The energy crunch – Effects on households and businesses and government's reaction

While the skyrocketing price of natural gas and the steep costs of emission allowances to a large extent explain the high wholesale power price in 2021 and even today, the price that consumers and businesses pay with their electricity and heating bills in Germany is also influenced by taxes and levies -- or the exemption from these.

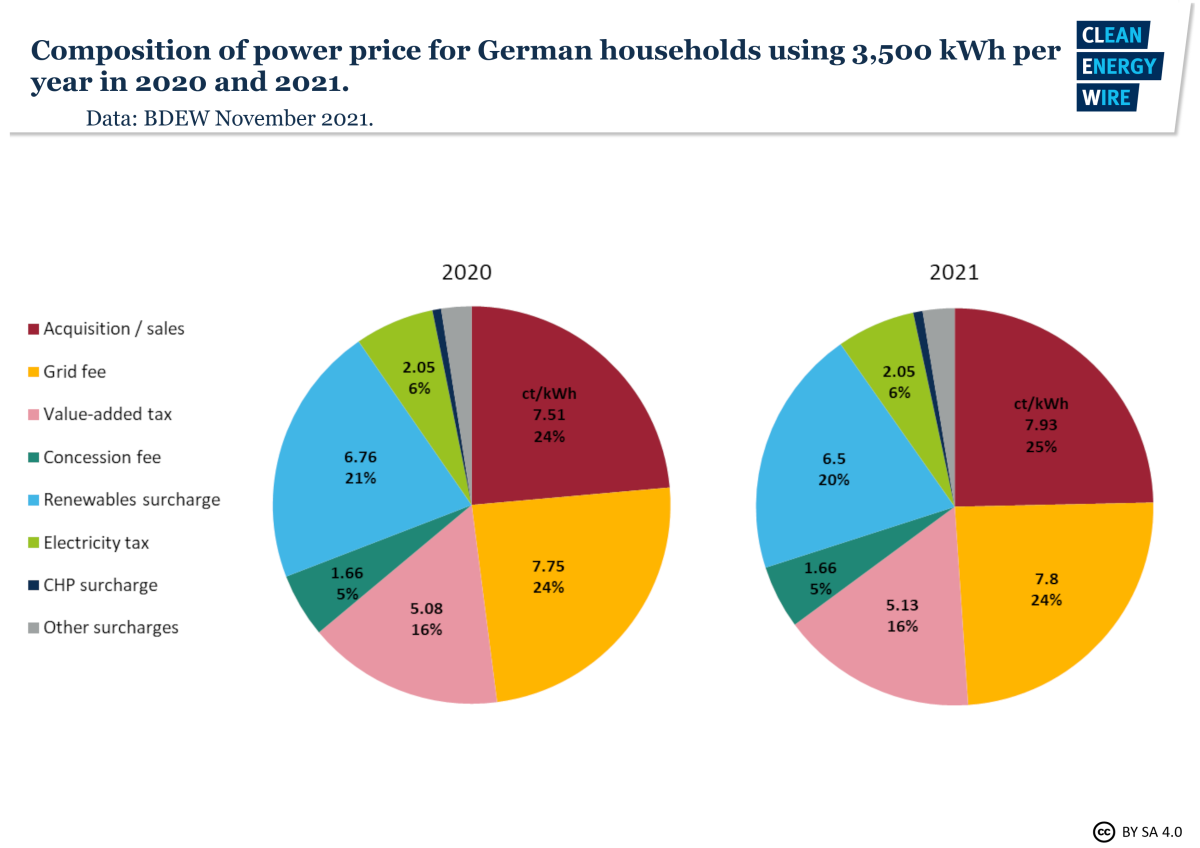

In Germany, electricity prices for consumers are among the highest in Europe due to a range of taxes and levies that make up more than half the price. The average power price for households and small businesses in Germany stood at 32.16 cents per kilowatt hour (ct/kWh) in 2021. About one quarter of the 2021 price (7.8 ct/kWh) results from regulated grid fees, which include metering and associated services, according to an analysis conducted by the German Association of Energy and Water Industries (BDEW). Another quarter arises from the actual power supply costs, including the wholesale power price and the supplier’s margin. Yet another large share (around 20%) is made up by the renewables surcharge, which covers the guaranteed feed-in tariffs for renewable energy installations.

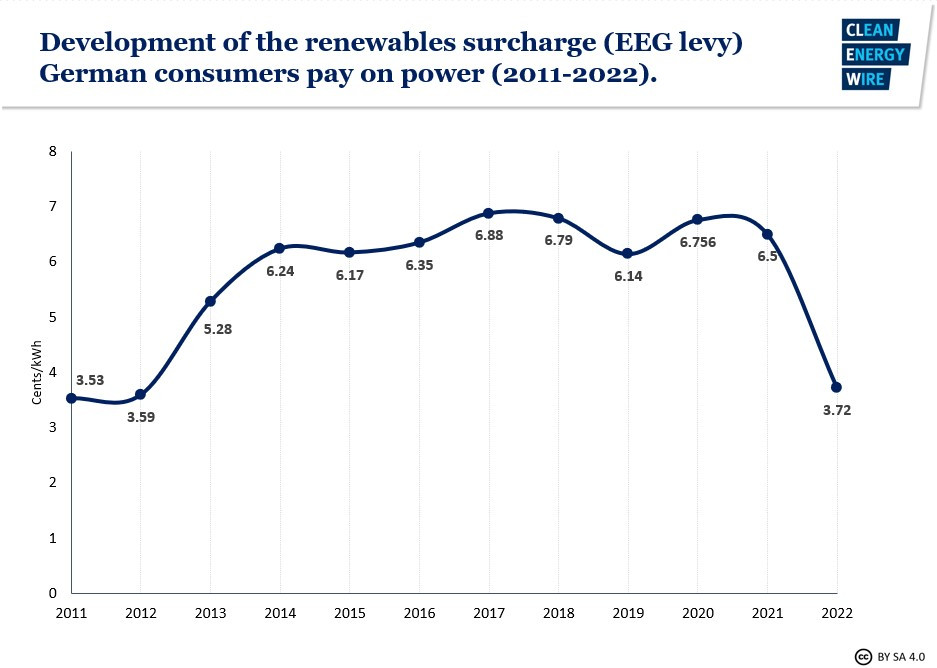

However, in 2021, the government reduced the renewables levy to 6.5 ct/kWh and since January 2022 it has been 3.72 ct/kWh. This would reduce by 100 euros the annual power bill of a household that consumes 3,500 kWh per year, comparison website Strom-Report has calculated. Renewable energy installations will instead be supported from the state budget using income from the sale of emission allowances. Originally intended to make the use of electricity, e.g. for heat pumps and driving, more attractive and to reduce the burden on consumers from the new CO2 price on fossil heating fuels, the renewables levy reduction is now eaten up by the rise in power supply costs (see above).

Energy-intensive commercial customers are exempt from certain components of the power price, and some levies vary according to the consumer's location. Although they pay one of the highest nominal power prices of all customers in Europe, the actual monthly power bills of German households are usually smaller than, for example, those in the U.S., where the price per kilowatt-hour is lower but consumption due to less efficient appliances and more use of air conditioning is much higher. Also, Germans spend a much lower share of their income on energy bills (including electricity, heating and petrol) than many other EU citizens, according to the German Economic Institute (IW). German households pay just over nine percent of their average monthly income for energy, on par with consumers in neighbouring France and the Netherlands. In contrast, Bulgarian households spend more than 25 percent, followed by Greeks and Hungarians at 20 percent.

The poorest households in Germany – which already pay the highest share of their income for energy – were particularly hard hit as many of them lack alternative options and are on fixed incomes.

The degree to which German consumers are affected by the energy crunch in Europe depends largely on their individual power and gas supply contracts. While some electricity suppliers have adapted their rates to reflect higher procurement costs, others have terminated running supply contracts with consumers and several power suppliers have filed for insolvency.

Suppliers tend to source the electricity for their customers partially through long-term contracts (futures on the EEX Power Derivatives Market) often for years ahead, and partially through short-term power purchases on the spot market (EPEX). Depending on how much (still cheap) futures a supplier is currently holding to provide for its customers, or how much the company “bet” on (now not cheap anymore) spot market buys, suppliers are faced with more or less serious financial problems.

Households that have been dropped by their supplier automatically receive power and gas from their local standard provider ("Grundversorger," often the municipal utility), which usually charges higher prices than other suppliers. Consumer protection advocates say that the case of low-cost supplier Stromio, which cancelled consumer contracts before the end of December 2021, has affected several hundred thousand households. Some suppliers that cancelled consumer contracts while not filing for insolvency are suspected to have sold on the futures they procured cheaply to make great profits instead of supplying their customers.

State secretary Patrick Graichen at the economy and climate ministry said that such practices would have legal repercussions but that there were otherwise good reasons why the procurement strategies of power traders have not been regulated.

Faced with a large influx of new customers for whom they now have to source extra amounts of electricity at a time of extremely high wholesale prices on the spot market, some local standard suppliers (which are legally obliged to supply any household) have started to charge more to their new (involuntary) customers than to their existing clients. Price comparison website Check24 has counted around 260 standard suppliers that have introduced new tariffs exclusively for new customers, on average more than doubling their prices.

Following a steady increase in gas prices throughout last summer, by autumn Germany’s industry repeatedly warned of the repercussions the high energy prices would have on their operations. Salzgitter, the country’s second largest steel producer that aims to speed up its shift to carbon-neutral steelmaking, said it could not rule out production stops at some of its plants. Swiss Steel Group, which also operates several plants in Germany, said it would need “immediate relief” from the government to keep production levels steady. And steel industry association WV Stahl said that the price crunch was going to “seriously impede” the industry’s transition to climate neutrality. The VIK, which represents 300 German energy intensive companies, demanded that the government reduce the power price by abolishing the renewables surcharge and lowering the electricity tax.

Natural gas provides nearly half of the energy for the chemical and pharmaceutical sectors. In agriculture, rising gas prices are making production of ammonia and nitrogen fertilisers economically difficult.

German industry association BDI has said that abolishing the renewables levy on the power price was a welcome but insufficient step to support the switch from fossil fuels to electricity in industry. The BDI demands more relief from fees and levies on energy, saying that "all companies are suffering from sharply rising energy and electricity costs."

When buying and selling natural gas on the exchange-based commodity market, traders are routinely required to make down payments to cover operators’ open liabilities. The price volatility on the gas market has increased the need for such security payments. Major German utilities, such as RWE, Uniper or STEAG, have therefore made the news when they had to secure higher credit facilities to cope with the unprecedented volatility in energy markets. In January 2022, Uniper secured up to 10 billion euros, including around 2 billion euros with German state-owned KfW bank; competitor RWE said they had made arrangements to cope with the situation via credit lines and other funding instruments. Uniper CEO Klaus-Dieter Maubach said that while the extra liquidity was needed when buying and selling gas, the “hedging amounts will flow back to us on the day we physically fulfil our contracts.” Uniper stressed that it was a “very healthy company,” but needed to be prepared in this highly volatile market environment. Uniper shares fell 1.69 percent to 41.29 euros on the day of the announcement.

Consumer advocates: The Federation of German Consumer Organisations (VZBV) has warned that exploding energy prices are causing distress for consumers and that many households that have been forced into the standard supply regime have to pay significantly higher prices than existing customers. The VZBV considers this two-tier system to be wrong as it undermines competition and has called on politicians to take action. "Some electricity and gas providers have obviously relied on a short-sighted business model and have not lived up to their responsibility towards their customers. But this was also possible because the transparency obligations and regulations were not sufficient. It is not the consumers who must foot the bill for these dubious business models and poor market regulations. Politicians must make consumer protection in the energy market more crisis-proof," said Thomas Engelke, head of the energy and construction team at VZBV. The VZBV also pointed out that while some local suppliers, e.g. in Frankfurt am Main and Leipzig, are charging new customers more than double what existing customers pay, other municipal utilities, e.g. in Bremen and Stuttgart, have even lowered their tariffs, while rates remained stable in Berlin, Hamburg, Munich, Düsseldorf, Essen, Hannover and Nürnberg.

The Verbraucherzentrale Nordrhein-Westfalen announced it will sue some standard providers. “Even if we understand the difficult situation of default providers, this is not acceptable,” said Verbraucherzentrale head Wolfgang Schuldzinski. “Forcing customers that have done nothing wrong to end up in a default supply setting is against the law,” he argued, saying the issue could eventually land on the desk of authorities dealing with cartel cases.

Energy industry: Energy industry association BDEW has said that rising consumer bills are not the fault of the standard energy providers. “Dubious low-cost providers are the problem, not the primary service providers, who also provide service in emergencies,” BDEW head Kerstin Andreae said in a press release in January. The BDEW advises customers whose contracts have been unilaterally cancelled to take legal action. Standard providers that had to raise their tariffs for new customers that they received involuntarily were forced to buy additional quantities of electricity or gas “overnight.” The extremely expensive short-term purchase of additional quantities and the collateral required for this can bring the basic suppliers themselves into economic difficulties, the BDEW argued. It was therefore mainly in areas where many Stromio customers resided that the standard supplier had to increase its rates for new customers.

The German Association of Local Utilities (VKU) said that the consumer organisations were barking up the wrong tree when blaming the standard providers for price increases. “The fact is that those who always go for the highest savings in the short term - as was unfortunately recommended by consumer organisations for a long time - also pay for this with a higher risk,” VKU managing director Ingbert Liebing said.

Susanna Zapreva, CEO of standard supplier enercity, argued at the Handelsblatt Energy Summit 2022 in January that she wouldn’t consider it fair to burden faithful, existing customers because of the new clients. The BDEW also argued that it wouldn’t be “wholesome” consumer protection if existing customers would also have to share the burden.

Energy market observers: Power market expert and author Christoph Podewils argued that some providers must be taking advantage of the situation. If wholesale prices per kilowatt-hour have risen by around ten percent within a year and the government lowered the EEG levy by around three cents in January, an increase of 30 cents or more by some electricity suppliers cannot be explained, he wrote. The government should therefore refrain from paying additional energy subsidies to poorer households because this would just pay into the pockets of suppliers with exaggerated prices, funded by the taxpayer. Instead, the government should increase the transparency of the composition of energy tariffs by suppliers or introduce a price supervision system, which was abolished during the liberalisation of the energy markets. He also proposed an overhaul of the electricity market to make renewable power cheaper for consumers – by funding renewables via contracts for difference and by not letting the most expensive power station in the merit order set the price.

In view of skyrocketing energy costs, the German government at the end of February 2022 agreed on a wide-ranging plan to provide financial relief to consumers, including the elimination of the renewable energy levy – a move that will save electricity users 6.6 billion euros (3.27 cents per kilowatt-hour; the levy was previously scheduled to end as of 2023). The 10-step plan, which still has to be approved by the parliament, also includes a higher commuter allowance and more support for recipients of welfare and unemployment benefits. In total, the relief plan’s measures add up to the double-digit billions. Those measures also include projects that have already been implemented, such as minimum wage increase to 12 euros an hour. In early February 2022, the cabinet had decided to give low-income households a one-off heating cost allowance. In a response to rising prices for heating oil and gas, consumers who receive housing benefits or student/trainee support will get between 115 and 175 euros, to be paid out in summer when many households will face bills reflecting the higher prices. According to the buildings ministry, 1.6 million people are to benefit from the subsidy, including 370,000 students. The measure will cost the state nearly 190 million euros.

In the longer term, a so-called “climate payment” to all citizens is envisaged to compensate people for rising energy costs due to higher CO2 pricing. Social housing subsidies have also been increased to account for a higher CO2 price on heating fuels as of 2022.

Environment minister Steffi Lemke, whose ministry is also in charge of consumer protection, said that some of the cancellations of power and gas customer contracts might have been illegal, according to early data seen by her ministry, and called the expensive new contracts with standard providers for cancelled customers “problematic.” Some of dramatic increases in prices in these contracts could not be explained by increased purchase and retailing costs, she said. She named reduced taxes on heating energy as a possible measure to help poorer households.

A reform of the Energy Industry Act (EnWG) is meant to prevent short-term terminations of electricity and gas contracts and establish uniform tariffs for basic supply so that new customers do not have to pay double or triple the amount compared to existing customers.

Energy and climate state secretary Graichen said that – at EU level – it could become necessary to help European businesses that are faced with extreme energy prices when they are in international competition with e.g. U.S.-American companies that do not struggle with volatile prices. He added that all businesses should be aware that now was the perfect occasion and time to invest in solar and wind farms or start sourcing energy via power purchase agreements (PPA) with renewable installations to make themselves independent from volatile fossil fuel prices.

It is part of the new government’s energy transition emergency plan to strongly support German industry in reducing its greenhouse gas emissions, for example through carbon contracts for difference.

EU member states are largely responsible for their national energy policies, and EU rules allow them to take emergency measures to protect consumers from higher costs, which many countries have done (Reuters published an overview in February 2022). Almost all European countries have introduced response measures, e.g. waiving electricity taxes and grid fees, or transfers to vulnerable consumers. Think tank Bruegel provides a regularly updated overview of these measures (see below).

In October 2021, the European Commission presented a toolbox with suggestions on how member states and the EU could address the impact of the energy price increase and strengthen their resilience against future volatility. It includes short-term national measures, such as emergency income support to households, state aid for companies and targeted tax reductions. “The Commission will also support investments in renewable energy and energy efficiency; examine possible measures on energy storage and purchasing of gas reserves; and assess the current electricity market design,” the announcement reads.

The 27 EU member states have so far refrained from taking concerted action. The participants in a ministerial-level meeting in early December 2021 failed to agree on a proposal tabled by France, Spain and Italy to abandon the merit order principle, according to which the last kilowatt-hour needed and the most expensive power station determines the wholesale electricity price. Germany, Austria and Denmark opposed such an intervention in the electricity market. Italy and Spain have also proposed to introduce join natural gas procurement by the EU member states. Hungary and the Czech Republic would like to introduce changes to the European Emissions Trading Scheme (EU ETS).

The energy price crisis has also sparked renewed debates about the dependence on imported fossil fuels and supply strategies (long-term vs. spot), as well as effects of the energy transition on this dependence.

“Today’s gas crisis must serve to accelerate the transition to clean energy. For this, we also need trust. People need to trust that the transition will be fair. Businesses, that it will improve their competitiveness. And investors, that we will stay the course,” European Commission President Ursula von der Leyen said in a speech in January 2022.

Member of the European Parliament (MEP) Peter Liese has proposed that the EU should give its member states a partial opt-out from the planned emissions trade for transport and heating fuels. According to Liese, countries should be able to exempt private housing and private transport from the CO2 price for the first two years so as to not overburden consumers. The new emission trading system is planned to come into effect in 2026.

For the UK, an analysis by Carbon Brief shows that had energy transition policies, such as energy-efficiency subsidies, onshore wind deployment and zero-carbon home standards, remained in place, energy bills would be considerably (2.5 billion British pounds) lower today.

[The first version of this factsheet was published on 8 February 2022]