Please note: Most German households use natural gas or oil for heating, for which they receive separate bills. This factsheet exclusively looks at electricity bills.

Electricity price components

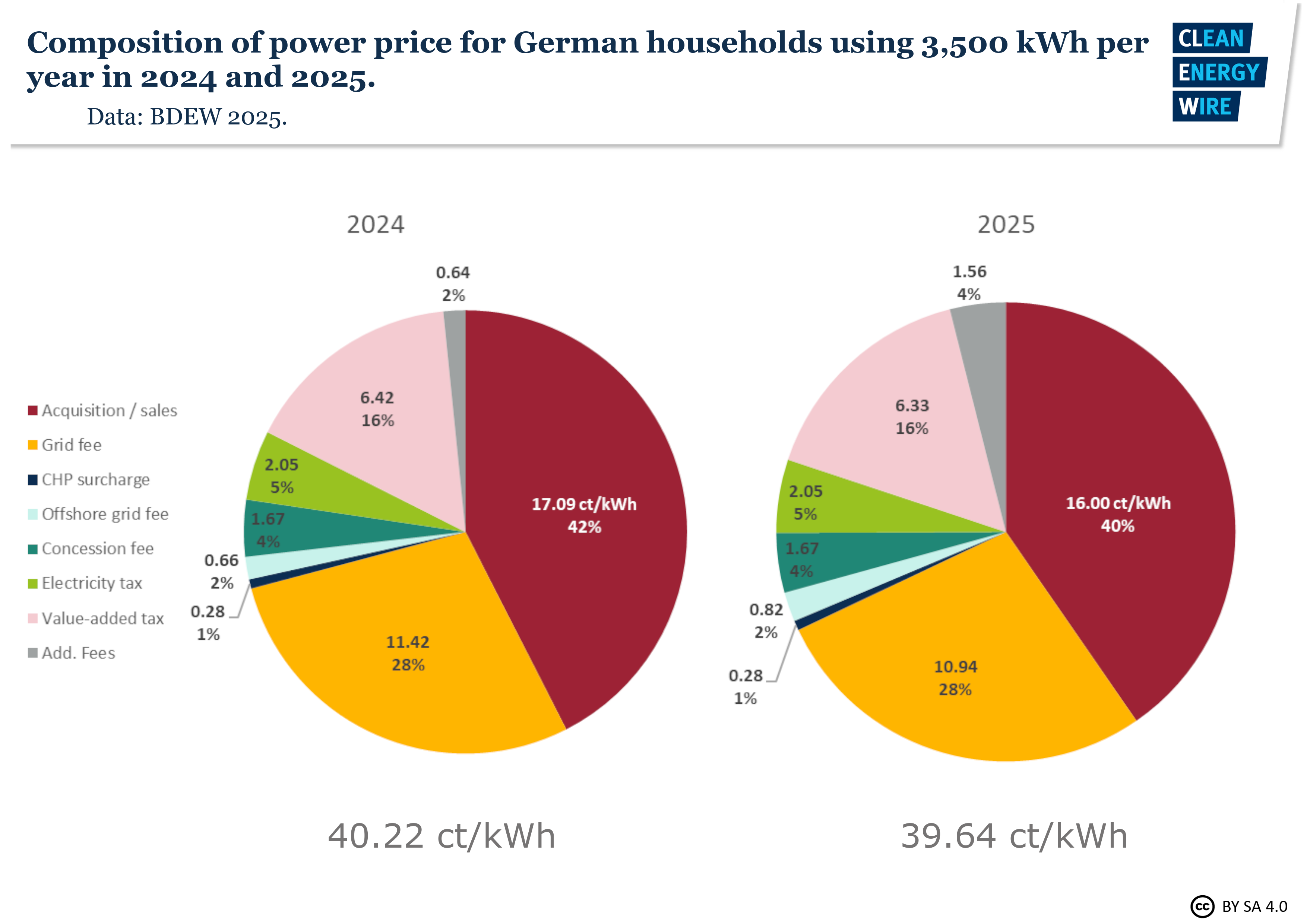

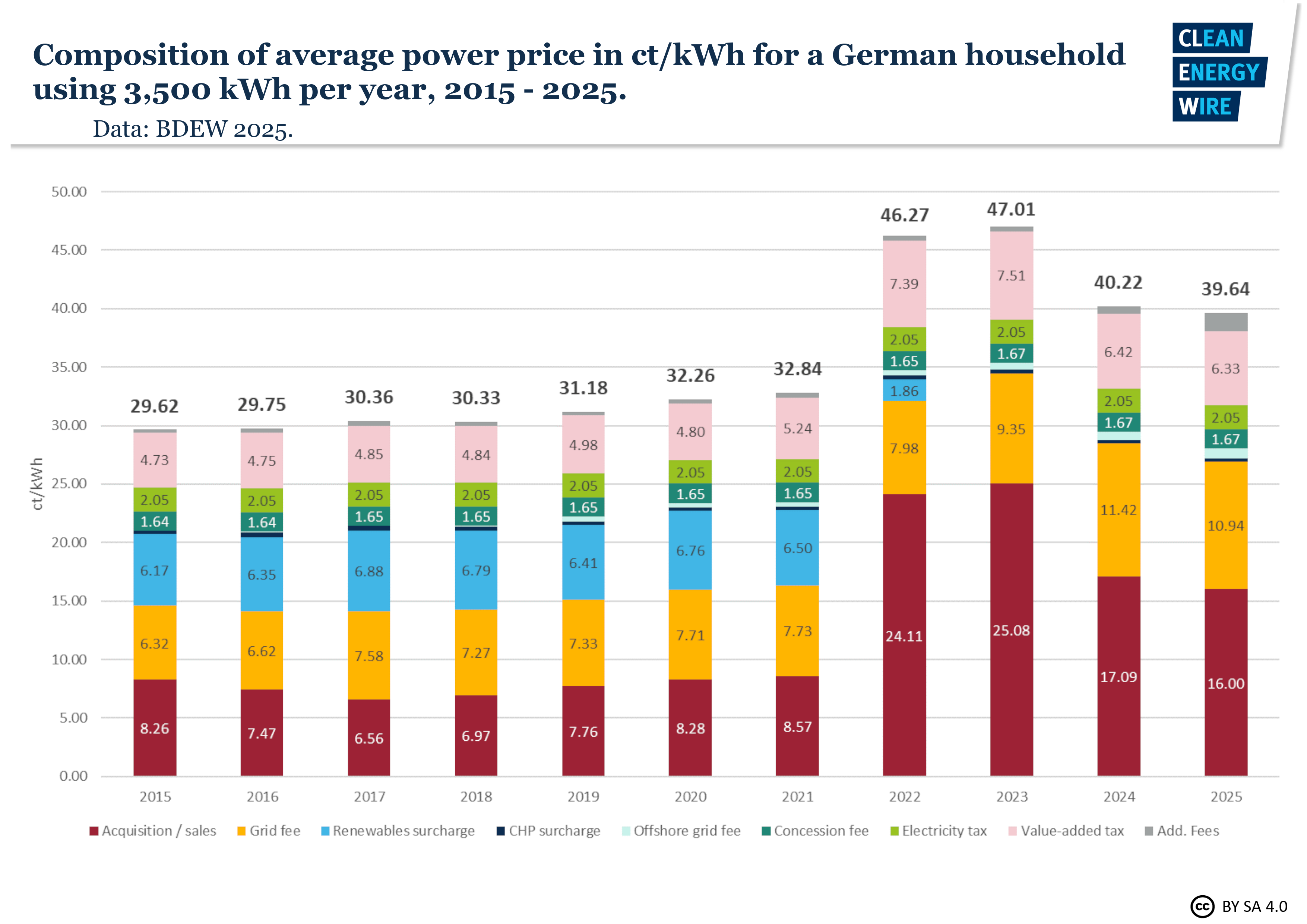

Three years after the beginning of the European energy crisis, German households continue to pay significantly more for electricity than they did before 2022. While the average price receded markedly from its peak of, 47 cents per kilowatt hour (ct/kWh) in 2023, to 39.6 ct/kWh in 2025 , the level remains still well above the 32.8 ct/kWh average in 2021.

Price hikes on wholesale energy markets have been the main driver of rising electricity bills in the past years. The post-pandemic recovery and the Russian invasion of Ukraine threw global energy markets into turmoil, particularly for natural gas, which accounts for a large fraction of Germany’s electricity production mix.

The average household with an annual electricity consumption of 3,500 kWh paid 115.6 euros per month in 2025, figures by utility association BDEW showed. According to an analysis by price comparison website Verivox in early 2025, this made Germany’s household power prices the fifth-highest in the world. Germans already paid the highest nominal power prices in Europe in many past years.

However, only about 40 percent of the price of electricity is determined by market factors, BDEW found. About one third (32%) resulted from a range of factors directly determined by policy, including taxes and levies. Those policy-driven price components even accounted for more than half of the total price before the abolition of Germany’s renewable energy levy, which stood at 3.72 ct/kWh on the eve of its elimination in mid-2022.

Grid fees, including metering and associated services, accounted for 27 percent of the 2025 price. The fees can vary considerably between individual regions, depending on the capacity of the local grid, population density and load management measures taken to stabilise regional networks. The government will subsidise electricity transmission grid costs with 6.5 billion euros in 2026, which could reduce the fees by an average of 16 percent for household consumers.

CO2 emissions allowances in the European Emissions Trading System (ETS) have also contributed to higher electricity prices. Prices for allowances quadrupled between 2020 and 2025, making fossil-based electricity production more expensive.

Power price composition 2025*

Total price: 39.6 ct/kWh

Supplier’s cost (40.4%)**

The profit margin and supplier’s cost of purchasing electricity on the wholesale market – 16.00 ct/kWh

Grid fees (27.6%)

Charges for the use of the power grid, set by the Federal Network Agency (BNetzA) – 10.94 ct/kWh

Sales tax (VAT) (16%)

The sales tax is 19 percent on the pre-tax price of electricity and makes up 16 percent of the price after tax – 6.33 ct/kWh

Electricity tax (5.2%)

A tax on power consumption - wer, also known as ‘ecological tax’ in Germany - which was introduced in 1999 in a bid to incentivise more efficient electricity use and fund climate projects – 2.05 ct/kWh

Concession levy (4.2%)

A levy on the use of public space for power transmission lines that the utility passes on to the consumer – 1.67 ct/kWh, depending on the size of the affected area.

Offshore liability levy (2%)

Grid operators must pay damages if they fail to connect offshore wind farms in a timely manner, preventing them from selling the power they produce. Operators can pass these costs on to consumers through this levy - 0.82 ct/kWh.

Surcharge for combined heat and power plants (0.7%)

Operators of combined heat and power (CHP) plants receive a guaranteed price on the electricity they sell. The difference between the guaranteed price and the actual price they receive on the market is financed through this surcharge of 0.28 ct/kWh.

Levy for industry rebate on grid fees (3.9%)

Large power consumers are partially or totally exempt from grid charges. These costs are distributed among consumers via this levy, amounting to 1.56 ct/kWh.

[*Average price for new customers as of October 2025; **Difference to 100% due to rounding. Source: BDEW 2025]

End of renewables surcharge overshadowed by surge of other price components

The renewable energy surcharge was used to pay the difference between wholesale prices and fixed feed-in tariffs for green energy, which are guaranteed by law to renewable power producers for 20 years. The surcharge grew from 0.08 ct/kWh in 1998 to 6.5 ct/kWh in 2021 and was reduced to 3.7 ct/kWh at the beginning of 2022,before being eliminated entirely later that year. Since the surcharge ended, the difference is paid directly from the state budget.

In the first six months of 2022, households still paid about 6.5 billion euros for the surcharge. Unlike energy-intensive commercial customers, households are required to pay levies and taxes in full.

However, the savings for households generated by ending the renewables surcharge were quickly offset by other price-inflating factors, meaning that the average household paid about 20 percent more for electricity in 2025 than it did in 2021.

The state intervened heavily during the energy crisis to shield customers from excessive price hikes, most importantly through the national ‘price brake’ on gas and electricity. The scheme agreed at the end of 2022 limited the price of 80 percent of consumption to 40 ct/kWh for electricity but was phased out one year later.

When taking office in May 2025, the coalition government of chancellor Friedrich Merz’s conservative CDU/CSU alliance and the Social Democrats (SPD) agreed in its coalition agreement to reduce electricity prices for both households and companies by at least 5 ct/kWh by using CO2 price revenues to cut the electricity tax to the European minimum for all customers, among other measures.

However, in July the government said the measure would be limited to industry users only, citing the need to save money as the main reason for not making good on its promise. Energy industry representatives and other stakeholders criticised the government for leaving households and small businesses out in the cold on electricity tax reductions, but government representatives said more steps were planned for 2026 to cut energy costs for all.

Customers change providers, save energy in bid to cut costs

Customers in Germany can reduce their electricity bills by routinely comparing prices and switching suppliers, according to consumer protection association Verbraucherzentrale NRW. A 2022 survey by the IT association Bitkom found that nearly 60 percent changed their provider at least once in the past ten years, up from merely 38 percent in 2016. This was primarily because digitalisation makes it easier for consumers to browse and change existing contracts for providers that are cheaper or offer more sustainable electricity supply contracts.

Apart from switching providers, consumers can also increase the energy efficiency of their homes to lower electricity costs. Widespread use of energy-efficient appliances or low-energy light bulbs helped reduce per capita electricity consumption, which in 2021 was significantly lower than in comparable economies, such as Canada, the United States, France or Japan. During the energy crisis, in 2022, the German government and a broad alliance of business and civil society groups urged citizens to save energy to reduce dependence on Russian imports while accelerating the energy transition.

Two years later, in mid-2024, three-quarters of respondents in a survey said that they had started conserving electricity, gas or heating oil during the crisis, and almost all of them (93%) continued to do so after prices dropped again. In early 2025, another survey found 57 percent of respondents continued energy-saving efforts they started during the crisis. The primary motivation for more than one third (36%) of respondents was environmental protection and climate action, while about a quarter (26%) said they primarily wanted to save costs.

Many customers said they also pay greater attention to the share of fossil fuels used in their energy consumption. The share of electricity in consumption generally is set to rise, as electrified alternatives are replacing much of households’ fossil-fuel based energy use, such as swapping gas boilers for heat pumps, or combustion engine cars for electric cars.

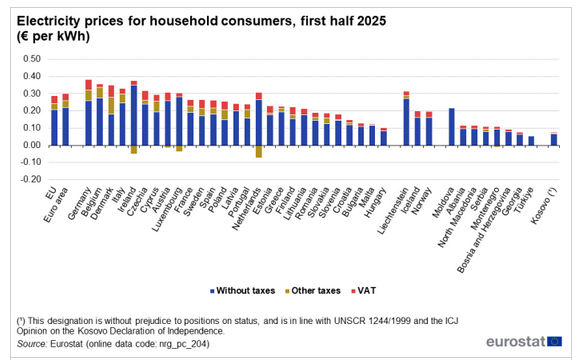

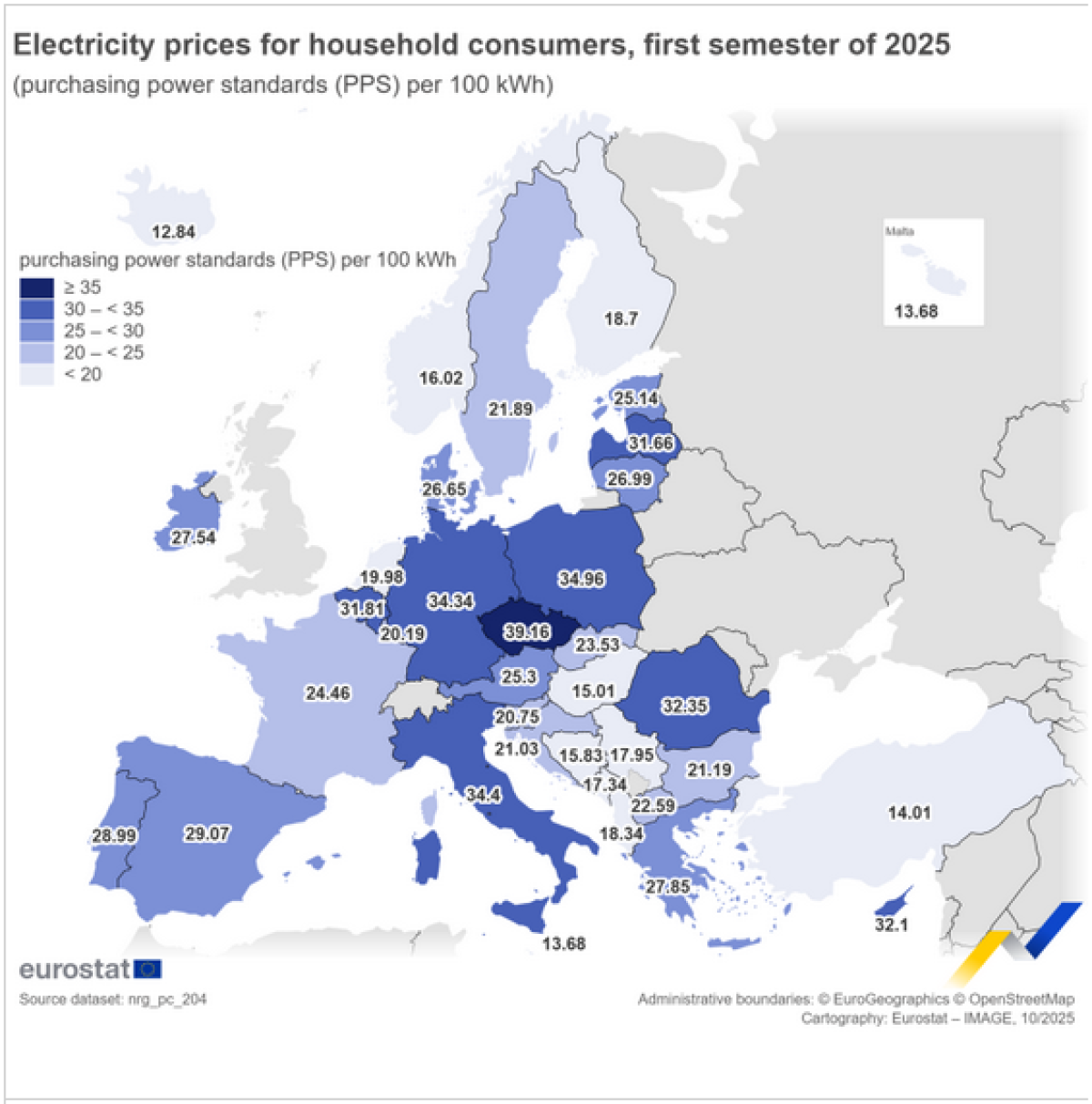

Real electricity prices range in European midfield

Nominal household power prices in Germany were the highest in the entire EU in the first half of 2025, with the share of taxes and levies also among the top group of member states. Despite this, the country’s general course in the energy transition retains support by a vast majority of citizens, a survey found in late 2025. A possible reason for this high degree of acceptance is that the financial impact of rising electricity prices on the household budget has not been substantial for many people, as it constitutes only a relatively small fraction of their total income.

In an analysis of EU electricity prices in purchasing power standard in the first semester of 2025, statistic agency Eurostat grouped Germany at the higher end of the price scale, although behind countries like Czechia, Poland or Italy.

A 2021 analysis by the German Economic Institute (IW) likewise found that Germans spend a much lower share of their income on energy bills than many other EU citizens and rank in the midfield in this metric. German customers paid just over 9 percent of their average monthly income for energy (including petrol and gas), on par with consumers in neighbouring France and the Netherlands. In contrast, Bulgarian households spend more than 25 percent on electricity, gas and petrol. Greeks and Hungarians shared second place at 20 percent. Another analysis, by the International Energy Agency (IEA), set the share of income paid by German households for energy in 2022 even lower, at about 5.5 percent. This was below Italy (7.2%) and Spain (6.5%), but above the UK (4.8%) and France (4.7%).

In 2017, a survey conducted by IT association Bitkom found that many people in Germany do not even know how much they actually spend on electricity. Ninety-two percent of respondents said energy consumption was an important consideration when buying new household appliances. At the same time, almost half (49%) said that they did not know their annual power consumption, and 37 percent had no idea how much they paid for it.

However, around five percent of Germany's population (4.2 million people) reported being late in paying their utility bills in 2024, according to the country’s statistical office Destatis. Tenants of rental properties were hit particularly hard, with 6.4 percent struggling to pay their electricity or gas bills on time, the office said based on a survey on income and living conditions.

Future price trends difficult to predict but renewables seen as cost-cutting in long-term

A combination of market developments, technological advances, and political decisions will shape Germany’s household electricity prices in the future, making predictions difficult. Government and industry representatives during the energy crisis repeatedly stressed that the best way to shield the country against future price hikes is to quickly expand renewable energy production.

Germany’s monopoly commission in a 2025 expert opinion called for a comprehensive reform of the electricity system to better align prices with power output. Dynamic grid fees could help steer supply and demand and ultimately allow “a happy hour” for electricity consumers that lets people benefit from times of abundant renewable power feed-in, the competition watchdog said.

A digitalised grid would be a prerequisite for introducing more flexible fees, the commission said. It added this could also help avoid the “politically difficult” debate about splitting the country into multiple power price zones. In 2022, an alliance of northern German states called for a sweeping reform of the country’s electricity market to allow states with a high share of renewables, which tend to be in northern Germany, to benefit from their clean energy infrastructure and pay lower prices than their neighbours further south. Germany’s government repeatedly rejected the measure supported by the European Commission to improve cost efficiency.