Green resources, reuse and recycling are key to cleaner e-car batteries

Batteries that store renewable energy in cars, households and industry plants have become a mainstay of decarbonisation strategies around the world. The pressure is on to ensure that they will not only be truly sustainable during their use phase, but also before and after.

Civil society groups have called on carmakers around the world to review their battery sourcing practices and make sure that supply chains do not rely on highly emissions-intensive or unethical and environmentally damaging practices. The rapid spread of e-mobility will also result in an enormous increase in discarded batteries. Reuse and recycling will have to become much more comprehensive and efficient to avoid squandering valuable resources in environmentally harmful green technology waste. Boosting circular use will not only improve electric mobility's environmental footprint further, but also reduce reliance on critical raw material imports. Better recycling and circularity concepts for battery materials hold "enormous" ecological and financial potential, says Germany's engineering association VDI.

According to the European Commission, global demand for batteries will grow exponentially over the coming years and rise 14-fold by 2030, with Europe accounting for about one-fifth of the increase. Demand for specific battery raw materials could rise up to 1,000 percent by the middle of the century if efforts to meet the Paris Agreement's emissions reduction targets are taken seriously, figures published by the World Bank suggest. This is turning deposits of these resources into increasingly strategic assets that could rival today's geopolitical significance of oil or gas reserves.

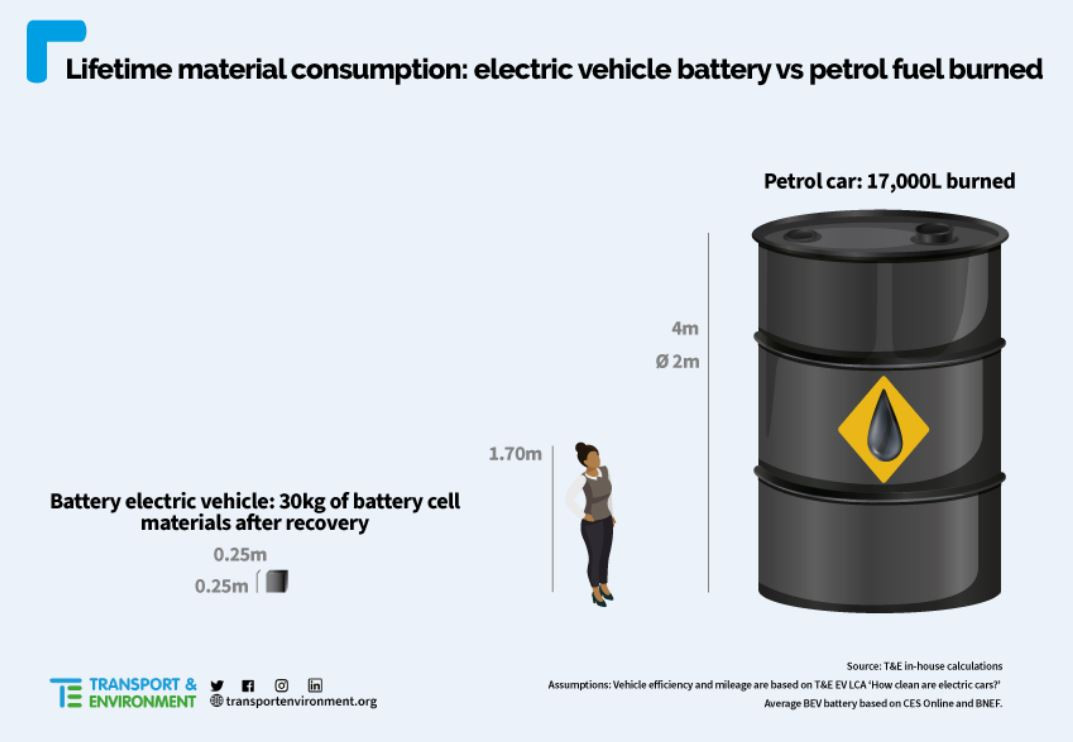

The problems that need addressing to make batteries greener are numerous, but it is clear that e-cars' overall ecological footprint is already much smaller than that of combustion engine technology. While proper recycling could ensure that the production of an average electric vehicle required no more than 30 kilograms of raw material in 2020, an average combustion engine car burned more than 17,000 litres of petrol for its operation only - "the equivalent of a stack of oil barrels 25 storeys high," according to green mobility NGO Transport & Environment.

The shift to electric mobility is a golden opportunity to help reduce the huge environmental and social impact of current resource extraction practices across the globe. The United Nations Environment Programme calculated that about half of the world’s greenhouse gas emissions, nearly 90 percent of the worldwide loss in biodiversity and water scarcity problems, as well as a large part of all violent conflicts are ultimately caused by the extraction and processing of resources.

What's in a battery?

Batteries are evolving so rapidly that they are considered the least predictable among the key clean energy system components. The International Energy Agency (IEA) has described the course of technological development as highly speculative, even in the medium term. New use cases change the material composition and, consequently, the related sourcing and disposal practices.

Car batteries are typically encased in a plastic or steel frame that holds the battery cell, which contains most of the device's critical materials. Lead-acid used to be the dominant technology and is still found in small batteries that help start the combustion engine in most cars on the road today. But lithium-ion batteries, which have a much higher energy density and saw fast cost declines in the past years, are dominating the electric vehicle market and will most probably account for the largest share by far in battery storage capacity throughout at least the next decade, according to the World Bank.

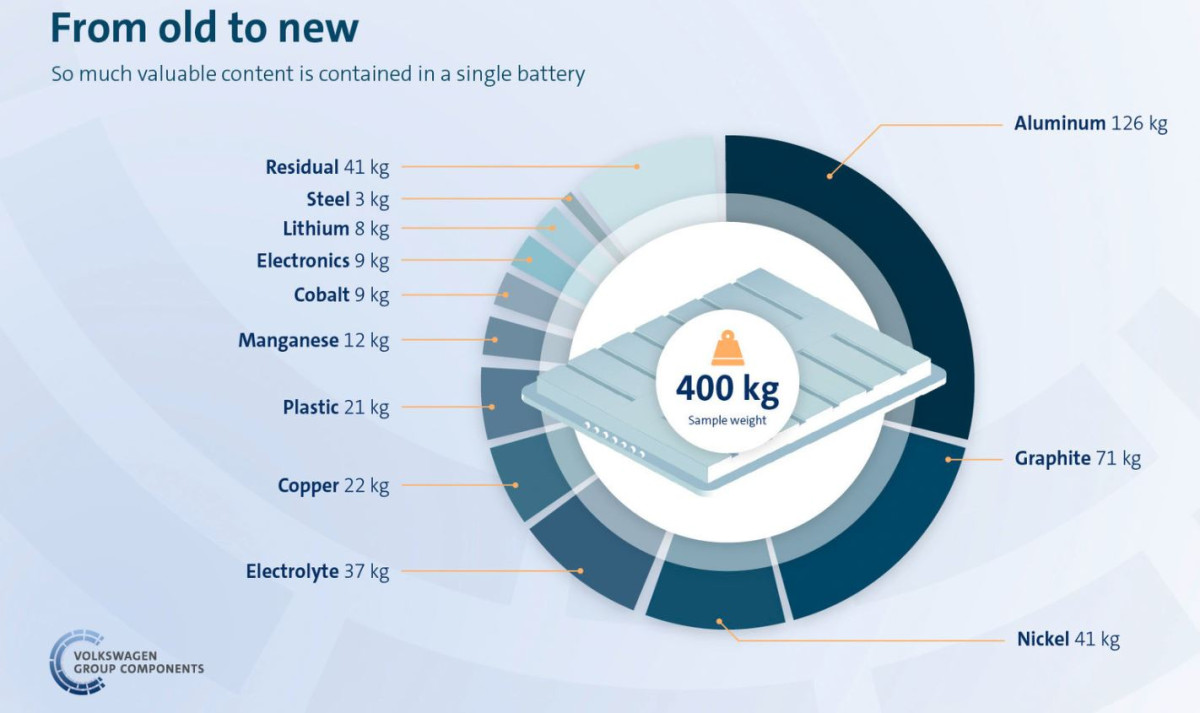

Europe's largest motoring association ADAC said the average battery of an electric car on the road in Germany as of 2019 weighed about 400 kilograms and had a capacity of about 50 kilowatt hours. Most of the weight comes from the reinforced casing needed to protect car batteries against accidents. Aluminium, steel and plastics therefore make up the bulk of components. But the average battery also held six kg of lithium, 10 kg manganese, 11 kg cobalt, 32 kg nickel and 100 kg of graphite, the most relevant materials when it comes to recycling (figures may vary for batteries from individual carmakers).

Availability and sourcing of battery materials

Most of a battery's volume consists of resources that are widely available on international markets, for example steel or aluminium. These include primary resources from mining and also secondary resources obtained by recycling.

In contrast, the supply of several other key materials in battery cells is highly concentrated geographically, and producers still lack quickly scalable recycling procedures to retain them in the production loop. Lithium and cobalt are key components, and demand for these two metals is projected to grow 60-fold and 15-fold, respectively, by 2050, according to the European Commission's Action Plan on Critical Raw Materials.

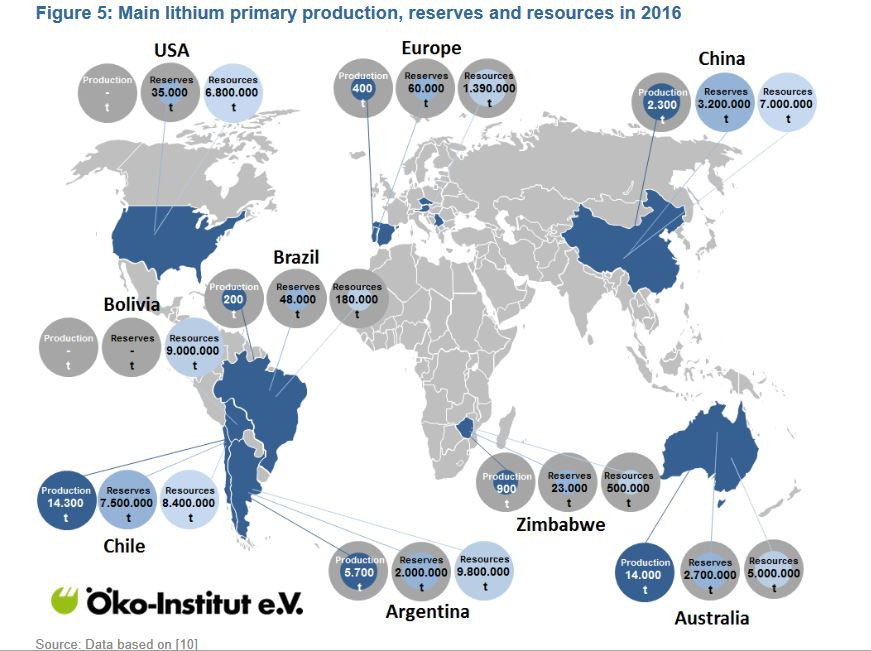

Lithium production has been dominated by Australia in the past years, followed by Chile, Argentina and China. The world's largest lithium deposits are concentrated in three South American countries, namely Bolivia, Chile and Argentina, which together hold about 60 percent of currently available resources. In this so-called 'lithium triangle' in the arid Atacama Desert region, water consumption for lithium extraction from salt brine has become a major concern.

About 240,000 tonnes of lithium will be needed worldwide in 2030, and 1.1 million tonnes in 2050, to sustain the current electric mobility trends, according to figures published by the German Institute of Applied Ecology (Öko-Institut). Proven reserves as of 2020 amounted to 17 million tonnes, but potential resources are believed to be much greater. Rising demand leads to increasing prices, meaning that exploration of and extraction from previously unknown or unprofitable sources becomes more attractive, including, for example, deep-sea deposits that are very costly to access.

A lithium mine in the Ore Mountains on the Czech-German border is thought to hold enough lithium for powering about ten million e-cars. Another project in Germany which could become even larger is a pilot that seeks to extract the "world's first" CO2 neutral lithium for car batteries in a geothermal extraction project in the Rhine Valley, illustrating the variety of new sourcing methods that could become relevant in the technological shift. And many other projects, for lithium and other precious metals, in regions ranging from Portugal to Norway show that countries across Europe are rethinking their mineral resource supply.

Proven lithium reserves are already four times larger than they were in 2008. If the entire potential of identified resources is included, about 80,000 million tonnes of lithium are available, according to Öko-Institut. Germany's resource agency DERA thus placed lithium in the "medium risk" range in its 2019 critical raw materials index. Despite the current geographic concentration of supply, "good governance" in sourcing countries is likely to guarantee stable supply, it said.

For cobalt, on the other hand, the agency sees a much higher risk, as reserves are concentrated in states where political instability or geostrategic considerations could hamper access for German industry. Cobalt mining is concentrated in the Democratic Republic of the Congo (DRC), which accounts for 60 percent of global output. Hazardous working conditions and extensive use of child labour in its mines are infamous. The DRC also received most investments in new mining projects in recent years, according to Germany's Federal Institute for Geosciences and Natural Resources (BGR).

Researchers of the German Helmholtz Institute said that demand for battery production alone could outstrip proven cobalt resources, and advocated further research into replacing cobalt with more widely available substitutes. Carmaker Tesla is already trying to end using cobalt due to the metal's many downsides.

In a similar vein, lithium's dominance is not set in stone, as it could also be challenged by other materials with better characteristics. In general, however, demand for both elements and a wide range of other materials, such as nickel, copper, and graphite, is expected to increase substantially over the next years.

Many large companies, such as carmaker BMW and chemical giant BASF, attempt to make their sourcing activities more transparent. But a wide range of NGOs in the so-called Supply Chain Law Initiative say attempts by individual companies are inadequate given the momentous changes on resource markets associated with the shift to e-mobility and renewables. They call for an effective law that enforces better resource procurement standards to create a level playing field for companies. Existing proposals for a supply chain act at the European level have spurred the German government to introduce a national law, but it has been criticised for neglecting critical environmental aspects.

What happens to old batteries?

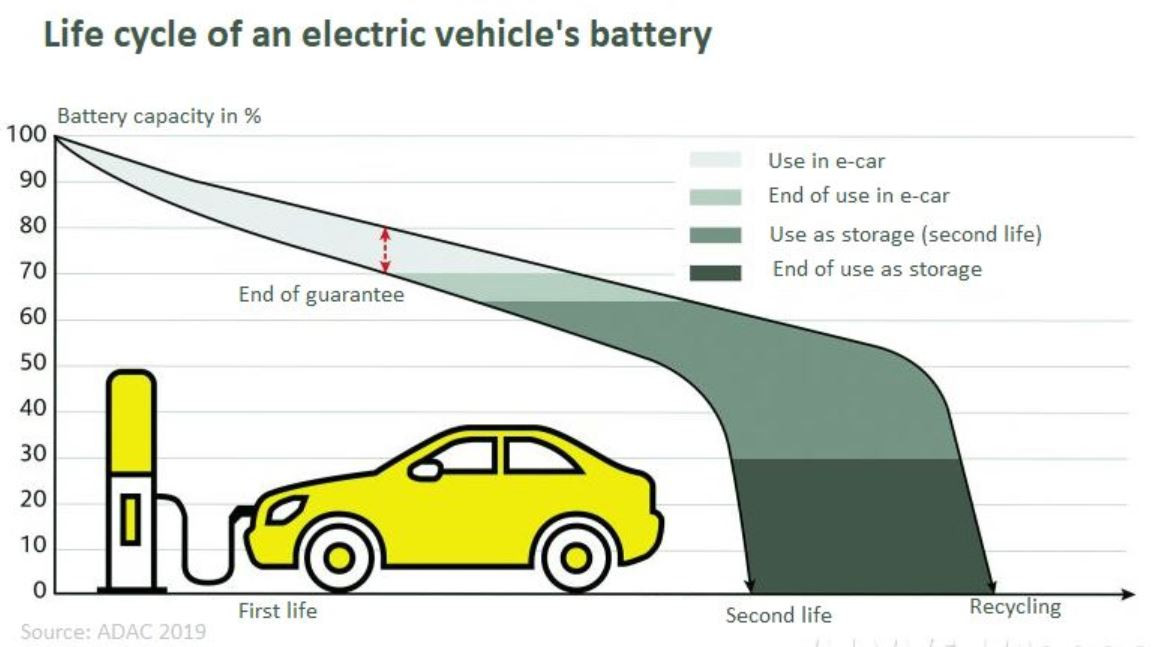

Many studies assume the average lifespan of e-car batteries is between 8 and 10 years, but many are already used for longer periods. Future batteries might last even longer, as multiple battery makers have said the arrival of "million-mile" batteries is imminent. These could outlast their vehicles and potentially be used several times.

Once they fall below a charging capacity of about 80 percent, batteries are generally no longer seen fit for use in cars. At present, the number of EV batteries at the end of their lifetime remains relatively low. Carmaker Volkswagen told Clean Energy Wire its current treatment of old batteries is largely limited to "internal sources" like old prototype models. Returns by customers do not play a major role yet, but this is expected to change significantly over the next decade. In 2030, the volume of old EV batteries could add up to 1.7 million tonnes in the EU, according to consultancy Roland Berger. These could potentially cover up to 30 percent of current demand for valuable materials like cobalt or nickel.

Second life improves environmental footprint

Rather than disassembling batteries for recycling, a more efficient way is to make them fit for other purposes. Car club ADAC said that a car battery that went through up to 2,500 charging cycles still had a residual capacity of about 75 percent, making it ecologically and economically unreasonable to dispose of them at that stage. Second life applications as stationary storage units put a lot less strain on the batteries than using them in vehicles. This means they may continue to run for another 15 years after being removed from the vehicle. This can either happen in small scale or in industrial applications that connect large numbers of batteries, an approach carmakers themselves are experimenting with. Demand for stationary battery storage to stabilise electricity grids dominated by renewables is expected to grow rapidly in the years to come.

Recycling holds great potential

Once batteries have fully exceeded their service life, they turn into industrial waste. Given the known difficulties in sourcing raw materials and recycling’s current inefficiencies, batteries' afterlife treatment still holds enormous potential for improving their environmental footprint. In 2035, over a fifth of the lithium and two-thirds of the cobalt required will come from reused EV batteries, according to Transport & Environment. "This, combined with battery density improvements, will reduce the impact of extraction and significantly reduce dependency on imports."

Recovery rates from lithium-ion batteries for some materials already reach up to 90 percent, for example steel, copper and nickel, according to the Öko-Institut. But the recovery rates of other materials, for example lithium, manganese or graphite, are currently very low, despite progress in finding new procedures that are not efficient enough yet for industrial applications.

Outdated legislation

Discarded batteries cannot be deposited in landfill sites. Under the German Batteries Act, which itself is based on the 2006 EU Battery Directive, retailers have to take back e-car batteries from their customers free of charge. Car retailers can then pass on the scrapped materials to manufacturers.

While components of smaller batteries may be disposed of by combustion, at least 50 percent of the materials in larger and high-energy car batteries must be recycled. But the directive predates the rapid uptake of lithium-ion batteries, and consequently it does not specify material flows for the components used in the now dominant technology. The required recycling levels can thus already be met by reusing the metals and plastics in the casing, which is much cheaper but leaves the precious metals inside the battery cells untouched, according to ADAC.

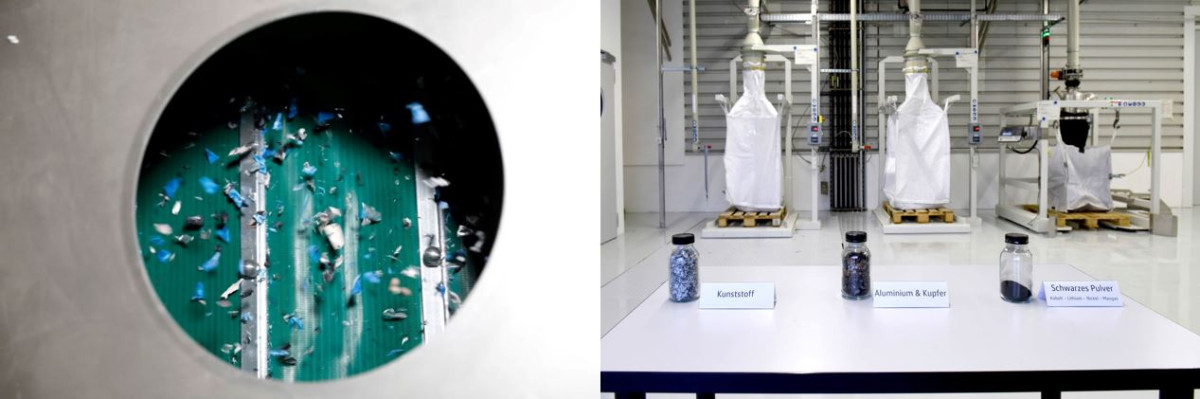

After batteries are fully discharged and the cells are removed from their casing there are two basic methods to recycle valuable materials inside the cells. Components can either be melted down or ground into granulate, which is then dried and filtered to separate the ingredients. Recycling efforts are usually focused on regaining the precious metals (nickel, cobalt, copper, iron and aluminium) and to avoid heavy metals like quicksilver, cadmium or lead from leaking into the environment, according to the UBA. Some of the components thus collected are not fed back into the economic cycle but end up as fill material for road construction, for example – which is why a new and tighter definition of what exactly "recycling" means is needed, the agency said. There is no industry standard for the eco-friendly design of car batteries. Each carmaker uses different models, which makes automating disposal and recycling procedures difficult. Separation is often done by hand.

The German government has supported several industry and research projects aimed at improving recycling capacities before volumes reach much higher levels (for example LithoRec, LiBRi, LithoRec II, EcoBatRec, ABattReLife, New-Bat).

The European Commission proposed a new batteries regulation at the end of 2020 in the context of its Circular Economy Action Plan. The regulation is meant to replace the existing directive from 2006, which merely covered retailing and waste management aspects. In contrast, the new regulation deals separately with the safe disposal of battery components, clean and ethical sourcing, sustainable production conditions and circular economy aspects, such as collection quotas, second life, durability or eco-friendly design. It also stipulates that only batteries that come with a carbon footprint declaration can be put on the market for electric vehicles and industrial storage by mid-2024.