internationally would be "a success both in terms of climate policy and industrial policy," according to Germany's industry association BDI, which insists that "the current hydrogen hype is justified." The country's utility association BDEW also considers the renewable gas an "all-round talent of tomorrow's energy supply."

But E3G's Heilmann and other experts also warn that the focus on green hydrogen must not lead to a neglect of other steps to reduce emissions – for example, increasing efficiency, recycling, and substituting emission-intensive materials such as steel, concrete, and plastics with climate-friendly alternatives wherever possible.

Making clean hydrogen commercially viable for industry

Germany will eventually have to replace the natural gas left in its energy mix with clean alternatives to become climate-neutral. Natural gas currently covers almost a quarter of Germany’s primary energy consumption, mostly used for heating and cooling in households and public buildings, and in industrial heating systems. In the whole of the EU, burning natural gas causes more emissions than burning coal.

Industry already uses hydrogen as a raw material or energy carrier in many processes, but it is made from fossil fuels. On a global scale, this conversion is responsible for yearly emissions of around 830 million tonnes – roughly equivalent to Germany's entire footprint.

German heavy industry is already betting heavily on clean hydrogen in their long-term decarbonisation plans. Many energy-intensive German companies, like chemicals group BASF or steelmaker Thyssenkrupp, already have detailed plans for drastic emission cuts, but lack viable business models to implement them – not only because renewable hydrogen remains too expensive, but also because massive investments are required to enable its use on a large scale.

Many companies in these sectors have launched pilot projects to test low-emission hydrogen technologies. For example, steelmaker Salzgitter proposes to use hydrogen to make climate-neutral steel, but it says it can't realise its plans because they will cost billions of euros – making the steel much more expensive, without improving the end product. Industry executives say the government must find a way to make the technology commercially viable – for example with investment subsidies, and cheap and abundant renewable electricity.

The same is true for chemical makers - one of the country's most energy intensive sectors. The industry said in a study it could become largely greenhouse gas neutral by 2050 with additional investments of around 45 billion euros. But it would need more than 600 terawatt hours (TWh) of electricity per year from the mid-2030s – more than Germany's entire current power production – mainly to produce hydrogen and other renewable fuels. The steel industry has also declared it will need huge amounts of renewable electricity to decarbonise. These figures illustrate that Germany will have to import the bulk of its future green hydrogen demand, simply because the country is too small to make sufficient amounts of the fuel with renewable power.

Because of the enormous power supply required to make green hydrogen, conversion losses, and the expected surge in demand, many experts advocate restricting its use to applications that cannot be decarbonised using simpler methods. For example, energy economist Claudia Kemfert from the German Insitute for Economic Research (DIW) calls for limiting the use of hydrogen in the transport sector. "We should only make such additional efforts when there are no or hardly any climate-friendly alternatives, i.e. in heavy goods traffic, ships or aircraft," Kemfert argues. "For small cars in private transport, as we know it today, this effort is certainly not worthwhile. Hydrogen would be far too expensive for that." Others say it shouldn't be used for heating, because heat pumps can use renewable electricity directly and therefore more efficiently.

"Clean green hydrogen is an expensive premium product with limited availability," says Heilmann. And it remains a long-term project: Most studies conclude that green hydrogen won't be competitive with natural gas before the 2030s.

Hydrogen investments could become a strand of "green stimulus” packages

As the coronavirus pandemic takes its toll on the global economy, state support is all the more urgent. After all, as companies’ profits wane so will their appetite for expensive low-emission projects. Even before the current crisis, Germany's industry was weighed down by economic challenges such as trade conflicts related to the US, China, and Brexit, as well as digitalisation, structural changes and a slowing global economy.

But the crisis also offers the opportunity to include low-emission investments in government efforts to get the economy back on track, in the form of so-called "green stimulus" programmes discussed at national, European, and international level.

"The funds mobilised for upcoming economic stimulus programmes will most likely remain unmatched in the coming years. This creates a historical opportunity to transform the economy into a low-carbon and sustainable one," states Germany's Sustainable Finance Committee. "It is now especially important to create the necessary regulatory framework and enabling conditions to facilitate investment in more sustainable projects for infrastructure improvements and across industries within Germany and wider Europe."

According to energy think tank Agora Energiewende, investments to the tune of 15 billion euros are needed to get the industrial sector on a sustainable growth track after the pandemic. German industry with its roughly 5.6 million employees could use the interruption to improve its long-term competitiveness by improving the energy efficiency of steel furnaces or chemical steam crackers. The think tank proposes investing five billion euros into ramping up Germany's hydrogen production capacity, which would enable a production capacity of 10 gigawatts by 2030.

The International Renewable Energy Agency's (IRENA) also specifically recommends hydrogen investments in response to the coronavirus crisis in its2020 Global Renewables Outlook.

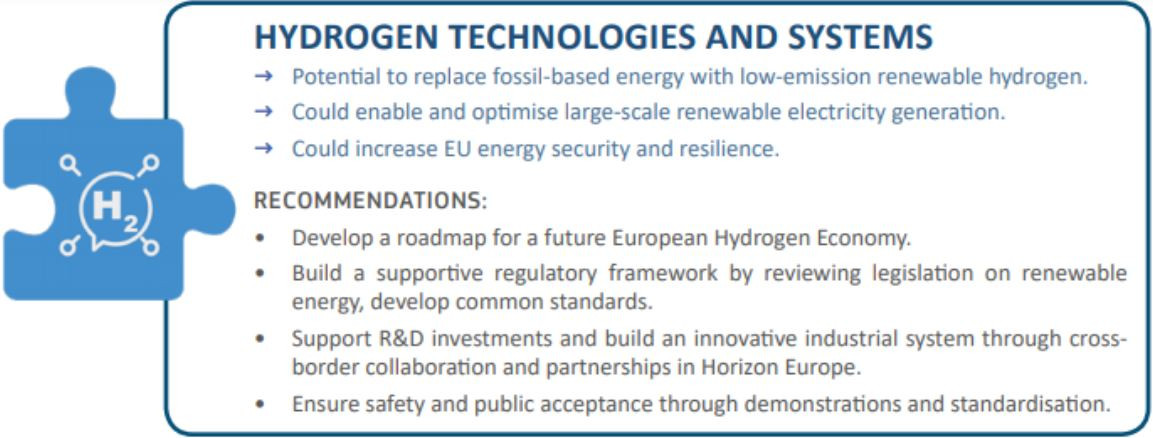

Germany is "linchpin" of Europe's hydrogen strategy

Germany's initiative to pave the way for a hydrogen economy looks set to become a key part of a broader European strategy. The European Commission said in March it would present an EU-wide Clean Hydrogen Alliance in the summer, in support of the bloc's objective of becoming the first climate-neutral continent in the world by 2050. The initiative enjoys broad backing from EU member states and companies involved in the hydrogen value chain, with Germany and the Netherlands among the countries that have signalled the strongest interest, an EU official told Euractiv. The EU looks set to declare the hydrogen push an "Important Project of Common European Interest" (IPCEI), enabling government subsidies without strict state aid limits.

The Netherlands already unveiled a national hydrogen strategy in March, stating the country wants to use its “unique starting position” in the gas value chain to become a world leader in the production and use of green hydrogen, which “can become a globally traded commodity”.

"Our aim is to intensify cooperation on hydrogen across national borders. We are thinking globally. However, cooperation with Germany has priority," said Noé van Hulst, the country's hydrogen envoy. Germany is "the linchpin of a future European hydrogen infrastructure" due to its central location and strong industry, van Hulst said.

The EU's plans for a hydrogen strategy follow a call for action on hydrogen by European business associations. For their part, industry groups applauded the EU's move. "We are still leading as Europeans. But especially China is challenging that position. A Hydrogen Alliance would definitely help to boost the European industries," said Jorgo Chatzimarkakis of the Hydrogen Europe business association. Germany's economy minister Peter Altmaier has also referred to China, Japan, and other Asian countries as the biggest competitors in the hydrogen technology race.

With reference to Germany's and Austria's hydrogen plans, Chatzimarkakis said: "This all looks like the starting point of a coherent European Hydrogen strategy."

The oil and gas industry is among the loudest supporters of hydrogen-economy plans, not least because it could offer the companies an entry into a low-carbon future, as their existing gas infrastructure could be used for the production, transport and storage of hydrogen. The renewables industry is also enthusiastic, because making green hydrogen will require massive amounts of renewable electricity.

Ministries disagree over key strategy details

Given its international relevance, Germany's hydrogen strategy has been eagerly awaited for months, amid a succession of stumbling blocks. It has not only been delayed by the pandemic, but also because the ministries involved could not agree on targets for making green hydrogen. Controversy has also ensued about the extent to which "blue" hydrogen made with natural gas using controversial carbon capture and storage (CCS) should be used as a transitional technology, and whether hydrogen should also be used for cars and heating.

"The hydrogen strategy is a landmark decision. It should result in coordinated measures that replace the existing potpourri that won't get us anywhere quickly," said E3G's Heilmann.

While think tanks and opposition parliamentarians have criticised the German economy ministry’s draft strategy for including blue hydrogen, industry association BDI opposes ruling out its use. It argues that any insistence on green hydrogen would slow technology development given that the CO2 neutral gas will not be available in sufficient amounts to allow large-scale applications by 2030. The economy ministry's February draft, seen by the Clean Energy Wire, said that while green hydrogen “is sustainable in the long term,” blue hydrogen “will have to play a role for economic reasons to quickly establish the technology in the market to decarbonise various areas of application.”

In contrast, Germany's research and environment ministries have pushed for an ambitious focus on green hydrogen, and a clear priority for sectors without an alternative route to a low-carbon future, especially heavy industry. "We need a clear schedule and a clear target, and that must be green hydrogen," said research minister Anja Karliczek, who called blue hydrogen a "distraction."

Environmental activists also view blue hydrogen with scepticism, fearing it offers a pretext for the oil and gas industry to prolong fossil fuel operations. They also say that it is not emission-free, because of methane emissions during natural gas production and transport.

Most blue hydrogen supporters agree that it would have to be gradually substituted with the green variety to strike long-term climate targets. Green hydrogen also looks set to quickly replace the "blue" variety as soon as it becomes available in sufficient amounts, because the cost of hydrogen made with CCS will far exceed the renewable variety, according to estimates by Bloomberg New Energy Finance.

“Clear prioritisation is needed here; CCS cannot be the 'wild card' for every sector,” says Heilmann.