Bioenergy - the troubled pillar of the Energiewende

Experts

- AGEB - AG Energiebilanzen e.V.

- Agora Energiewende

- BDEW-German Association of Energy and Water Industries

- Biogasrat

- BMU - Federal Ministry for the Environment, Nature Conservation and Nuclear Safety (until 2025)

- BMWi - Federal Ministry for Economic Affairs and Energy (until 2021)

- Bundesverband Bioenergie

It takes three people to feed and operate the plant. They work in shifts to ensure that seven days a week, 365 days a year, just enough duck dung and maize silage is fed into two large fermenters, where assorted bacteria turn the substrate into biogas. The bacteria do their work automatically, as does the stirring system that keeps the unappetising brown slush moving so it gives off the valuable biogas – which is then turned into even more valuable bio-methane. But calculating how much substrate needs to be added and getting the “biology” right, i.e. the bacteria to produce the maximum amount of gas, is a human job.

“A biogas plant is not simply a machine, it can take up to a year and a half until the operator gets the bacteria strain right and can achieve the highest possible gas production from the amount of substrate he uses,” explained Dr. Mathias Kern of biomass plant supplier PlanET Biogas Group, which built the bio-methane plant for Neuhardenberg duck farming company, Odega. A plant this size costs between 8 and 10 million euros and can produce 700 m3 of biogas per hour.

Renewable energy installations, and bioenergy in particular, are praised with giving a lot back to the communities where they are installed. Apart from jobs – there are 119,900 people employed in the bioenergy sector in Germany – they add to the districts’ commercial tax income, often generate income from land leases, bring business to local companies, and save on expenses for imported fossil fuels. Kern says that Neuhardenberg, a village close to the Polish border with a population of 2,700 and sandy, low-yield soils, is seeing just such benefits from Odega’s new plant.

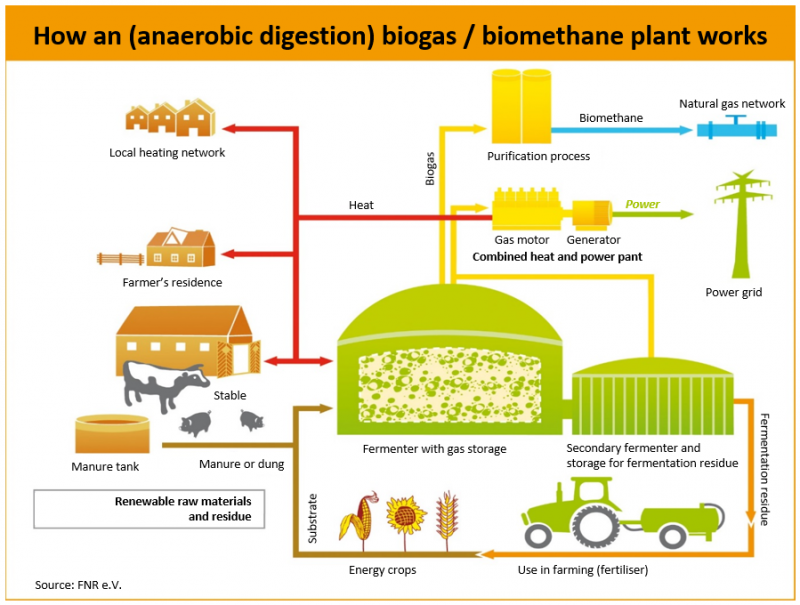

Germany’s project to decarbonise its economy (the Energiewende or energy transition) while at the same time quitting nuclear power has so far focused mainly on the electricity sector. Renewables covered roughly a third of the country’s power consumption in 2015. But while wind and solar PV fluctuate with the weather, posing logistical challenges for the grid, biomass could be controllable in much the same way as conventional power sources. As a rule, biomass is used to fuel small combined heat and power (CHP) plants, meaning it’s also making a significant contribution to a shift to renewables in the heating sector – which has so far lagged behind power in the race to ditch fossil fuels. Overall, 7.8 percent of Germany’s power generation and 11.7 percent of heat consumption were covered by bioenergy in 2015.

Despite these advantages, shifts in public policy and issues over public acceptance have put the German biomass industry through something of a rollercoaster ride over the last decade. After an unprecedented boom in at the start of the millennium that saw new installations shoot up like daisies across the country – particularly in rural Bavaria and Lower-Saxony – the sector has seen many ups and downs.

The Renewable Energy Act (EEG) came into effect in 2000, introducing feed-in tariffs that guaranteed renewable power providers a fixed price for the electricity they produce for 20 years. But it was reformed in 2014, resulting in a cut in feed-in tariffs for new installations and, as a result, a dramatic drop in the construction of new in biogas plants – the most common type of bioenergy installations.

There are nearly 9,000 biogas – or anaerobic digestion – plants in Germany. They are typically operated by farmers, and turn renewable energy crops like maize or turnips, plus manure, into a gas constituting of roughly 50 percent methane and 50 percent CO2. This gas is then burned in a CHP plant to generate electricity and heat. The renewable power is fed on to the grid and the plant operator receives feed-in tariffs in return. Aside from biogas plants, Germany also has a smaller number of plants burning wood, or generating power and heat from biogenic waste. (CLEW factsheet on different types of biomass use in Germany).

“Since the policy changes of 2014, we mostly see the construction of plants that are fed with biogenic waste instead of energy crops, and a lot of small manure-based installations with a very reduced capacity,” said Matthias Held, energy policy consultant at the German Bioenergy Association (BBE).

Bio-methane plants like the one in Neuhardenberg are another niche operation that still makes economic sense for farming businesses. Rather than burning the biogas straight away to generate electricity (and heat), the PlanET installation separates the methane produced from the CO2. The purified 98-percent methane is then fed into the normal gas supply network where it mixes with (fossil) natural gas. Operator Odega has a contract to supply gas to the operator of a CHP plant in southern Germany. Such plants receive subsidies that allow them to pay roughly double for bio-methane than they would for imported natural gas, Kern from PlanET explains. “The operator in Neuhardenberg is going to make money in the first year of operations,” he said confidently.

Guido Ehrhardt from the German Biogas Association in Berlin (Fachverband Biogas) says it’s difficult to judge how many biogas plant operators are turning a profit. As always in the business world, a third make money, a third are exchanging money, and a third are running at a loss, Kern from PlanET estimates. But keeping operations local helps. “In order to run a biomass plant successfully, it makes sense to have all the necessary renewable raw materials nearby,” Ehrhardt told Clean Energy Wire. Operations that have to source plant material from further away are often not economically viable, both men agree.

Boon for local economy

Odega aims to get the substrate for its biomethane plant from within a radius of 10 kilometres, and mainly uses dung from its own duck farms. Including the three men on site, there are some seven or eight people employed in jobs like harvesting and delivering maize silage and deploying fermentation residue on the nearby fields as fertilizer.

With the biogas boom that started in the early years of the new millennium, many new and existing manufacturers and service providers entered the business – from project planning offices, manufacturers and builders of tubes, hulls and roofs, to manufacturers of CHP components.

Local building companies did most of the groundwork for the Neuhardenberg plant, which began operating in March 2016, after around five years of planning and construction. The suppliers of the main technological components are not immediately local, but they are all German. PlanET, the general contractor, is based in Vreden, North Rhine-Westphalia; Vorwerk, which manufactured the mechanism that purifies the biogas to natural gas standards is based in Lower Saxony; and the air separation application that generates pure oxygen needed for the plant’s biological process was made by Airtexx in Bavaria.

Germany’s biogas industry is a classic example of a sector dominated by small and medium sized companies – the “German Mittelstand” that is regarded as the backbone of the country’s economy. It is also a sector of small and widely spread actors, many of which are only partially involved in bioenergy – for example supplying a certain type of tube, generator part or tarpaulin roof. This makes it hard to judge the health of the sector overall.

The boom years

Sebastian Schmidt is managing director of Ökobit in Föhren, Rhineland-Palatinate, a full service provider that has built 175 biogas and bio-methane plants and has 70 employees. The company is one of many that got going when Germany introduced feed-in tariffs for renewable power.“The reason to establish our company was the Renewable Energy Act 2000,” he said.

The first feed-in tariffs and bonuses for biogas paid under the Renewable Energy Act 2000 – and a revised version of the legislation in 2004 – were as high as 22 ct/kWh. Under subsequent laws, average payments were still as high as 19.8 ct/kWh for a 450 kW plant. Until 2015, certain types of substrate, usage of manure or heat utilisation earned operators bonuses that added 2-10 ct/kWh to the basic remuneration. In 2015, the average plant received 22.5 ct/kWh, the German Association of Energy and Water Industries (BDEW) estimates.

Numerous local businesses were founded to develop biogas projects and manufacture plant components, as a result of research projects or by energy transition enthusiasts. Existing manufacturers of CHP plants specialised or expanded their product range for biogas, explains Held from the BBE.

The number of biogas installations rose from 1,050 in 2000 to 8,856 (with an installed capacity of 4,018 MW) in 2015. That’s equivalent to three or four nuclear power reactors. Most new plants were added in the years 2006, 2009, 2010 and 2011. In 2015, the biogas sector in Germany had a total turnover of 8.2 billion euros and employed 42,000 people.

But though Germans often talk of the “biogas boom”, the industry has been at the mercy of frequent policy changes from the start. “After the boom following the EEG 2004, there was a dent in development until 2009 because everybody was waiting to see what the new law would offer in remuneration. The peak phase followed, including 2011, which was our best year,” Schmidt at Ökobit told the Clean Energy Wire.

Periods where investors played the waiting game have alternated with bursts of activity, as they rushed to get plants completed in time to receive higher payments before feed-in tariffs were adjusted downward, Andreas Lenger, key account manager biomethane at PlanET told Clean Energy Wire.

Acceptance issues and legislated support is cut

Despite its economic successes and support from the state, the status of bio energy in Germany’s family of renewables has always been that of grudgingly accepted stepchild. The “food vs. fuel” discussion at the centre of international arguments against bioenergy was held in Germany too, even though the use of domestic energy crops for fuel is negligible. Germany imports some 1.8 million tonnes of palm oil every year most of which is used for bio-diesel. Compared to large palm oil consumers like India, China or Indonesia, which each consume between 5 and 10 million tonnes per year, this is a relatively small amount. Germany does not suffer from food shortages, and fuel for biomass plants (e.g. wood pellets) is not imported from abroad on a large scale. Nevertheless, issues in other countries, such as high use of wood pellets in the UK, have also tarnished the sector’s image in Germany, says Matthias Held at BBE.

But the most challenging argument against bioenergy in Germany has been the “maizification” of the landscape. In some parts of the country, there has been strong opposition to increasing cultivation of forage maize as an energy crop for biogas plants (See CLEW Factsheet on bioenergy’s public acceptance problem). Villages have been bitterly divided over biogas plants. On one side are farmers interested in the extra profit from running a biogas plant. On the other, those who argue that maize monocultures are not only ugly, but ecologically harmful. More use of maize has also led to increases in land prices and energy crops encroaching on biodiverse grasslands.

Along with public acceptance issues, the sector has suffered from the fact that no significant price digression has been achieved. While other renewable technologies boosted by feed-in tariffs have fallen in price, biogas remains one of the most expensive renewable source of power. Previous changes to the EEG failed to significantly reduce the amount of maize they use, or make installations more flexible. As a result, the government reduced its funding considerably in 2014. The Ministry for Economic Affairs and Energy cut bonuses for new facilities and introduced a limit of 100 MW new biogas-power capacity per year.

In the first year after the 2014 law came into effect only 150 new biogas plants were completed in Germany. Most were small manure-based facilities with a capacity of under 75 kW, because these still receive the highest possible feed-in tariffs. The added capacity only amounted to 23 MW – significantly less than the 100 MW possible under the newly established expansion limit.

The 2014 reform also aimed to make biogas plants more flexible in their power supply by limiting fixed payments to 50 percent of the power they provide and forcing them to adjust the remainder of their power production to market requirements. And the government has sought to encourage the use of biogenic waste, instead of renewable raw materials grown specifically for the use in bioenergy. But even new installations of waste-based plants have fallen sharply.

So far, both PlanET and Ökobit, which specialise in agricultural biogas plants have weathered the storm. But some of their competitors have not. Many larger biogas plant suppliers – but also firms in the CHP business – have folded in recent years. The sector is in the middle of a consolidation phase.

Surviving the consolidation phase

The boom of the early years triggered the creation of several listed companies, among them full service provider Schmack Biogas, with an annual turnover of 67.6 million euros and 400 employees. The company folded in autumn 2009 when its main market of smaller biogas plants for farmers dwindled and it couldn’t make the same margins by constructing bigger installations, the Handelsblatt reported at the time.

Listed full service provider Biogas Nord AG suffered a similar fate in 2013, and former market leader MT-Energie went into insolvency in 2014. Both Schmack and MT-Energie have since found new investors, Schmack becoming part of the Viessmann Group, and MT-Energie part of the SERCOO Group, a conglomerate of formerly ailing biogas-technology firms. MT-Energie is one of a number of companies now reduced to offering services like maintenance and repowering of existing plants, instead of whole turnkey facilities.

“They grew too much too fast,” said Sebastian Schmidt from Ökobit of his larger competitors in Germany. Mathias Kern from PlanET, which has built 400 biogas plants in Germany and employs 250 people, brings it down to the simple formula: “Those biogas companies that used to be listed, often don’t exist anymore.” He says planning and constructing biogas plants is a long-term business without exponential growth rates, not geared to investors who want to make money quickly.

Biomass echoes CHP

Manufacturers of CHP, which is part of every power-generating biogas plant, have gone through a similar phase. “The German market for new biogas systems is basically dead,” Silke Rockenstein of CHP firm MTU Onsite Energy, part of Rolls-Royce Power Systems AG, told the Clean Energy Wire.

Of the top nine CHP companies in 2010, five have since gone bankrupt. Schnell motors filed for insolvency in 2016, citing the political and economic framework conditions for biogas CHP in particular. According to the Schnell management, the cut in support for biogas in the EEG 2014, overcapacities, and “extreme, cutthroat competition” was troubling biogas CHP unit manufacturers in Germany. The other affected companies, small and medium sized businesses from all over Germany – including Seva Energie, PRO2 (which is now part of the same SERCOO group as biogas company MT-Energie), Senergie (now f.u.n.k.e. Senergie), BMF Haase – cite similar reasons for their demise. However, reports at the time of the insolvencies often also point to other, more company-specific problems, as a cause.

Most of the insolvent CHP companies were taken over by new investors. 190 out of 280 jobs at BMF Haase Energietechnik in Neumünster (the former Haase AG) were saved. After a decline in orders for biogas plants led to bankruptcy in 2012, the new focus was on single system components and maintenance services, instead of providing whole installations, Haase’s new management said.

Other CHP manufacturers, like market leader 2G, have pulled through the dry spell in the biogas market by focusing on other forms of energy. 2G was founded in 1995 and grew into one of Germany’s large biogas CHP manufacturers, getting its stock market listing in 2007. It began building CHP for use with natural gas in 2009, pursing new business in the United States. As 2G’s sales revenues from biogas CHP systems in Germany fell from 39.2 million euros in 2014, to 16.1 million euros in 2015, revenues from natural gas CHP systems overtook those from biogas systems for the first time. It also noticed that shareholders, who had invested at the time of the biogas boom had – sometimes in a concentrated manner – sold their shares. 2G was now looking to attract more investors with “longer term investment horizons and a more fundamental understanding of CHP technology”, according to its 2015 annual report.

Business abroad as a lifeline

Other CHP and component manufacturers that once generated a larger share of their revenue with biogas related products have been able to cope with the demise of biogas because their technologies have other applications, whether in landfill sites, sewage treatment plants or other types of generators in the manufacturing industry and power stations.

This aspect of the sector has saved it from worse pains, says Held of bioenergy association BBE. While consolidation has undoubtedly taken place – and according to Sebastian Schmidt from biogas system provider Ökobit is not over yet – Held says it is unlikely that the bio energy sector will suffer as badly as the German solar PV sector. In the solar sector, almost 45,000 jobs were lost between 2012 and 2013 after feed-in tariffs were reduced and cheaper Chinese panels flooded the market in Germany. “But bioenergy technology, and in particular CHP, requires a lot of know-how that cannot be as easily manufactured as a simple solar PV wafer,” Held said.

Ökobit managing director Sebastian Schmidt echoes this view. “When it comes to technological know-how in the biogas area, German manufacturers are leaders in the world market,” he said.

Another increasingly important pillar of PlanET and Ökobits’ business is the service and maintenance of existing plants, which already makes up one third of PlanET's turnover.

Some companies have got through the crisis by focusing on biomethane plants, like the one in Neuhardenberg. Both PlanET and Ökobit began to offer this technology early (in 2007/2008). Now it is generating interest abroad. And some biomethane plants are still being built in Germany with the focus on profits from gas, rather than feed-in tariffs for electricity. If a biomethane facility operator can find a long-term customer who, for example, uses the gas in a gas-fired CHP plant, it’s the CHP operator that gets state support, often under previous or transient EEG rules.

As several of their competitors went bankrupt, MTU Onsite Energy had the advantage of having focused on different kinds of gas and an established international market, Rockenstein at MTU Onsite Energy says.

A similar approach also saved PlanET, which has built plants in France, the UK and Canada over recent years, and recently established a subsidiary in the United States. “If we hadn’t focused on markets abroad early enough we wouldn’t exist anymore,” said Andreas Lenger at PlanET. PlanET now gets one third of its revenue from abroad. At Ökobit, foreign sales will outstrip domestic sales this year, the management says.

The reasons for companies and individuals outside Germany to invest in biogas and biomethane plants are diverse and often very different from those at home, Laura Eras, international sales manager at PlanET told Clean Energy Wire. Few other countries have had such generous feed-in tariffs for renewables, including biomass. “What we often hear is that a customer wants to make use of waste material that the farm or business produces to generate his own power or gas, in order to become self sufficient and independent from insecure and costly imported electricity or fuels,” Eras explained.

In developing countries, where a secure energy delivery system is not in place, micro biogas plants –but also larger bioenergy installations – are an economically viable option compared to conventional power plants and the necessary infrastructure.

Will biogas ever be competitive?

In Germany however, the competitiveness of bioenergy remains a hot question for the sector. When energy minister Sigmar Gabriel announced the latest reform of the Renewable Energy Act in 2016, which again includes a limited growth path for biomass installations, he reasoned that it didn’t make sense to support the most expensive form of renewable power when others were still gradually falling in price.

Electricity generated in an average biogas plant built in 2015 with a 150 to 450 kW capacity receives feed-in payments of between 11 and 13 cent per kilowatt-hour (ct/kWh). Small installations of under 75 kW will receive over 23 ct/kWh. By comparison, new small solar rooftop PV installations received around 12 ct/kWh in 2015, onshore wind 5-8 ct/kWh. The average power price at the electricity exchange was 3 ct/kWh in 2015.

“We’re not expecting large price drops in biogas technologies, the way we’ve seen them in other renewables,” said Guido Ehrhardt from the German Biogas Association (Fachverband Biogas). “And the biogas itself cannot get much cheaper because of the costs of the substrate and limited amount of space to grow energy plants.” Mathias Kern at PlanET says the sector is fighting hard to keep the prices stable. In general, components for biogas plants have become a bit cheaper, but because the systems as a whole have simultaneously become more complex, the overall price for a new plant hasn’t fallen.

Future-proofing biomass power in Germany

If Germany’s biogas sector wants to have a future, certain changes in flexibility, the power market and public acceptance are key, the German bioenergy lobby believes. At the same time, it stresses how valuable “the only controllable renewable energy” will be for Germany’s future power system.

“Comparing biomass with wind and solar energy and saying that the latter are cheaper is comparing apples and oranges,” Ehrhardt said. He argues that the current design of the power market means the flexibility that biomass can provide to the power system is not sufficiently incentivised and rewarded. Over-capacities of fossil power stations that provide constant base load power should be taken out of the market, Ehrhardt argues. That would allow flexible biogas plants to make a profit from price peaks at times of low supply from fluctuating renewables, and in turn could reduce the basic remuneration required by biomass plants and thus the power price, he says. So far, about a quarter of biogas plants in Germany have been upgraded to provide flexible power.

The latest EEG reform, which will come into effect in 2017, hasn’t just cut feed-in tariffs. It has given the sector a second chance by allowing older biogas plants that are approaching the end of their 20 years of guaranteed feed-in tariffs to participate in auctions for follow-up financing. Without this, many of the existing biogas plants would simply have to shut down, a study by the German biomass research centre DBFZ shows.

The EEG 2017 and the auctions will give existing plants the opportunity to invest in flexibility and other upgrades with an extended recovery period for investments. CHP firm MTU Onsite Energy believes that there will be a small wave of such repowering orders up till the end of 2017.

Biomass as a main supplier of primary energy

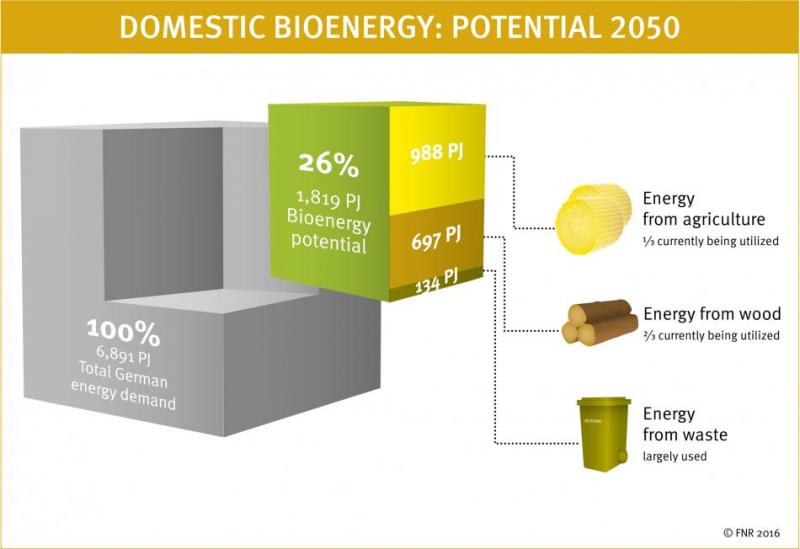

With Germany aiming to reduce greenhouse gas emissions by 80 to 95 percent by 2050, with 60 percent of gross final energy consumption (including electricity, heat, transport) covered by renewable energy in the same year, the bioenergy sector believes its contribution will be required. By 2050, 26 percent of Germany’s primary energy consumption could come from bioenergy, providing 1,800 petajoules (PJ), the Fachagentur Nachwachsende Rohstoffe FNR (Expert agency for renewable raw materials) estimates (see figure below).

But Hannes Böttcher, researcher for biomass and land use at the Institute for Applied Ecology (Öko-Institut), isn’t sure if this calculation will hold. As Germany’s overall energy consumption falls in line with efficiency targets, the share of biomass in overall energy consumption might become higher. But to achieve a 26 percent share, an expansion of today’s land use for energy plants would be necessary.

“And this is what we find questionable, because if this isn’t possible in a sustainable way and leads to more biomass having to be imported, there is neither an ecologic benefit nor would Germany reduce its dependence on imported fuels,” Böttcher explained. In its own climate protection scenario for 2050, the Öko-Institut calculates that in a 80 percent less greenhouse gas emission scenario, biomass energy would provide 1,237 PJ or 19 percent to a total primary energy consumption of 6,500 PJ.

Böttcher also points to the concern that biomass might eventually become too valuable to be used for power generation – this was already true for wood and might become an issue for other plants if they are needed in transport fuel production or other sectors. “In any case, it’s hard to imagine that Germany will expand the land area used for growing energy plants like maize,” he concluded. And if the cultivation of energy plants were to become more environmentally friendly, yields would probably decline.

In its latest proposal for the next steps of the energy transition, the Ministry for Economic Affairs and Energy (BMWi) suggested that biomass would be largely used for fuel in transportation, not as an electricity source.

New energy plants and better use of heat

Still, the agricultural biomass industry is working on solutions. The German Biogas Association (Fachverband Biogas) has presented the North American silphie (or cup plant), as a “revolution in environmentally friendly cultivation of energy plants”. The plant could be used instead of maize, with a similarly high yield and benefits for the soil, the association says.

Another key to making biogas energy more acceptable to the public is to maximise its heating potential, alongside power production. “Local heating networks are extremely important for the economic feasibility and acceptance of bioenergy,” said Matthias Held, energy policy consultant at the German Bioenergy Association (BBE).

Although virtually all bioenergy plants make use of the heat they produce, channelling this into public heating networks, rather than consuming the heat on site, means they can play a greater role in achieving the goals of the energy transition.

Some 30 percent of the heat in a normal biogas plant is needed for the fermenting processes and operations of the plant itself. 57 percent of the remaining heat is put to other uses by the operators (for example to heat stables and other farm buildings or dry corn). But only 27 percent of operators are connected to a local heating network. Since 2004, biogas plants that make use of the heat outside of the plant receive bonuses under the Renewable Energy Act (EEG); since 2012, new installations are obliged to use at least 60 percent of the generated heat. In places where the heat from the biogas plant cannot be utilised, plants shouldn’t be built, the DBFZ advises.

And there are already examples of how bioenergy cannot only bring economic benefits to the community, but play the starring role in a local energy transition.

There are 179 officially registered “bio energy villages” registered across Germany which aim to provide an entire community with almost 100 percent renewable electricity and heat. Biogas plants in such villages typically feed their heat into a local network supplying households and public buildings. Heat distributed by a biogas plant is often offered at prices comparable or lower than those for an oil heating system.

13.2 percent of Germany’s heat consumption comes from renewable sources, the largest share of this was in 2015 provided by bioenergy plants (88 percent). When the heat is utilised in this way, the efficiency factor of a biogas plant can be increased to 90 percent.

Bertold Meyer is major of Bollewick, a bioenergy village in Mecklenburg-Vorpommern where 75 percent of homes are supplied with heat from local biogas plants through the local heating network. “It was important to us that we pursue a wholesome approach that reaps the local energy saving, generation and consumption potentials and at the same time lets the people benefit economically from the project,” he said.