Reluctant Daimler shifts gear in race to sustainable mobility

Daimler Group key figures 2020

Group unit sales: 2.84 million (2019: 3.34 mio)

Revenue: €154.3 billion (2019: €172.7 bln)

Earnings before interest and taxes (Ebit) reflecting underlying business: 8.6 bln (2019: 10.3 bln)

Net profit: €4.0 billion (2019: €2.7 bln)

Employees (end 2020): 288,481 (end 2019: 298,655), thereof 170,515 Mercedes-Benz Cars & Vans; 99,640 Daimler Trucks & Busses

Market capitalisation (early March 2021): €70 bln

[Source: Annual Report 2020]

Daimler is headed by CEO Ola Källenius, who took over from his longstanding predecessor Dieter Zetsche in May 2019. In contrast to BMW and VW, Daimler is not family-controlled [see graph]. The company said in early 2021 that it plans to rename itself as Mercedes-Benz "at the appropriate time," and wants to spin off its truck division by year-end.

Late convert to electric cars

Daimler remained sceptical on the future of electric mobility longer than many of its competitors, including arch rival BMW, which launched the dedicated EV brand "i" as early as 2013 [See factsheet Early e-car starter BMW has lost ground in clean mobility race]. That changed after Daimler's former junior partner Tesla, in which the company held a major stake from 2009 to 2014, began outselling the premium Mercedes S-Class in the US. The Stuttgart-based company said in 2016 that the market was now ready for e-mobility. Then CEO Zetsche announced that Daimler would “radically develop into a different company within the next 10 years." Daimler has repeatedly stepped up its electrification plans since then.

The group launched its first purpose-built electric car in 2019, the EQC, a large SUV. Before the EQC's arrival, Daimler offered electric cars only as a modification of models originally developed for conventional combustion engines, a serious limitation when it comes to their interior design. In the same vein as VW, Daimler has developed a dedicated vehicle architecture for pure e-cars, on which the EQC is based.

In 2020, Mercedes-Benz tripled global sales of plug-in hybrids and all-electric vehicles to more than 160,000 units, increasing the electric vehicle share to more than 7 percent, from 2 percent in 2019. "2021 stands above all for the acceleration of electrification at Mercedes-Benz Cars. A total of four new Mercedes-EQ models will be presented: the EQA, EQB, EQE and EQS," the company said.

Combustion-engine phase-out

In time with the rollout of the EQC, Daimler also committed to a more general climate initiative dubbed "Ambition2039". Shortly before assuming his new role of company CEO, Källenius promised to make the entire Mercedes-Benz Cars fleet carbon neutral by 2039. The company plans to make production in its European plants CO2-neutral by using renewable energy by 2022. By 2025, up to 25 percent of car sales are to be all-electric – but with the caveat that this will "depend on framework conditions." By 2030, Daimler aims to have all-electric and plug-in hybrids make up more than half of its car sales, while at the same time cutting the number of combustion engine models by 70 percent. Following the announcement, Daimler's climate plans were described as the "most ambitious target of any major automaker" and "the most ambitious timeline among any of the leading automakers."

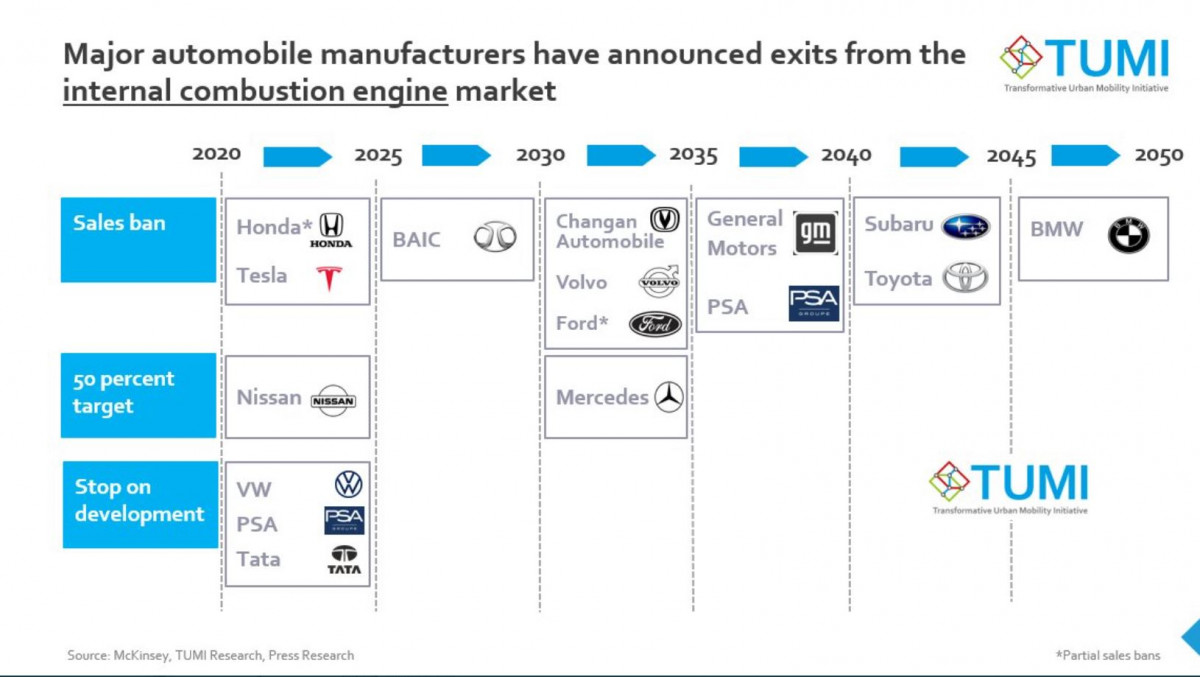

But since then, other carmakers such as Ford, GM, and Volvo have announced a faster exit from combustion engine technology than Daimler. Detailed comparisons between company strategies are often difficult because "they're only described in general terms within corporate sustainability reports or CEO presentations, while the details remain confidential," according to the International Council on Clean Transportation (ICCT), a sustainable mobility NGO. Overall, Daimler's strategy is similar to BMW's, but in contrast to the arch rival, Daimler hasn't got any intermediate targets for the shorter term, the ICCT's Peter Mock told Spiegel magazine.

CEO Källenius announced at the company's shareholder meeting in March 2021 that Daimler "wants to accelerate the electrification of its product portfolio." He added it was his ambition to reach the company's 2039 climate neutrality target "earlier," but without specifying a date, confirming earlier press reports that Daimler was considering an earlier end to the combustion engine for its Mercedes-Benz brand. According to the reports, the board of directors is assessing scenarios, according to which Mercedes could offer only new cars with electric drives five or eight years earlier. But Källenius also said Daimler would not prematurely phase out combustion engine sales because these models are a "cash machine" needed to fund future electric models.

Daimler board member Markus Schäfer, who is in charge of development, also said in March 2021 that the company is "preparing for an earlier changeover," because the shift to e-cars may happen much faster than previously assumed. He added the speed of the transition will be shaped by the upcoming Euro 7 emissions standard, "up to a scenario that makes it almost impossible to register internal combustion vehicles after 2025."

Good-bye to fuel cell cars, but not trucks

Unlike VW, which had presented a climate plan described as a "game changer" for the industry earlier in 2019 [For details, see the factsheet Huge EV bet could turn diesel pariah VW into "game changing" pioneer], Daimler didn't bet everything on the battery-electric card, but instead kept its propulsion options open. "Our current focus is on battery-electric mobility. But there’s also room and need to continue to work on other solutions, for example, the fuel cell or eFuels," Källenius wrote in a company blog setting out the strategy. He added: "Today, no one knows for sure which drivetrain mix will best serve our customers’ needs 20 years from now. That’s why we encourage policy makers to pave the way for tech neutrality: Let’s fix the target, but not the means to achieve it." Daimler's works council has also repeatedly weighed in to warn against an exclusive focus on battery electric mobility.

But the head of Daimler Truck, Martin Daum, said in April 2020 that Mercedes-Benz had given up on fuel cell-powered cars, would soon stop production of its only hydrogen model, the GLF F-Cell, and did not plan any other models with this propulsion system. Instead, the fuel cell division would be fused into a joint venture between Daimler truck and Volvo, which was completed in early 2021. The partnership plans to launch a fuel cell truck in the second half of the decade. However, Daimler continues to tout the fuel cell as an important option for cars on its website.

Daimler plans to end the use of diesel engines in heavy duty vehicles over the next two decades, promising "CO2 neutrality" for new vehicles in the branch by 2039 in the European, Japanese and North American markets. The company said in early 2021 that it plans to spin-off Daimler Truck before year-end.

Time for trucks: The next big thing in the shift to climate-friendly transport

Battery-electric trucks will win race against fuel cells and e-fuels - researcher

Cost-cutting cooperations

Daimler is seeking salvation from the overwhelming cost pressures associated with the switch to future mobility in cooperative efforts with other carmakers. The company announced in early 2019 to team up with China's Geely, its largest shareholder, to turn the Daimler brand Smart into a "leader in premium-electrified vehicles”.

In what German business daily Handelsblatt called a "historic partnership" to take on Google and Uber, BMW and Daimler agreed to a broad alliance in mobility services in early 2019 involving the merger of BMW's DriveNow car sharing business and Daimler's Car2Go. The companies launched five shared brands: the car sharing Share Now; ride-sharing unit Free Now; the Park Now parking service; the Charge Now EV charging service; and Reach Now, which facilitates bookings across various modes of transport.

But the mobility services division is struggling to make money. According to media reports, a partial sale looks increasingly likely. Källenius has said the unit must become financially independent.

BMW and Daimler have also pooled resources in order to get the ballooning costs of self-driving cars under control.

Critics doubt true conviction

Daimler's climate ambitions have not silenced all critics. Climate advocacy groups lament the company’s continuing affiliations with trade groups that actively lobby against stricter car emission rules, both in Germany and the US. British NGO InfluenceMap, specialised in assessing company climate lobbying, says that "Daimler has opposed stringent CO2 standards for vehicles in the EU, although with some improvement in this position over time," adding that the company "appears to have become more positive in its lobbying since 2018."

NGO Environmental Action Germany (DUH), a vocal industry critic which set the ball rolling on inner-city driving bans, highlights that notwithstanding its mostly green rhetoric, Mercedes launched the "monster SUV" GLS, which will top the short-term record holder BMW X7 as Germany's largest SUV.

Additionally tainting Daimler's green ambitions, the company has become deeply embroiled in the Dieselgate scandal, despite its insistence of no wrongdoing. The European Commission officially accused carmakers VW, BMW and Daimler of illegal collusion to avoid competition on emissions reduction technology in April 2019. German authorities have forced Daimler to recall more than 800,000 cars over potentially illegal software to skirt emission rules.