Q&A: Capacity mechanisms in Europe's fossil-free electricity system

***Please note: This factsheet is part of a series on how electricity markets are evolving to support the energy transition. Find the full deep dive here.***

Capacity mechanisms are financial support measures designed to make sure there are reliable options for a secure supply of electricity at all times. In short, capacity providers – that is electricity generators, storage operators, and also flexible consumers – are paid to keep a buffer available (in the form of capacity) to help mitigate risks to the electricity system, particularly at times when demand is highest (peak demand) or, for example, during dark doldrums (so-called Dunkelflaute events, when there is both little wind and sunshine for an extended period).

Capacity mechanisms work by helping to balance demand and supply, which is essential for electricity systems to work. Power plants, flexible consumers, and storage assets that are part of a capacity mechanism do not use their full potential at all times, potentially relinquishing revenues. Instead, they set aside reliable capacity to be activated at times of stress, and get paid for this service.

"Capacity mechanisms are increasingly likely to become a long-term feature of many European electricity markets," concluded a report assessing the role of capacity mechanisms in the energy transition by European Transmission System Operator (TSO) association ENTSO-E. "Ensuring security of supply during periods of limited renewable output, while keeping electricity affordable – especially as electrification expands across sectors – is a fundamental public service."

What is the purpose of capacity mechanisms?

The role of capacity mechanisms is to ensure the secure supply of electricity by providing sufficient revenue certainty and a viable business case for resources critical to system security.

Six European countries – Portugal, Spain, France, Ireland, Denmark, and Sweden – already face concerns about the reliability of their electricity systems, according to a 2024 assessment on the security of electricity supply in the EU by ENTSO-E.

While the report did not cover the whole of the EU as many member states lacked relevant data, ENTSO-E found that another five countries – Finland, Estonia, Belgium, the Netherlands, and Italy – could face gaps in the medium (2026-2029) or long term (2030-2033). Their systems might therefore be unable to deliver enough electricity to meet demand at all times in the near future.

"To avoid customer curtailments, you have to support investments in a way," said Emma Menegatti, a researcher at the Florence School of Regulation (FSR) who studies the future of capacity mechanisms in Europe.

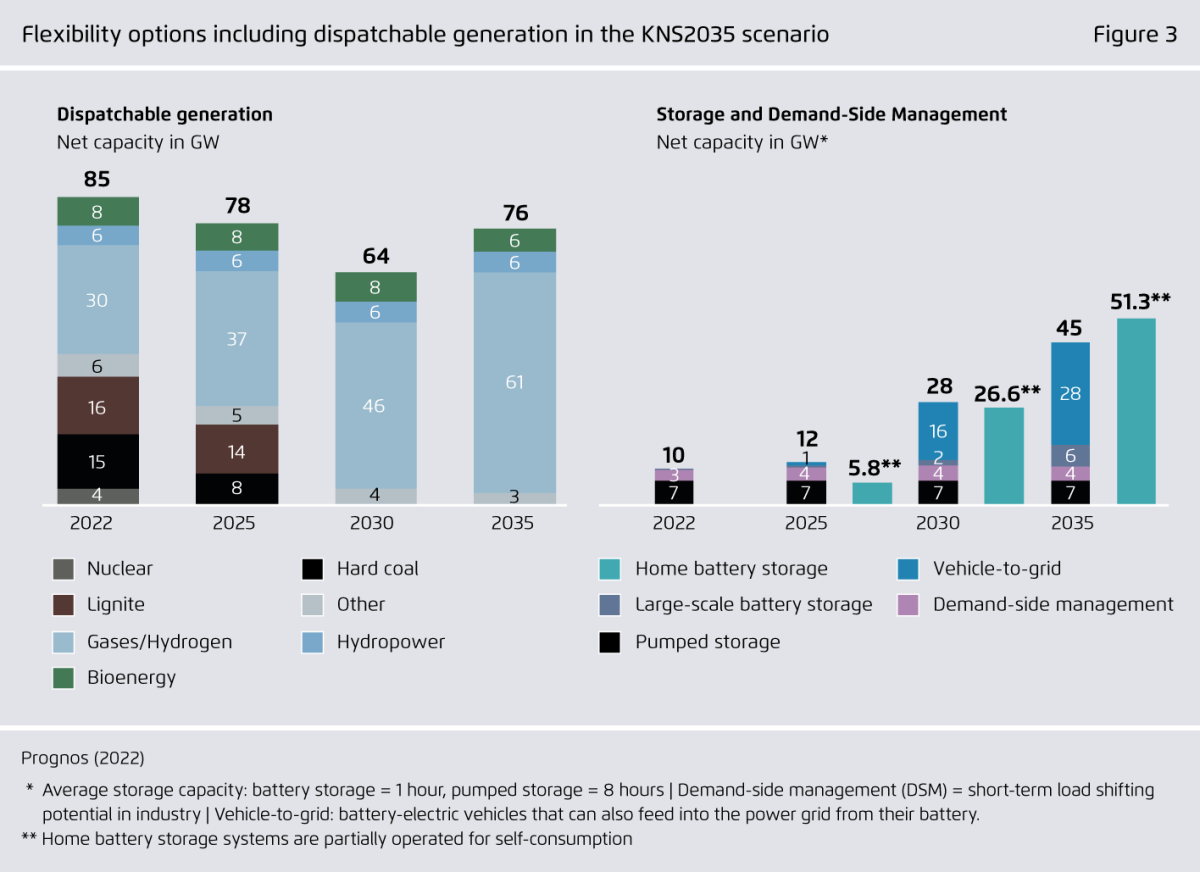

Agora Energiewende / Prognos." />

Agora Energiewende / Prognos." />Why are capacity mechanisms gaining prominence as the energy transition advances?

"The energy sector is undergoing a fundamental change," said Nicolas Leicht, who researches electricity markets at think tank Aurora Energy Research. "We're trying to deploy a lot of highly intermittent renewables, while at the same time trying to get rid of the most polluting electricity sources, and we are trying to electrify everything.

"Dispatchable capacities – which are still needed because there will always be moments when you'll need their reliability – are not being built because they cannot earn enough money in a renewables-based system," Leicht told CLEW.

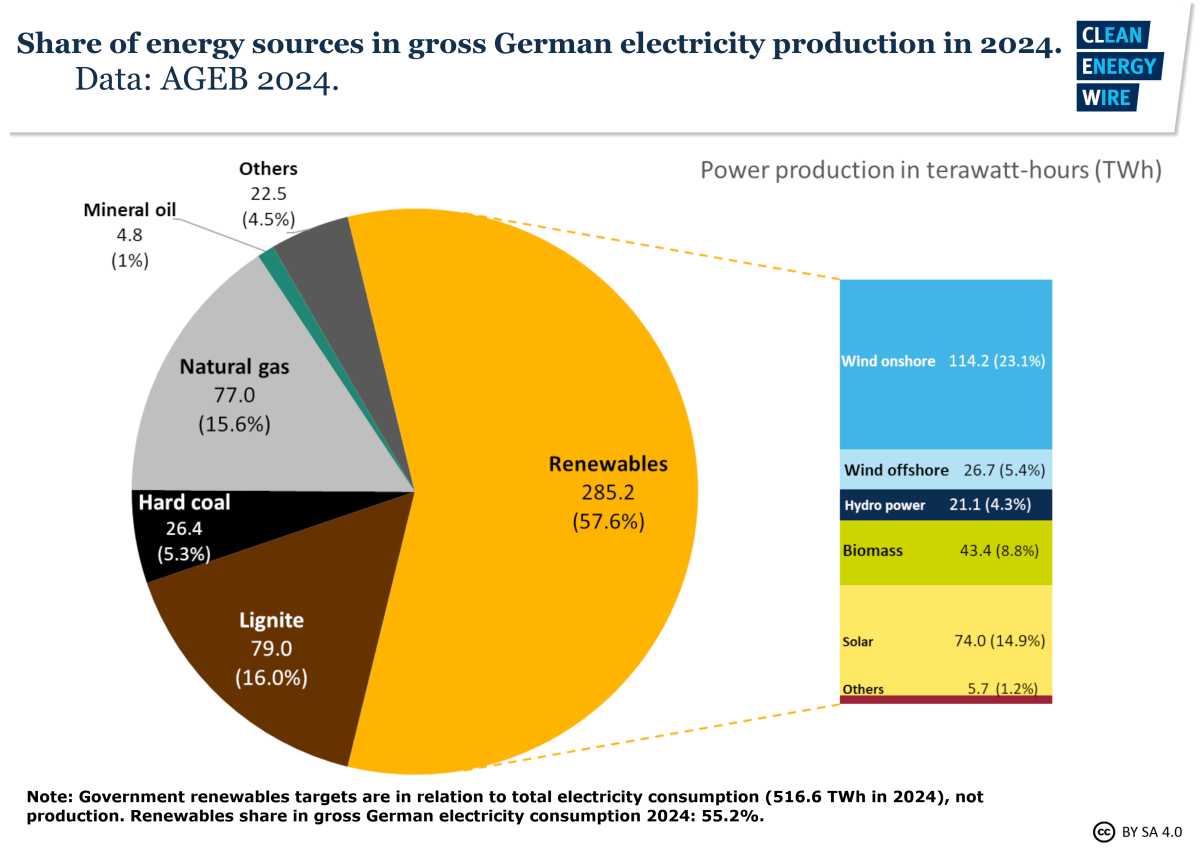

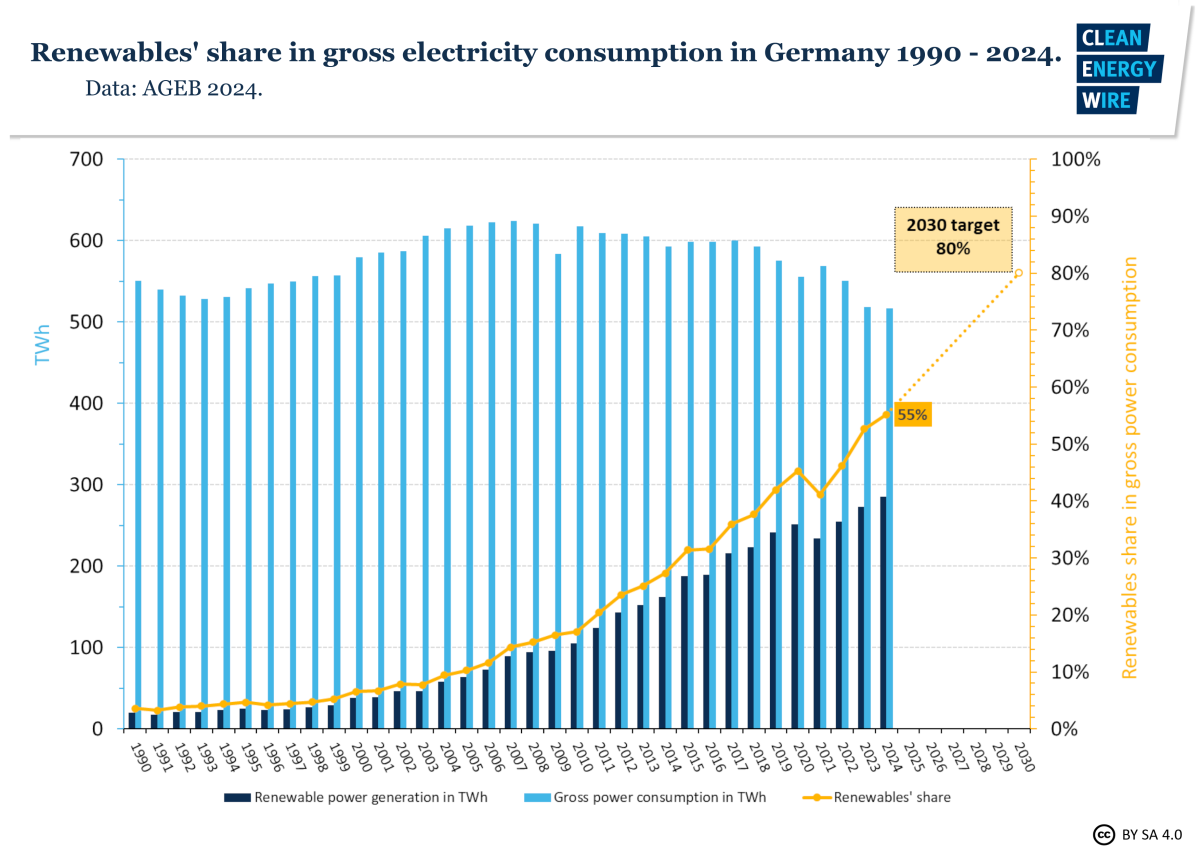

This is because power generators – whether wind farms or coal plants – generally only get paid for the electricity they actually produce. They sell this on electricity spot markets, and following the so-called merit-order-principle, the stations with the lowest offers are selected to provide power until demand for electricity is covered. With the expansion of renewables, which are now the cheapest way to generate electricity, power stations with high generation costs such as gas-fired and hard coal-fired plants run fewer and fewer hours every year.

The situation makes the business case for new investments unattractive. Meanwhile, the opportunity for old plants to make profits has also grown smaller as a result of renewables expansion, while carbon pricing makes the burning of fossil fuels ever more expensive. Yet with security of supply gaps emerging as a result, one question lingers: should old electricity generators, which can be easily fired up or down, really be permanently decommissioned?

Electricity regulators and experts have raised concerns that, as more thermal capacity (coal, lignite, and nuclear power plants) is taken off the grid, there will be periods of time when a country can no longer guarantee a stable supply of electricity around the clock.

"Capacity mechanisms used to be seen as a way to subsidise dirty plants, as they could be sure to be available when needed," said FSR's Menegatti. "This is changing now, and we have seen batteries gaining market share, as well as demand-side response, if done well."

Since the 2022 energy crisis, capacity mechanisms went from being seen as a temporary measure to becoming recognised as a possible structural component of future electricity markets. It became clear that governments would intervene at times of skyrocketing power prices to shield industry and households. The assumption that markets could always provide the right type and amount of capacity crumbled, as moves to cap power prices weakened investment signals and created market distortions.

Before introducing a capacity mechanism, countries carry out a so-called adequacy assessment to determine current available capacity (the maximum amount of electricity all generators can produce), what is set to be retired, and what investments are expected – and finally work out whether periods of scarcity are likely.

Electricity systems need to go beyond being able to cover annual peaks and include daily flexibility and balancing too. If periods of scarcity are likely, countries could opt for introducing a capacity market or strategic reserves – each one a type of capacity mechanism.

- In a strategic reserve, a select few resources – usually fossil fuel plants close to retirement – are kept open in case their capacity is needed to fill gaps. These plants are put in a stand-by reserve and are not allowed to participate in electricity markets, instead getting paid by a central authority to simply be available and ensure they can be activated quickly during critical periods. Germany, for example, currently has a strategic reserves mechanism.

- In a capacity market, capacity providers – be it storage systems, gas power plants, or even large flexible consumers – compete for so-called capacity payments, guaranteeing them earnings as they stand at the ready to provide said capacity. This is on top of the revenues they make in other electricity markets.

During critical periods, for example, if a lack of wind and sunshine cuts renewable energy output, large consumers that are part of the capacity market lessen their demand (free up capacity) to reduce stress on the system or batteries feed electricity into the grid to make up for the production gap, thus ensuring system stability either way.

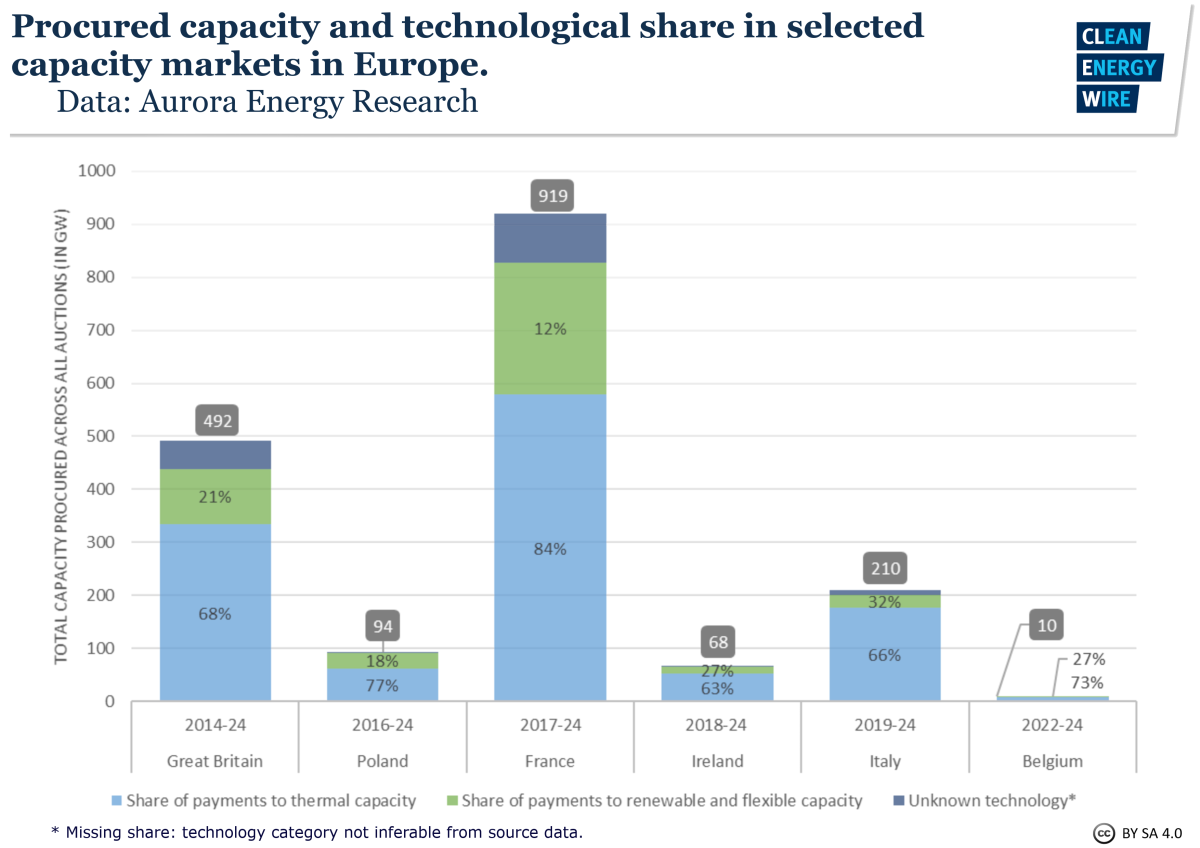

Regulators calculate how much capacity is required to keep the lights on, then run an auction, which ultimately determines how much capacity providers will receive for their service. The design of this auction – how long in advance it is held, the length of the contracts, or how much capacity is procured – can make a marked difference in which technologies get support or what the final cost for consumers is. Countries including the UK, Poland, and Italy have a capacity market.

What are the drawbacks to capacity markets?

While the need for increased flexibility in the electricity system is clear, "The question is whether [a capacity market] is the best option to go for, because it can get very expensive," said Janina Ketterer, the head of German system change at energy company Octopus. "Given the discussions we now have on reducing consumers’ bills, having a capacity market goes completely contrary to that."

Capacity markets are funded via levies and tariffs paid by electricity consumers. Well-designed capacity markets can lead to healthy competition, being open to all technologies instead of targeting a select few resources. However, costs can rise fast, for example if too much capacity is procured.

Moreover, it is not always necessary to introduce a capacity mechanism to ensure electricity systems can supply power at all times. European countries such as Hungary and Lithuania have rolled out targeted support schemes for storage resources, which are not linked to capacity mechanisms.

Climate groups have also sounded the alarm on how the majority of capacity market contracts across Europe – worth over 50 billion euros – have gone to fossil fuel assets. They call for these mechanisms to be reconfigured "to prioritise future-proof investments in clean energy solutions", including energy storage, demand-side response, and interconnections linking the electricity grids of neighbouring countries.

"The capacity market should be planned in such a way as to support future technologies designed for a new, low-carbon energy system," wrote Polish think tank Forum Energii. Some contracts are valid for up to 17 years, meaning that if polluting fossil fuel plants are awarded one, they might still operate into the 2040s, close to Europe’s deadline to become climate neutral.

Link to source." />

Link to source." />Another open question is which technologies are supported and which are disadvantaged as a result. "In theory, capacity markets are technology-neutral, but you can make little tweaks to favour certain resources, such as demand response or storage. If you look in detail, capacity markets end up favouring some technologies a bit," FSR's Menegatti said.

Octopus' Ketterer agrees: "It is called a market, but it is really not a market – it is very heavily regulated." Ultimately, supporting some assets and not others can have adverse effects, which regulators then have to work to counter-steer. "A capacity market has a huge administrative burden: the UK has been tweaking the system on an ongoing basis over the past 10 years, and they're still integrating flexibility and demand side response into it," Ketterer said.

Power market analysts have also pointed out that subsidies given to some power plants in strategic reserves make it harder for others to compete and that the mechanism could be abused to keep old fossil-fuel power plants in operation.

The UK has the longest-standing capacity market in Europe, having introduced one in 2014 ahead of its phaseout of coal. "There is the perception that you will get a lot of new-built big gas power plants, and that has not materialised," Octopus' Ketterer explained. While the market has attracted new capacity, it has largely materialised in the form of smaller gas units and batteries, she said.

Belgium, which introduced a capacity market to support its planned phaseout of nuclear power, stands out as a successful example of the integration of batteries into the market. Auctions held two years in advance, instead of the usual four, are particularly attractive for storage projects.

Poland, meanwhile, was heavily criticised for awarding a large share of capacity contracts to coal and lignite plants in its first auction. "The extension of the capacity market for coal – from the perspective of the investment gap and the needs of the system – does not solve the problem but only postpones it and leads to a bad allocation of money," wrote Polish think tank Forum Energii on the need to reform the country's capacity market.

Countries including Germany (see below for more), Spain, Portugal, Greece, and Estonia are all discussing the introduction of a capacity market.

Capacity mechanisms in the EU's interconnected electricity market

There is a growing tendency towards capacity markers in the EU: countries like Hungary, Romania, and Czechia all face the challenge of phasing out coal in the near future and will have to introduce mechanisms to ensure their grids remain balanced during and beyond the transition.

As they look at instruments such as capacity markets to guarantee a secure supply of electricity, governments and regulators need to account for several parameters, including how much capacity to procure, the timeframe of the auctions, the length of contracts, how technologies compete, whether there are location requirements, and who will pay and how.

Capacity mechanisms are currently designed and operated at a national level, even if Europe's electricity market is already highly integrated. The design of a country's capacity market should therefore thoroughly consider electricity imports too, FSR's Menegatti argued. She explained that capacity markets can have negative consequences on neighbouring countries that do not have a similar mechanism in place. "If you overshoot your local needs, in the long term, it will reduce investment incentives in the neighbouring country."

To mitigate this cross-border effect, capacity markets need to be coordinated and harmonised, Menegatti found during her research. However, as these mechanisms have historically been tailor-made to fit unique national contexts, such a discussion raises many political, legal, and technical questions.

The EU is working to make it easier for countries to introduce capacity mechanisms. Still, "there is not yet a common vision at EU level on [capacity mechanism] design and, more generally on the [power] market design to ensure security of supply," according to a Clean Air Task Force assessment on how to accelerate clean power deployment in Europe.

Germany is set to introduce a capacity market in 2028, after deciding against one ten years ago. "In 2015, Germany had a massive overcapacity. But the situation is totally different now: we have a rather scarcer system and the need for speed in the energy transition has gotten a lot faster," said Aurora's Leicht.

"There have also been a lot of market interventions, especially [during] the energy crisis in 2022. This made sense, but gave a lot of power to the arguments for a capacity market. As soon as the prices spiked – which would set the incentive to get new capacity – [revenues] were skimmed off," Leicht explained.

Germany's new coalition government of the conservative CDU/CSU alliance and the Social Democrats (SPD) is now in talks with the European Commission to iron out the details for a capacity market. The introduction of one requires the bloc's approval under rules for state aid.

Initial plans by the previous coalition government outlined that new gas-fired power plants – which are meant to provide backup capacity for the German electricity system amid the transition to renewable power, and which would receive government support to encourage construction – would eventually be integrated into the capacity market.

The gas-fired plants are part of Germany's planned "Power Plant Security Act" set to guarantee a secure supply of electricity. They are supposed to replace coal power plants that will be gradually taken off the grid.

To deliver on the country's aim of having a largely decarbonised supply of electricity by 2035, these power plants might need to be retrofitted with carbon capture technology, transformed to run on green hydrogen, or be decommissioned early, as their technical lifetime would run beyond the deadline.