North Sea states aim for “world’s largest energy hub” with major offshore wind investment plan

The North Sea’s neighbouring states have launched a joint initiative to massively scale up offshore wind power production and international grid connections. By turning Europe's famously windy northern maritime zone into a renewable energy reservoir, the countries aim to lower industry costs and provide the region with a reliable clean electricity source to help Europe reduce its dependence on fossil fuel imports. At the third North Sea Summit held in the northern German city of Hamburg, government representatives of Germany, France, the UK, Luxembourg, Iceland, Norway, Belgium, Ireland, the Netherlands and Denmark, agreed to mobilise up to one trillion euros between 2031 and 2040.

German chancellor Friedrich Merz said all signatory states, which included EU members and non-EU states, shared the goal of achieving a secure and affordable energy supply. “For this, we need more cooperation,” Merz said, citing cross-border planning of offshore wind projects, hydrogen production, and grids as areas where this would be implemented. "I see great potential for better cost efficiency," the chancellor said. He added that the protection against physical and cyberattacks on energy infrastructure in the region played an important role at the talks, which in addition to the EU Commission also featured representatives of the military alliance NATO.

The plan aims to add 15 gigawatts (GW) of new capacity each year, reaching up to 300 GW in tens of thousands of installed turbines by 2050. Moreover, it provides for a fast increase of interconnectors that allow several countries to benefit from the electricity produced in the same wind farm and to develop the production of green hydrogen at sea.

"The world’s largest energy hub"

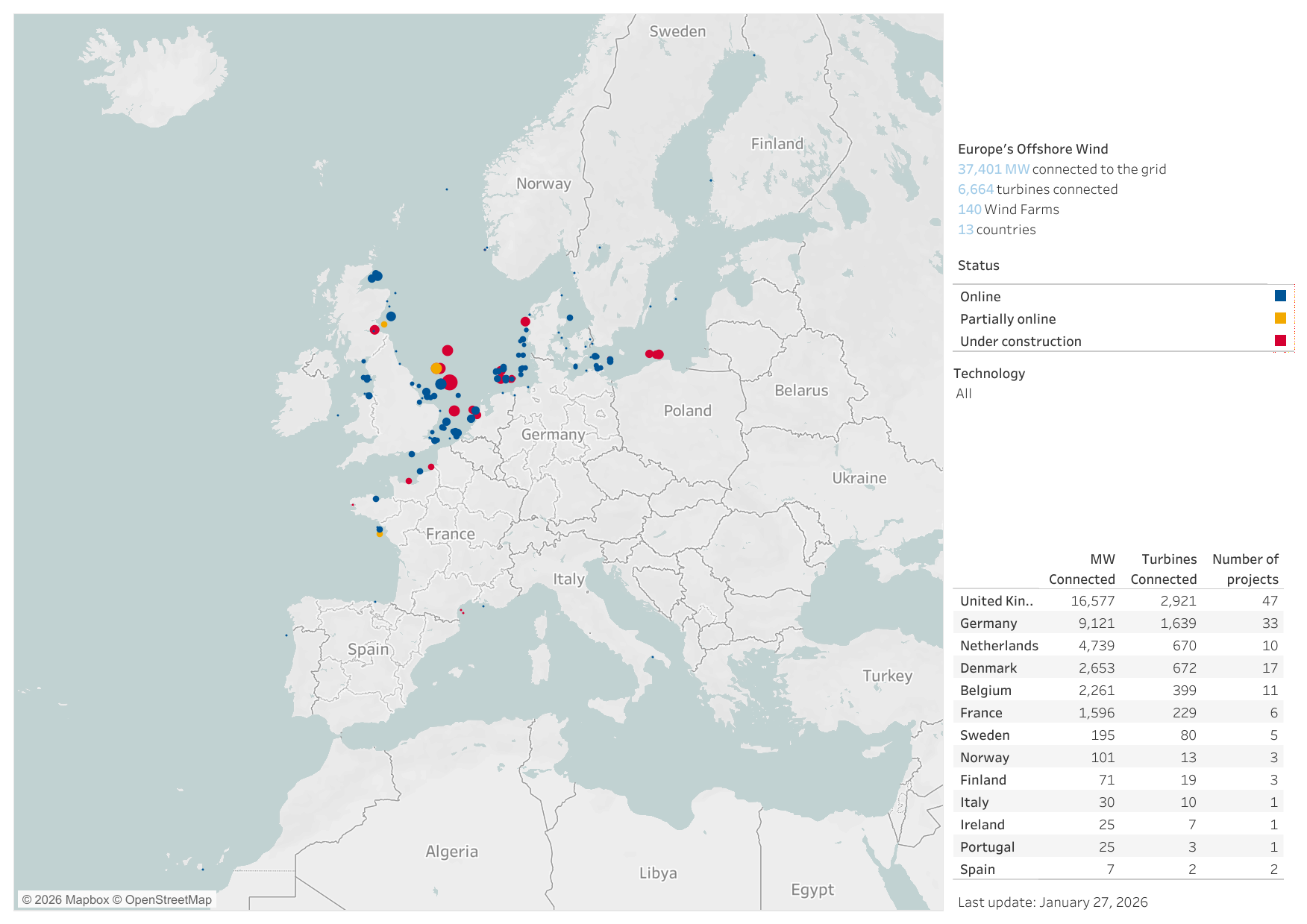

As of early 2026, a combined offshore wind capacity of 37 GW was installed across Europe. A recent analysis by the Boston Consulting Group found that North Sea countries would need to increase their expansion rate sevenfold in order to meet targets agreed at the 2023 summit, which aim for a capacity of 120 GW by 2030. Industry representatives have said that expansion has slowed in recent years due to rising investment costs and auction designs that create too much uncertainty for potential bidders.

“Our aim is to build the world’s largest energy hub,” said Germany’s energy minister Katherina Reiche. She said that Europe now can seize a major opportunity to attract capital, as investors are looking for stable conditions amid rising geopolitical uncertainties. “Every offshore wind project that connects Europe is making us more resilient,” Reiche said. She stressed that the multilateral agreement would provide Europe’s offshore wind industry with much-needed planning security to invest in production infrastructure, port capacity and specialised vessels.

The first North Sea Summit was held in 2022, in response to Russia’s invasion of Ukraine, as a forum for developing joint strategies to make their energy infrastructure more resilient. Four years later, threats to Europe’s security remain acute as the war on Ukraine continues. At the same time, recent statements about the possible seizure of Greenland, an autonomous territory belonging to the Kingdom of Denmark, severely undermined confidence across Europe in the US under president Donald Trump as an ally. European governments have responded by intensifying collaboration in strategic fields, including energy.

“Europe stands together in stormy weather,” said German minister Reiche, adding that “we have to prepare” for possible external shocks. The European Union’s energy commissioner, Dan Jørgensen, said that “homegrown clean energy” was the only way to become more independent and cut the hundreds of billions of euros that EU states spend on fossil fuel imports each year.

Renewable energy clearest path to energy security in Europe – governments

With a view to ongoing security challenges, Danish commissioner Jørgensen said that “the Greenland question is on everyone’s mind” at the summit. An analysis warning that Europe’s move away from Russian energy over the past years is accompanied by a fast-rising dependence on US supplies of LNG released in the week before the summit only underlined the need for action. However, Jørgensen stressed that neither Denmark nor the EU were against trading with the US. “We do need LNG from America as it is now,” Jørgensen said. However, “in the long-run we want to become free of gas.” After phasing-out Russian energy, Europe should avoid replacing one dependence with another, he added.

UK energy secretary Ed Miliband said it was “absolutely in our interest” to cooperate with other European states on offshore wind. Renewable power would offer the clearest path to energy security and help the UK and the rest of Europe to “get off the roller-coaster of fossil fuels,” the energy secretary added.

Cooperation to cut costs

Miliband pointed at the country’s latest round of offshore wind auctions, in which 8.4 GW of capacity was awarded, marking Europe’s most successful tender to date. The auction “sent a message across Europe that offshore wind is the backbone of the future energy system,” Miliband argued. The auction relied on Contracts for Difference (CfDs), which guarantee operators a minimum price for their output while capping revenues when market prices are high. Under the North Sea investment pact, CfDs will become the standard remuneration model for offshore wind auctions, a step that Germany’s offshore wind industry has long called for.

According to industry group Wind Europe, the joint approach agreed in the investment pact should lead to cost reductions of up to 30 percent and create more than 90,000 additional jobs. A separate analysis conducted by research institute Fraunhofer IWES found that connecting wind farms internationally could significantly reduce costs. Spreading turbines over larger areas would reduce wake effects and increase average turbine output, the researchers said.

“We need more cross-border cooperation and optimisation to improve cost efficiency,” said Kerstin Andreae, head of the German Federation of Energy and Water Industries (BDEW). Simply increasing capacity would no longer be sufficient, she said, arguing that new turbines must be planned in a way that optimises both costs and output. “A key lever for this is less dense construction and using suitable areas in other countries’ waters that pay towards Germany’s national expansion target.”

Spreading turbines more evenly across the North Sea would also help reduce environmental impacts of offshore wind energy production, said Sascha Müller-Kraenner, head of Environmental Action Germany (DUH). “We absolutely support the newly announced cross-border cooperation projects, as the German government’s ambitious expansion targets do not all fit into the exclusive economic zone alone,” Müller-Kraenner argued. However, all member states had to ensure that the industry’s expansion respects ecologic limits and coordinate planning to minimise adverse effects on ecosystems.

Germany's offshore wind industry worried about ongoing uncertainties

The mood in Germany’s offshore wind industry and elsewhere in Europe has shifted markedly in recent years. While bidders in offshore auctions in 2023 were ready to pay billions of euros to implement new projects, a subsequent auction round in 2025 failed to attract a single bid. “The high bids that we saw in the past in a way concealed the true situation that the industry finds itself in,” Hans Sohn, head of communications at offshore wind industry association BWO, told Clean Energy Wire.

The meagre expansion of less than 1 GW annually since 2020 was caused by a spike in investment and capital costs, for which CfDs would provide a possible remedy. “And then there’s uncertainty about the availability of skilled workers, special construction vessels, storage and processing capacities at sea ports and so on,” Sohn added. Industry representatives therefore called to delay a planned auction in February until the end of the year to reform the auction design, but Germany’s government has signalled it intends to keep the schedule.

Another major uncertainty for the industry is the expected power price in the next two decades, Sohn added. “Demand and price depend on the pace and scope of electrification, meaning the roll-out of electric cars, heat pumps and so on – but it also depends on the level of industrial production we will have in Germany in the future.”