Digitalisation ignites new phase in energy transition

The digitalisation of the Energiewende

Contents

Contents

The Great Energiewende Enabler

“There is no doubt that digitalisation will take the energy transition to an entirely new level,” says Robert Spanheimer, energy expert at digital industry association bitkom.

Fabian Reetz, from technology and society think tank Stiftung Neue Verantwortung, agrees: “Digitalisation approaches the entire energy sector with lightning speed. It changes the rules of the game, shifts the balance of power, and makes possible what has been impossible up to now.”

The Energiewende - the dual shift from nuclear and fossil fuels to renewable power - has already transformed Germany’s energy sector. Renewable power now covers around one third of the country’s electricity consumption. It is on track to provide half in little over a decade.

Complex IT systems will take centre stage in this next phase of the Energiewende, in what utilities call “the largest ever national IT project”. Weather-dependent solar and wind installations will replace conventional power plants as the central pillars of the electricity system, requiring unprecedented ways of matching supply and demand. Green power must be used more efficiently if Germany is to reach its ambitious climate targets. It must also seep into the transport sector to replace petrol, and into heating to push out oil and gas.

The full impact of digital technologies will go far beyond the installation of “smart” electricity meters connected to the internet, or being able to remote-control household heaters with a mobile phone.

“The crux of the matter are the concepts associated with digitalisation, such as the exchange of surplus power generation among neighbours and the activation of flexibility on smaller scales,” explains Spanheimer.

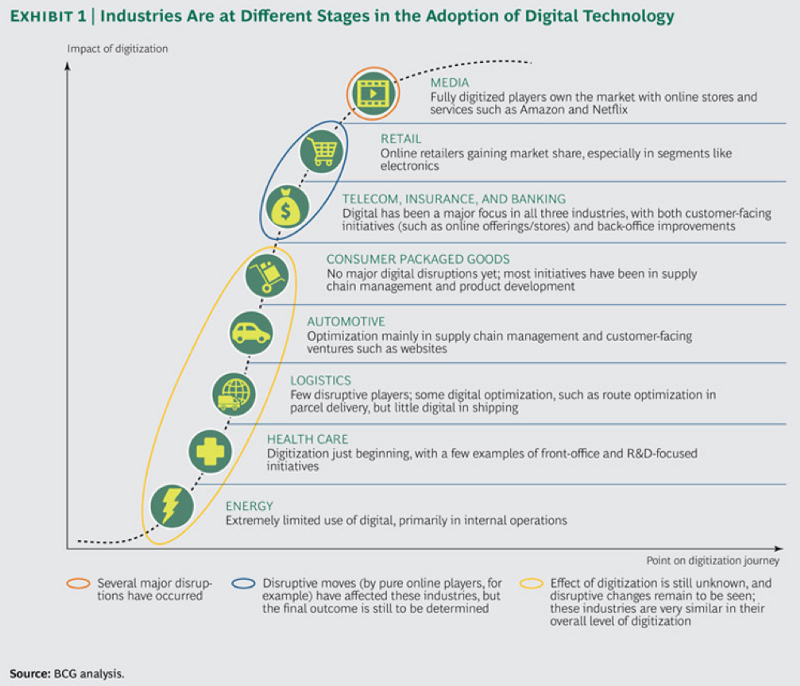

The energy sector lags behind other industries, such as media and retail, in its adoption of digital technologies. But it is now buzzing with catchwords like big data, virtual power plants, smart grids, internet of things, sharing economy, and blockchain technology.

Companies with entirely new business models are able to enter the energy market thanks to digital technologies. These turn ordinary power consumers into electricity traders, or link household appliances with industry machines and batteries in internet-based networks.

But despite the progress it remains unknown what digitalisation will do to the energy sector, its businesses, and people’s behaviour, in the long term.

“It’s a bit like trying to predict the effects of the internet before it was invented,” says Reetz.

Stephanie Ropenus, digitalisation expert at energy think tank Agora Energiewende*, says “the phenomenon of digitalisation is a quantum leap for the energy transition”.

“The IT and communications sector will have to fuse with the energy sector. This is not only a paradigm shift for industry, but also for society, and involves opportunities and risks. We now have to ask ourselves: What do we want?”

The Great Energiewende Enabler

Digitalisation – in the narrow sense of the word - refers to the process of transferring analogue information into a digital form. But in the context of the energy sector, it is used to describe the broader impact of information and communications technology.

Sensors that can read and communicate power flow data in real time are generally considered the starting point for the digital transformation of the energy sector, followed by the remote control of power flows.

These “smart meters” capable of two-way communication between power producers and consumers, are the basis for “smart grids,” which can detect and instantly react to local changes in generation and demand, increasing efficiency and flexibility.

These stepping stones will be essential to cope with an increasing share of intermittent renewable power in Germany’s grid.

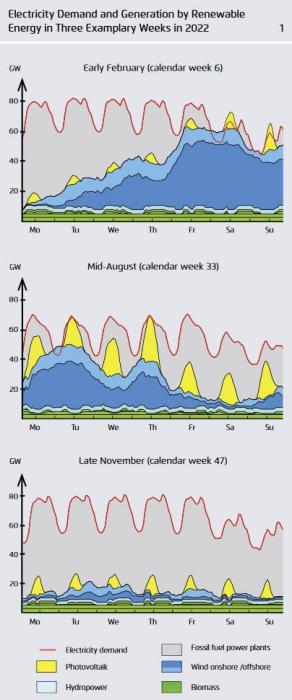

One of the greatest challenges for the Energiewende is matching weather-dependent wind and solar power generation to demand without relying on nuclear power or climate-damaging coal and natural gas.

In a conventional power system, fossil or nuclear power plants are switched on or off depending on electricity demand. This is not possible in a renewable system because electricity generation does not depend on demand, but on wind and sunshine.

The following graph shows electricity demand and renewable supply expected in three typical weeks in the year 2022, and illustrates the challenges ahead.

Germany already boasts more than 1.5 million PV installations and almost 30,000 wind turbines. These numbers are set to rise considerably. Their output will have to be coordinated with additional demand from millions of electric vehicles, and heat pumps, in the years to come.

“A fully decentralised renewable supply is impossible without digitalisation,” bitkom’s Spanheimer told the Clean Energy Wire. “We have arrived in the next phase of the energy transition. Without the internet, the Energiewende can’t be completed.

“The question is no longer which technologies provide the cheapest electricity – it’s wind and solar, no one doubts that. Attention has shifted to the question of how to deal with the special properties of this power, and how to integrate it in the most cost-efficient way.”

Increasingly sophisticated weather forecasts to predict how many renewable megawatts will be fed into the network is an important application of digital technologies [for more details, read the article Weather forecasts aim to make renewable power predictable and the factsheet Volatile but predictable: Forecasting renewable power generation].

Artificial intelligence (AI) might also prove crucial. Google owner Alphabet’s AI company DeepMind sees huge potential in this technology to predict peaks in demand and renewable supply, the company told the Financial Times.

The adjustment of power consumption to intermittent renewable supply is another key step. This approach is currently limited to large industry applications, such as aluminium smelters.

But it is likely to extend to households in the future. For example, charging e-cars at times of scarce renewable generation might be discouraged by higher prices in contracts with flexible pricing.

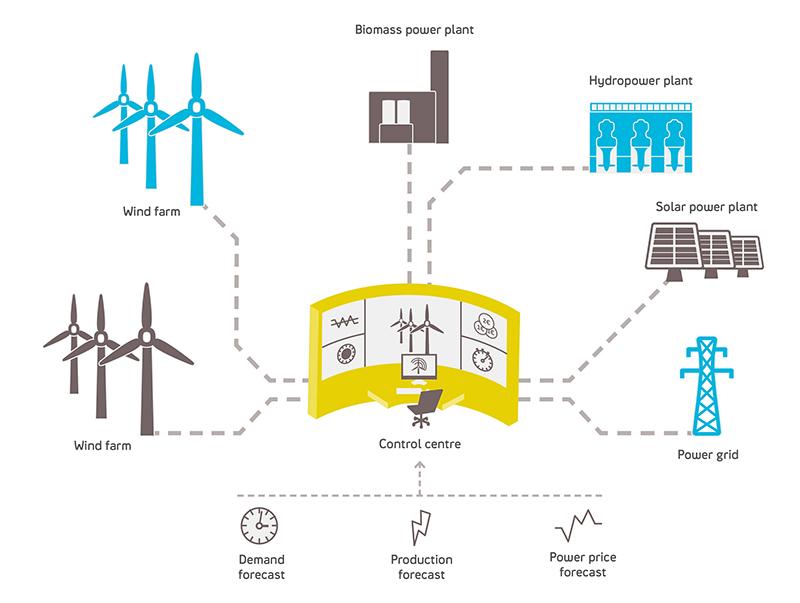

Car batteries - like household heat pumps - might also become part of virtual power stations: cloud-based IT control systems pooling large numbers of decentral power producers and flexible consumers. By smartly distributing and trading electricity, virtual power plants can relieve the grid and allow the integration of renewable power into existing electricity systems.

For example, German start-up Next Kraftwerke, which calls itself “a power plant operator without any power plants”, uses a network of more than 4,000 renewable installations with a total capacity equivalent to several nuclear power stations to trade power and balance the grid.

Digital technologies are once again key to this enterprise [the factsheet How can Germany keep the lights on in a renewable energy future? provides details].

“Creating demand flexibility can only work via communication. This is where digitalisation can show its strengths,” explains Spanheimer.

The shift from fossil fuels to renewable electricity in heating and transport – often dubbed “sector coupling” - is considered an essential part of Germany’s move to a carbon-emission-free economy. This is because renewable power can replace the use of fossil fuels in these sectors, and because the efficiency of the entire system can be greatly improved, as cars and heat pumps use less energy than combustion engines and oil-fired heaters, for example.

Digitalisation is also vital within the transport sector to enable the decarbonisation of mobility. Applications range from smartphone apps for car-sharing services to entirely new infrastructures required for the “coming flood of data” from autonomous cars.

"The integration of transport and heating still involves many challenges. For example: What will happen when people return from work and everybody wants to charge their electric car at the same time? The problem of concurrence and peak hours doesn’t just affect renewable power generation, but also demand. At the same time, electric vehicles can in fact contribute to system stability if approaches such as smart or managed charging are applied,” according to Agora’s Ropenus.

Efficiently matching supply and demand lowers the costs of the energy transition. It reduces the need for expensive power grid extensions, and cuts the costs of grid extension delays, caused by re-dispatch measures.

Christoph Burger, senior lecturer at the European School of Management and Technology (ESMT), says the energy transition has reached a watershed moment because the share of renewables is high enough to create a booming market for flexible supply and demand.

“Only about ten years ago, large grid operators like Tennet had to intervene in the grid only a few times per year,” he says. “In 2015, Tennet counted around 1,400 grid interventions. Some people are worried and say: ‘Oh dear, supply security is at risk’ – but others say: ‘Great, that’s an indicator for new business models involving flexible supply and demand, let’s do it!’”

Michael Liebreich, head of Bloomberg New Energy Finance, believes digitalisation will be central to these businesses focussing on the challenges of integrating renewables.

“No matter how cheap hardware becomes, software will always be cheaper,” Liebreich said at a Berlin event in the spring.

“Digitalisation is an enabler that facilitates the next phase of the Energiewende. It’s not a magic bullet for all problems, but a tool to master the task of coordination,” says Agora’s Ropenus.

Decentral autarky?

Environmental NGO Germanwatch believes digitalisation “offers the potential to advance the democratisation of the energy transition”. It could make users independent of market processes by enabling power redistribution and sharing among neighbours, according to the NGO.

But Germanwatch also warns that autarky for the wealthy could undermine solidarity because a dwindling number of people connected to the grid would have to shoulder the costs [for more details, see the factsheet Germany ponders how to finance renewables expansion in the future].

Burger also believes the trend to decentral independence cannot be discounted.

“Germany has increasing numbers of people who have access to cheap solar power and a battery. In the extreme case, they could leave the power grid into energy autarky. If we talk about digitalisation, we should keep an eye on this extreme scenario, which might be quite likely given the economies of scale to come,” Burger says.

Almost half of new solar arrays now sold in Germany are already coupled with a battery storage system, according to industry association BSW.

“In the face of globalisation, this decentralised approach is very attractive for many economies because it creates jobs, and involves a very high share of local value creation. The ‘lead supplier’ of a PV array is not necessarily the cell manufacturer, but instead the mechanic installing the project, which might be financed by a small savings bank.

“This is how the digitalisation of the energy transition can become a growth model – in combination with cheap technologies for local power production, and the social movement that people want to take things into their own hands.”

But Agora’s Ropenus suggests Germany’s power system won’t become wholly decentralised.

“We will probably see a co-existence of centralised and decentralised power systems based on renewable energy. While most renewable power generation is connected directly to the distribution grid and can be considered 'distributed generation,' offshore wind farms are a form of central power generation. Also, self-suppliers will need the public grid as a back-up.”

Business turbulence

The shift to a more renewable, decentralised, and flexible power system is a massive threat to the established utilities’ business model of selling kilowatt-hours produced in large conventional power plants.

Former market leaders E.ON and RWE have responded by splitting themselves in two. Like their traditional rivals EnBW and Vattenfall, they now scramble for new business models in an innovation race against agile new players, from start-ups to IT giants (for details on how the battered utilities are forced to compete with start-ups, read the dossier Utilities and the energy transition).

For bitkom’s Spanheimer, the digital transformation still begs many questions concerning the future energy business landscape.

“For example, we already have a rough idea that an apartment building with a solar array on the roof and a battery in the cellar will behave totally different in a future power market, because it can provide flexibility to the system. But what will the trading structures for these services look like? Who will provide them? Will we have new companies? How will the established ones behave?

“We face massive changes. This is why so many companies with entirely different backgrounds have a keen eye on the energy sector. Some believe their experience with internet platforms might give them an advantage over established power companies.”

Agora’s Ropenus says: “Who will get the authorisation to receive which data? Who is allowed to switch connections off, and when? Who is allowed to take which decisions? Will the process be driven by market forces, or by grid security considerations?”

German Energy Agency dena says experience suggests it is often easier for a successful digital company to conquer a new industry than for an established company to develop a successful digital business.

“New business models are expected where a sufficient amount of data is generated to serve as a basis for new integrated solutions […] The power of their existing (data) networks and their financial power open up undreamed-of possibilities to the large players of the digital business world (for example Google, Facebook) in the new market and business areas of the energy world,” according to a dena industry survey.

A key stumbling block for many new business ideas based on decentral and small-scale power exchanges are high transaction costs. Many industry insiders believe that “blockchain” technology could be a revolutionary solution to this problem. Blockchain – the system that also stands behind the online currency bitcoin – allows cheap and safe transaction processing between consumers without the need for a central mediator, and is already used in pilot projects. [Find more details in the factsheet on the Blockchain technology]

The effects of digitalisation is not only felt by the largest utilities but also their smaller peers. The Association of Local Utilities (VKU), for example, is concerned its members are put at a disadvantage because smart meter data is first transferred to transmission grid operators. Many new energy business models rely on the automated analysis of huge data sets from smart meters (“big data”), meaning data ownership is a hotly contested issue.

Energy law firm Becker Büttner Held (BBH) polled regional power companies about the effects of digitalisation on their business. Around nine out of ten said they expected a fundamental transformation in the energy market, and the entry of new competitors.

But at the same time, very few are prepared to invest in new business models, or to implement digital offerings. “The energy companies realise the challenges of digitalisation and a corresponding need for action, but only a small number have started to initiate the necessary transformation from energy supplier to energy service provider,” the BBH study concludes.

A utility survey by business consultancy pwc arrived at similar results. Only 17 percent of utilities said they had a strategy for digitalisation in place. A survey conducted for the economy and energy ministry even showed that around half of all firms in the energy and water sector still thought digitalisation was not necessary for their business.

But energy industry insiders and politicians questioned by dena still hope that the digitalisation of the Energiewende can become an export success for Germany by strengthening economic growth and the competitiveness of the energy sector.

The country could become “the leading market and the leading supplier of (digital) Energiewende technologies, both in hardware and software”.

Regulators play catch-up

The regulatory framework is key to tapping the innovation potential of a digital energy transition, according to dena.

“Regulators have to create a reliable framework so that established companies, start-ups, and society can realise this potential, and make use of it with new solutions.”

Digitalisation had to become the “axiom” of any future policy and regulatory framework, E.ON’s head of political affairs, Vera Brenzel told an expert event in Berlin. Free flow of data for instance -- also across borders – was paramount to create new services for customers and fully leverage the potential of digitalisation, she added.

Bitkom’s Spanheimer also stresses the importance of regulation for setting the right incentives.

“We won’t make much headway without detailed reforms to redefine innumerable market relationships, both on the internet and on power markets. For example, to create tradeable products that honour the provision of flexibility by virtual swarms of heat pumps or batteries, or enable power trading among neighbours. Many parameters need adjusting. But this process is in full swing already.”

Spanheimer believes Germany’s new Act on the Digitisation of the Energy Transition, which centres on the introduction of smart meters and “heralds the launch of the smart grid, smart meter and smart home in Germany”, was an important step in the right direction.

The law stipulates a gradual roll-out of smart meters, starting with large power consumers and power generation facilities. Smaller users like average households are to follow later.

Germany is behind countries such as Italy in the introduction of smart meters – the vast majority of households have only an analogue counter that is read off once a year, so the power provider can send a bill.

Stiftung Neue Verantwortung’s Reetz says the Act on the Digitisation of the Energy Transition was “out of date even before it took effect” and didn’t take into account recent developments, such as blockchain technology, and “largely reduces the digitalisation of the energy sector to the roll-out of smart meters”.

Burger agrees that technological developments can easily overtake legislative processes, which mostly take months or years.

“The question is this: How can we speed up the process, or design it in such a way that it is open to all technologies? We must avoid creating a path dependence by implementing an outdated or wrong technology.

“Everybody is looking at Germany, and I believe it would be helpful to create free spaces for experiments in regional lighthouse projects, to see what will happen there.”

The director of business foundation 2°, Sabine Nallinger, criticised at a Berlin event that none in the political and regulatory arena really felt in charge to create a suitable framework, while companies were seizing the new opportunities very fast.

But Spanheimer insisted the power supply was far too important to rush. “We are dealing with an absolutely critical infrastructure here, where you have to proceed with extreme caution. For example, Germany insisted on very strict security standards. That might have taken a little longer, but there is a general agreement that we now have a very high level of security in the digitalisation act.”

Digital Risks

The rapid advance of digital technologies in the energy sector has raised concerns about data privacy, and the risk of cyberattacks and blackouts.

Scientists at the Münster University have shown that detailed data on power consumption provided by smart meters can reveal the TV programme running in a household.

Privacy is a particularly sensitive issue in Germany because of the country’s history of state surveillance during the Nazi era and in the former East Germany.

Agora’s Ropenus admits the final shape of digitalisation in private households remains uncertain. “Does our society want smart appliances in households - and to what extent? Will people allow remote external access to their home? I do believe that flexibility will reach heat pumps and electric cars, but it remains to be seen whether we will ever get a wide diffusion of smart washing machines.”

The impact on supply security is also unclear. Blackouts remain very rare in Germany. Dena warns that as “digital infrastructure takes on an increasingly critical role as a central element of tomorrow’s energy system […] the digital integration could increase the risk of domino effects.”

But Spanheimer insists a digital energy transition could boost defences against cyberattacks and large-scale black-outs because it may be possible to restart decentralised grids without the help of external transmission networks.

“Compared to a centralised grid, it would become more difficult to knock out a decentralised system on a large scale.”

The integration of transport into the power sector also poses new security challenges, he says. “Even if we manage to design highly secure distribution grids, a network of car charging stations could turn into a new vulnerability. Switching off a large number of charging stations simultaneously would bring any grid to its knees. IT security requires a holistic approach.”

Ropenus believes the digitalisation of the energy transition is a “game changer” when it comes to power supply security.

“IT technology allows a higher degree of grid capacity utilisation because automated protective mechanisms can become active within milliseconds."

But some doubts remain among experts and the public alike whether we can trust algorithms more than a real person in a grid operator's switch room.

"The comparison might be slightly exaggerated, but the question is: Would you board a plane without a pilot?" asked one expert, who did not want to be named. "The issues are similar here – it’s about ceding control.”

*Like the Clean Energy Wire, Agora Energiewende is a project funded by Stiftung Mercator and the European Climate Foundation.