Ukraine war pushes Germany to build LNG terminals

LNG, or liquefied natural gas, is natural gas that has been super-cooled (−162°C) to a liquid state for easier storage and transportation. Natural gas has 600 times less volume in liquid form than gaseous, and LNG can be transported by ship, truck or rail to places traditional natural gas pipelines cannot reach, or can even be used as a fuel directly. In general, the gas is first liquefied in its country of origin, then transported via ships and re-gasified at the destination, before being fed into existing gas grids and pipelines.

Compared to other fossil fuels, natural gas emits the least amount of carbon dioxide when burned, prompting many countries to see it as a potential “bridge fuel” between dirtier fossil fuels and carbon-free energy sources. However, natural gas is primarily composed of methane, itself a powerful greenhouse gas, and the rate of methane leakage in natural gas production, transport and storage is still hotly debated.

The coronavirus pandemic caused a global demand shock in 2020, which impacted gas production. Subsequently, supply could not keep up with rebounding demand during the economic recovery, leading to a gas crisis that hit Europe hardest, with prices reaching record highs.

Russia’s war against Ukraine exacerbated the crisis from early 2022, as sanctions, other political action and eventually sabotage of the Nord Stream projects led to supply cuts and eventually a stop of direct pipeline deliveries from Russia to Germany.

Dominated by surging LNG demand in Europe in response to sharp cuts in pipeline gas supply from Russia, global LNG trade is set to grow by 5 percent in 2022, according to the International Energy Agency (IEA). However, this is less than the 2016-2021 average of 8 percent, it said.

Where does it come from?

United States, Qatar and Russia are the world’s biggest exporters of LNG, said IEA. A 2022 ICIS report said Australia, Qatar and the U.S. continue to vie for the position of top global exporter, but exact exports were often difficult to verify via ship-tracking, so it remains unclear which country tops the list.

The U.S. has been the main driver of LNG growth in recent years. Looking ahead, the U.S. and Qatar are expected to engage in a two-horse race for dominance in the global LNG market, reported Bloomberg. Other major exporters include Australia, Malaysia, Nigeria, Indonesia, Algeria, Russia, Trinidad & Tobago, Oman and Papua New Guinea.

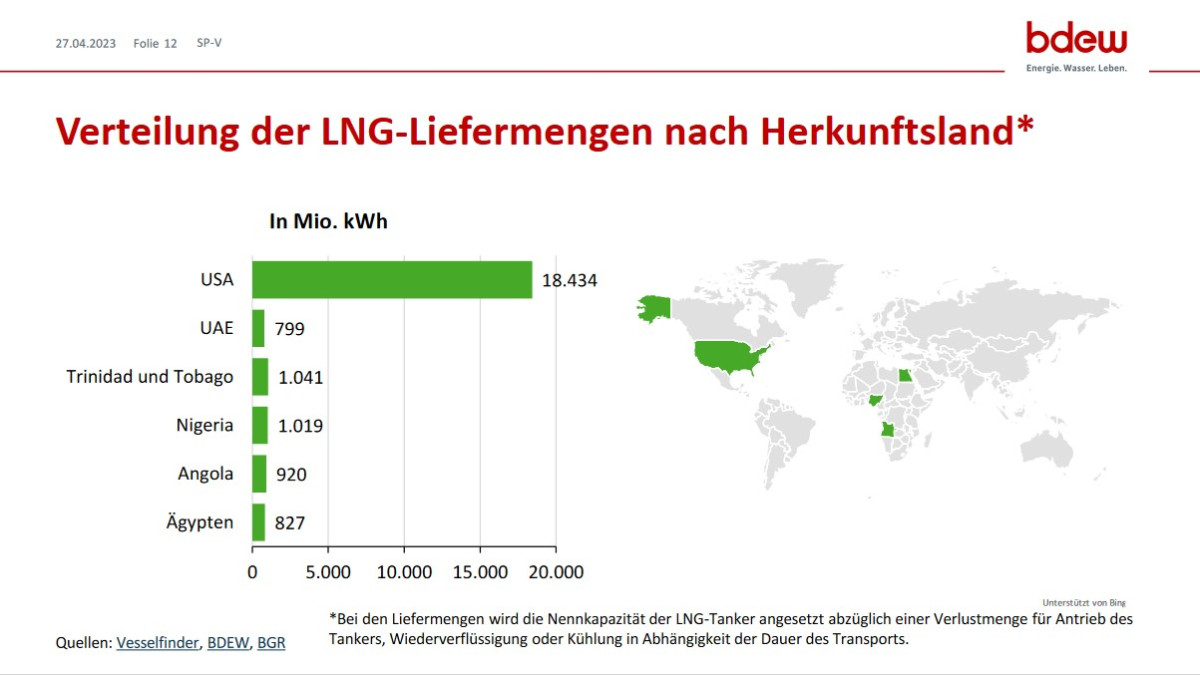

In the first few months of operations for German LNG import terminals, most of the 20 or so cargos came from the U.S., according to data by energy industry association BDEW.

An ICIS report showed that Europe imported 32 percent of global LNG deliveries in 2022 (20% in 2021), while Japan regained its traditional position as top global importer, overtaking China. South Korea held steady at third place, while France leapt higher to fourth largest importer, said ICIS.

China was the world’s biggest LNG-importing country in 2021, followed by Japan. Taken together, European countries also import a sizeable share. In 2020, Europe was responsible for a quarter of global inter-regional LNG trade.

[Gas infrastructure industry association GIE also provides a map on LNG terminals in Europe, last updated in summer 2022. The map provides comprehensive information on existing and under construction LNG Terminals in Europe, including send-out capacity, LNG storage capacity and the main terminal characteristics. Planned or under study LNG terminals projects are also detailed.]

In 2021, 13 EU countries imported a total of 80 billion cubic metres of LNG, and LNG imports made up 20 percent of total extra-EU gas imports in 2021. The bulk of natural gas is imported via pipeline, mostly from Russia and Norway. Around 10 percent of the EU's gas needs are currently met by domestic production and the share is set to decrease over the coming years.

The biggest LNG importers in the EU were Spain (21.3 bcm), France (18.3 bcm), Italy (9.3 bcm), the Netherlands (8.7 bcm) and Belgium (6.5 bcm).

Graph shows utilisation rate of EU LNG import terminals. Source: European Commission.](/sites/default/files/styles/paragraph_text_image/public/paragraphs/images/europeancommission-utilisation-rate-eu-lng-regasification.jpg?itok=D7BOADXX)

While Europe’s LNG terminals were underutilised on an annual average for years, many have operated near full capacity throughout 2022. Spain has the continent's biggest capacity – which is not yet used to full capacity – but has only limited pipeline connections to the rest of the continent.

The European Commission says LNG can boost the EU's gas supply diversity and therefore improve energy security. In July 2018, European Commission President Jean-Claude Junker pledged that the bloc would import significant amounts of LNG from the U.S. as a concession to cool a potential trade war. While largely a matter of business rather than politics, exports from the U.S. to Europe have indeed increased every year since then. In 2021 LNG exports to the EU recorded the highest volume, reaching more than 22 billion cubic meters, with an estimated value of 12 billion euros.

In March 2022, the U.S. and the EU said that the U.S. would scale up LNG exports to Europe to 50 bcm per year starting in 2023. However, if the continent aims to replace a sizable chunk of current Russian pipeline gas with LNG from different sources, the import infrastructure is insufficient.

Due to the war in Ukraine, "we’re seeing right now a flurry of new announced projects across EU member states,” Simon Dekeyrel, a climate and energy analyst at the European Policy Centre, told Energy Monitor. “But a big LNG import terminal takes around five years to build and come online” and require "very substantial investments".

Germany is one of the world’s largest gas importers and sources about 95 percent of its consumption from abroad. About one quarter of Germany’s energy demand was covered by natural gas in 2022, the second most important energy source in the mix after oil. Russia (around 55 percent), Norway and the Netherlands were the most important source countries until the start of the Ukraine war. Gas has been imported to Germany only via pipelines up until the end of 2022.

Germany did not have its own regasification terminals for LNG, and imports entered through neighbouring countries’ terminals, especially from Belgium and the Netherlands. Germany also receives some of its LNG via road freight.

For years it appeared there was no economic case for direct LNG imports to Germany since the country is so well connected to receive gas through pipelines from neighbouring countries, and because European LNG import capacities were heavily underutilised. Critic also argued that LNG imports were more expensive than gas delivered via pipeline.

This caused the debate around a domestic LNG terminal to largely subside in recent years, and plans were plagued by delays and uncertainty. However, the wish to lessen reliance on Russia in light of president Vladimir Putin's war against Ukraine, Russia stopping direct pipeline deliveries and high gas prices revived discussions.

Germany has since gone full steam ahead on expanding its import infrastructure and the first provisional floating terminal went online in December 2022.

Days after Russia invaded Ukraine, chancellor Scholz announced that Germany would build two domestic import terminals. Economy and climate minister Robert Habeck said this was necessary to “govern energy supply on our own state territory and guarantee sovereignty.” The German government quickly announced it would co-fund with a 50 percent stake the terminal project in Brunsbüttel, and later announced further support for other projects. To speed up the permit and construction process, the government introduced the 'LNG Acceleration Act'. It allows the licensing authorities, under certain conditions, to temporarily waive some procedural requirements, especially in the area of environmental impact assessment.

In addition to one or more fixed onshore terminals, the German government has leased five so-called Floating Storage and Regasification Units (FSRU) in the short term, two of which were to be installed by winter 2022/23. By July 2022, the government had decided that the ports of Wilhelmshaven and Brunsbüttel, Stade and Lubmin would host the terminals. Another floating terminal with government support in Hamburg was cancelled. A private consortium set up a sixth terminal in Lubmin (see details below), and later another. Due to the fallout of Russia’s war against Ukraine there has been international competition for FSRUs, of which there are currently just under 50 worldwide, according to German news service Tagesspiegel Background.

Critics have said that Germany is heading towards massive overcapacity. However the government says a significant “safety buffer” is necessary to ensure that the country and neighbouring states will receive a sufficient supply of natural gas in the coming years. A government report said that an overcapacity is necessary to prepare for any failures due to accidents, sabotage or other external events, and to supply EU neighbours.

The chancellor emphasised that the fixed onshore terminals could eventually be converted to handle climate-friendly gases. “An LNG terminal that receives gas today can also receive green hydrogen tomorrow,” said Scholz. This is in line with plans by the economy ministry, but has also been subject to criticism because it is not clear what a later conversion of the terminals would entail.

There are further reasons that would make further autonomy in the gas sector more attractive for Germany. Shipping companies could use LNG as an alternative to the CO2-intensive fuel they use now, and LNG could play a growing role in their efforts to reduce emissions in the freight industry. If Germany’s harbours want to remain internationally competitive, they might need to supply ships with LNG in the future, German business publication Handelsblatt wrote in 2018.

There have been three major German LNG terminal projects in the planning process for several years: Scholz in his speech mentioned Brunsbüttel (German LNG Terminal) at the Elbe river near the North Sea, and a competing location in the city of Wilhelmshaven (LNG Terminal Wilhelmshaven GmbH). The third long-term project is planned in Stade (Hanseatic Energy Hub), near Hamburg. With the government getting involved, the projects have changed.

Fixed onshore terminals:

By December 2022, there had not been a final investment decision on any of the fixed onshore terminals, reported Table.Media.

In Brunsbüttel, located in the northernmost state of Schleswig-Holstein, a consortium named German LNG Terminal planned to build a regasification facility with a capacity of 8-10 billion cubic metres (bcm). The project had been delayed, but in March 2022 the government said it would co-fund it with a 50 percent stake through development bank KfW. The project is a joint venture between KfW, Dutch government-owned Gasunie (40%) and RWE (10%), and would be operated by Gasunie. Shell had said it will make a long-term booking of “a substantial part” of the terminal’s capacity. The regional government aims to change regulation to speed up the construction process. It could be operational by 2026 if plans can be sped up. "Schleswig-Holstein will do everything in its power to ensure that the chancellor's clear commitment to the construction of an LNG terminal in Brunsbüttel is taken forward swiftly," state premier Daniel Günther (CDU) has said.In the past the project has been a target of environmental protests.

Wilhelmshaven and Stade are also planning on hosting a permanent terminal (see below).

Floating terminals (with plans for later fixed onshore terminals):

- Brunsbüttel [in operation]

Brunsbüttel hosts one of the five floating terminals leased by the government. It will have a capacity of 7.5 bcm/year (initially only 3.5, due to pipeline connection construction) and start operation by the end of February 2023, according to RWE. The FSRU “Hoegh Gannet” arrived on January 20, followed by a several-week phase of commissioning and trial operations, during which the first gas volumes were fed into the German gas network from the beginning of February (the first cargo from ADNOC – Abu Dhabi National Oil Company – in LNG tanker "Ish" arrived on February 14 2023). International specialist company Reganosa will take over the operation and maintenance of the new land-based infrastructure. Owner Höegh LNG will operate the vessel. It is set to be replaced when the permanent onshore terminal starts operations by 2026. - Wilhelmshaven [in operation]

German energy company Uniper had planned a floating LNG terminal in Wilhelmshaven at the North Sea, but re-evaluated this in 2020 “because of market players' reluctance to make binding bookings for import capacities at the planned terminal in the current circumstances.” It officially dropped the plans several months later and said it was instead aiming to build a green hydrogen hub at the site. However in February 2022, after Scholz’s pledge, business daily Handelsblatt reported that the government had asked Uniper to revive the LNG port plans. Wilhelmshaven will host the first German floating terminal (leased by the government) and construction for the necessary infrastructure started in July 2022, with the jetty finished by November. The FSRU arrived on 15 December, the terminal was inaugurated on 17 December, and the first gas (brought on board the FSRU) was fed into the grid on 21 December. On 3 January, the first full cargo of LNG reached the terminal with gas from the U.S. as part of the terminal's commissioning process, with commercial operations starting in mid-January. In a second project step, a permanent and expanded port solution for the FSRU is to be realised with additional unloading and handling facilities for green gases like ammonia, said Uniper. - Wilhelmshaven 2 [operation planned for end 2023]

Wilhelmshaven is set to host a second floating terminal (Excelerate’s Excelsior), leased by the government. The unit with 5 billion cubic metres (bcm) of capacity is planned to be operational by the third quarter of 2023. A consortium of E.ON, Engie and Tree Energy Solutions (TES) will operate the unit, which can supply about 5 percent of Germany’s annual consumption, according to the companies. TES plans to build up a green hydrogen import facility at the same location and once that is up and running – planned for 2025 – the floating LNG terminal will end operation. - Stade [under construction, operation planned for end of 2023]

While chancellor Scholz mentioned only Brunsbüttel and Wilhelmshaven in his parliament speech, two more locations have been announced since. Stade for some time tried to realise a permanent terminal. Shareholders of the Hanseatic Energy Hub (HEH) are the Buss Group, the energy infrastructure operator Fluxys and Partners Group (on behalf of its customers), and U.S. chemicals company Dow. The economy ministry in July 2022 said Stade would host one of the government-leased floating terminals, the Transgas Force by Dynagas. Construction for the jetty started in early 2023 and the vessel is expected to be ready to import LNG in the port of the future Hanseatic Energy Hub by the end of 2023 with a capacity of 5-7.5 bcm per year. The HEH also wants to build an onshore facility with an annual capacity of 13.3 bcm by 2027, which would replace the floating terminal. Following the conclusion of the binding open season, the hub was still marketing its individual capacities by April 2023. SEFE (formerly Gazprom Germania) and EnBW have secured long-term capacity. - Lubmin / Rügen [envisioned operation for end 2023 in doubt due to local resistance]

Lubmin will also host floating terminals, or at least become the landing point for pipelines connected to nearby terminals in the Baltic Sea. The decision was taken because Lubmin is the site where the Nord Stream gas pipelines land in Germany, which means the grid infrastructure to import large volumes and transport them to the south and neighbouring countries is already in place. However, the projects will be located at one of the more difficult and contentious locations, due to the shallow waters in the Bay of Greifswald and large opposition from popular holiday destinations in the area.

The government-leased FSRU Transgas Power by owner Dynagas, which is to be operated by RWE and Stena Power, is a very contentious project. Early on, the media reported "many open questions" regarding plans for the terminal. In early 2023, the regional government presented details of the plans, which showed that the floating terminal would be installed off the coast of Germany’s largest island Rügen. Local and regional authorities, as well as the population, were very critical of the plans. They feared there would be negative consequences for the local environment and tourism, which is particularly important on the island as it is a popular holiday destination. The initial plans would see a riser tower and an FSRU just 5 kilometres away from the beach by the end of 2023. It would be connected to the gas grid in Lubmin through a pipeline of about 40km in length. At a later stage, another riser tower and several more FSRUs could be added.

However due to opposition, the government has now decided to place the FSRU in the nearby port of Sassnitz-Mukran on the island. Media reported that Scholz pleaded for this. The chancellor and economy minister Habeck visited Rügen in April 2023 to defend the plans, arguing that the import capacity on Germany’s western coast is insufficient to secure supply for eastern Germany and neighbouring countries. In a letter to the regional government, economy minister Habeck proposed to also move the FSRU Neptune [see Lubmin 2] to the port of Mukran, which would mean a total of two floating terminals connected to the grid in Lubmin. Privately-owned Deutsche ReGas would operate both FSRU. A joint decision between the regional and federal government about the location in the port of Mukran has to happen fast so that there is a chance of first gas flowing in the coming winter (2023/2024), wrote Habeck in the letter. - Lubmin 2 [in operation]

Another terminal was built by a private consortium (in operation since mid January 2023): This non-government project in Lubmin is called "Deutsche Ostsee" and has a capacity of 4.5 bmc/year. The FSRU Neptune arrived in Germany at the end of November 2022. France's TotalEnergies told S&P Global it would supply the FSRU for use by privately-owned Deutsche ReGas. Deutsche ReGas said that due to the shallow depth of the area around the port the project needed a floating storage unit (Seapeak Hispania) situated in the Baltic Sea where LNG tankers could offload their cargo. From there, three shuttle ships would transport LNG to the FSRU (Neptune) in the port of Lubmin where it is re-gassified and fed into the grid. TotalEnergies and the MET Group have secured 80 percent of the terminal's capacity in the first phase of operations up to December 2023. The company started test operations at the end of 2022. Commercial operations started mid-January after tests were finalised and the necessary operating permit was obtained. Chancellor Olaf Scholz (SPD) inaugurated the terminal alongside ministers from Mecklenburg-Western Pomerania. Economy minister Habeck proposed to eventually move the Neptune to the port of Mukran on the island of Rügen [see Lubmin/Rügen]. - Lubmin 3

In a second phase, Deutsche ReGas plans to install a second FSRU in Lubmin by December 2023, linked to a new planned offshore pipeline. It remains to be seen if this plan is going to be realised.

Several reports have criticised the size of German LNG plans. These are “massively oversized” and state involvement means that taxpayer money is used for what could eventually become stranded assets, said a report by think tank NewClimate Institute in December 2022. In another report presented in July, the DUH and the Heinrich Böll Foundation said Europe should avoid “gigantic overcapacities” by coordinating the development of LNG infrastructure.

Table.Media reported that even a government paper expected overcapacities. In another article, the news service reported that the government had justified the buildup of a domestic import infrastructure with false assumptions about the volumes that terminals in neighbouring countries can import. The government had argued that the combined capacity of terminals in Poland, the Netherlands, Belgium and France came to about 40 bcm per year. "But this figure is not correct," writes Table.Media. An evaluation of the daily figures of the European gas grid operators (AGSI) showed that the terminals fed in almost 70 bcm in 2022, and this was not the maximum capacity. "This is 96 bcm per year if the operators' figures are added up." The economy ministry later said that 40 bcm is what Germany could receive from those terminals, not their total import capacity.

The government justifies plans for the buildout saying that part of the gas is to be forwarded to southern European countries. In addition, more capacity would provide better protection against "unforeseen events or damage to infrastructure". In addition, the German terminals could have a "price-reducing effect", according to the economy ministry.

In general, there is considerable opposition to a German LNG terminal from environmental organisations. Environmental Action Germany (DUH) called Scholz’s decision “premature” and said such installations create more dependence on fossil energy.

In April, DUH criticised plans for an import terminal in Stade, arguing that it will not help with the current energy crisis and will harm the climate. “Despite all the claims to the contrary by the developer and politicians, the terminal can only be used for the import of fossil natural gas,” said managing director Sascha Müller-Kraenner. This means that it will not contribute to the energy transition, but will cement our dependence on climate-damaging fuels for decades to come.

A recent report by the German Institute for Economic Research (DIW) concluded that Germany does not need its own import terminals. The researchers warned the projects do not “make sense due to the long construction times and the sharp decline in natural gas demand in the medium term,” and warned of stranded assets.