Volkswagen places massive EV bet to master green mobility shift

VW Group key figures 2020

Sales: €222.9 billion (2019: €252.6 billion)

Earnings after tax: €8.8 billion (2019: €14.0 billion)

Unit sales: 9.2 million (2019: 11.0 million)

Employees (year-end): 662.600 (2019: 671.200)

Market capitalisation (March 2021): €109 billion euros

[Source: company news release]

VW was the world's top-selling carmaker in the second half of the 2010s, but was overtaken by Toyota in 2020, partly due to the effects of the coronavirus pandemic in Europe. The Volkswagen Group comprises 12 brands from seven European countries: Volkswagen Passenger Cars, Audi, SEAT, ŠKODA, Bentley, Bugatti, Lamborghini, Porsche, Ducati, Volkswagen Commercial Vehicles, Scania and MAN.

The sheer size of VW means the group's sustainability strategy not only has massive repercussions for the entire car industry, but also affects general efforts to fight climate change. Its passenger cars are responsible for one percent of global CO2 emissions.

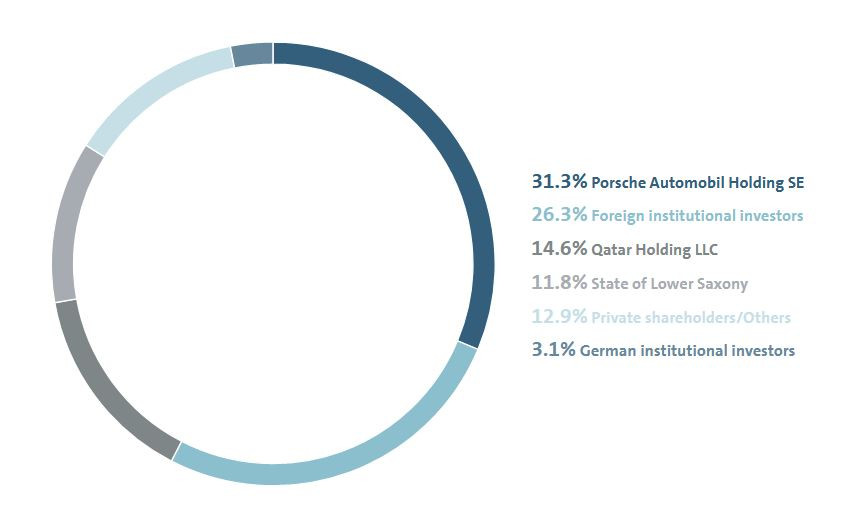

The Group operates around 120 production plants across the globe that churn out more than 40,000 vehicles every weekday on average. VW is a publicly listed company. The group, whose main shareholders include the state of Lower Saxony and Qatar, is controlled by Porsche Automobil Holding, the investment vehicle of the Porsche and Piech families, which holds the majority of voting rights.

"Dieselgate" triggers radical overhaul

Volkswagen admitted in September 2015 that it had for years cheated on US diesel emissions tests with secret software masking excessive nitrogen oxide pollution, causing a wave of lawsuits and fines. The “Dieselgate” scandal has cost the Wolfsburg-based company more than 30 billion euros. During the fallout, the group twice replaced its CEO. Since April 2018 VW is headed by Herbert Diess, a former BMW manager, who initiated a radical shift towards battery-electric mobility.

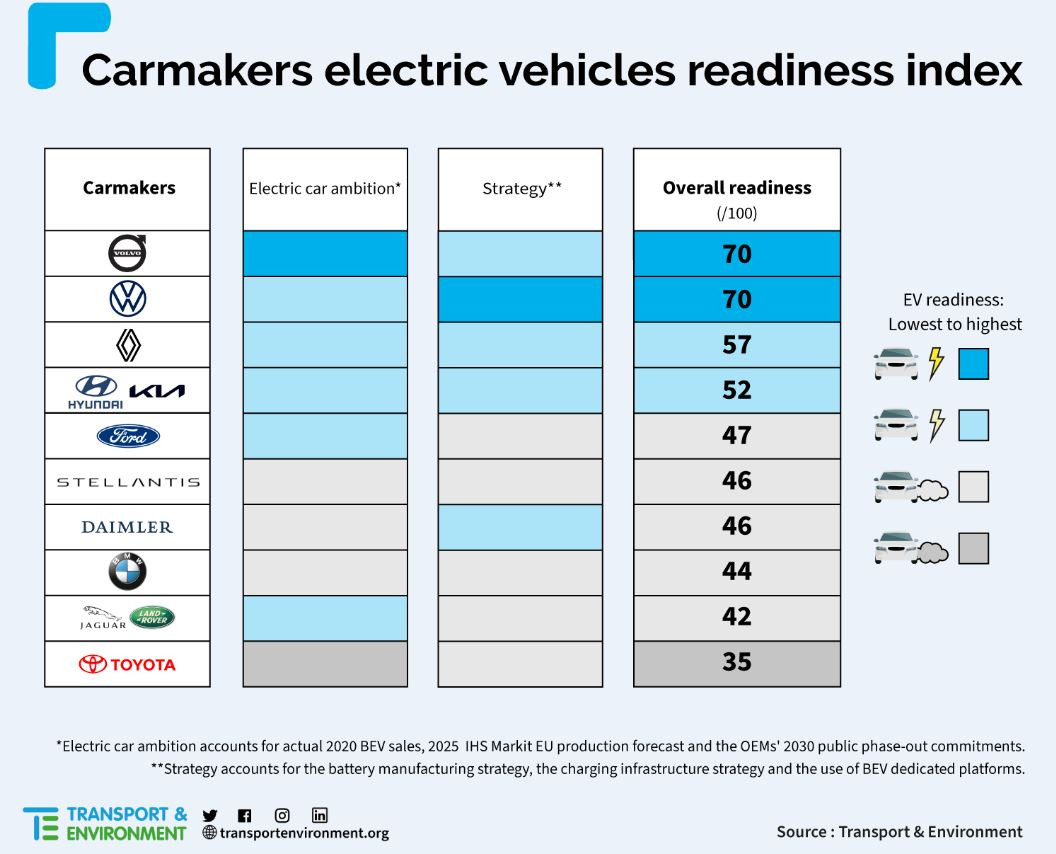

Following the Dieselgate scandal, VW repeatedly stepped up its electric ambitions, but could not dispel widespread initial doubts about its true conviction. This only changed with Diess, whose strategic overhaul, presented in early 2019, silenced most critics. Europe’s federation of green mobility NGOs, Transport & Environment (T&E), called the VW announcement “a game changer for the automotive industry" at the time. T&E executive director William Todts commented that "this is the first credible climate plan by a major automaker,” and the International Council on Clean Transportation's (ICCT) Drew Kodjak said it was "bigger, bolder, and far more detailed" than major rivals' plans.

VW's move is all the more remarkable because in contrast to young companies focusing exclusively on e-mobility, the group needs to transform a huge legacy business with extremely strong union representation. Media reports reflected the enormous challenges and risks ahead. VW "has embraced electrics with the enthusiasm of a religious convert," wrote Charles Riley for CNN Business. "Success means that Volkswagen will overtake rivals, including Tesla, in electric car sales and fend off new challengers from China and Silicon Valley; failure could signal the beginning of the end." The Economist called VW's plans "the biggest commitment to battery power by any car company."

"Volkswagen Group wants to become the global market leader in e-mobility and is investing a total of 35 billion euros in it by 2025," the company explained in an early 2021 press release laying out its green ambitions. "By 2030, Volkswagen Group will launch around 70 pure e-models, of which around 20 have already started. In addition, by the end of the decade there will be around 60 hybrid vehicles in the product portfolio, of which just over half are already in production." By 2050, the company aims to be balance sheet CO2 neutral.

Dies has recently become more sceptical that his company will outsell electric car market leader Tesla at the end of the decade. He told the Economist magazine that Tesla's surging market valuation gives it the resources to grow quickly.

No combustion engine phase-out date

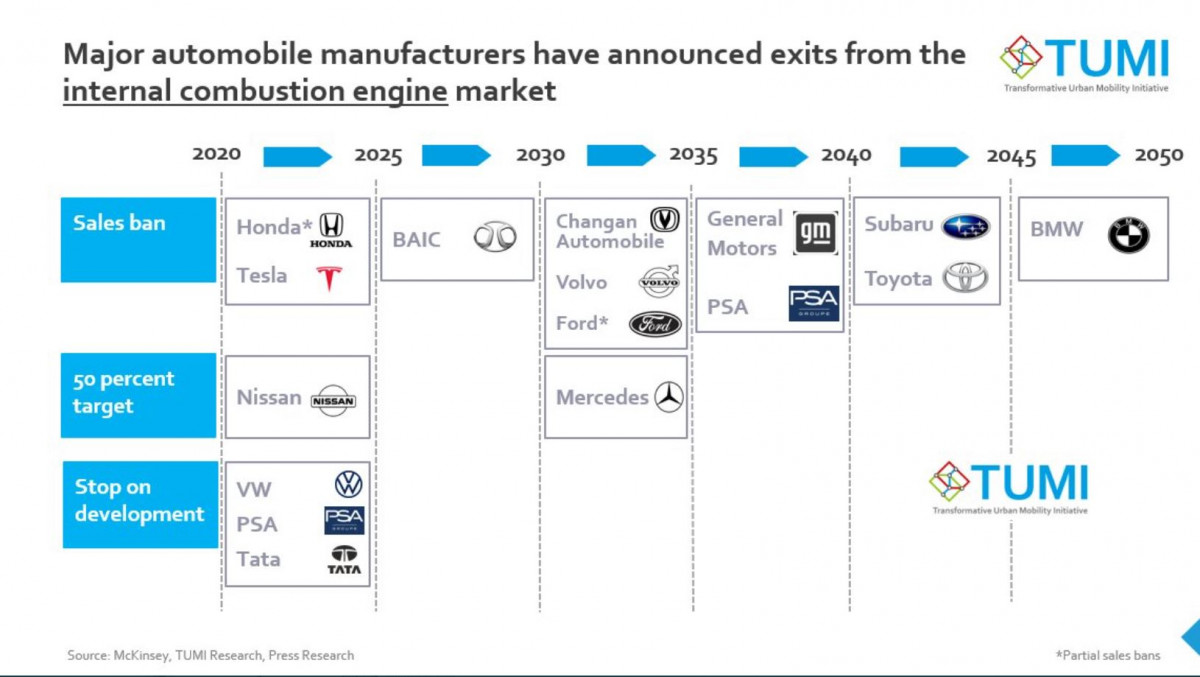

Since VW announced its pioneering electrification plans, rivals have caught up, with Ford, GM, Volvo, and others announcing an exit from combustion engine technology (see graph). In contrast, VW has not set a date for phasing out combustion engines. The company says clients should decide which technology to buy.

The VW group's huge variety of vehicles – ranging from trucks to supercars - is likely one of the reason for its reluctance to set a phase-out date. Even among its luxury car subsidiaries, there are considerable strategy differences. While Audi plans to phase out conventional cars in 10 to 15 years at the latest and is working on a concrete time plan, according to media reports, Porsche is also betting on synthetic fuels – while the Group stresses their inefficiency. Diess also told the Economist in early 2021 that VW is a global company, and that many markets won't be ready for electric cars by 2035.

But premium subsidiary Audi looks set to become the first prominent German carmaker with a clear combustion engine phase-out plan. The company will stop launching new combustion engine or hybrid models in 2026, when the last new conventional model will go on sale, according to a Süddeutsche Zeitung report. "Only battery models will be sold from the beginning of the 2030s at the latest, even in China, where Audi plans to continue using internal combustion engines for several years longer than in Europe," according to the report.

The ICCT's Peter Mock told Spiegel magazine the VW group's overall electrification targets are no longer very ambitious in comparison with other carmakers, but he still believes the company is on the right track, also because it has signalled it is open to more stringent EU climate targets.

In March 2021, the Volkswagen brand doubled its 2030 target for the share of full-electric vehicles in total European sales to 70 percent. In the US and China, the brand aims for a fully electric share of over 50 percent. In April, the brand presented its roadmap for climate-neutrality, which includes the aim of cutting the company's CO2 emissions per vehicle by 40 percent by 2030, exceeding the group-wide target of 30 percent. "From 2030, all plants worldwide, other than in China, are to operate entirely on green electricity," VW said.

Early focus on pure battery-electric vehicles

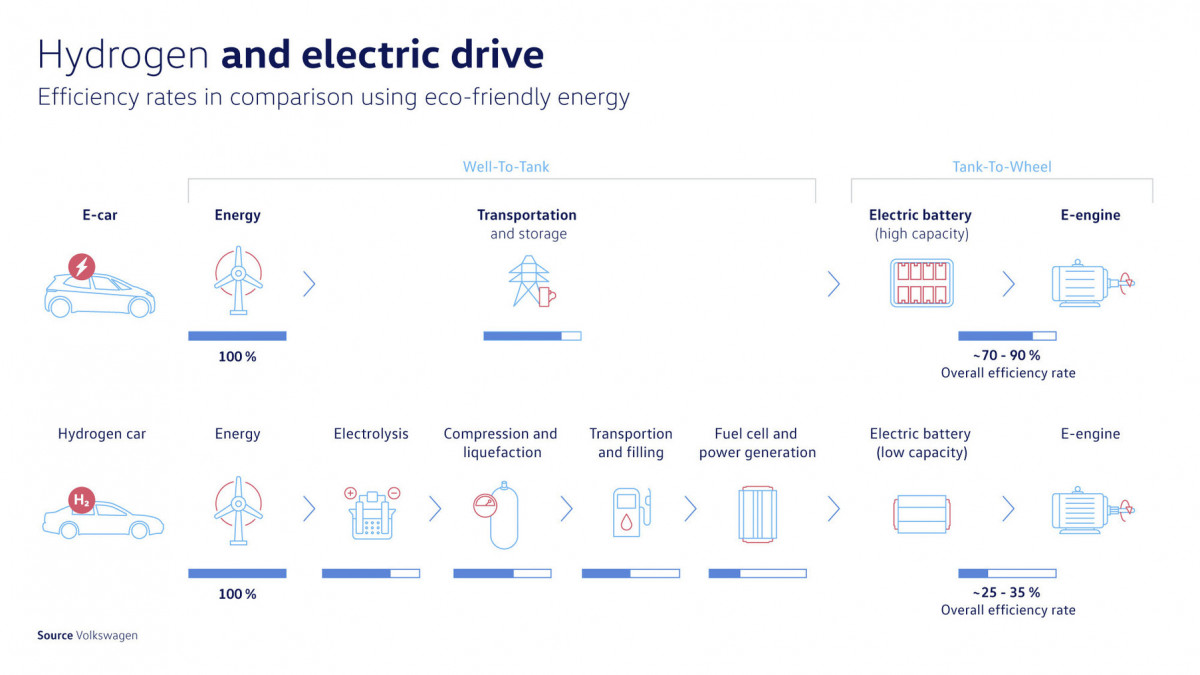

In contrast to domestic rivals BMW and Daimler and many other conventional carmakers, VW decided to focus on battery-electric cars, instead of keeping its options open for alternative zero-emission propulsion systems, such as fuel cell vehicles or synthetic fuels. It teamed up with Swedish company Northvolt to set up its own battery cell production, which is also a very costly step that has been long shunned by German carmakers.

In March 2021, the company said it planned to build six battery cell factories in Europe by 2030 alone or with partners, with a total capacity of up to 240 gigawatt hours a year. The company also said it was working on a major expansion of charging infrastructure, in a joint effort with oil major BP and top European utilities Enel and Iberdrola.

"Our emphasis is on the electric car, because from today's perspective it is the best and most efficient choice for reducing CO2 in transport," Diess explained. Most transport experts would agree because propelling cars with fuel cells would require a much larger amount of energy.

The matrix to turn a latecomer into a frontrunner

VW was a relative latecomer to electric mobility, but the company quickly laid a foundation for an entire range of pure electric vehicles by developing a new underlying vehicle platform, the modular electric drive matrix (MEB) - the core of VW's electric ambitions. “The modular electric drive matrix is arguably the most important project in the history of Volkswagen, similar to the transition from the Beetle to the Golf,” said Thomas Ulbrich, the Volkswagen Brand management board member responsible for e-mobility. By placing all the batteries skateboard-like underneath the car's interior, a pure electric platform opens entirely new possibilities to design the vehicle around people instead of around all the technology required in a combustion-engine car.

The first models based on the new platform are the ID.3 and ID.4, and many others are to follow, such as the ID Buzz van, an electric follow-up to the legendary VW Bus. VW wants to establish the MEB as a new standard not only within the company, but in the entire industry by licensing it to competitors. Joining forces with other carmakers could help VW to scale up its market power during negotiations for entirely new supply chains necessary in the switch to e-mobility.

Following a teardown of the ID.3 in early 2021, Swiss bank UBS called Volkswagen's first purpose-built electric car "the most credible EV effort by any legacy auto company so far." UBS analyst Patrick Hummel said "VW might not be the Apple, but the Samsung of the EV world with profitable, high-volume EV brands."

The group's premium brands, Audi and Porsche, have also started selling dedicated battery-electric cars. Audi and Porsche are crucial for the entire group, because they generate a lot of profit despite selling only a fraction of Volkswagen-branded cars.

VW's nascent mobility services also reflect its electric ambitions. In mid-2019, VW launched the carsharing service "We Share" in Berlin, comprised entirely of fully electric cars, which it recently extended to Hamburg. It has also started to roll out its MOIA ride-sharing service, which only uses electric vans.

Clash with car lobby group VDA

VW's focus on battery-electric cars is highly controversial in the industry, not least because the company openly calls for policy backing. According to media reports, VW even threatened to quit influential car industry association VDA because it wanted the lobby group to fully focus on electric vehicles instead of insisting rigidly on “technological openness”. Diess reportedly said that policy support for other propulsion technologies would only divert much-needed resources for a battery-electric push, including backing for a charging infrastructure.

Harming the climate now in order to save it later?

Some critics remain unconvinced of VW's supposed catharsis, however. NGO Environmental Action Germany (DUH), which set the ball rolling on inner-city driving bans, says it doesn't buy that a serious change of course has taken place under Diess, describing the new strategy as "nothing but announcements". DUH points to the fact that VW plans to launch "a plethora of new SUV models" in the near future. VW counters: "For us, SUVs are certainly the models with the highest margins, and in view of the uncertainties surrounding the switch to electric mobility, it would be economically irresponsible to say that we are leaving this lucrative business to our competitors."

NGO Greenpeace said in a report in late 2020 that Volkswagen doesn't do enough to sell its own electric cars, and in some cases even undermines them. Many VW dealers advised against buying the fully electric ID.3, with many even expressing fundamental doubts about electric mobility, according to Greenpeace.