New German finance minister must strike balance between climate spending & solid budget

The job of German finance minister has become a key position in national and European politics. The treasurer of the continent’s richest country controls the state’s budget and has an important say in how much Germany and also the EU invests in climate action. In the negotiations for the new German government coalition, a conflict between the Green Party and the Free Democrats (FDP) over the question of which party will provide the treasurer of the biggest economy was one of only a few details that emerged from the otherwise very discrete three-party talks that also included the Social Democrats (SPD).

Ultimately, the pro-business FDP won the prize of heading the Federal Ministry for Finances (BMF). Since the beginning of the coalition talks, FDP leader Christian Lindner made no secret of his desire to take over the ministry from SPD politician Olaf Scholz, Germany's new chancellor. During the election year, Lindner styled himself as a guardian of fiscal discipline and a balanced budget. This has led to worries that his nomination could mean the government coalition's ambitious climate plans run dry of funding, and Germany becomes the face of austerity again rather than investment driver for Europe, with some international observers even calling him “unsuitable” for the job.

The FDP leader, who stunned observers in 2017, as he let coalition talks with the conservative CDU/CSU and the Greens collapse by pulling out in the last minute, is an outspoken sceptic of state intervention and debt-financed investments. And his party has always stood for a laissez-faire approach to market forces. This is a marked contrast to its coalition partners SPD and Greens, who have run on a platform of large public investments and better regulation of companies to ensure they abide by emissions reduction targets.

However, despite the free market-liberal's reservations regarding generous state spending, Lindner said he would regard the BMF as an “enabler-ministry” for climate action. His task therefore would be to ensure the coalition’s climate plans are properly funded while fiscal discipline is maintained. “I see no conflict,” Lindner said at a press conference on the eve of the new government’s inauguration. Asked about possible worries in other European countries about a tight-fisted German treasurer, Lindner said he does not plan to deny European projects funding if these investments point in the right direction, adding that Greece has set in motion impressive reforms since the financial crisis that could even serve as inspiration for the next German government’s ambitions to induce change.

"Enabler ministry" needs to turn pandemic impact into growth path

The coalition treaty states that the new government faces a “challenging” budget situation due to the costs of the coronavirus pandemic, but promises to raise the necessary “public and private” funds to finance investments in “future projects,” which includes climate action. As for most other countries around the world, the coronavirus pandemic impacted the German budget significantly.

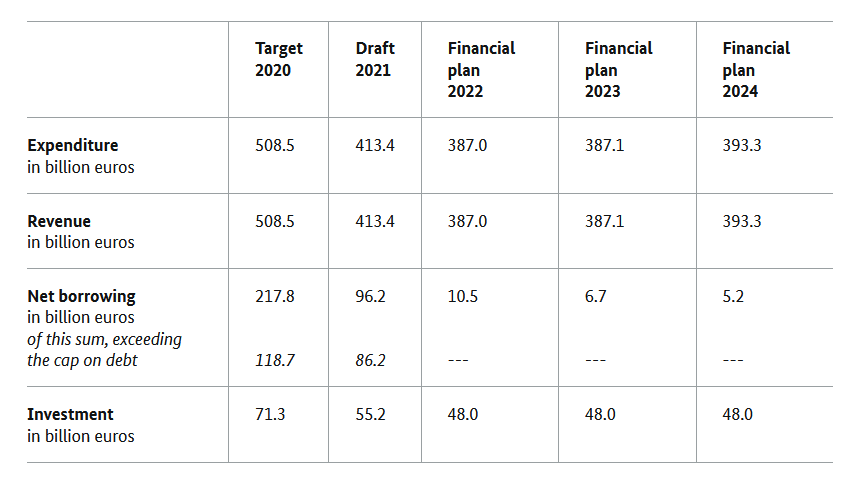

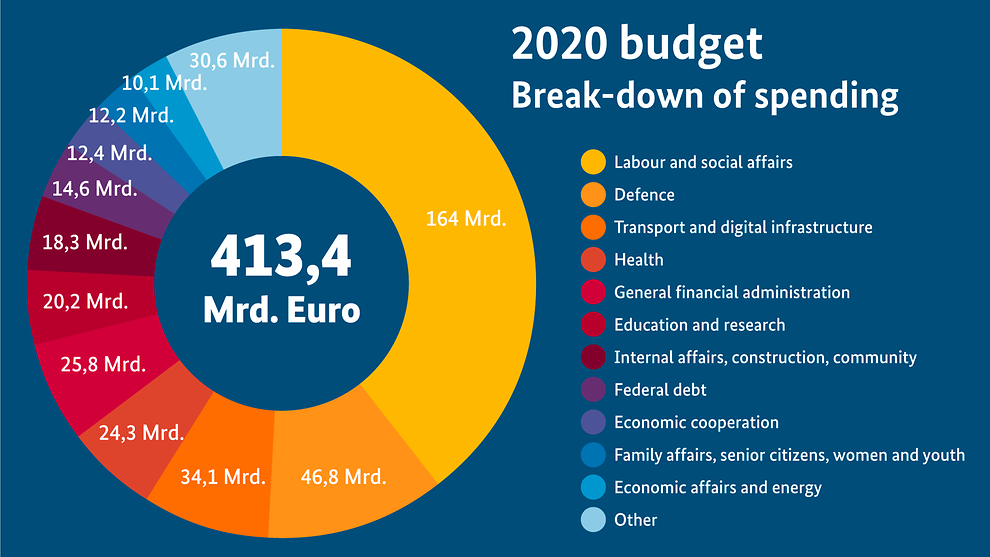

State revenues plummeted from about 508 billion euros in 2020 to just over 413 billion euros in the following year, a drop of almost 20 percent. Chancellor Scholz in his previous role as finance minister enabled counter investments, with a focus on climate-related infrastructure investments, such as railways and road construction. To this end, the government will borrow way above its so-called "debt brake" - a balanced budget amendment - with new credits totaling about 96 billion euros.

The suspension of the debt ceiling until 2023 due to the pandemic will be used to earmark funds for climate projects throughout next year. Overcoming the recession and investing in future projects would be two sides to the same coin, the parties said, promising “planning security” by making-long term commitments to certain funding structures. Among Lindner's first tasks after inauguration was drafting the 2021 supplementary budget. Lindner planned to release about 60 billion euros, partly from unused funds from the coronavirus recovery package. Ahead of the cabinet meeting on 13 December, the new finance minister stressed that a landmark court ruling from earlier in the year compelled the government to quickly address climate-related challenges.

“The FDP so far has not shown great appetite for the topic of sustainable finance”

Beyond immediate budgeting questions, the 42-year-old, who has held no previous ministerial post and has no hands-on experience in financial policy, has said little about his long-term ideas as treasurer, including the creation of a more sustainable financial sector. The FDP was the only one of the parties running for government that did not include proposals on the crucial issue of better aligning financial markets with climate policy in its election programme, although Germany started to considerably ramp up its activities in the fast-growing market in the past three years.

“The FDP so far has not shown great appetite for the topic of sustainable finance,” said Ingmar Jürgens of think tank Climate & Company. Jürgens is currently on leave from his position in the EU Commission to focus on sustainable finance research and his work as independent policy advisor. But even though the FDP so far has not hinted where it stands regarding the required reforms to the financial system, there is reason for optimism that Lindner might take the issue serious. The previous government with Scholz as finance minister decided not to adopt a set of recommendations compiled by Germany’s sustainable finance committee, opting instead for drafting its own strategy that was criticised as a vague and watered-down alternative. “The new government’s coalition treaty now at least says the parties want to base their strategy on the committee’s report, so that could be a signal in the right direction,” Jürgens said

The new finance minister will arguably be the most influential figure in the German government after chancellor Scholz. To a large extent, this is due to his veto right regarding other ministries’ law proposals if they have implications for the budget, which can significantly impede or slow down the legislative process. While climate so far has not been counted as an individual item in the budgeting process, this has an impact on all expenditures related to emissions reduction and the energy transition in other areas as well.

The BMF also represents Germany in the coordination of the common EU budget and monetary policy. It regulates taxation, public stakes in corporations, money laundering and financial sector supervision. The ministry has representatives in all other ministries in government to ensure that each of them abides by the BMF’s guidelines. Ultimately, this means Lindner gets a say in what other ministries, notably the novel climate ministry led by Green party co-leader Robert Habeck, but also the FDP-led transport ministry and the new buildings ministry can spend.

Lindner could raise up to 46 billion euros annually with rigorous financial planning - think tank

The short term tasks awaiting Lindner in this new and powerful role are numerous already: In Germany’s upcoming presidency in the G7 club of influential economies, new chancellor Scholz’s idea of creating an international “climate club,” aimed at streamlining taxation and other financial guidelines among countries willing to engage in faster emissions reduction, will require careful diplomacy and determination by the German minister of finance. Lindner will also quickly have to start work on the 2022 budget, which needs to reconcile a new rise in difficulties imposed by the coronavirus pandemic with climate plans. This means he will be have to run a fine line between delivering investment promised in the new government’s coalition treaty and keeping a promise to his own FDP voters that the state will not embark on a debt- or tax-powered spending spree.

Lindner has said he instead wants to tackle climate-damaging subsidies and unlock more private capital for climate action with so-called “super write-offs”, which are supposed to spur much-needed private investments in emission reduction or digitalisation “and ultimately pay back into the state’s coffers.” The new parliament will decide on the 2022 budget at the beginning of next year, which will immediately be followed by the first calculations and estimates for the following year’s drawing limit and financial planning up until 2026. The loophole for 2022 budget provided through the temporary suspension of the "debt brake" will no longer be available by 2023.

According to energy policy think tank Agora Energiewende, the new government could potentially unlock up to 46 billion euros per year even under a reinstated debt brake and also without raising taxes. Besides reducing damaging subsidies, this would include higher investments through partly state-owned corporations and a new calculation of borrowing mechanisms that open a more flexible corridor for new debt. “Germany’s success in climate action depends considerably on the new government’s financial planning,” said think tank head Patrick Graichen, who moves on to become state secretary under Habeck in the merged climate and economy ministry. “If the new government sets up a climate budget right after taking over office and makes use of smart financial instruments to encourage investments, the funds needed can be set in motion,” Graichen argued.

Market-liberal Free Democrats could learn to embrace sustainable finance

Rising energy costs in Germany and the rest of Europe, for which the new coalition has already signaled support for struggling consumers, look set to complicate the task for the new minister, who has consistently advocated for a small-state approach. As well as households facing higher energy bills, industrial companies will also be in need of assistance by the treasury ministry to ensure their transformation towards carbon-neutrality is backed by sound rules for state support, loans and tax write-offs for decarbonisation investments. “We will need some form of ‘ownership’ by the BMF of the industrial transformation that we are facing,” Climate & Company’s Ingmar Jürgens said. “The ministry needs to make sure that its entire toolbox is geared up to support and incentivise the German and European economy.”

A clear and early positioning by Lindner on where he stands regarding Germany’s stated ambition to become a “leading location” for green and sustainable finance is needed to gauge what can be achieved in the coming legislative period, Jürgens said. For that to happen, greater consensus with France as to where European sustainable finance should be developed would also need addressing by the minister in gatherings like the G7, he added.

Lindner ought to consider that sustainability rules for financial actors actually strengthen the market, rather than obstruct it, he said. “The FDP’s knee-jerk reaction to sustainable finance so far often has been rejection on the grounds of fearing more regulation for businesses. That’s a misunderstanding that urgently needs to be addressed,” Jürgens argued. Pressure to introduce financial disclosure rules for companies will mount internationally in any event, “be it through their investors and banks, or be it by their customers and business partners who require more transparency in their own portfolios or supply chains.” Standardisation in the form of an EU Directive could therefore ultimately reduce reporting costs.

Even for free-marketeers the question should not be “yes or no” to regulation, but rather which framework is needed to amplify market efficiency, he said. “More and better quality of sustainability-related data reporting by companies allow freely operating market actors to better assess investment risks, which actually is at the heart of what a market liberal party should fight for,” he concluded.