German financial sector expects EU standards to boost green finance

The integration of the financial industry into Germany’s climate action efforts is key to making the country’s entire economy more sustainable. However, “greening” the German finance sector is hindered by the absence of common national and European standards, as well as investors focusing too much on short-term returns, experts said at a conference in Frankfurt.

Germany had to work towards making sustainability criteria, such as climate protection, an integral part of the investment strategies and financial regulations both nationally and across the European Union, Levin Holle of the German finance ministry (BMF) told the Sustainable Finance Summit Germany.

The event was organised by the Hub for Sustainable Finance (H4SF), an initiative by the German Council for Sustainable Development (RNE) and Germany’s stock exchange, the Deutsche Börse Group, which seeks to bring together actors from the financial industry, environmental organisations, and policymakers in a bid to promote green finance principles and to provide a platform for dialogue about the impacts of banking and investment on climate action.

Holle said the financial system must support sustainable development goals, and that Germany needs to become “a globally relevant location” for making this happen. He considered it crucial to identify the risks associated with non-sustainable investments and to apply higher prices accordingly, but stressed that this could only be carried out effectively at the European level.

Karsten Löffler, co-head of the Frankfurt School of Finance’s UNEP Collaborating Centre and manager of the Green and Sustainable Finance Cluster Germany (GSFC), said that Germany has particular strengths when it comes to integrating financial services in its efforts to create a more sustainable economy. It’s innovation-driven industry, its powerful small- and medium-sized company sector, the “Mittelstand,” and its far-reaching experiences with the Energiewende, the country’s dual effort to phase out fossil fuels and nuclear power in favour of a more efficient energy system based on renewables, all contributed to a conducive environment for green finance, he said.

The European Commission’s Action Plan for a Greener and Cleaner Economy, launched in March 2018, was key for establishing international sustainability standards for financial investments across Europe and a common European taxonomy to better understand and quantify long-term risks stemming from non-sustainable investments, finance ministry representative Holle said. “We need to move from talk to action,” he added, stressing that financial reporting standards for both financial and industrial companies are a prerequisite for inducing change in the financial sector.

"Technically challenging and politically sensitive"

Holle said that European financial disclosure regulations, benchmarking of sustainability criteria, and transparent labelling of green financial products were paramount to ensure that companies willing to improve their sustainability record find a framework to build on, but warned that a flawed European taxonomy that omits or misinterprets standards “bears a great risk in itself” as it could perpetuate environmentally damaging developments. “We’ll have to decide which parts of the EU action plan can still be implemented before the European elections” in May 2019, he said.

Speaking for the European Commission’s Directorate-General for Financial Stability (DG FISMA), Martin Koch said that while European standards for sustainable finance “are the most important tools” to achieving meaningful change in the financial industry, “this is both technically challenging and politically sensitive.” Definitions of sustainability still vary significantly across the countries of Europe, and diverging national interests in applying them add to the difficulties in arriving at a common European taxonomy. He said including social aspects that consider the economic interests of workers and citizens is necessary to achieve a broad acceptance of a joint European sustainable investment standard.

Investors keen to go green but lack regulative infrastructure

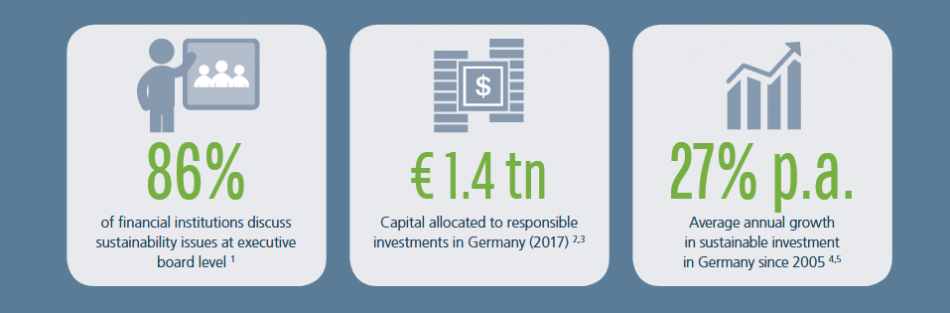

In August 2018, the GSFC published its first baseline report on the status of sustainable finance in Germany. It found that the topic is discussed intensively in financial companies and institutions, but that the absence of standards and definitions prevent the collection and assessment of relevant data. This uncertainty makes it difficult for companies to turn their green ambitions into action and carry out investments guided by sustainability criteria.

Private capital will certainly be needed to fund the transition to an economy that better manages natural resources and curbs environmental damage, such as global warming, commented H4SF manager Karsten Löffler.

“The state alone is not able to make the necessary investments in sustainability,” Löffler said. However, “private investors are very keen to engage” and top up public investments, he added. In 2017, sustainable investments in Germany totalled 1.4 trillion euros, with annual growth rates reaching 27 percent on average since 2005. But this alone would not be enough to ensure that German and European climate targets are bolstered by sufficient funding, the H4SF baseline report found.

At the summit in Frankfurt, Joachim Faber, chairman of Deutsche Börse’s advisory board, encouraged willing investors to experiment with sustainable investments and surmount fears that these could turn out to be less rewarding. According to Faber, sustainable investment indices did not perform worse on average than conventional indices in terms of capital returns – “and they even perform much better when accounting for risk-adjusted returns.” “Basically,” he said, “sustainable finance amounts to nothing less than good risk management.”