Net zero targets could force Taiwan's chipmakers abroad

*** Please note: This article is the first in a series on the international impact of corporate net zero targets, which is part of the CLEW focus on company climate claims.

This dossier lists our existing publications and future content plans, and our upcoming events are here.

This blog explains why we decided to launch the project.***

As the world’s largest technology companies, such as Apple, Google and Microsoft, push for emissions reductions along their entire supply chains to reach net zero targets, Taiwanese chip suppliers find themselves at a competitive disadvantage. The production of chips requires a lot of electricity, and there are few options to source renewable power on an island with a particularly dirty power mix.

Without microchips as core processing units, none of our cars, smartphones or laptops would work. The widespread delivery hiccups caused by the COVID-19 pandemic shed light on how indispensable these tiny parts are for today’s economy. The shortage rippled across countries and industries: in Germany, for example, new car registration fell ten percent in 2021, partly as a result of the chip shortage.

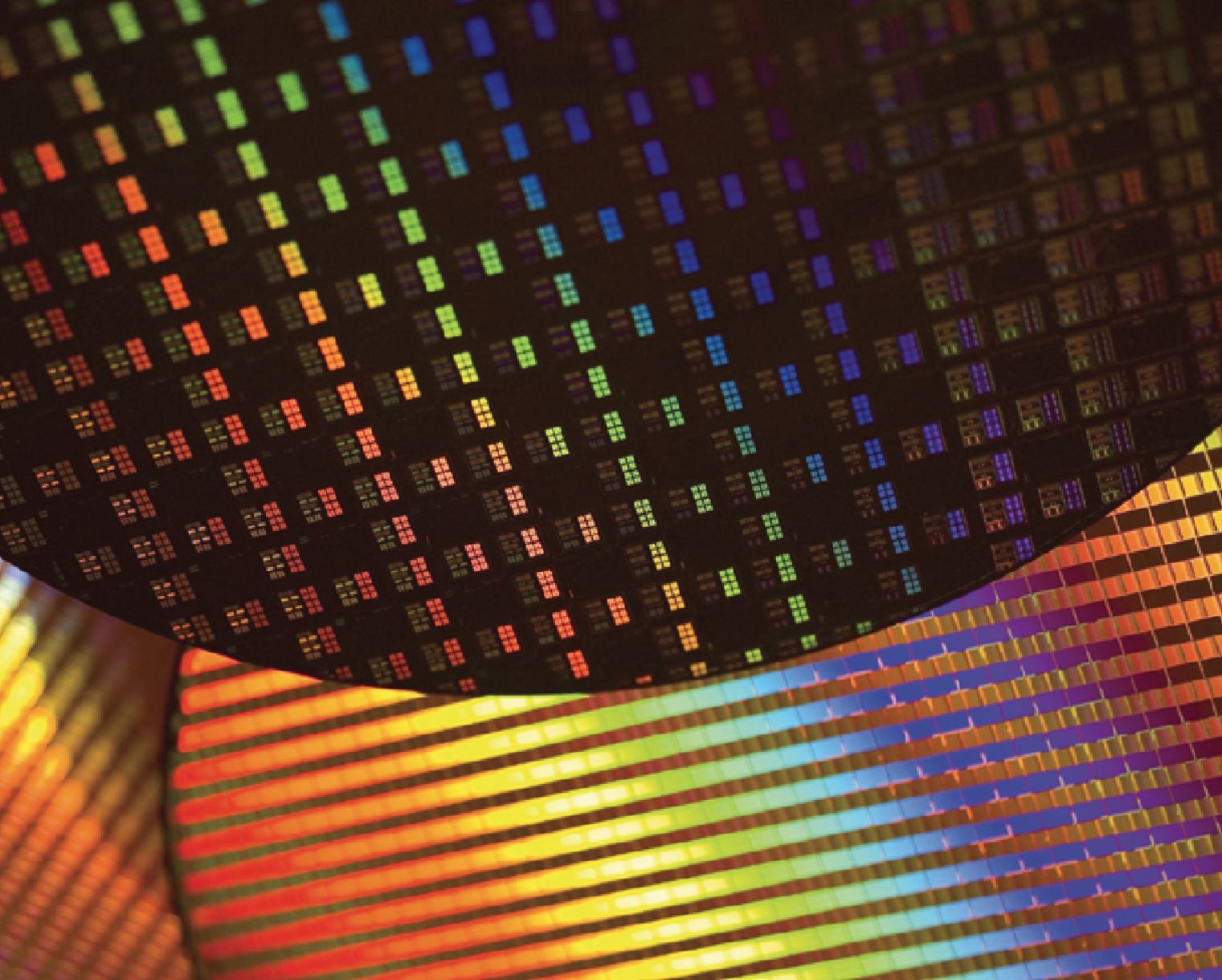

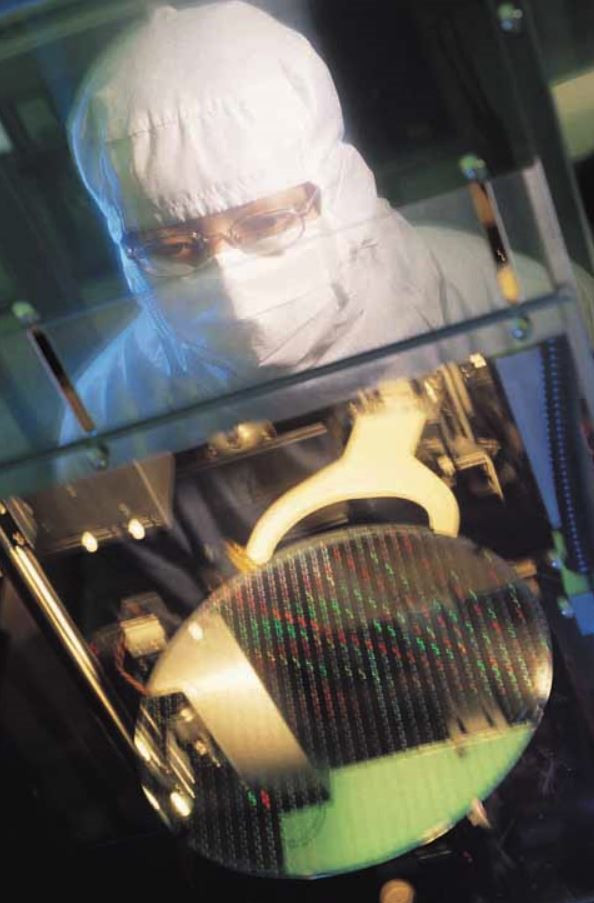

More than 90 percent of the world’s manufacturing capacity for the most advanced semiconductors — with transistor sizes (nodes) below 10 nanometers — is located in Taiwan, according to the Boston Consulting Group. The smaller and more energy-efficient semiconductors are, the more energy-intensive their production becomes.

Since chips are used in countless products and net zero targets are spreading across industries, the race for low-carbon semiconductors is on. "The chip industry has for a long time put less priority on taking on the decarbonisation issue," said Guy Wittich, a senior strategic advisor on the semiconductor industry in the Dutch Ministry of Economic Affairs and Climate. "Now that is changing. With rising energy costs and a worsening climate crisis we see industry taking on that aspect more seriously."

Following the Paris Agreement of 2015, tech companies committed to net zero goals one after another. Apple unveiled a roadmap in July 2020 to achieve carbon neutrality for its products and supply chain by 2030, putting huge pressure on its suppliers, particularly chipmakers, which account for a substantial part of supply chain emissions.

But with a power sector dominated by fossil fuels, Taiwan faces mighty challenges to provide “green” chips, because the enormous amount of electricity needed is responsible for a large part of semiconductors’ climate impact – in technical terms, scope 2 emissions from purchased electricity.

As of 2021, 81.6 percent of the electricity Taiwan consumed came from fossil fuels, mainly from imported LNG (42.5%) and coal (35.6%), while renewables accounted for a mere 6.3 percent. This sobering result led officials to downgrade this year their 2025 renewables target to 15 percent from an original target of 20 percent. Taiwan’s government still plans to cover 60 percent of the power use with renewables by 2050.

It’s hard to overstate the power needed to make advanced chips. Taiwan’s largest chipmaker TSMC accounts for 6 percent of Taiwan’s total electricity demand. In 2025, that number is forecast to rise to 12.5 percent. Liang Chi-yuan, professor of management at National Central University in Taoyuan City, told Bloomberg Taiwan won’t have enough electricity capacity to accommodate its semiconductor industry unless chipmakers start building their own power plants.

TSMC is arguably among the world’s most important companies most people have never heard of. The company is the largest supplier of outsourced chips, which makes its products ubiquitous - it produces chips for Apple’s iPhones, iPads and the Mac. In 2021, it was the third largest semiconductor maker in the world with US$56.84 billion in sales, just after Samsung (US$82.02 billion) and Intel (US$76.74 billion), according to a Focus Taiwan report.

Like many other chipmakers, TSMC has set a net zero target for 2050, which includes the target to exclusively source renewable energy by that date (see table). Scope 2 emissions – mainly from using electricity - accounted for 62 percent of the firm's total in 2020, according to a TSMC report.

|

Market share* |

Company |

Net zero** pledges |

Strategies |

|

28% |

TSMC (Taiwan) |

September 2021:

|

|

|

13% |

UMC (Taiwan) |

June 2021:

|

|

|

10% |

Samsung (South Korea) |

Sept. 2022:

|

|

|

7% |

GlobalFoundries (US) |

Aug 2021:

|

|

* Share in global semiconductor manufacturing revenues

** Including Scopes 1 & 2

Sources: Counterpoints Research, TSMC, UMC, Samsung, GlobalFoundries

For TSMC, it is imperative to decarbonise if it wants a future in the business. Apple, its most important customer, contributed 26 percent of TSMC revenues in 2021, and is exerting enormous pressure on suppliers to achieve its 2030 net zero target, which includes 100 percent renewable electricity, also in its supply chain.

At present, it looks extremely unlikely that TSMC can fulfil these demands. Even if it reaches its own target of using 40 percent renewable electricity by 2030, it will still be falling far short of Apple’s expectations. Judging from the chipmaker's recent emissions statistics, decarbonisation is no less than an uphill battle, as it consumes more and more power. According to its TCFD report, the company’s scope 2 emissions grew 38.7 percent between 2014 and 2020.

In contrast, rival Intel committed to net zero greenhouse gas emissions in its global operations by 2040, and wants to achieve 100 percent renewable electricity as an interim milestone in 2030.

For TSMC, Taiwan is where the biggest challenges lie. The global proportion of scope 2 emissions from the firm’s Taiwan chipmaking plants, or fabs, grew from 93.5 percent in 2014 to 99.6 percent in 2020, as detailed in the TCFD report. While TSMC’s global subsidiaries outside of Taiwan cut emissions by 86 percent in the same period, the emissions attributed to its Taiwan fabs increased by 47.7 percent.

Explosive demand for its products, coupled with the adoption of power-consuming technology, contributed to the emissions surge. TSMC owns 80 EUV (extreme ultraviolet) machines, an extremely power-hungry lithography equipment manufactured by Dutch chip-gear specialist ASML, according to Bloomberg.

Responding to the decarbonisation challenges in a written statement, TSMC didn’t want to comment on individual customers or specific markets, but estimated that their carbon emissions will peak in 2025, considering the development trends of Taiwan’s renewable energy market and the continued implementation of greenhouse gas reduction practices.

“We believe the use of renewable energy is a critical strategy to achieve net zero emissions,” TSMC said, without specifying how they plan to deal with the gap with Apple’s expectation.

TSMC reiterated its strategies to decarbonise, including direct emission cuts in manufacturing, corporate power purchase agreements (CPPAs) for renewable electricity, carbon credits and energy efficiency improvements.

Complicating the matter, TSMC cannot deliver the emission cuts alone. In its Sustainability Report, TSMC has set a target for its own suppliers, who contribute 24 percent of TSMC’s emissions, to save 1,500 GWh of electricity use by 2030. It has also demanded that its major equipment suppliers cut power consumption of their products by at least 20 percent by 2030.

Fight or flight?

Should TSMC and its supply chain fail to meet their decarbonisation targets, the company will likely face heightened pressure from its big customers, and could face revenue losses.

One option to decarbonise chip production is to locate plants in countries with plentiful supply of renewable power. This process is already set in motion: TSMC is working around the clock to build new fabs in Arizona in the U.S. and in Kumamoto in Japan, both expected to start production in 2024.

“Access to renewable energy may be a major factor as companies decide where they should build new fabs—something that is becoming more common as they try to increase capacity to alleviate the chip shortage,” according to consultancy McKinsey.

“They can generate further gains by developing new off-grid power sources that rely on green technologies, such as photovoltaics, fuel cells and battery energy storage systems. But these supplies often only complement, rather than replace, a fab’s long-standing on-grid sources.”

If TSMC is to provide low-carbon chips for specific customers, they are more likely to come from locations outside of Taiwan. Because of its dirty power mix, Taiwan’s carbon intensity (emissions produced for each kilowatt-hour of electricity generated) of 567 grams is 60 percent higher than that of the U.S., 36 percent higher than Japan and 61 percent higher than Germany.

Industry experts expect TSMC to continue to diversify locations. Renewable energy use, as well as supply chain security concerns related to geopolitical risks, could play a part in the decision making.

In the broader chip industry, alliances are formed to foster momentum for sustainability. The Belgian Interuniversity Microelectronics Centre (imec) introduced the Sustainable Semiconductor Technologies and Systems (SSTS) programme in September 2021, allowing participants to share and have access to information on the environmental impact of various chip making processes, like CO2 emissions, electricity and water consumption, and raw materials use.

According to Lars-Åke Ragnarsson, SSTS programme director, the semiconductor manufacturers have never been transparent about their data, because it was long considered proprietary and kept secret.

Now, via the SSTS program, chip designers and equipment manufacturers have access to comprehensive data in order to conduct life-cycle assessments of their designs. For example, a designer could know how much water and material use, emissions and power consumption would be associated with a certain technology, with different parameters adjustable, including region and electricity mix.

“Data is crucial for the companies to make decisions on what kind of designs should be adopted to minimise impact on the environment,” Ragnarsson said. The next step would be to help fabs reduce these environmental impacts.

As of October 2022, the initiative had 11 partners, including five big systems (such as Apple), one foundry and five equipment suppliers. All data is anonymised, and SSTS won’t do rankings of any kind. The programme is expected to launch the “imec.netzero” platform in late 2023 for public use.

Ragnarsson said he has seen positive responses across the board. “Sustainability is one of few areas where companies are willing to share information,” he said.

Other similar initiatives may soon also materialise. On the sidelines of the COP27 climate conference in Egypt, the global chip industry association SEMI launched the Semiconductor Climate Consortium (SCC) and announced 65 initial members across the supply chain, including GlobalFoundries, Global Wafers, imec, Intel and TSMC.

Industrial alliances and ambitious pledges are essential, but they cannot replace real efforts. The net zero challenges for the chip industry are dire, especially so for TSMC, whose manufacturing prowess relies on increased consumption of energy in a place where the adoption of renewables is much slower than elsewhere. If decarbonisation is a top priority for TSMC, locating plants outside of Taiwan could be its only option.