Modest wind power expansion recovery in Germany fails to allay industry fears

The number of onshore wind turbines added in Germany doubled in the first half of 2020 with respect to the same period last year but still remains far too low to spark optimism in the wind power industry or put the country on track towards meeting its renewable power targets.

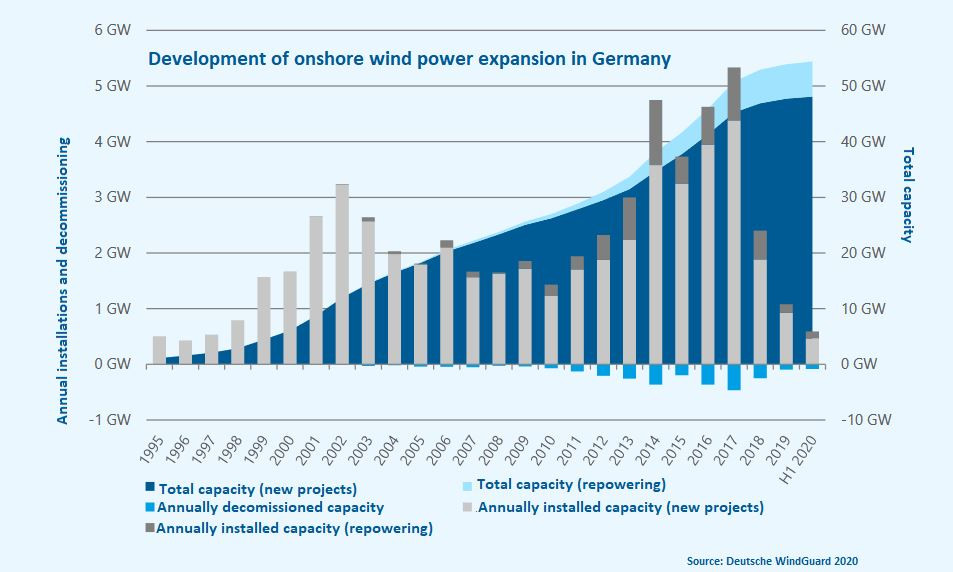

Between January and July, 178 turbines with a combined capacity of 591 megawatts (MW) were built in the country, compared to only 86 turbines in the first half of 2019, industry associations German Wind Energy Federation (BWE) and VDMA Power Systems said, adding that they expected a total of 1,500 MW to be added to the country's energy system by the end of the year. The total number of onshore turbines currently in operation in Germany stood at 29,546 and their combined capacity was about 55,000 MW.

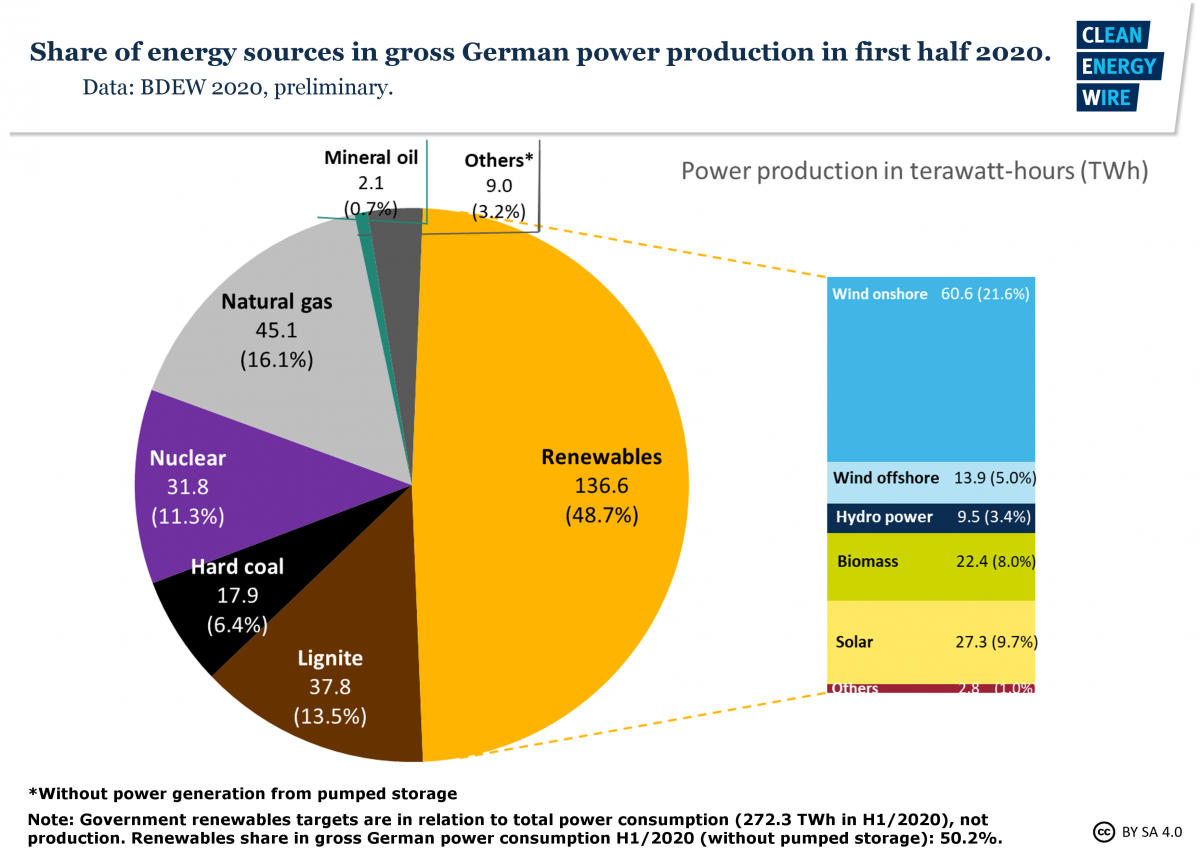

The share of wind power in Germany's electricity system climbed to unprecedented levels in the first half of 2020 and contributed substantially to renewables covering more than half of the country's power demand, as wind and sunshine were available in abundance and demand plummeted due to the coronavirus lockdown. However, despite its strong output, onshore wind power is struggling to regain the expansion vigour it had before 2017, when the process was changed from fixed guaranteed remuneration for new projects to tenders in which bidders vie for the lowest level of support. Onshore wind power is by far the most important renewable energy source in the country and is expected to play a key role in Germany's future emissions reduction scenarios.

The lobby groups urged the government to implement eased regulations for turbine construction as licensing troubles and legal challenges by local critics greatly contributed to the drop in expansion figures in the past years. "The government has repeatedly made clear in recent months that a lasting increase of renewable energy supply is what is desired," VDMA Power Systems head Matthias Zelinger said, arguing that the National Hydrogen Strategy even plans with 5,000 MW of additional capacity of onshore wind power by 2030. "It would be contradictory to announce ambitious climate targets on the one hand but then not to do anything to pave the way for more renewable power generation on the other hand."

BWE head Hermann Albers said the "list of tasks" for the economy ministry to ameliorate the wind industry's situation has become more urgent than ever as the coronavirus pandemic and previously existing problems conflate into a set of severe difficulties for a key industry in Germany's energy transition. The lobby groups warned that about 15,000 turbines with a combined capacity of 16,000 MW would lose their guaranteed 20-year support payments over the course of the next decade, meaning solutions to keep or replace the turbines' capacity are sorely needed.

BWE head Albers said power purchase agreements (PPA) to directly sell a turbine's output to an individual customer at fixed rates and repowering schemes to replace old turbines with newer ones at existing locations are two of the most effective ways to counter the looming loss of capacity in the 2020s. The decommissioning of older turbines and the importance of technological upgrades through repowering also made itself felt in the first half of 2020, when 88 turbines were taken offline, reducing the net expansion to 90 turbines. However, thanks to the much higher average output per turbine, the net capacity addition still stood at 507 MW.

The ongoing difficulties of onshore wind also became visible in the latest round of auctions, which according to Germany's Federal Network Agency (BNetzA) once again failed to attract enough bidders to meet the auctioned capacity volume. While bidders could submit projects with a capacity of some 275,000 kilowatts (kW), only about 191,000 (kW) were awarded, with an average support level of 6.14 cents per kilowatt hour. Parallel solar power tenders, on the other hand, attracted many more bidders and easily filled the 192,000 kW of auctioned capacity with an average support level of 5.18 cents/kWh.