German industry embraces Energiewende transformation challenge

The energy transition's effects on the economy

Contents

In growing parts of German industry, resistance to the Energiewende has given way to concerns that the energy transition’s home country could miss the boat in the global movement towards a low-carbon future.

“Germany needs a robust strategy for implementing its comparatively stringent emission reduction targets if it does not want to fall behind in the global race to develop carbon-neutral economies,” reads a call for government action signed by 50 prominent businesses including sports equipment makers Adidas and Puma, budget retailer Aldi, industry conglomerate Siemens, the electronics industry, and others, in early 2018.

Replacing fossil fuels and nuclear power with renewables has already begun to reshape many sectors. It will have far-reaching impacts on many others, as the main transformations still lie ahead. “The Energiewende will turn the German economy inside out,” says Achim Wambach, president of the Centre for European Economic Research (ZEW). “Economic activity will be transformed. We will find ourselves in a different world once renewable electricity powers all sectors. Germany’s economy will be changed beyond recognition.”

But how to make this a success? After wreaking havoc among traditional utilities, heavily reliant on coal and nuclear power and sluggish to embrace renewables, Germany’s carmakers are now in focus. Years of developing “clean” diesel technology ended in scandal, leaving VW, Daimler and BMW scrambling to catch up in the e-car segment. The Energiewende will change the face of countless other businesses, among them construction, steelmaking, engineering, and chemicals.

On the road to cutting emissions by 80 to 95 percent by 2050, Germany’s official target, the jury is still out as to whether the energy transition will be a boon or a bane for the economy as a whole. Sceptics – among them many energy-intensive companies – continue to warn that it might undermine Germany’s strong international competitiveness by overburdening companies with high power costs and stringent emission rules.

Energiewende proponents counter that a determined decarbonisation is essential to preserving the country’s status as a technology leader, because it will spur innovation and boost growth, employment, and international demand for climate-friendly technologies “Made in Germany.” Young companies with innovative business models are, in fact, springing up across many sectors, snatching clients and personnel from struggling incumbents.

In their 2018 call for government action, businesses agreed: “Taking on a vanguard role in climate protection represents a tremendous opportunity for promoting innovation and bolstering Germany’s economic competitiveness."

German industry is central to the whole of the economy. Industry’s share of total economic output, stable at a whopping 23 percent for two decades, is much higher than in most other developed countries. After a dip in the wake of the financial crisis, employment in the sector has steadily risen, and currently stands at 7.6 million (out of a population of 83 million and total employment of more than 44 million).

The government, economists, and businesses believe the fate of Germany’s much-admired industry is the key to the energy transition’s success or failure. Germany emits less than three percent of the world’s CO2. So showing the rest of the world how a big industrial economy can successfully switch to clean energy is essential to making a real impact on global emissions.

“Comprehensive climate protection efforts in Germany [are] only successful if they motivate other countries to follow suit,” according to a landmark study on the economics of climate protection by the country’s most important industry association (BDI) published in early 2018. “On the other hand, they could become counterproductive if a strong negative impact on the economy discouraged other states.”

In the wake of the Paris Climate Agreement, German industry has come to realise that the Energiewende can be good business. At a BDI presentation of its economic benefits at an event in early 2018, managers still expressed widespread scepticism, but instead of asking – as before – if the energy transition was a good idea at all, the new focus was: “What’s the best way to go about it?”

More and more German business leaders concur with Michael Liebreich, head of Bloomberg New Energy Finance, who stated in early 2018 that the “road to deep decarbonisation” presents “a moment of unparalleled opportunity. Fantastic rewards await those countries, businesses and investors who place the right bets.”

Germany’s current economic boom suggests that the Energiewende has not been a major drag on businesses so far.

Recent data signals that Germany is far from losing its manufacturing base or its competitive edge. Quite to the contrary, sustained economic growth, fuelled by its formidable export prowess and domestic consumption, has pushed employment to a record high. Lack of skilled labour has become a key business concern.

Since the turn of the millennium, when the Energiewende started in earnest, industry – from machinery to chemicals and carmaking – has grown by around one third.

“It’s been a long time since the German economy has been in such good shape,” ZEW’s Wambach told the Clean Energy Wire. “This is why we can afford certain Energiewende policies other countries can’t.”

The country continues to rank among the world’s most competitive economies, according to global indices such as the World Economic Forum’s.

But this does not answer the question: Can Germany remain an industrial powerhouse on its journey to a low-carbon future?

The Energiewende’s profound implications have already shaken up various industries. They are now dawning on most others – the near collapse of the country’s largest utilities was a sharp wake-up call.

“The Energiewende has triggered a structural transformation which will not only result in winners, but also losers – especially those companies that cling to the past for too long and try to stop time for as long as possible,” says Claudia Kemfert, head of the department of Energy, Transportation and the Environment at the German Institute for Economic Research (DIW).

Former utility giants RWE and E.ON vastly underestimated the shift to renewables, with disastrous consequences. Both shed tens of thousands of jobs, then decided to split themselves in two –separating renewable and fossil-fuel technology. Only two years later, they announced they would combine their entire power generation in a stunning reversal that revealed to what extent the former top dogs are still grappling with the new reality.

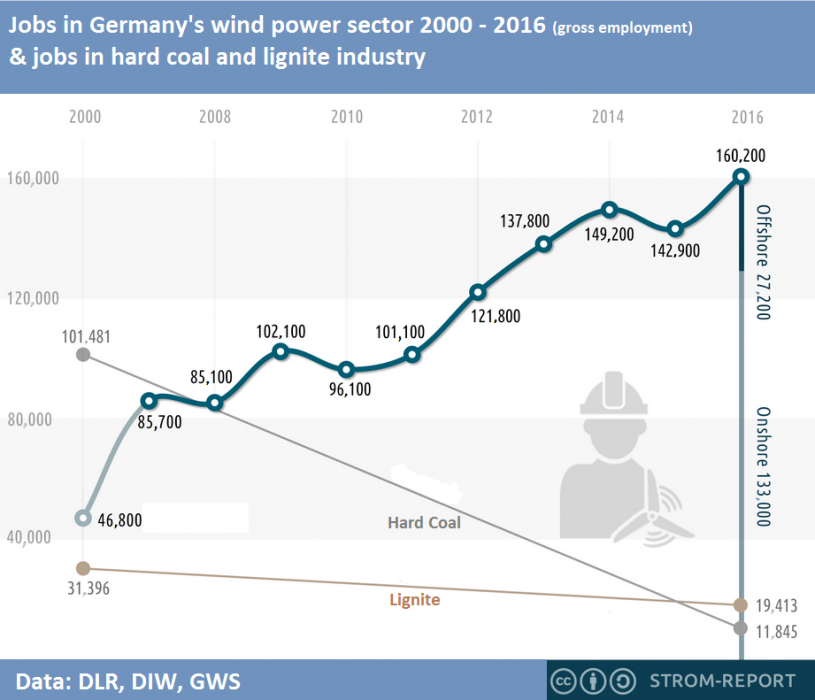

Despite the incumbents’ troubles, the energy sector today employs around 700,000 people, more than in the Energiewende’s early days. That’s because roughly one in two sector employees now works in renewables. Innovation in a sector once famed for its blandness is ripe: countless start-ups vie for a prominent place in the future energy world. [For details, read the dossier Battered utilities take on start-ups in innovation race and the article RWE and E.ON overhaul power sector]

One example is start-up Thermondo, which specialises in the installation of efficient and decentral heating systems in private homes, and came 2nd in the Financial Times’ 2018 list of Europe’s fastest-growing companies. The Berlin company was founded in 2012 and already has more than 300 employees.

“In sum, employment resulting from energy sector activities has increased since 2000 due to the roll-out of renewable energies,” states a recent study on the Energiewende’s employment effects. “Sectors and technologies that were important in the past are losing significance. At the same time, the structural transformations give rise to new technologies and players.”

The wind industry today employs five times as many people in Germany as the coal industry. As late as 2000, coal employment was around three times higher than in the wind power sector.

But even within the renewables sector, the development has been far from smooth, as attested by the spectacular boom and bust of Germany’s once leading solar industry.

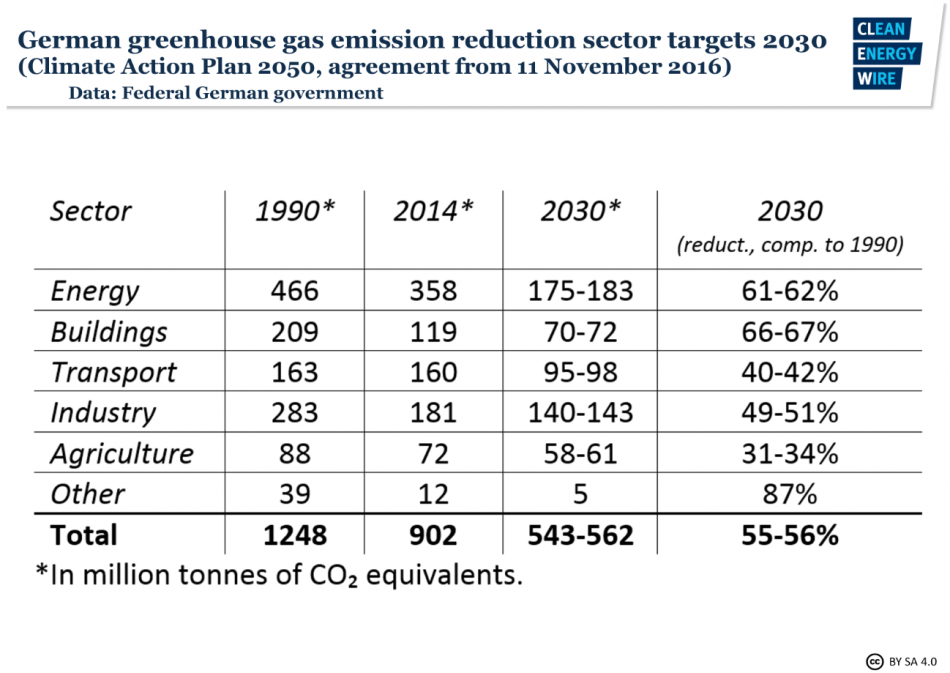

The utility space has already been overhauled by the Energiewende. But more change lies ahead, as Germany’s energy sector will have to roughly halve its emissions by 2030 compared to 2014 levels, according to official government targets for individual sectors of the economy.

The shift to low-emission technologies has also reached Germany’s car industry with full force. The impact is felt not only at carmakers BMW, Daimler, and Volkswagen, who have at last seriously committed to the shift to electric mobility, but also at a huge array of suppliers. In total, the industry employs around 800,000 people, and cars remain the country’s top export good. [Find plenty of background in the dossier BMW, Daimler and VW vow to fight in green transport revolution.]

Transport is Germany’s only sector that has made no progress in cutting emissions, but the upcoming shift promises to be rapid and profound: The sector will have to reduce CO2 emissions by 40 percent within little over a decade.

The sector underlines that the Energiewende’s effects on employment are complex.

“At present, the shift to electric mobility boosts employment in the automotive industry, because it will continue to produce conventional engines, while researching and rolling out electric vehicles at the same time,” says the ZEW’s Wambach, who is also a member of the National Platform for Electric Mobility, which advises the government.

“But as soon as conventional engines start to be discontinued, it will lead to job losses, because an electric engine is much simpler and therefore contains far less value added. This is why employment currently benefits from the shift to electric mobility, but that will no longer be the case in five to ten years.”

More than 600,000 German industry jobs hinge on combustion engine technology, according to the Institute for Economic Research (ifo).

Many car industry experts are concerned that Germany is lagging behind in the shift to e-mobility, as Tesla’s electric cars outsell the luxury flagships of Mercedes-Benz, BMW, and Audi, which are still equipped with combustion engines, even in Europe.

In one of his first speeches as Germany's new economy and energy minister, Peter Altmaier urged carmakers and mobility experts to push the mobility transition so Germany can remain a technology leader.

The country has already missed the boat on the production of battery cells, which represent the lion’s share of electric cars’ value added. In a setback for the German government, the automobile industry and the European Union, the continent’s largest car supplier Bosch decided in early 2018 not to enter the fray, leaving the dominance of Asian suppliers unchallenged. Altmaier said the government is ready to support the production of EV batteries.

In other transport sectors, such as aviation and shipping, the change has barely begun, but promises to be just as profound. Numerous start-ups like Munich-based electric airplane maker Lilium have already made international headlines with innovative concepts. [We hope to cover these sectors later this year.]

Germany’s industry must reduce its CO2 emissions by an additional 20 percent by 2030, and also has set its eyes on the 2050 targets.

Siemens is a prominent example of profound shifts within a company. The healthcare-to-turbines industry conglomerate with 377,000 employees epitomises the upheaval caused by the Energiewende. Decarbonisation has boosted its renewable energy and industry efficiency divisions, while business areas serving fossil energy production have “burned to the ground,” according to management. [For details, read the factsheet Germany’s Siemens: a case study in Energiewende industry upheaval]

The business of energy efficiency is not only flourishing at Siemens. More than half a million people in Germany already work in this growth area, and the number of start-ups is rising strongly, according to industry efficiency initiative DENEFF.

Beyond corporate Germany, entire geographic regions are also feeling the seismic shift. The Association of German Chambers of Commerce and Industry (DIHK) has identified winners and losers from north to south, east to west.

“In the north of the country, industrial activity has been traditionally weaker. But recently, some regions have turned into wind energy clusters. Thanks to the Energiewende, they now have strong industrial sectors,” says DIHK energy expert Jakob Flechtner. “In contrast, energy-intensive industry has had a strong presence the country’s west and south – for example steel and aluminium makers – where concern about the Energiewende’s potential negative impacts is highest.”

Given the dramatic changes within companies, entire industries, and regions, it might come as a surprise that the Energiewende’s net employment effect is rather limited on a national scale. Most studies on the issue conclude that the number of new jobs slightly outweighs the losses caused elsewhere.

Similarly, the Energiewende’s overall impact on economic growth is likely to be “neutral to slightly positive” if it is implemented well, according to the industry association BDI’s landmark analysis mentioned earlier.

The BDI itself admitted it was “surprised” by this finding. Media commentators, environmental NGOs, and industry experts all agreed the highly anticipated study marks a pronounced shift in industry’s stance on climate protection. “The BDI seems to increasingly realise that Germany’s industry is put in danger if we don’t use an ambitious climate policy as a driver for innovation and modernisation,” according to environmental group Germanwatch policy director Christoph Bals.

The BDI has generally been sceptical of Germany’s Energiewende and has repeatedly warned of a threatening “de-industrialisation.”

“Industrial companies will benefit from ambitious climate protection,” as long as Germany’s efforts to reduce emissions do not put energy-intensive businesses at a disadvantage on global markets, according to the BDI. That’s largely because the country will massively cut fossil fuel imports, and instead spent the money on clean energy investments.

“Successful efforts to tackle climate change would trigger extensive modernisation activities in all sectors of the German economy and could furthermore open up opportunities to German exporters in growing ‘clean technology’ markets. Studies suggest that the global market volume of key climate technologies will grow to 1 trillion to 2 trillion euros per year by 2030. German companies can solidify their technological position in this global growth market,” the BDI said.

The BDI’s study mirrors international findings. The OECD last year also argued that action on climate change boosts economic activity, while the World Economic Forum said in early 2018 that “as countries like China, India and Mexico demonstrate, the motivation [for an energy transition] is not just to avoid the costs of global climate change, but increasingly to capture their share of the transition’s economic opportunity for domestic voters and taxpayers.”

Regular surveys by the Association of German Chambers of Commerce and Industry (DIHK) also show that the Energiewende’s net effect on economic growth remains limited.

Since 2016, companies say that the Energiewende has on average a slightly positive impact on their competitiveness. But these figures mask considerable differences between different economic sectors: Whereas industry and trade remain more sceptical on balance, the service industry and construction have favourable views. [Find more details in the factsheet What business thinks of the energy transition]

As other megatrends such as digitalisation and artificial intelligence sweep through the economy, it becomes ever harder to quantify the Energiewende’s economic impacts. Disentangling effects is increasingly difficult because distinctions become blurred. [The dossier Digitalisation ignites new phase in energy transition has all the details.]

“The energy transition partly overlaps with other forces, such as digitalisation,” says the DIHK’s Flechtner. “They cross-fertilise.”

Decarbonisation is only one pressing issue among many others that keeps the economy in a constant state of flux. Previous challenges demanding comprehensive adaptations were liberalisation, globalisation, and the internet.

“Digitalisation is the most important driving force in the industrial sector at the moment,” Siemens spokesperson Florian Martini told the Clean Energy Wire. “Not only energy is in a process of transformation, but the entire economy. It’s always been like that.”

Energy prices are the most prominent industry concern in connection with the Energiewende. Solving this issue will require a walk on a tightrope: if energy becomes too expensive, Germany could irretrievably lose key industry sectors. But if it remains too cheap, companies have little incentive to lower carbon intensity.

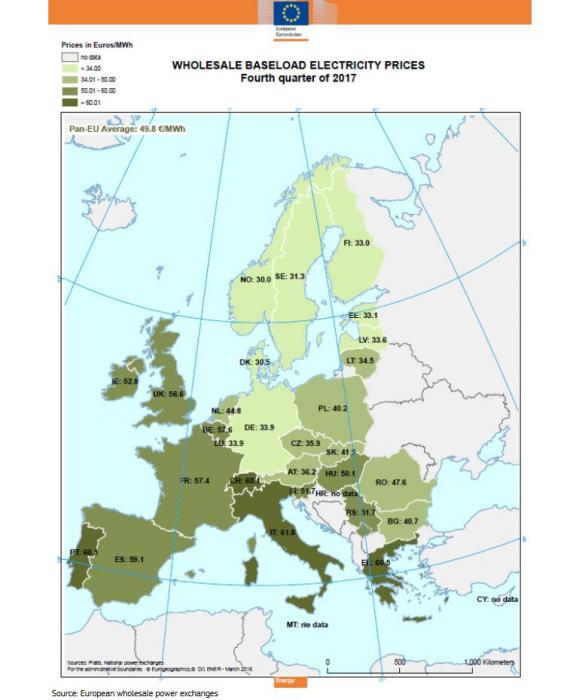

The issue is more complex than first meets the eye. While Germany’s household power prices are among the highest in Europe, partly due to the surcharge to finance renewables expansion, wholesale power prices are among the continent’s lowest following a dramatic drop caused by wind and solar generation. Renewables provided more than a third of the power the country used in 2017. The new government has said it wants to increase their share to almost two thirds by 2030.

Germany’s energy-intensive industry benefits from the fall in wholesale prices, because it is largely exempt from taxes and levies to preserve its competitiveness. But wholesale prices do not always reflect what large users pay, because many make their own power, or have long-term power purchase agreements independent of the market. [For more details, see the factsheets What German households pay for power and Industrial power prices and the Energiewende]

“You also have to differentiate clearly between energy prices and costs,” says the DIW’s Kemfert. “Prices are key, but consumption is also crucial. German industry is very efficient.”

“Additionally, power prices are only one component of energy costs. Oil, gas, and coal are still more important on a national scale, and for many companies. Our energy cost indicator for the industry has shown that total energy costs have decreased substantially over recent years.”

But DIHK’s Flechtner says especially many smaller companies do suffer from high power prices, because they do not enjoy the full range of industry exemptions, and therefore might move production abroad as a result.

“Of course, those companies don’t just pack their bags and go. Rather, it’s a creeping process concerning decisions where to modernise or extend production – here in Germany or abroad,” according to Flechtner.

He adds that Germany’s small and medium-sized businesses – the so-called Mittelstand – boasts a number of highly innovative hidden champions that rely on an uninterrupted local value chain.

“This involves everything from basic material development and research to implementation. If we want to preserve industry as a whole, we have to ensure all the chain links stay in Germany. This is why it would be so regrettable if we lose energy-intensive raw material companies.”

But even in the case of Germany’s numerous chemical companies – among them the world’s largest, BASF – complaints about high power prices must be seen against a backdrop of many other concerns.

Utz Tillmann, head of chemical industry association VCI, earlier this year concluded a sector outlook with a list of issues that urgently needed addressing – energy prices came last but one.

“If we [Germany] want to keep up in the international comparison, we need to set the course for more investments and innovation, speed up the optimisation of digital infrastructure and the administration’s digitalisation, improve education, an affordable energy supply, and adjustments in corporate taxation,” according to Tillmann.

After complaining about the high costs of the Energiewende, he added: “Don’t get me wrong: The chemical industry in particular is a proponent of the energy transition, not an enemy. Chemical products and solutions play an important role for the energy transition: Raw materials for renewable power production, or for power storage as a precondition to link up heat, mobility and electricity in the future, are part of many company portfolios.”

But Frank Peter, deputy executive director at Agora Energiewende* and head of the energy think tank’s Germany team, argues that sparing industry from high power prices must not go too far because it will reduce incentives for low-carbon and flexibility innovations.

“Industry protection must go hand in hand with the right incentives to lower carbon intensity. If Germany conserves current production in the name of protecting industry from the Energiewende’s consequences, we will miss the boat on an international level. Other countries such as China have also made great strides in their effort to cut industry emissions by increasing environmental standards. These efforts have meant cost increases for affected industries abroad, thus lowering the pressure to keep all industry exemptions in Germany in the name of competitiveness,” says Peter.

“Protecting existing industry production, while also establishing a new low-carbon one, is one of the Energiewende’s central challenges.”

As an example, Peter names recent suggestions by steelmakers Salzgitter and Thyssenkrupp to replace fossil fuels with renewable hydrogen in production, and to recycle CO2 emissions in the chemical industry.

Salzgitter says its low-carbon steel production technologies with the objective of replacing “substantial portions of the fossil natural gas used with hydrogen, which is to be acquired through electrolysis using volatile electricity from renewable energies,“ can cut the company’s CO2 emissions by up to 85 percent, with the further option of supplying residual emissions for synthesis processes.

Thyssenkrupp calls its “Carbon2Chem” project an “essential contribution to climate protection as well as energy transition,” but admits it will take about 15 years before the concept will be applicable on an industrial scale.

“Innovations like these have great export potential. But if we leave all industry exemptions unchanged, what are the incentives to get these technologies to market?” asks Peter. “At the same time, we have to tread carefully. Once steel-making has left the country, it will no longer be possible to establish low-carbon steel-making technologies here.”

Peter says the right policy mix will be absolutely crucial in the years to come.

“The present regulatory framework simply no longer fits. It is a key task for policy to translate the Energiewende’s macroeconomic benefits into valid business cases. We are nowhere near to solving this issue,” according to Peter.

“A real price on CO2 emissions for all sectors would be an obvious possibility, but the government has other options – for example, it could adapt the rules for procurement. Public authorities are the country’s largest steel buyers.”

Germany’s new government has already indicated the nexus between the Energiewende and businesses could become a key concern.

Economy minister Altmaier has said he wants to lower power prices for small and medium-sized companies that do not benefit from rebates for energy-intensive industries to make them more competitive.

Environment minister Svenja Schulze plans state support to push decarbonisation projects in energy-intensive industries, such as steel and cement, with a view to exporting new technologies. The federal government would reimburse up to half of the costs “if a company develops an alternative technology with emission-free energy,” according to Schulze.

Other experts also stress the central role of future policies.

“Above all, the government must establish the right framework for the medium and longer term, and it is decisive how it approaches that challenge,” says Kemfert.

“Reliable long-term targets provide the planning security necessary to see the transformation through. You only need to look at the car industry to realise that we’ve got a long way to go here,” says Kemfert with reference to government inaction in the “dieselgate” scandal, and Germany’s repeated lobbying at EU level to prevent stricter emission rules.

Many experts believe a profound overhaul of energy taxes and levies is key to igniting the next phase of the energy transition, which will involve running other sectors like heating and transport on renewable power to cut emissions. But despite a lively debate over the options for fundamental reform [See factsheet Germany ponders how to finance renewables expansion in the future], the new government has not shown any inclination to tackle this complicated and far-reaching endeavour.

Germany’s Energiewende will remain a work in progress for decades to come. Many hard decisions still lie ahead, and few economic activities will be left untouched. But business now appears increasingly ready to embrace the challenges, in the hope of reaping long-term rewards.

“The energy transition can be described as a rejuvenation cure. It will involve some pain and profound changes. But in the longer run, it makes the economy fit for the future,” says Kemfert.

At the same time, other countries can draw valuable lessons from Germany’s experience as a „living lab“ for the energy transition, according to Ortwin Renn, scientific director at the Institute for Advanced Sustainability Studies (IASS) in Potsdam, who researches the economic impacts of Energiewende policies.

Given the pitfalls of quantifying the Energiewende’s economic impact in detail, exact numbers will remain a mystery. But according to ZEW’s Wambach, the issue might no longer carry a lot of weight.

“In the end, it doesn’t really matter whether it’s good for the economy or not – it’s simply necessary. The Paris Agreement has made this a task we will have to address anyway, and therefore we should do it to the best of our abilities.”