Germany’s Siemens: a case study in Energiewende industry upheaval

Siemens key figures 2017

Revenue: 83 billion euros (+3% compared to 2016)

Net income: 6.2 billion euros (+11%)

Employees: Total 377,000 (+6%)

- In Germany 118,000 (+1%)

- Outside of Germany 259,000 (+8%)

Market capitalisation: 90 billion euros (April 2018)

[Please note: Figures given are as of 30 September 2017, the end of Siemens’ fiscal year. Source: Company data; company overview]

Roots in a 19th century Energiewende

Siemens is no stranger to energy transitions. With deep roots in the energy business, Siemens has always been particularly susceptible to shifts in how the world is powered – and usually turning the transformation to its own advantage. In fact, it owes its rapid early ascension from a “garage start-up” founded in 1847 to the Energiewende of the 19th century – the electrification of homes, businesses, public infrastructure, and communications. Siemens built power stations, electric railways, and the world’s first electric elevators, trams, and street lights. It ascribes its success to permanent innovation and an international outlook – The company is now present in virtually every country in the world.

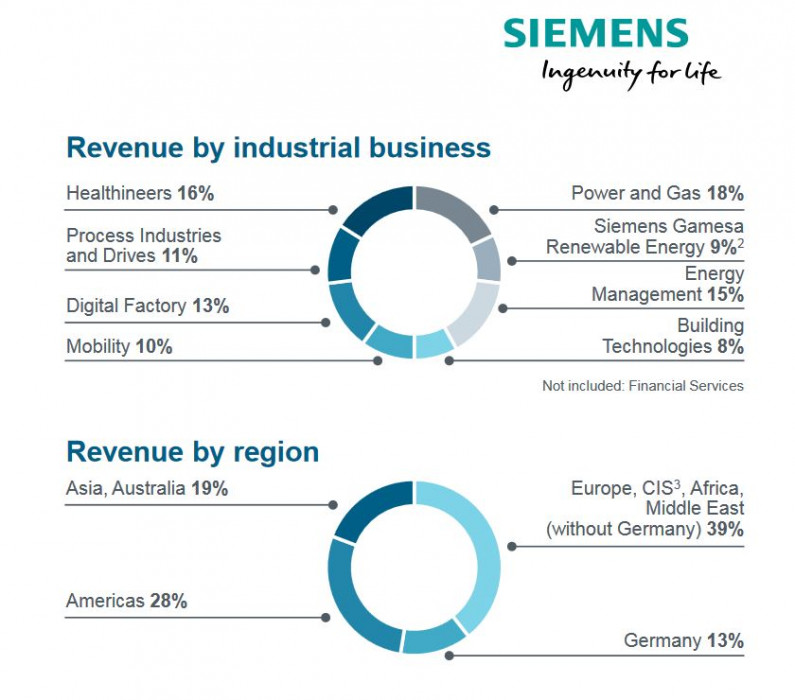

Today’s Siemens is a sprawling industry conglomerate. The group is Europe’s largest engineering company, and among Germany’s biggest employers. Its main industrial businesses by order of revenue are Power and Gas, the medical equipment division “Healthineers,” Energy Management, Process Industries and Drives, Digital Factory, Mobility, wind turbine maker Siemens Gamesa Renewable Energy, and Building Technologies. Its arch rival is US-based General Electric, while other competitors include Swedish-Swiss ABB, and French group Schneider Electric.

Like GE, Siemens is currently slimming down. In 2017, it merged its wind-power unit with Spanish rival Gamesa to form Siemens Gamesa, which remains majority-owned by Siemens. It also decided to hive off its trains and signalling unit, and withdrew from its historic lighting business. It listed its medical equipment division on the stock market in March 2018.

Siemens and sustainability

Today’s Siemens puts great emphasis on its ambition to become a truly sustainable business. The company says it was “the first global industrial company to commit towards carbon neutrality by 2030.”

Canadian “clean capitalism” media and research company Corporate Knights rated Siemens as the world’s most sustainable company in 2017, stressing its focus on renewable energy and efficiency, with an “outstanding” performance in energy productivity, both at clients and in its own operations. Thanks to Siemens’ high clean energy revenues, Siemens came second in the global “Clean 200 List” by California non-profit As You Sow and Corporate Knights.

The conglomerate was listed in the Dow Jones Sustainability Index (DJSI) for the 18th consecutive time in 2017, and was also ranked as one of the most sustainable companies in the industrial conglomerates industry group. The Carbon Disclosure Project (CDP) also awarded top marks. It joined the Carbon Pricing Leadership Coalition of the World Bank (CPLC) in 2016 to advocate the introduction of carbon pricing globally.

Cashing in on the Energiewende

Prior to Germany’s current Energiewende, Siemens was heavily involved in Germany’s build-up of nuclear energy in the ‘70s and ‘80s, making the company a prime target of anti-nuclear protests.

The company exited the nuclear technology business in 2011 in the wake of the Fukushima nuclear disaster in Japan, burying ambitious growth plans involving a joint venture with Russian nuclear technology company Rosatom. Siemens said the decision was motivated by the “clear positioning of society and politics in Germany regarding a nuclear exit.” But according to media reports, the nuclear activities had already been controversial within the company, as they appeared to clash with its desire to be seen as a renewable leader.

Nowadays, Siemens regularly stresses that the shift to a low-carbon future is an excellent business opportunity. It believes that “fighting climate change is not only prudent, but profitable. Siemens is leading this effort.”

Products and services grouped in Siemens’ ‘Environmental Portfolio,’ comprising technologies such as smart grids, industrial automation, e-vehicles, energy-efficient systems, and renewable energy technologies, account for about 50 percent of annual revenue.

The company says its business activities make a big difference in the fight against climate change. “In fiscal 2017, the technologies of our Environmental Portfolio enabled customers all over the world to reduce their CO2 emissions by 570 million metric tons. That’s equivalent to about 70 percent of Germany’s annual CO2 emissions.”

Siemens says it owes its strong position in offshore wind power to the Energiewende in Germany. “As an offshore wind energy pioneer, it’s of course only thanks to the German energy transition and European climate diplomacy that we could become the globe’s most important technology partner for wind energy with more than 20,000 employees,” spokesperson Florian Martini told the Clean Energy Wire.

He added Siemens’ crucial role in making the traditional power grid fit for renewables, and his company’s involvement in future technologies, such as a renewable microgrid in the Bavarian village of Wildpoldsried, and the recent inauguration of a large battery storage project in the same region. He also stressed the use of Siemens technology to reduce industry emissions with efficient engines, transmissions, and turbines, as well as buildings’ carbon footprint. “This is not only about insulation, but rather about enabling buildings to communicate with the energy system using energy management systems and digitalisation.”

Energiewende like “growing pineapples in Alaska”?

Despite its commitment to decarbonisation, CEO Joe Kaeser has been a vocal critic of how the energy transition is being implemented in Germany. At an oil industry conference in Texas he joked in 2015 that giving state support to the solar industry in Germany was like growing pineapples in Alaska. He also said that anyone making energy policy should do the opposite of what Germany is doing. More recently, he insisted that the Energiewende in Germany was right in principle, but poorly managed.

In a 2017 position paper on Germany’s energy transition, Siemens says it is “technically feasible with existing technologies at a similar range of today’s average annual total system costs” to reduce greenhouse gas emissions by at least 80 percent by 2050. The conglomerate recommends ramping up renewable energies, accelerating the exit from carbon-intensive power generation, pushing for e-mobility solutions including the roll-out of a catenary infrastructure (overhead powerlines for e-trucks), an “energy efficiency first” principle, a “binding ambitious energy efficiency target,” and “inevitably” putting a price on carbon emissions, either via a carbon tax or by adding a price floor to emissions trading.

Needless to say, the company stands to benefit strongly if its recommendations are implemented, because they mirror much of the company’s product portfolio. For example, it considers the electrification of mobility as a business opportunity, is already involved in a catenary truck pilot project, and specialises in industry efficiency, among others.

As an operator of wind power and natural gas businesses, Siemens is also likely to benefit from a coal exit in Germany, of which it is a proponent. During ongoing talks to form a new government coalition, the company sent an unofficial working paper to members of the Green Party, calling for “an accelerated end to coal-fired power production” coupled with a European carbon floor price. The letter said Germany’s next government ought to gauge the possibility of shutting down the country’s most carbon-intensive power plants earlier than planned.

Similar to the utilities that have established hubs to nurture new ideas in a start-up atmosphere, Siemens bundled its start-up activities in a separate unit called “next47” to “foster new disruptive ideas.” It will receive funding of one billion euros over the next five years and focus on “distributed electrification, artificial intelligence, connected (e)-mobility, autonomous machines, blockchain applications, and e-aircraft.”

Power and Gas Division “burning to the ground”

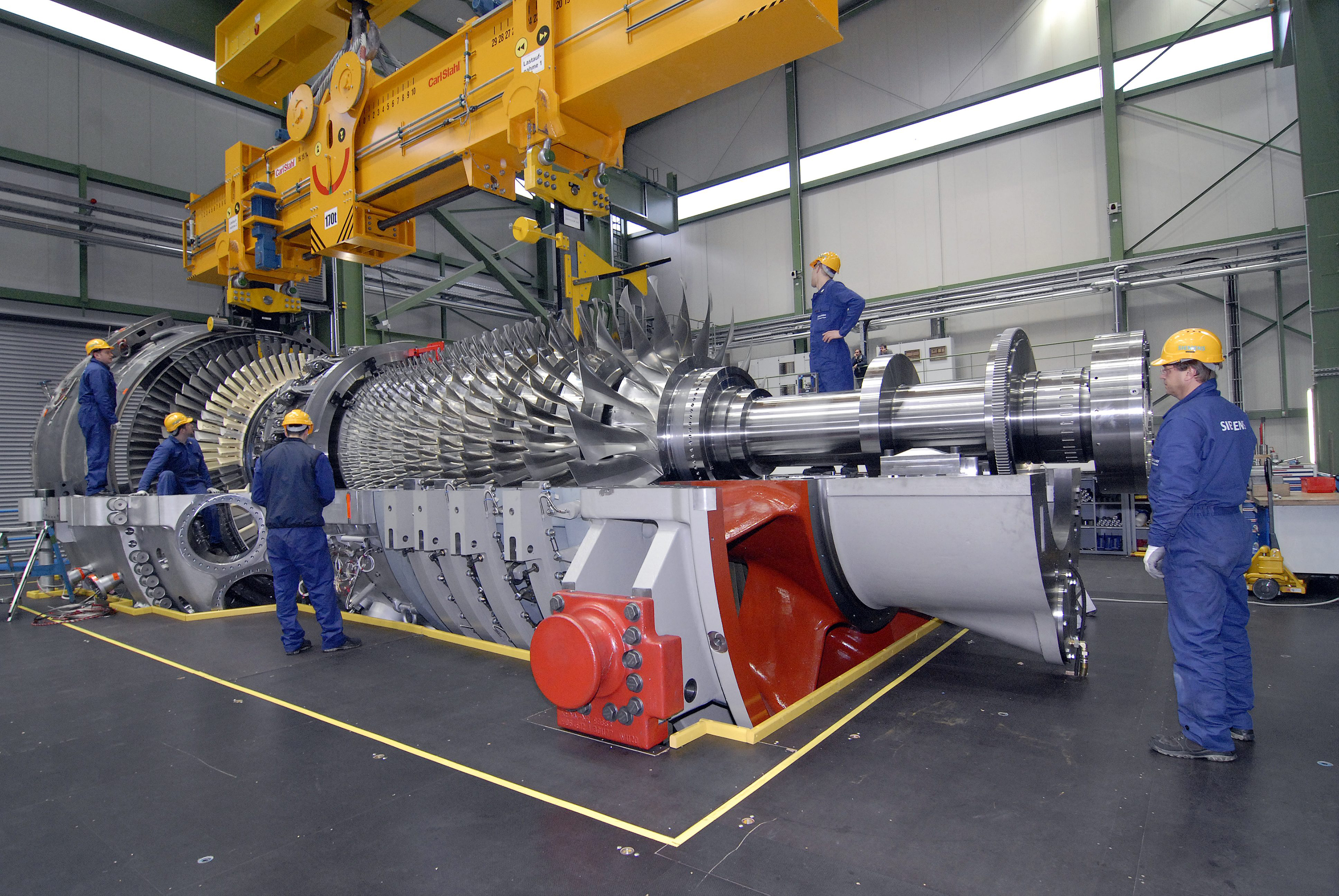

Despite the emphasis on sustainability in its corporate communications, Siemens underestimated the shift to renewable energies in Germany and abroad – similar to many utilities, as well as competitors GE and Mitsubishi Heavy – and remained a big supplier to the oil and gas industry. The Power and Gas division, which specialises in gas turbines, is by revenue still the company’s largest business, and has long been instrumental for the group’s total profits.

This is why the collapse of international demand for fossil power generation caused “disruption of unprecedented scope and speed” in this business area, according to Siemens. Board member Janina Kugel said “the market is burning to the ground” as the world switches “extremely quickly from conventional to renewable energies.” Profits at the division plummeted.

“Siemens axed nuclear and reduced coal exposure, betting on gas as a low-carbon alternative. But this business turned out to be much more difficult than anticipated," Barclays analyst James Stettler told the Clean Energy Wire. “Things have gotten a lot tougher, which was partly just bad luck. Many utilities are simply no longer investing in fossil power. In the company’s home market, for example, there is a malfunctioning carbon market, where coal has taken market share from gas.”

In late 2017, Siemens decided to act by cutting 6,900 jobs, or about 2 percent of its global workforce, including 2,900 in Germany, mainly at the power and gas division. “The declining market for fossil power generation is not a temporary slump. Instead it reveals the expected dramatic development that we’ll only be able to address – and we must address – by taking strategic measures,” Chief Executive Joe Kaeser said. The plans caused an outcry in Germany, partly because Siemens was still making record total profits. The then SPD head Martin Schulz called the job cuts “antisocial” and blamed bad management.

In response to the accusations, company CEO Kaeser replied in an open letter that Germany’s “generous subsidies” had created jobs mainly in China’s solar industry, while the government’s refusal to provide risk coverage to nuclear or coal-fired power plants was a competitive disadvantage for Siemens in export markets.

Kaeser insisted his company had not missed the boat on the energy transition at all, given that it is “the world’s renewables market leader in terms of installed capacity”, and that its wind power business, Siemens Gamesa, is “the leading producer of renewables”.

Kaeser stressed that his company is rapidly increasing the number of its employees both in Germany and abroad, even while shedding jobs in its turbine business. Siemens hired 38,000 people in 2016, 5,200 of them in Germany, and plans to do likewise in the coming years, according to Kaeser. “This would mean that we hire around 16,000 people in Germany, while those 2,900 jobs are lost” in the German power plant division.

In a surprise move in early 2018, Kaeser proposed a large-scale effort to transform Germany’s eastern lignite mining region, where a plant affected by the job cuts is based, into a hub for future technologies such as e-mobility. He said the turbine plant could remain in business for two to five years to ease the transition to a new technology cluster, which could focus on storage technologies such as battery production, and where Siemens could put its experience as a supplier to Tesla’s US battery production to use. He added this concept required the participation of industry, as well as subsidies from the regional and federal governments.

In addition to the troubles in its fossil power business, Siemens is also facing headwind in renewable division Siemens Gamesa, one of the world’s largest wind turbine manufacturers. The company announced in late 2017 that it would shed up to 6,000 jobs of its 27,000-strong workforce as part of a restructuring plan following the merger in the same year, after it had to downgrade its profit outlook.

Siemens has also suffered heavy blows in other divisions unrelated to energy over the years. A famous example is its mobile phone division, which missed the broad shift from business to consumer market in the early 2000s and became one of the most prominent casualties of the industry’s rapid evolution. Siemens sold the loss-making unit in 2005, which went bankrupt shortly afterwards.

But Barclays believes that Siemens is likely to emerge as an Energiewende winner.

“All in all, Siemens still has a decent position in many markets that stand to gain from the energy transition. They have a lot going for them. But gas was simply very profitable. The decline in power has outweighed gains in Energy Management while Siemens Gamesa Renewable Energy has been struggling with both internal and external issues," said analyst Stettler.