Gas to become energy transition’s 'second pillar' – German energy industry

Gas-fired power production will become "the Energiewende's second pillar", the new head of German energy industry lobby group BDEW, Kerstin Andreae, said at the association's year-end press conference. Given that Germany will end nuclear power after 2022 and is aiming to gradually phase out coal by 2038 at the latest, alternatives are necessary to guarantee a secure power supply, Andreae said. The former Green Party MP called the economy ministry's decision to classify gaseous energy carriers as a necessary long-term component of Germany's energy transition a "milestone" that was needed to pave the way for the rollout of power-to-gas technology to produce hydrogen with renewables in the country. "We need to create a market for green gas," Andreae said, adding that the use of green gases for sector coupling measures and as an energy storage mechanism had to be developed further.

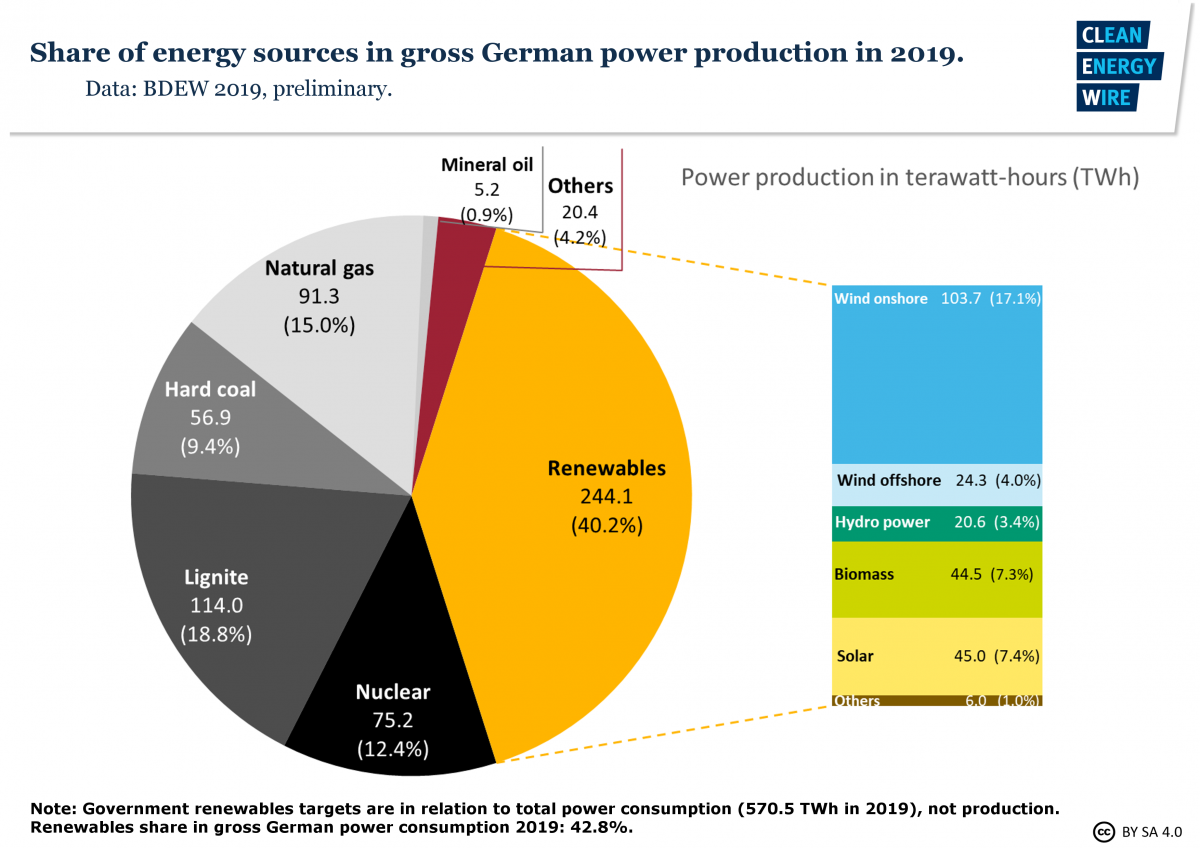

Natural gas currently covers a quarter of Germany’s primary energy consumption, mostly used for heating and cooling in households and public buildings and in industry. The share of natural gas in Germany's gross power production rose from 13 percent in 2018 to 15 percent one year later, whereas much more emissions-intensive hard coal and lignite declined by one quarter to about 28 percent today when counted together, the BDEW said in its annual stocktaking report. Meanwhile, the share of renewable power sources in gross production climbed to 40 percent in 2019. According to figures by energy research group AG Energiebilanzen released a day earlier, the total gas consumption, including heating and industry purposes, increased by 3.6 percent, whereas the coal use in primary energy consumption dropped by more than 20 percent.

The figures also showed that Germany's energy sector has lowered its greenhouse gas emissions by 44 percent since 1990. Compared to last year, emissions in 2019 fell 16 percent -- about 51 million tonnes of CO2. The main reason behind the reduction has been the large drop in coal-fired power production, which declined by 25 percent compared to 2018, whereas renewable power sources increased their output by 9 percent.

Andreae stressed that the resolute expansion of renewable power sources, both wind and solar, was the most important measure for a functioning energy transition. She said the drop in onshore wind power expansion in 2019 was "not pretty" and by all means had to be overcome as soon as possible. According to the BDEW, 3.7 gigawatts (GW) of new turbines have to be added every year to reach the country's 2030 renewables goal of 65 percent in power demand. "If you phase out one technology, you also have to phase in another one," Andreae said, urging that reviving wind power be made an integral part of the coal exit law and the rollout of solar power in inner cities be pursued more vigorously.

The energy industry lobby group's calls for green gas fall in line with multiple initiatives in Germany at the state level and by businesses to bring power-to-x technology to scale and answer many of the energy transition's open questions. The synthetic fuels produced with renewables are seen as an ideal solution for storing energy in the existing gas network and using hydrogen for sectors where electric supply is no viable option, such as in aviation or for several industrial processes. The low efficiency is still widely regarded as a major drawback, however, as much more energy has to be put into converting power into hydrogen than can be stored with it.

Hydrogen production with renewables has been dubbed "tomorrow's oil" and Germany sees itself well positioned to take a lead in the technology's deployment thanks to its high degree of renewables integration and numerous trial activities in the private sector. The economy ministry (BMWi) under minister Peter Altmaier recently pointed out what he regards as a key theatre for energy diplomacy in the next decades, saying that Germany must beat Asia to "become number one" in the hydrogen technology race. There are also less hawkish initiatives regarding hydrogen, however, such as Germany’s recently announced plan to establish an international hydrogen production coordination hub and possible plans to intensify efforts with the UK to boost power-to-x production in the North Sea with offshore wind power.

Regarding the use of natural gas, the government is no less resolute, recently presenting a Gas 2030 strategy with the fuel as a key pillar in the coming years. Chancellor Angela Merkel openly criticised the decision by the European Investment bank (EIB) to stop lending for natural gas projects, saying she did not think it was "right" to cut off the fossil fuel in an effort to promote green finance practices at the EU level.

Moreover, Germany has been supporting construction of the Nord Stream 2 gas pipeline project in the Baltic Sea, a strategy that has been criticised both by many European neighbours and by the US, which looks set to impose sanctions on companies involved in the project’s construction. Foreign minister Heiko Maas rebuffed the threats from Washington, arguing that "European energy policy is decided in Europe, not in the USA". Merkel also criticised the sanction decisions.

Germany's coal exit commission explicitly recommended deploying new natural gas plants in its phaseout agreement and recommended that the country switch its "grid stability reserve" capacity, currently at 2.3 GW, from coal to gas. Rolf Martin Schmitz, CEO of RWE, Germany's largest energy company, furthermore added that the country would have to build additional gas power plants that can also run on climate-neutral synthetic gas following the nuclear exit. "I expect tenders for gas power plants in 2022 at the latest," he said.