Sustainable start-up builder econnext links social, green and finance worlds

Company profile

- econnext is an industrial holding, founded in 2016 “to build impactful and profitable companies”

- typically builds own start-ups or acquires majority stakes in young ventures

- company slogan: “For people. For planet. For profit.”

- three founders and 11 family investors, including members of prominent German industrial families: the Brenninkmeijer (German-Dutch), Mohn, van Agtmael, and von Siemens families

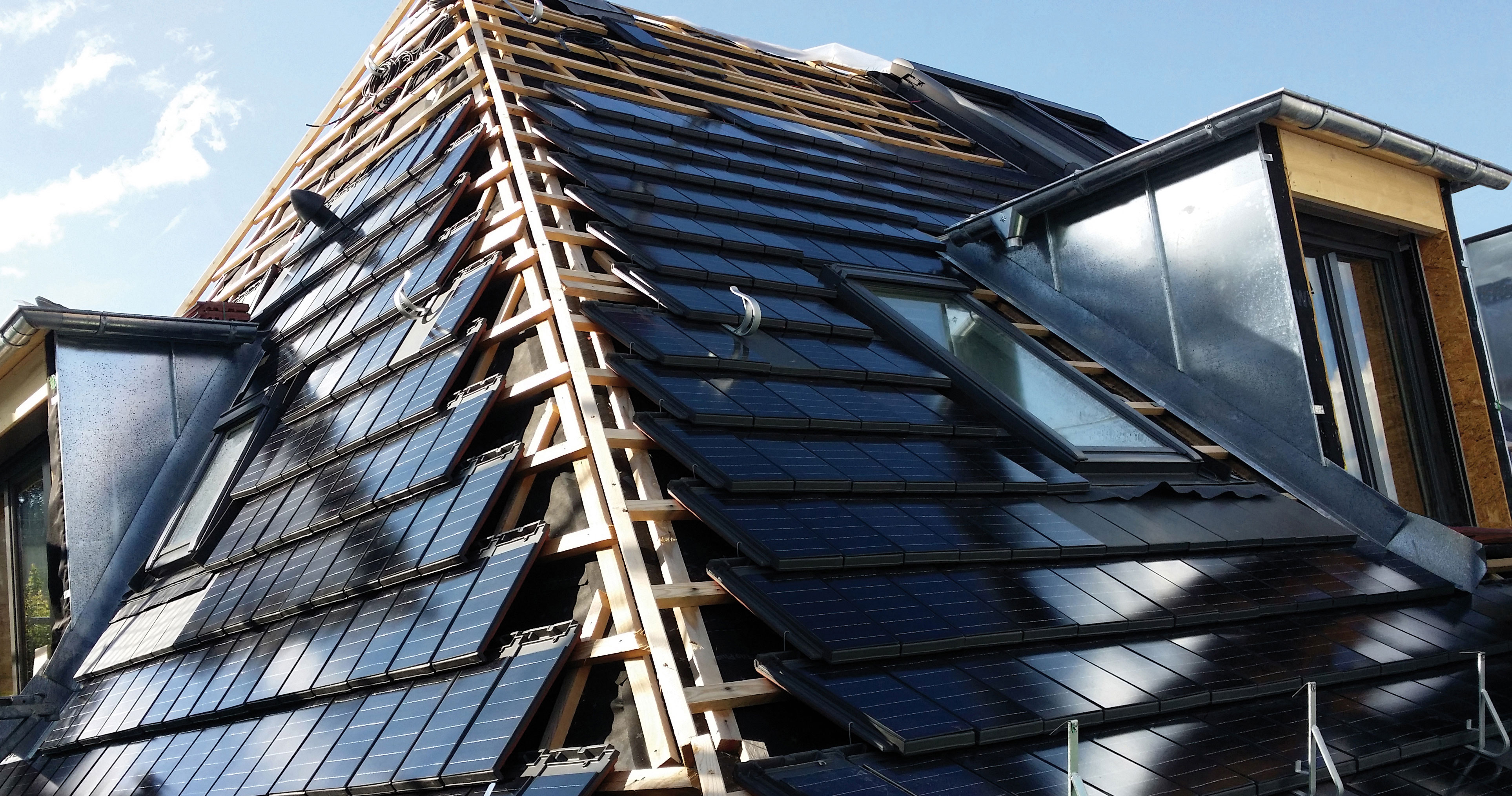

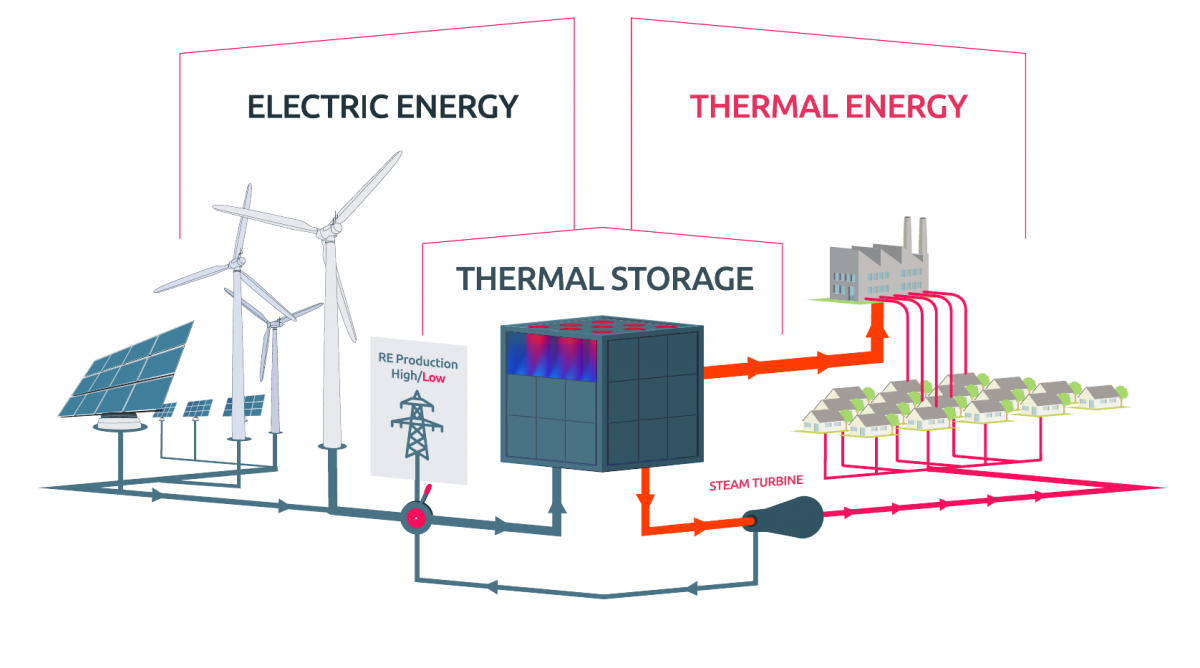

- currently six start-ups in portfolio, most in energy and climate: Lumenion (energy storage), autarq (roof-integrated solar PV tiles), FLAXRES (recycling technology for photovoltaic, industrial glass and displays), GRIPS (tailor-made renewables system financer/owner/operator), ESG Screen 17 (tailor-made SDG investing), GoStudent (low price tutoring)

- it’s about empowering start-ups and ideas, says econnext co-founder Schneider

- Schneider says as world is “running out of time” in regard to SDGs, the scale up of certain technologies and ideas needs a push

- especially in Germany, which is “bad at scale”, says Schneider

- econnext sees itself as an intermediator between the social, green and finance worlds, which often do not speak the same language

What econnext says

Clean Energy Wire: What exactly is econnext? What do you do?

Michael Schneider: We are a German-Dutch industrial holding ‘with purpose’, founded to build profitable businesses around the UN Sustainable Development Goals (SDGs). We started in 2016 and are now three founders and eleven family investors that include members of the Brenninkmeijer, Mohn, van Agtmael, and von Siemens families. We are all joint shareholders of econnext.

You are based in Germany's financial capital Frankfurt. Is one of the reasons you exist that Germany is considered rather conservative and rather risk-averse in the financial sector – and so start-ups need players like econnext?

No. However, it's a good question because what many others would have done is go to Ireland or the Netherlands or Luxembourg or Liechtenstein. We intentionally decided no, we will have all the businesses we build in Germany, for obvious reasons.

From an SDG perspective, if they were ever successful, we did not want them to be associated with the search for a tax haven, or any location where your start-up could be seen as playing tax treaties or environments. If you're dealing with development finance, you probably know the term “treaty shopping”, where you pick your location just based on where taxes suit you best. There is always an optimisation that start-ups will strive for, but we wanted to make the statement that we set everything up in Germany. If you looked at start-up culture, you'd probably not have picked Germany for its tax environment.

Do you have classical start-ups among your companies?

All of them are. There is not a single non-start-up, though some are more mature than others.

We can proudly say everyone's excited about our companies' products – from autarq solar roof tiles to Lumenion's energy storage – and now it's our job to make them more mature and scale the businesses. If you look at it from an SDG perspective, the only big question is scale. If you don't raise the necessary amount of money, if you don't have the engineering power, if you're afraid of a foreign market, then you're not going to make it. And we need to be fast, as the world is running out of time.

Germany is bad at scale. We've not had a good track record in the past 30, 40 or 50 years, with few exceptions like for example MP3. We have fantastic innovation power, we have great minds, but we're often very slow in time-to-market. In terms of start-up culture, we Europeans are a bit too conservative.

Quite frankly, as econnext – a holding company – I was never of the opinion that Germany is the nucleus of global climate action. If you have fantastic technology, and you feel there is a market for it, it's never going to be only in Germany.

Your focus is SDGs. How many of your companies are in energy and climate?

We did not plan it this way, but most are. We have businesses in circular economy, clean energy, storage and the SDG-related fin-tech Screen17.

The beauty of econnext is that the shareholders are agnostic in what SDG-business models will come our way, and then the 14 of us will sit down and make a decision. Our autarq business produces solar roof tiles, and when the company FLAXRES – which deals with recycling of solar panels – came along, we went for it. Why wouldn't we be interested in somebody that can recycle our own solar roof tiles into the raw materials and can save 95 percent of energy against traditional mechanical/chemical recycling? There's a fantastic synergy between the two start-ups.

The German government recently decided on its climate action package. What's your view on the proposals?

The diplomatic answer would be: things are going in a direction. They're probably going in the right direction. The legislative process will take another six months or so until we know all the details.

Quite frankly, as econnext – a holding company – I was never of the opinion that Germany is the nucleus of global climate action. If you have fantastic technology, and you feel there is a market for it, it's never going to be only in Germany.

If you think that the climate package is not enough – as I do – and if you feel that we don't have enough time for small steps like that, then you look for a market place where you are welcome, where your technology is red-carpet material. It's not good advice for a start-up to wait for your federal government to introduce the right regulatory framework. Instead, you go to the markets that love you for what you are: a technology provider.

Of course, you will help develop policy and try to advise your national government if you can. After all, you're still a European citizen and you'd love to scale your company in Europe. But if the situation happens to be best in Ghana – where we are active with our sustainable energy contractor GRIPS – then you set up there. If there is a SME in Zambia that suffers from power outages and uses expensive diesel generators but has no ‘renewable energy surcharges’, high energy taxes or grid fees, then you build a PV/battery hybrid there, which we did.

Optimistically, as a holding of sustainable companies, you don't look at your home country's federal government for help. You just look for the markets that are welcoming. Would I have wished to be more welcome in my home market? Absolutely. Would it be good advice to wait for that kind of legislation in the current global political environment? No. There are so many markets that are welcoming for sustainable development, we speak many languages, we can go there.

Where does your money come from?

It's shareholder money. We are a German LLC [Limited Liability Company] with 14 shareholders. It's a very close-knit group with three active founders or CEOs.

In a fund, traditionally, you would collect money and it becomes a blind pool. Then people sit in an investment committee and make the decisions. There's a management fee involved.

We felt that wasn't the right model for a start-up for any type of SDG, as it can take many, many years to develop. Coming from the financial sector, we didn't want a 2-percent-management-fee-fund that doesn't know what it is going to invest in. We felt it was time for an innovation where the manager is basically the employee of the company. What we believe we did is eliminate a large chunk of fees by being the start-up managers ourselves. We wanted what's called a perpetual capital or evergreen structure, we wanted it to be in Germany, we wanted to be able to invite shareholders from all backgrounds, from families that deeply care about sustainable development but also are very interested and good at scaling – and have built businesses from scratch before.

At econnext, we have a very diverse set of shareholders who bring together that conservatism with the right amount of thinking and calm execution focus and, to some extent, time. You want to roll out a product when you are sure it works. But at the same time – if you are sure – you want to immediately talk to KfW [the German government-owned green/promotional/development bank] and to policymakers and say, “This is ready, let's go”. All shareholders are active and available for speedy econnext-decision making in case we as founder-CEOs need support. It is often a matter of hours and happens per messenger or e-mail group.

So, it's the empowerment for these start-up teams and ideas at the right time, and then the right scale follows. Scale is the reason we are inviting more passive institutional investors into econnext in our current fundraising round.

Why is econnext set up the way it is?

A few years ago, we found that there was no industrial holding focusing on the SDGs. So we started as a holding, locked in our for profit but environmental and social mission in our articles of association and sent them to BaFin – the German financial regulator – and we said: Look, we are setting up an industrial holding and we would like to have the respective exception from what's called the Alternative Investment Fund Manager Directive. It's a stuffy term, but that helped us become a holding for all kinds of start-ups in that field, rather than a venture capital fund or a bank.

That's very important, because as an industrial holding you have no fund prospectus telling you when to exit a cool, sustainable business that may need more time. You don't have anyone forcing you to choose between dividends and selling the business. You can just take dividends and grow the business, because you are very happy with it. You could grow it organically or you could buy other companies – which is not our focus – or you could say this needs a bit more time. This patience is so important because we don't know with energy, for example, whether innovative scaling will take a bit more time.

Engineers will tell you a certain sizing can be done, but you can't just jump and become 100 times bigger overnight. So, the main answer, in short, is time. Being an industrial holding, you can choose the speed, the timing, the focus as you want – just patience and dedication to your business cases. That's what an industrial holding allows you to do.

On your website you say you're an intermediator "between the social, green and finance worlds". What does that mean and why is it necessary?

I used to work on the development finance side. That means on a project level, financing cocoa in Sierra Leone and staple foods in Zambia, for example. It made me realise you have to be able to translate between the three worlds.

From an ODA [official development assistance] perspective, you have to be able to say to one player that this is a landlocked developing country, or this is a least developed country. At the same time, you have to say to another player that the IRR [internal rate of return] is XYZ … or whatever else the right KPI is for your partner organisation.

The project finance world may never have heard of ODAs – they have barely heard of the Equator Principles, they may have heard of IFC (International Finance Corporation] performance standards. Have they ever looked at 300 pages of occupational safety and health guidelines by the World Bank? I don't think so.

So that's two different languages, and then you have the social world. Even if the project is financed and it's a social project and it helps those in need and you get your ODA acceptance, you still may not have looked at ‘just transition’ to green jobs or the local labour conditions. You may not have looked at indigenous peoples, you may not have looked at biodiversity, or community health and safety.

All these things come together and we had not seen – before econnext – anybody who had tried to translate between those three groups of actors that often don't talk. That's why it's so important to try and be that professional intermediary.