CLEW Guide – Italy moves on green transition, but fossil ties remain tight

With its “CLEW Guide” series, the Clean Energy Wire newsroom and contributors from across Europe are providing journalists with a bird's-eye view of the climate-friendly transition from key countries and the bloc as a whole. You can also sign up to the weekly newsletter here to receive our "Dispatch from..." – weekly updates from Germany, France, Italy, Croatia, Poland and the EU on the need-to-know about the continent’s move to climate neutrality.

Content:

Key background

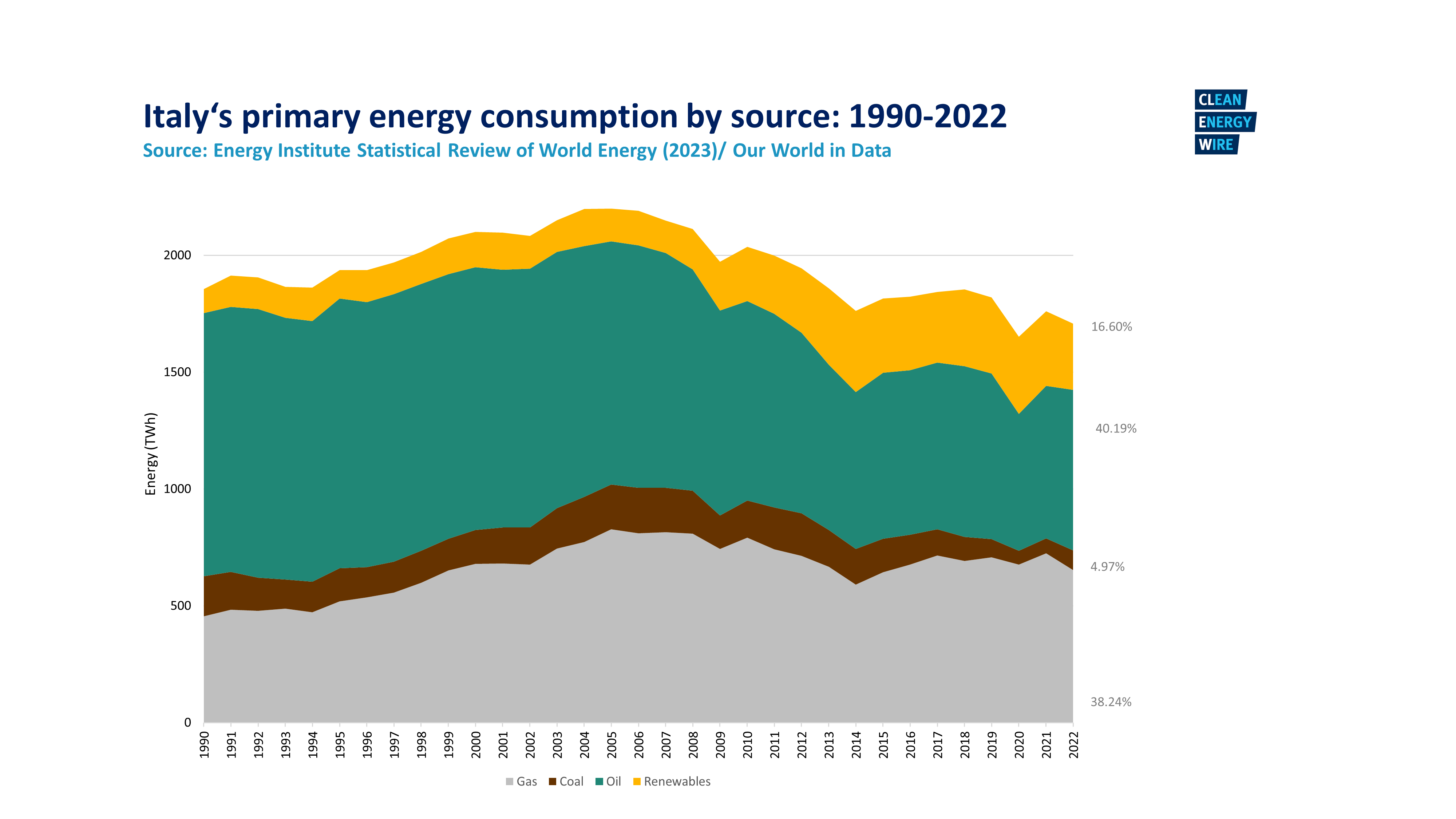

- Italy is different - Italy’s energy transition shows some distinctive contrasts with peers. It remains one of the EU’s most import-dependent countries, has no nuclear power and limited domestic fossil reserves, making imported natural gas central. Compared to Germany, Italy does not face a major coal phase-out, yet unlike Spain, it has not fully capitalised on its renewable potential despite early leadership in solar. The balance between energy security, affordability and decarbonisation is therefore particularly delicate in Italy’s case.

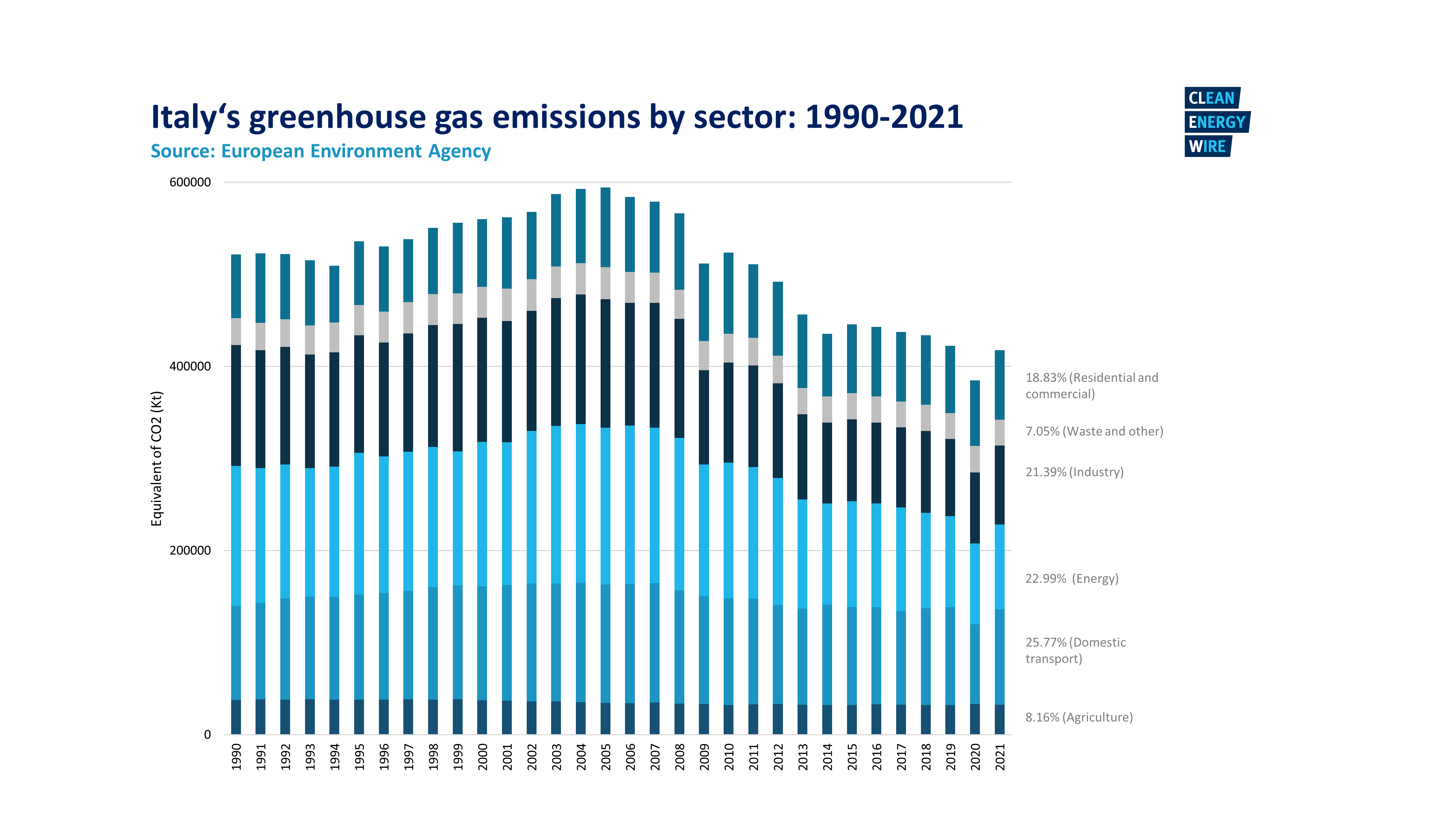

- Emissions decline- Since 1990, Italy’s total emissions have fallen by 26 percent and power sector emissions by 64 percent, but road transport emissions have grown, highlighting a persistent challenge.

- Energy mix and import dependence - Italy is among the EU’s most energy import-dependent countries, covering around three-quarters of its energy needs with imports. Natural gas fuels around 44 percent of electricity generation. Russia used to be a major supplier until 2022; since then, Algeria has become the top source (34 percent of imports in 2024), followed by Azerbaijan (16 percent) and smaller shares from northern Europe. This dependence exposes Italy to price volatility and makes security concerns a key driver of policy.

- Renewables: early leader, uneven progress - Italy was an early solar leader in the 2000s thanks to generous subsidies. Renewables covered 41.2 percent of electricity demand in 2024 and around 42 percent in the first 11 months of 2025. Growth is geographically uneven: hydropower dominates in the Alps, while solar and wind are concentrated in the south and on the country’s islands. Grid bottlenecks and permitting delays have slowed expansion compared to Spain or Germany. The updated NECP (July 2024) sets a target of 131 GW renewable capacity by 2030, but analysts warn that the plan lacks detail and credible implementation measures.

- No nuclear, contested return - Italy shut down its last reactors after the 1987 referendum, and a second vote in 2011 reaffirmed public opposition. Nuclear has long been politically toxic, but the Meloni government has revived the debate, presenting nuclear scenarios in the NECP and in 2025 joining the European Nuclear Alliance as a full member. The government foresees a possible 11–22 percent nuclear share in the energy mix by 2050, framing it as complementary baseload power. Public opinion remains sceptical, but industry groups welcome the signal. [See ourQ&A for the historical context, the feasibility of these plans, the key players involved and the role of social media in shaping public opinion.]

- Political dynamics and industrial risk - Frequent government changes have often made climate policy incremental rather than transformative. The current right-wing coalition stresses energy security and affordability, while warning against “ideological” climate rules. Italy’s powerful automotive sector illustrates the tensions: a study by ECCO and T&E warns that without a clear EV policy, Italy could lose up to 58 percent of its car production and 90,000 jobs by 2030. Despite 700 million euros in subsidies (up to 10,000 euros for scrapping an old car), EV uptake remains sluggish: only around 4 percent of new registrations in 2024 were fully electric, against an EU average of almost 14 percent.

- Response to the energy crisis - The 2022 energy crisis triggered a rapid diversification drive, including new long-term gas deals with Algeria and Azerbaijan and an expansion of LNG capacity. This improved short-term security, but risks locking in fossil fuel infrastructure. At the same time, the crisis boosted public support for climate change mitigation and adaptation. Surveys show 67 percent of Italians see adaptation as a national priority, and 75 percent say the government hasn’t done enough to fight climate change (Eurobarometer/ASviS 2024). Experts stress that Italy must speed up the deployment of renewables to reconcile security with decarbonisation.

Major transition stories

- Green Deal tensions - In Italy, the current government has repeatedly criticised the EU Green Deal, warning against what it calls an overly “ideological” approach that could lead to “industrial desertification,” especially in the automotive sector. Prime Minister Giorgia Meloni has called for more technology neutrality, greater recognition of hydrogen and biofuels, and life-cycle emissions accounting rather than tailpipe standards alone. At the same time, dozens of Italian businesses and investors have urged the European Commission not to weaken sustainability rules, stressing that regulatory certainty is key to mobilising green investment.

- A new National Hydrogen Strategy - In November 2024, Italy adopted its National Hydrogen Strategy, setting a target of 5 GW of electrolyzers by 2030 and the creation of local “Hydrogen Valleys.” At the same time, Italy is participating in the Southern Hydrogen Corridor (SoutH2), a planned pipeline network to bring renewable hydrogen from North Africa to Central Europe, together with Germany and Austria. However, watchdogs warn that the strategy risks reinforcing the dominant role of gas grid operator Snam rather than fostering a fully sustainable transition.

- Local opposition and attacks on renewables - The roll-out of renewable energy plants is facing strong resistance in some Italian regions, sometimes leading to protests, vandalism or construction blockades. In Sardinia, the newly elected centre-left regional government passed a bill that nearly bans new wind and solar farms across the island, citing landscape protection. Grassroots groups argue that large projects promoted by mainland developers are “colonial” and exploit local resources. According to consulting firm Elemens, 99 percent of Sardinia’s territory has now been deemed unsuitable for new installations.

- Mattei Plan - Italy’s government has positioned the so-called Mattei Plan (Piano Mattei) as its flagship strategy for partnership with African countries, combining energy, infrastructure, climate resilience and economic development. The plan aims to turn Italy into a regional energy and development hub by fostering clean energy, sustainable investment, and stronger public-private cooperation. Recent steps include: a co-financing deal worth 400 million euros with the African Development Bank to support climate finance, sustainable agriculture, technical assistance and education projects under Mattei. The country has also launched an AI Hub for Sustainable Development in mid-2025, designed to engage African startups and strengthen local tech ecosystems (Agenzia Nova). As part of the Mattei Plan, the government has reaffirmed its partnership with multilateral institutions such as the African Development Bank (AfDB) and increased its commitments to development finance (AfDB Group).

- Climate protests - Climate protests in Italy remain active and diverse. In 2025, movements like Fridays for Future Italy, Last Generation (Ultima Generazione), and Extinction Rebellion have evolved from their environmental origins to address broader social and international issues. For instance, in April 2025, Fridays for Future Italy launched a campaign against soil consumption and urban development, highlighting the environmental and social implications of such projects. The Last Generation has expanded its activism to include protests against economic inequalities. In February 2025, activists staged a demonstration at the Italian Parliament, throwing spoiled produce to protest rising food prices and energy costs. These groups have actively participated in large-scale demonstrations, explicitly linking climate transition to broader social issues like inflation, economic inequality, and international conflicts such as the war in Gaza. Meanwhile, the government has endorsed stricter rules in a so-called security package that criminalize road blockades and passive forms of protest, raising concerns among rights groups about potential limitations on free expression and movement.

- Lawsuits against fossil fuels –Greenpeace Italy, ReCommon and 12 Italian citizens are suing ENI, the economy and finance ministry, and the Italian development bank Cassa Depositi e Prestiti (as shareholders) for damage – past, present and future – caused by climate change “to which society has significantly contributed by its conduct over the past decades, while being aware of it”. The NGOs have declined ENI's mediation request concerning a possible defamation lawsuit which the company aims to bring against Greenpeace Italy and ReCommon. In a major update, Italy’s Supreme Court has now ruled that the lawsuit can proceed, in what campaigners called a “historic” step for climate justice in the country, potentially setting a precedent for future litigation and aligning Italy with other European states holding fossil fuel companies accountable.

- Carbon Removal - As part of efforts to reduce and contain emissions, particularly in hard-to-abate sectors, Italy is advancing several Carbon Dioxide Removal (CDR) projects. The only operational facility today is in Ravenna, managed by ENI, which captures CO₂ from industrial emissions. At the same time, the Institute of Geosciences and Geo-resources (IGG-CNR) is developing mineral carbonation technologies under the EU-funded GECO project, aiming to capture CO₂ from geothermal plants and store it permanently, laying the groundwork for a domestic CCS supply chain.

- LNG infrastructure and public debate – In 2025, Italy's LNG import capacity continues to expand, with approximately 60 LNG carriers docking in the first four months alone. The Adriatic LNG terminal, Italy's largest, resumed full operations in September after maintenance, and is undergoing capacity enhancements to support grid stability amid increasing renewable energy integration. The government has also announced plans to deploy two new regasification units in Sardinia to facilitate the island's transition from coal to cleaner energy sources. Despite these developments, the import of LNG, including shipments from Russia, has sparked public protests, particularly in coastal regions. Greenpeace has recently published a briefing analysing the environmental and political implications of LNG in Italy, highlighting the need for a more coherent and sustainable strategy for managing liquefied natural gas imports.

- Adaptation –Italy’s first climate adaptation strategy was published in 2018, but it was officially adopted only at the end of 2023, after a long process of approval and review that showed how climate adaptation is undervalued in the country. The final text was widely criticized by the scientific community, which said it lacked a clear list of priorities and didn’t provide sufficient funds for implementation.

- Eni, Italy’s state-controlled energy company, has unveiled its 2024–2027 investment plan, allocating approximately 27 billion euros over the period. The plan outlines a strategic shift towards the energy transition, with a focus on renewable energy, biofuels, and carbon capture and storage (CCS) technologies. However, a report by Reclaim Finance indicates a 22 percent decrease in annual renewable energy investments compared to earlier targets, now planning 1.4 billion euros annually from 2025 to 2028. Campaigners such as Greenpeace Italy and ReCommon argue that this strategy delays the fossil fuel production peak from 2027 to 2028 and locks in climate risks, as investments in CCS projects like Ravenna and Hynet remain costly and uncertain, while renewables expansion is modest in comparison.

Sector overview

Energy

- The sector was responsible for 22 percent of total GHG emissions in 2022.

- The country’s last nuclear power plants were shut down in 1987, after the Chernobyl disaster. The country has committed to phasing out coal for electricity generation by the end of 2025, except in Sardinia where coal use is expected to end between 2026 and 2028.

- Oil and gas are still the main sources of energy used in Italy, for example in transport and heating, but the share of renewables in overall energy use increased to 18.5 percent by 2022. By 2030, 70 GW of capacity is planned to be added.

- By mid-2025, Italy had nearly 600 renewable energy communities, up 240 percent from the previous year, though their overall capacity remains modest at 50 MW. Most initiatives are small and concentrated in Northern regions.

- Electricity emissions in 2024 were down by 64 percent compared to 1990 levels. They account for one quarter of Italy's national GHG emissions, and it is the sector that is performing the best in terms of emission reductions, according to Ispra, a research centre for the Environment Ministry.

- Hydropower generation, one of the main renewable sources, has been challenged by droughts.

- The energy crisis fuelled by Russia’s war on Ukraine has forced a huge shift in energy supply, and potentially helped speed up the energy transition, but led to LNG buildout and increased gas purchases.

Industry

- In 2022, industry sector emissions accounted for 19 percent of Italy's total emissions, 38 percent down since 1990. This is partly due to reduced industrial activity.

- Italy is set on saving its industry (e.g. steel, chemicals, manufacturing) by making it climate neutral. One of the main concerns is not to sacrifice jobs in the process.

- After a long period of resistance, some companies are taking on the challenge and are seeing business opportunities in the global net-zero industry race.

- Green hydrogen is seen as key to decarbonising industrial processes. Italy is trying to convert old industrial areas to produce it through the recovery and resilience plan.

- The country has some state support programs for green industry, mainly using European funds.

Buildings

- The building sector is responsible for 18.8 percent of total GHG emissions, mostly through heating and cooling with fossil fuels.

- Seventy percent of Italian homes are heated with gas, 10 percent with oil, 15 percent with biomass. District heating is not widespread.

- Eighty-one percent of the housing stock were built before 1990, and the renovation rate is very low (0.85 percent per year). The final energy demand of residential buildings has risen in recent years.

- The government implemented “Superbonus 110 percent,” a subsidy programme worth billions of euros for building efficiency and other programmes for improving heating systems.

- The government aims for an annual building renewal rate of 2 percent in 2030 and 2.6 percent in 2050. It also targets a reduction of 1.9 percent in the energy consumption of public buildings, and reduce the sector’s GHG emissions by 32 percent by 2030.

Mobility

- Transport was responsible for 28 percent of total GHG emissions in 2024.

- According to Ispra, the transport transition is the one struggling the most in Italy. Emissions are still climbing (they were up 7 percent since 1990, with 90 percent stemming from road transport.

- Car country Italy: The country has car-centric policies and boasts 40 million cars. Some municipalities aim to lower the speed limit to 30 km/h in city centres and to ban the entry of more polluting vehicles.

- Italy expects to have more than six million EVs on its streets by 2030 (4.3 million of them battery-electric cars). The country has approved up to 700 million euros in new subsidies to boost EV adoption.

- Some members of the governing coalition and automotive companies have strong misgivings about the electrification of private mobility and the phaseout of diesel cars because they fear large economic losses. The government has policies in place to boost biofuels.

- Some municipalities, such as Bari, have experimented with free or low-cost public transport tickets.

- Rail development is slow, especially in the south of Italy, with few signs of improvement. Public transport options are very scarce in many rural areas.

- Road freight produces 25 percent of transport emissions, with volumes continuing to grow.

- Italy has few cycle paths and a high number of traffic accident victims in some cities, such as Milan.

Agriculture

- Responsible for 8.2 percent of total GHG emissions (mainly methane from livestock farming, nitrous oxide as result of nitrogen fertilisation; excluding LULUCF)

- Emissions have fallen 13.2 percent since 1990.

- Farmlands are responsible for more than 75 percent of agricultural GHG emissions.

Land use, land-use change and forestry (LULUCF)

- Taken together, forests, wetlands, peatlands and other land in Italy act as a net carbon sink, with long-term net removals reflecting land cover changes and forestry practices. Historical trends show forest area increased by about 25 percent and wetlands by about 12 percent since 1990, while urban settlements grew by about 43 percent. Meadows, pastures and agricultural land areas declined.

- According to the revised National Energy and Climate Plan (PNIEC 2024), LULUCF removals are projected to contribute to climate objectives, with a minimum net sink target of −35.8 million tonnes CO2 equivalent by 2030. However, the level of removals can vary greatly year by year, due to changes in land use or other factors like wildfires.

- Environment agency assessments highlight that maintaining and enhancing carbon sinks remains crucial for aligning with Paris Agreement targets.

Find an interviewee

Find an interviewee from Italy in the CLEW expert database. The list includes researchers, politicians, government agencies, NGOs and businesses with expertise in various areas of the transition to climate neutrality from across Europe.

Get in touch

As a Berlin-based energy and climate news service, we at CLEW have an almost ten-year track record of supporting high-quality journalism on Germany’s energy transition and Europe’s move to climate neutrality. For support on your next story, get in touch with our team of journalists.

Tips and tricks

- CLEW’s Easy Guide to Germany’s transition with background information and links to key energy and climate data.