Preview 2021: 'Climate election' set to dominate Germany's energy transition agenda

Will the pandemic and a new government help or hinder climate action next year?

Contents

Before the COVID-19 pandemic hit, the year 2021 in German politics was going to have one major focus: elections. In the run-up to the general elections in autumn, six out of the 16 German states will head to the ballot box during the year (Baden-Württemberg, Rhineland-Palatinate, Thuringia, Saxony-Anhalt, Mecklenburg-Vorpommern and Berlin), providing ample opportunity to test election campaign subjects and see how the different parties fare against the backdrop of a coronavirus-induced economic and social crisis and a strong push for more climate action from the Green Party and climate activists.

“Next year, the climate debate in Germany will be dominated by the elections. Not many decisions can be expected, but interesting political debates will show up”, Brigitte Knopf, secretary general of the Mercator Research Institute on Global Commons and Climate Change (MCC) told Clean Energy Wire – CLEW in an interview.

In mid-January, the largest party in parliament, the conservative Christian Democrats (CDU), will elect a new leader. The three current contenders all have vowed to make climate policy a key issue. The decision on who the CDU - along with its Bavarian sister party, the CSU - will send into the race to succeed Merkel as chancellor will likely be taken in spring 2021. As the candidates for leadership in Merkel’s CDU still struggle to make inroads with a wider electorate, CSU head and Bavarian state premier Markus Söder has emerged as a front-runner for many voters. He also signaled that a coalition with the Green Party may be well be on the cards under his leadership.

The conservatives' partner in the current coalition government, the Social Democratic Party (SPD), has already decided to send finance minister and vice chancellor Olaf Scholz into the race for the chancellery. Although the party presided over the introduction of the country's landmark Renewable Energy Act (EEG) and is credited with making important contributions to Germany's ambitious Climate Action Programme 2030, it has not been able to benefit from the surge in public interest in climate policy in recent years.

That trophy was seized almost entirely by the Green Party, which chalked up big gains in previous state and European elections and now constantly ranks second behind the CDU/CSU alliance in national polls. The party leadership hasn’t made up its mind who will be their candidate for the chancellery or who they would enter into a coalition with, both the SPD and the conservatives being possible partners. Apart from these decisions, the established Greens have to be careful not to have their voters swayed by a possible new party established by climate activists, such as the Fridays for Future (FfF) campaigners, who push for a much more radical change of the system to make Germany climate-neutral as early as 2035. “The Green Party has never been the natural partner of the climate movement,” FfF Carla Reemtsma told CLEW. While Jakob Blasel, a fellow FfF activist who is planning on running for parliament on a Green Party ticket, said: “A strong Green Party is the only realistic option to tackle climate issues in Germany”.

"A strong Green Party is the only realistic option to tackle climate issues in Germany"

The state elections in Baden-Württemberg on 14 March 2021 will also be crucial for the Greens. The country's first Green state premier, Winfried Kretschmann, has been in power there since 2011, and as of late 2020 also enjoyed a comfortable lead in polls. The vote could be an indicator for the success of the Greens’ more centrist approach, of which Kretschmann is considered a glaring example.

Against the backdrop of the pandemic, it is yet unclear how much of an emphasis the election campaigns will put on climate and energy policy issues in 2021. The strong connection between the pandemic recovery packages and sustainability could certainly keep them a prominent feature of the debate. For Christoph Bals, head of the NGO Germanwatch, there is little doubt that combating global warming will be a major consideration for people when they cast their ballot in September: "There’s no question: this will be a climate election,” he told CLEW. “Green recovery will be one very important issue. Do we really see a green recovery or a big 'green-washing show'?”

Preview 2021 – ‘We have to radicalise all parties to adopt more ambitious climate plans’

Preview 2021 – ‘A strong Green Party is the only realistic option to tackle climate issues in Germany’

Vote21 - German elections set the scene for key decade of energy transition

“The EU decision on the 2030 target will set the tone for next year’s climate and energy policy”, Brick Medak, head of think tank E3G's Berlin office told CLEW.

Germany’s national climate policy is hugely and increasingly influenced by decisions made at EU level. Heads of state and government have clearly set the tone for 2021 climate and energy policy with their proposal to increase the bloc’s 2030 emissions reduction target to at least 55 percent. The target has yet to be agreed in talks with the European Parliament. If successful, the new goal will trigger a complete overhaul of relevant EU legislation, which would either have direct effect or need to be translated into national regulation by all member states.

While 2020 was the year to decide the goal, 2021 will focus on how to get there, said environment minister Svenja Schulze. The European Commission plans to present its proposal – the “Fit for 55” package – by June 2021, just in time for the German election campaign. The package will include proposals on reforming the bloc’s emission trading scheme (EU ETS) or extending emissions trading in general, a new carbon border adjustment mechanism (CBAM), and possibly new national goals in sectors such as transport or heating. The carbon border adjustment in particular has drawn a lot of interest, both from energy intensive industries in Europe and the bloc’s trading partners. Will other countries increase their climate action because of a carbon border tax or does the EU risk a trade war? The EU Commission presents its first proposal in summer 2021.

The effects of Brexit on European energy and climate policy will also be fully felt next year: The UK government has taken significant steps to put the country on a path to net zero, yet the consequences on the trading bloc’s own drive and practical questions like the effects on emission trading remain uncertain.

Next year will also mark the implementation of the heavily criticised and delayed reform of the Common Agricultural Policy (CAP), which runs from 2021 to 2027. NGOs and climate activists have said that the distribution and conditions of the 387 billion euros in subsidies are not improving farming’s emissions record nearly enough. Emissions from animal husbandry, manure and land use (soils) in the farming sector have not been significantly reduced over the past decade, as farmers struggle with low prices for their products and consumers in Germany have been slow to embrace a less meat-heavy diet. “The phasing out of industrial animal production is central. It’s the biggest source of emissions in agriculture,” Christoph Bals said. A new Commission on the Future of Agriculture initiated by the German government will present its report in summer 2021, aiming to give the next governments pointers on how to reconcile improving climate and environmental protection, animal welfare and biodiversity with the economic viability of domestic farms.

Preview 2021: ‘EU decision on 2030 target will set tone for next year’s climate and energy policy’

In Germany’s national debate and policy plans on energy and climate, MCC secretary general Brigitte Knopf sees three major issues: “A debate about an earlier phase-out of coal (instead of the decided year 2038), about a ban on combustion engines, and what a higher European climate target for 2030 means for Germany”.

The EU’s more ambitious 2030 climate target will force Germany to change its emission reduction plans, which is yet another reason why the subject is likely to remain high on politicians’ agenda. While parliamentarians have said that renewables expansion targets would need to be adapted, it is likely – albeit not yet clear – that Germany will also adapt its national greenhouse gas reduction targets.

"If a sector does not meet the target, the respective ministry has to provide a programme of immediate policy measures within three months."

If these issues aren’t tackled before the general elections in autumn, they will become part of the next government coalition talks in autumn. These talks will almost certainly lead to crucial decisions that will shape German climate policy for years. A coal exit earlier than currently planned could also be on the cards.

In March 2021, Germany’s new Council of Experts on Climate Change, established in the 2019 Climate Action Law, will review how the country is progressing towards its emission reduction targets in each sector and publish a report by mid-April. “If a sector does not meet the target, the respective ministry has to provide a programme of immediate policy measures (“Sofortprogramm”) within three months,” Brigitte Knopf explained.

Another subject to watch in German national politics is the introduction of the new CO2 price on heating and transport fuels as of January 2021. While stakeholders and politicians don’t seem to fear any major uproar as these fuels will only become a few cents more expensive, this is still a test for the public acceptance of more climate action.

“The first phase of the CO2 price can only be a start in reforming the system of taxes and levies on energy. The new CO2 price has to increase quicker than planned by the current government. In order to make this happen, some social justice issues have to, and also can be, solved,” Christoph Bals at Germanwatch told CLEW. SPD ministers Svenja Schulze (environment) and Olaf Scholz (finance) have been pushing for making the instrument more socially fair by forcing landlords to share in the burden of higher heating fuel prices which could be translated into an early amendment to the CO2 price legislation in 2021.

Preview 2021: ‘German CO2 price can only be a start of energy taxes reform’

The rapid growth of renewable power production in Germany is a prerequisite for the country’s climate neutrality ambitions, especially given that electricity is meant to replace fossil fuels in transport, heating, and other sectors. The reformed Renewable Energy Act (EEG), coming into effect on 1 January 2021, has laid some foundations for this progress, but many stakeholders have deemed the legislation too cautious to initiate the renewables boom necessary to reach electrification and climate targets.

The current reform of the EEG will "not provide the necessary measures for reaching the designated goal of 65 percent renewable energy share in the electricity mix by 2030," warned Simone Peter, head of the renewable power industry association BEE in a CLEW interview. "The electricity market must be geared towards renewable energies in such a way that their cost benefits are passed on to consumers. This includes reformed financing mechanisms," she argued.

As it stands, the increase in renewable capacity, particularly onshore wind, has slowed down rather than accelerated since 2017 due to lengthy approval procedures, regulatory barriers and citizen opposition. In addition, a growing number of older turbines and solar PV facilities will be losing their funding after receiving guaranteed feed-in payments for 20 years and could be taken offline as a result. The solar PV industry likewise is worried– despite generally satisfactory expansion volumes as of late – that the country is nowhere near the levels needed to utilise the technology's full potential for emissions reduction.

Germany's current renewables reform will "not provide the necessary measures for reaching the designated goal of 65 percent renewable energy share in the electricity mix by 2030"

The year 2021 will show if important additions to the renewables legislation can still be achieved by the current government before the elections in September. These include sufficient funding for said old installations, better framework conditions for repowering existing renewable locations and for new power purchase agreements (PPA) between renewable generators and private consumers or even an overall review of the way renewable installations are funded.

Despite these stumbling blocks, the share of wind, solar, biomass and other renewables in the power generation mix continued to grow unabated in 2020 and reached 45 percent.

This was aided both by a drop in overall power demand due to the pandemic and a quick decline in coal-fired power production, for which Germany formally set an end date no later than 2038 last summer. Low power and high emissions allowance prices are increasingly driving coal plant operators away from the technology, as was demonstrated in hard coal decommissioning auctions in early December, when several modern plants were auctioned off for a swift closure. This has raised doubts whether the government's compensation plans for plant operators and the shutdown schedule are at all adequate – and whether continued mine expansion that requires the demolition of entire villages can be justified. Even though the first four gigawatts of capacity are taken offline at the end of 2020, launching the coal exit for good, debates about earlier closures and unduly compensation payments seem poised to continue in 2021.

At the end of 2021, three out of Germany’s remaining six nuclear power plants with a combined capacity of four gigawatts will go offline. The last three will follow at the end of 2022, ending Germany’s 62 years of nuclear power production. While the decision to exit nuclear is done and dusted and no serious political contender is pushing for extending the operating life of the existing plants, the issue of finding a place to safely store radioactive waste has yet to be solved. In 2020, a first report by the Federal Company for Radioactive Waste Disposal (BGE) found that over half of Germany is made of rock formations that could hold an underground nuclear repository. In 2021, the consultation process will continue, after which the next report will narrow down the number of suitable locations based on public input and further criteria.

Preview 2021: 'The crisis must be seen as an opportunity for a climate-neutral economy'

Germany takes first small step towards finding nuclear waste resting place

Tying into the renewables expansion and coal plant closures is Germany’s tight deadline for improving transmission grid connections before the last nuclear power plants in the South of the country go offline at the end of 2022. The power network is already coping with a large share of intermittent renewable energy –without any major effects on grid stability. But increasing this share further while simultaneously supplying the country's energy-hungry industrial centres in the South with green electricity largely generated in the North will require considerable upgrades.

For now, grid operators say that they are keeping to the timeframe even despite the pandemic. But building more power lines might not be enough to make the grid fit for the future. "We need a new electricity market design," Hans-Jürgen Brick, CEO of grid operator Amprion, said in a CLEW interview. The market will require a thorough overhaul, with the discussion of introducing a capacity market instead of the current energy-only market system possibly re-entering the agenda. Brick said more flexibility in the market will be needed to keep the system stable amid the energy transition, with gas-fired power plants being a possible "bridging technology" in this regard. "The interaction between production and consumption must be perfectly balanced. It requires a market that follows not only economic but also meteorological and technical laws," he argued.

Germany marks progress on grid expansion to bring wind energy from north to south

Germany’s power grids need 110 billion euros of investment by 2050, operator says

The coronavirus pandemic has heavily affected the shift to sustainable mobility on multiple levels and will continue to do so in 2021. While the fear of infection has put people off public transport and vehicle sharing schemes, it has boosted the use of private cars, cycling and walking. Low passenger numbers put public transport systems under economic pressure. At the same time, the rise of remote work could permanently ease congestion. New bike lanes have popped up in many German cities that are likely to become a permanent fixture.

"It is clear that the coronavirus pandemic is fundamentally changing our mobility behaviour," Barbara Lenz, who heads the Institute of Transport Research at the German Aerospace Centre (DLR), told CLEW earlier this year. "The big question is: Are we only dealing with a temporary shift, or is it here to stay?"

The economic effects of the pandemic also weigh heavily on Germany's car industry, which faces two additional challenges simultaneously: The rapid shift to low-emission vehicles and digitalisation. This is true for the country's mighty carmakers VW, BMW and Daimler, but even more so for many suppliers, which look set to be particularly hard-hit. Several carmakers and suppliers have already announced job cuts, and the industry's troubles could become a matter of controversy not only in Germany's general elections, but also in the Baden-Württemberg state elections in March, because the region heavily depends on the sector.

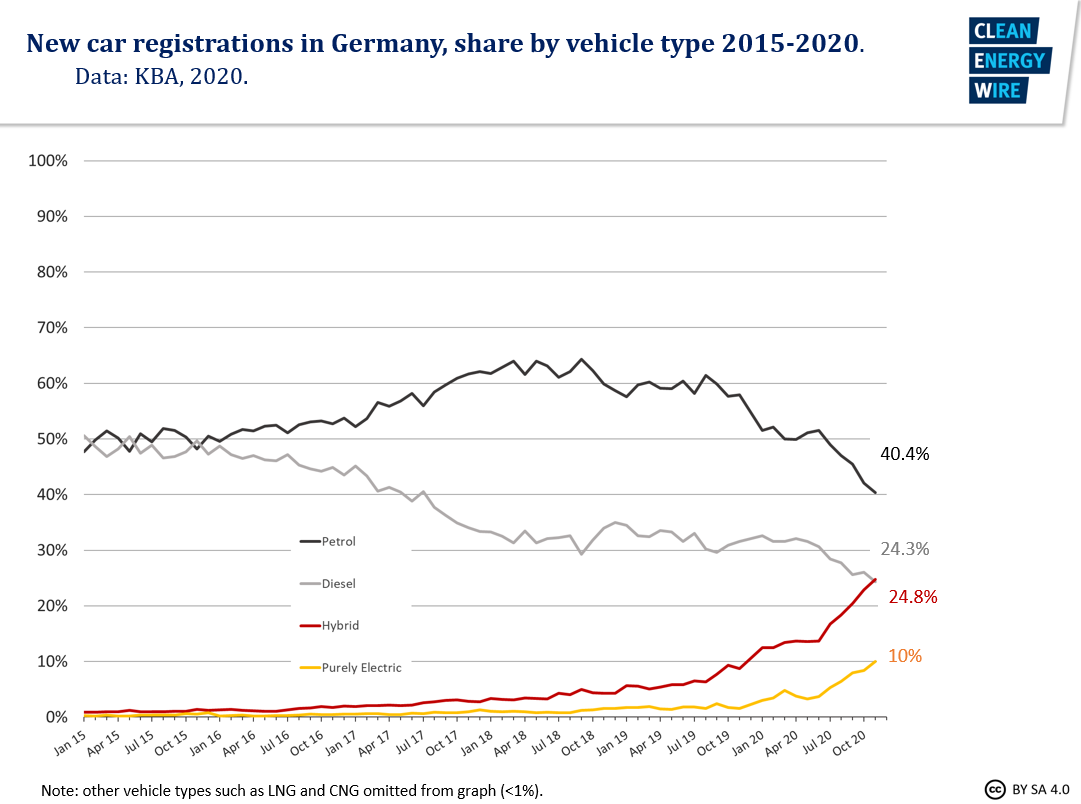

The take-up of electric vehicles has been slow in Germany in comparison to many other markets, but has picked up sharply in recent months. In November, registrations of new pure electric cars rose sixfold compared to a year ago to reach a share of ten percent, a trend that looks set to continue in 2021. Government subsidies for the purchase of electric cars and hybrids have been extended until 2025, accelerating the shift away from conventional combustion engine cars.

Tesla's new Gigafactory near Berlin, which could start operations in late 2021, would shine a bright spotlight on this transition. The trend of electrification will also increasingly affect commercial vehicles. Electric delivery vans and buses have become a common sight in German cities, and heavier trucks are set to follow soon.

The increase in the number of countries, regions and cities announcing an end date for the sale of combustion engine cars – most recently the United Kingdom and California, home of Tesla – will continue to add fuel to the phase-out debate in Germany, particularly during an election year. Closely related is the controversy over the technological options to achieve zero-emissions mobility in the car sector. While many think tanks and environmentalists call for a strict focus on electric cars, Germany's car industry association VDA continues to insist on an open approach that also includes fuel cells and synthetic fuels.

"In 2021, hydrogen in transport and how to continue with climate-damaging subsidies and new motorway construction will play a major role."

"In 2021, hydrogen in transport and how to continue with climate-damaging subsidies and new motorway construction will play a major role," Jens Hilgenberg, who heads transport policy at Friends of the Earth Germany (BUND), told Clean Energy Wire.

Next year will also see the completion of the much contested greenhouse gas quota in transport fuels. The environment ministry’s draft law puts the focus on electric mobility, hydrogen and advanced biofuels, while existing biofuels from biomass are to be phased out after the mid-2020s. Agricultural and biofuel industries are fighting this plan, arguing that it would impair Germany’s CO2 reduction potential in the transport sector. A final decision is expected by June 2021.

Battery-electric trucks will win race against fuel cells and e-fuels - researcher

The year 2020 has been all about the government laying the ground rules for a grand rollout of a world-leading green hydrogen value chain in Germany, and 2021 will show whether these policies are starting to kick in and actually see hydrogen electrolysis with renewable electricity and its use in industry take off.

"After the first implementation steps of the national strategy in the first quarter of 2021, however, politicians must be careful to make sure that the elections and the government formation do not lead to a prolonged standstill in the coming year," Carsten Rolle, who heads the climate and energy division at the Federation of German Industries (BDI), told Clean Energy Wire.

Heavy industry representatives and other energy-intensive manufacturers have warned of the repercussions a more ambitious EU climate target and higher CO2 prices could have on their international competitiveness and business models.

"German industry is concerned that differences in climate policy ambitions are increasing internationally due to the pandemic-related economic crisis."

"Following the recent months' discussions about targets, the European Green Deal will enter the critical implementation phase in the coming year. This will be accompanied by a tremendous wave of reform projects," said Rolle. "German industry is concerned that differences in climate policy ambitions are increasing internationally due to the pandemic-related economic crisis." On an international level, the presentation of China's next five-year plan is of particular interest for German industry in 2021 in terms of climate policy, because it will have huge ramifications for energy and efficiency technologies, according to Rolle.

Both the EU and national governments will likely introduce measures in 2021 to support industry undergoing transformation and preventing carbon leakage, i.e. industry leaving Europe to produce (and emit) abroad.

“Now that most big markets move in this direction it’s no longer in the interest of industry to block the transformation, but to be among the frontrunners”, Germanwatch’s Christoph Bals told the Clean Energy Wire. Several industry heavyweights have pledged to become climate-neutral in the foreseeable future – and as of next year they will be watched much more closely as to whether they deliver on their promises.

Preview 2021: 'Industry fears pandemic widens gap in global climate ambitions'

The international climate agenda next year will be shaped by UNFCCC climate change conference COP26 in Glasgow. It remains to be seen whether and how the conference can take place considering the pandemic. With a new 2030 climate target, the EU – and Germany – can once again take part in international climate talks as credible frontrunners and drive global action ahead of the COP in November.

With the election of Joe Biden as the next US president, expectations are high that a lot more will be possible in terms of multilateralism and cooperation. The EU has already reached out to the new US administration and proposed a renewed transatlantic agenda also on climate and energy.

China has recently announced more ambitious climate targets, which makes it a potential partner in driving the debate. “The EU’s key partners in driving climate action are China and the US. If these three 'climate superpowers' succeed in agreeing on an ambitious climate policy, they will be able to pull many other countries along with them," Brick Medak, head of think tank E3G's Berlin office told CLEW.

Germany will have a chance to play a key role in all of this early in the year, as it plans to host the Petersberg Climate Dialogue in Berlin – an informal international ministerial meeting, which often calls for more action and sets the tone for the rest of the year. The G7 and G20 summits will also play a more important role for climate in 2021, as they will be held in the UK and Italy, respectively, and the US will once again be among those pushing for more ambition.

Preview 2021: ‘EU decision on 2030 target will set tone for next year’s climate and energy policy’

The most prominent energy issue in German geopolitics – the contentious Nord Stream 2 natural gas pipeline – will continue to be high on the agenda in 2021. Construction has restarted after a year of pause due to US sanction threats, but it remains to be seen whether the project will ever be finished.

“2021 will not bring any major changes in terms of US policy towards Nord Stream 2. It is not just a Trump administration view, but a bi-partisan issue of Republicans and Democrats. Even under a new Biden government we will continue to deal with the general question of energy sovereignty and strategic autonomy, and approaches in the EU significantly vary,” Kirsten Westphal, senior associate at the German Institute for International and Security Affairs (SWP) told CLEW.

Preview 2021 – ‘EU energy sovereignty key issue even under US president Biden’

The importance of a financial system that is coherent with international climate targets by supporting investments in low-carbon technologies and curbing those in fossil fuel infrastructure has been recognised by the German government in earnest only in the past few years. Just when the coronavirus crisis fully hit Europe in early March, the country's newly established Sustainable Finance Committee tabled its first set of proposals that should prepare Germany for upcoming regulation at the EU level and enable it to take advantage of the rapidly growing "green finance" market. But its bid to develop a more coherent strategy was complicated by most of the finance ministry's attention shifting to the pandemic.

Nevertheless, the EU taxonomy on sustainable finance, which classifies investments according to their compliance with so-called ESG (environmental, social and governance) criteria, was formally adopted during the summer and will take effect at the beginning of 2021. The debate over the potentially detrimental effects the tight sustainability rules for finance may have especially on smaller businesses is ripe in Germany, as pleas by most parties in parliament at the end of 2020 showed. The pro-business FDP group said it feared that the European taxonomy might starve off companies that might find themselves unable to comply with the new rules. But Karsten Löffler, head of sustainable finance at the Frankfurt School of Finance and Management, told CLEW: "The EU Taxonomy is a good starting point for avoiding contradicting sustainability-related policy goals and for setting incentives accordingly. It can serve as a shopping list and indicator for sustainable activities. No one says that it’s easy, but it can be done."

"The EU Taxonomy [...] can serve as a shopping list and indicator for sustainable activities. No one says that it’s easy, but it can be done."

Many others consider a better preparation for tighter sustainability standards a prerequisite for businesses to thrive in the future. Finance minister Olaf Scholz in October stated that "transforming the economy towards greater sustainability offers huge opportunities." Karsten Löffler, also head of the Sustainable Finance Committee, said sustainable finance would not be a goal in itself, but a means to put the financial sector in a position to “best accompany and finance” the transformation of the economy towards climate-neutrality.

Preview 2021: Making finance truly sustainable “is not easy, but can be done”

EU taxonomy could deliver breakthrough in sustainable finance – researchers

High-profile advisory group lays out proposals for Germany's sustainable finance push

The role of central banks in mobilising sustainable finance is likely to come under scrutiny again in 2021. While European Central Bank (ECB) leader Christine Lagarde last summer said climate action should be made a central bank task, as economic disruption caused by global warming would also touch upon the ECB's key mandate of guaranteeing price stability, this position has been dismissed by conservative business circles in Germany, which say the ECB lacks a mandate for climate action, which is a "political task."