EU plans 'completely change outlook' for global hydrogen economy - BloombergNEF

Please note: This interview complements our in-depth analysis Europe vies with China for clean hydrogen superpower status.

Clean Energy Wire: European policymakers and industry often refer to China as the main rival in its green hydrogen ambitions. In which particular areas is China a threat to Europe's hydrogen industry?

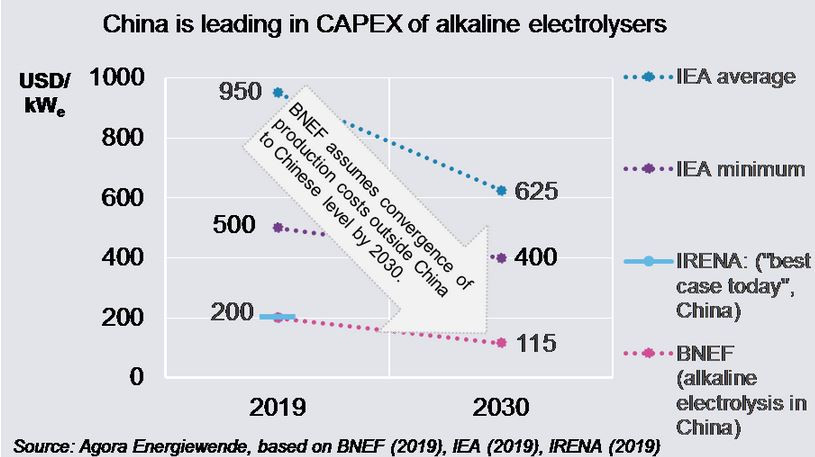

Kobad Bhavnagri: The Chinese have a lead in low-cost electrolyser manufacturing. According to the market surveys we've conducted, the price of electrolysers in the Chinese market is about 80 percent less than that in Europe. That makes the economics of producing hydrogen from renewable energy potentially much, much better in China and also, of course, opens the possibility that Chinese electrolyser manufacturers could start to export this equipment overseas and dominate electrolyser sales in the way they have dominated solar PV. China has a lead in that sense – cost advantage over European, and indeed Japanese or American equipment makers. But as far as we can tell, there isn't a whole lot of other hydrogen usage activity happening in China, apart from fuel cells. So Europe is more advanced in pilot projects it is conducting to use hydrogen in various different applications particularly in heavy industry, where we think hydrogen has the most promise, and also in other parts of the value chain and the supply chain – storing and transporting hydrogen – there is a little more happening in Europe than there is in China.

The big question is: Can the European manufacturers further cut costs to match the price of Chinese production, which in itself will be a moving target? And if they don't, then our hypothesis is that the Chinese products will start to be exported and eventually become dominant in the market or indeed western electrolyser manufacturers would begin to offshore their production into China where things can be done more cheaply. I wouldn't say at all that it is a foregone conclusion that the European products can be manufactured for the same price as the Chinese, but the forces of competition and economics suggest that either they will need to or they get outcompeted.

Do you think the Chinese-EU rivalry will force down green hydrogen prices enough to allow more countries to adopt net-zero climate targets?

Cheap hydrogen would certainly make committing to a net-zero target easier. Competition in hydrogen technology between Europe and China will be crucial to kickstart a global hydrogen economy, because it will drive down the cost of the technology, which will need to play a key role in cutting emissions in many sectors. In turn, this will enable more countries to commit to net-zero targets. We've seen this development in solar PV, where competition in manufacturing between Europe and China led to a drastic drop in prices, changing the economics, and thus paving the way for today's global roll-out of this technology, and renewable targets in many countries. Therefore, it will be exciting to watch how this competition will unfold in the years to come.

What this market needs foremost is to scale up, and that requires some countries or regions to take the lead, and to put in substantial commitments. And then it requires other countries to join in the race so the scale starts to multiply, and also strong competition, which is of course the engine of progress in our system.

German hydrogen strategy aims for global leadership in energy transition

EU wants to become market leader in hydrogen technologies, create 1 million jobs

Europe's and Germany's leadership in hydrogen is exactly what was needed to kickstart the move towards a hydrogen economy. And it's pretty cool because just a few weeks ago, before Germany came out with its announcement, it wasn't clear at all that hydrogen was going to happen. It was a promising concept, but the money just wasn't there, and the investment mechanisms just weren't there. But now with Europe and Germany willing to go first, and put real money behind their plans, that really sends a strong signal to everybody else – to China, to Japan, to South Korea, perhaps to parts of the United States – to say: 'Ok, we can't be left behind here.'

Do the new commitments by Germany and the EU make you more optimistic that the necessary price decrease will happen?

Yes, they completely change the outlook. Previously in our Hydrogen Economy Outlook, we were cautious or even sceptical that scale-up would happen, that the cost targets could be achieved, but the actions of Europe alone would exceed the volumes that we said were required to get on the optimistic cost reduction pathway. So Europe on its own could scale up the hydrogen economy to the sorts of levels that are necessary to get impressive cost reductions. There is of course a little bit of uncertainty. The German plan is the most concrete because they have committed the funding. The European plan doesn't yet have funding attached to it. It awaits the cooperation and the commitment of member states. So there is a little bit of uncertainty whether this will happen. But assuming it does, it will scale hydrogen up, drag the costs down, and get a hydrogen economy started.

How would you describe the status of green hydrogen in China today?

The Chinese have not really announced concrete hydrogen targets, and they haven't announced an intent to use green hydrogen. Part of the interest in hydrogen in China is driven by the coal sector which is the source of the majority of their hydrogen production today. And the coal sector is excited about the prospect of creating more demand for coal to produce hydrogen, which would be environmentally detrimental. There is not a clear commitment to electrolysis via renewables in China yet. But that might change. They haven't released their overarching plans. There was some anticipation that they would do so in their latest five year plan, but that was delayed most likely due to the trade war with the US. We don't yet really know what China has got in the making – but certainly in this area they'd be watching Europe's developments very closely.

Would a Chinese climate commitment to net zero emissions give green hydrogen a big push?

Yes, it definitely would. The most important ingredient for hydrogen is a commitment to net-zero targets. Because Europe now basically has that commitment under the Green Deal it's pushing seriously on hydrogen. The countries which don't have that commitment, like Japan, the US, Australia or China, have yet to really commit to green hydrogen because the same level of motivation is not there.

I think it is unlikely that China will announce a net-zero commitment any time soon. The Chinese posture towards climate targets is generally to under-promise and over-deliver. China is more likely to make incremental adjustments to its targets that will not put any constrains on economic growth. However, what has driven China's enthusiasm and investment in clean energy, electric vehicles, and potentially in hydrogen is less about climate, and more about industrial strategy and air pollution. Those two factors may well also motivate a pivot towards hydrogen.

Do you see any scope for cooperation between the EU and China on hydrogen?

The development of standards and common frameworks particularly on the technical level is a no-brainer. Every country will want to participate in that. Whether there is a cooperation on investment and on business activity is harder to say. Typically, what has happened so far with clean technologies is that Chinese players have tended to be quite separate from European or Western players. There are not many global entities. There tend to be some big Chinese companies and some big European companies that have dominance in their own home market. And in some instances, like Chinese solar manufacturers, they export obviously. In the automobile sector, there's more integration. You have a lot of large car manufacturers producing in China in order to access the Chinese market. In wind energy, you see that as well to some degree but Western companies manufacture in China to achieve lower costs, and not really to access the Chinese market, because there are very strong Chinese players there. So it's very hard to say whether there will be that sort of integration between the two in hydrogen. I suspect there wouldn't be.

The approach the European strategy is taking is very much one of trying to ensure a future for European manufacturers. It seems to be a strategy to counter competition from China in traditional manufacturing, and other low-cost manufacturers. And so it's hard to see how it would be in Europe's interest to have China play a big role in the development of its hydrogen industry. I don't really see what the European manufacturing sector would have to gain from having the Chinese play a significant role. The Europeans would be keen to export their technology once they develop it onshore within Europe. But to have Chinese equipment installed in Europe or to have Chinese contractors or engineering or chemical firms play a big role within the European market seems counter to Europe's interest at supporting a renaissance in its manufacturing sectors.

When do you expect global competition on electrolysers to heat up in earnest?

So far, Chinese electrolysers are not really sold outside of China. They are not a known product, and there are questions about quality and whether they can make them to the technical standards required by Western players. It will take time for those hurdles to be overcome. I'm sure the hope of the European players is that during that time, they can close the cost gap and establish dominance. I think Europe is very much hoping that the development of hydrogen equipment will resemble the wind industry much more than the solar industry.

In the wind industry, you have geographically stratified players for various reasons: The equipment is very big, but also it's technically quite complex. So European players have a stronghold in the European market, American players have a stronghold in the American market. The Chinese market is entirely dominated by Chinese players. There is only a small amount of competition in more minor markets, such as Australia, where Chinese companies have put in a big effort to establish themselves. But in the West, they are yet to have great success. In contrast, in solar the Chinese dominate and no one else really gets a foot in.

Do you think China is also about to make a big commitment to green hydrogen production? Europe hopes the sector will support one million jobs by mid-century.

It's hard to say. I think they are certainly thinking about it – but one million manufacturing jobs means much less in China than it does in Europe. I certainly think they want to keep at it and not be left behind. China is investing very heavily in technology to try and close the gap that it has with Western countries, in auto manufacturing, in technology, in artificial intelligence etc. But the same motivation of revitalising manufacturing doesn't hold in China.

Potentially China could say: We're not very interested in this yet, because that's the high-cost corner of the market and we are in the low-cost corner. If it's clear that this is not an industry they can export to, there might not be much motivation for them to go down that path.