The energy crunch – What causes the rise in energy prices?

How much have energy prices increased in Germany and Europe?

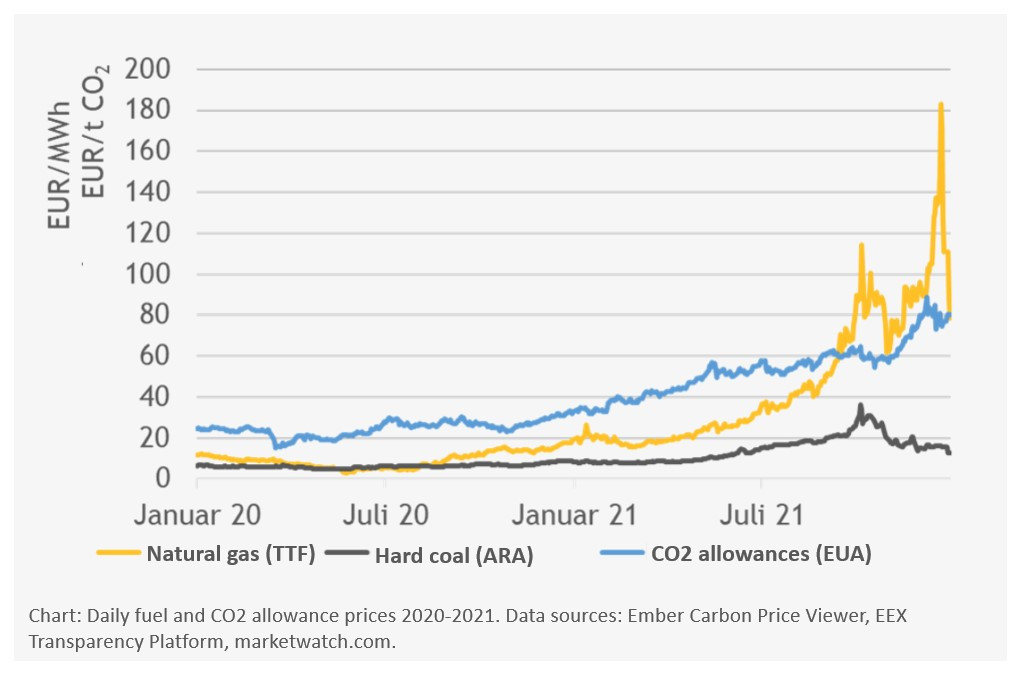

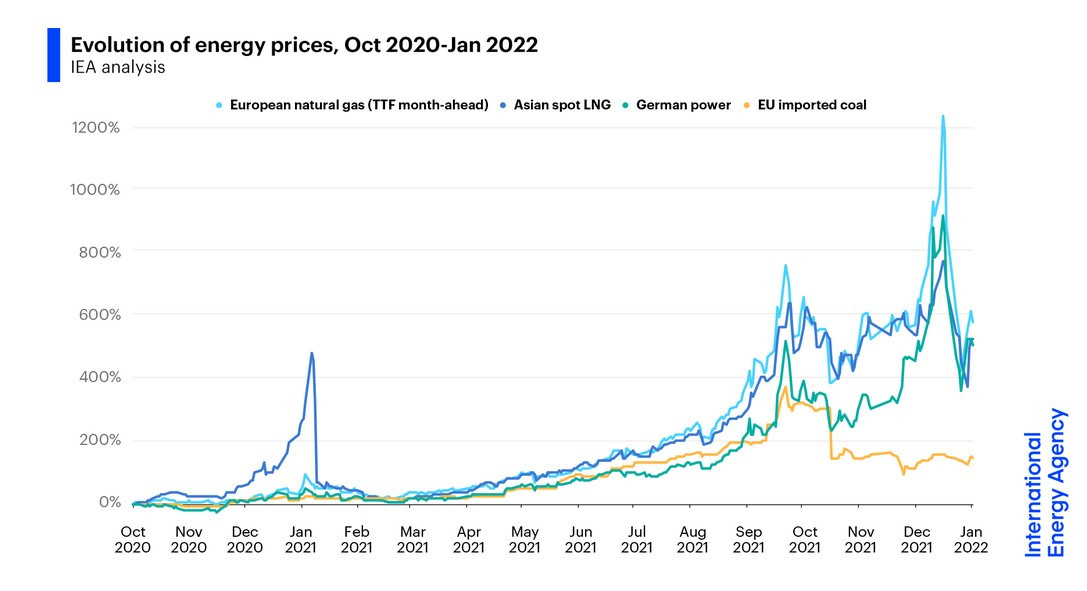

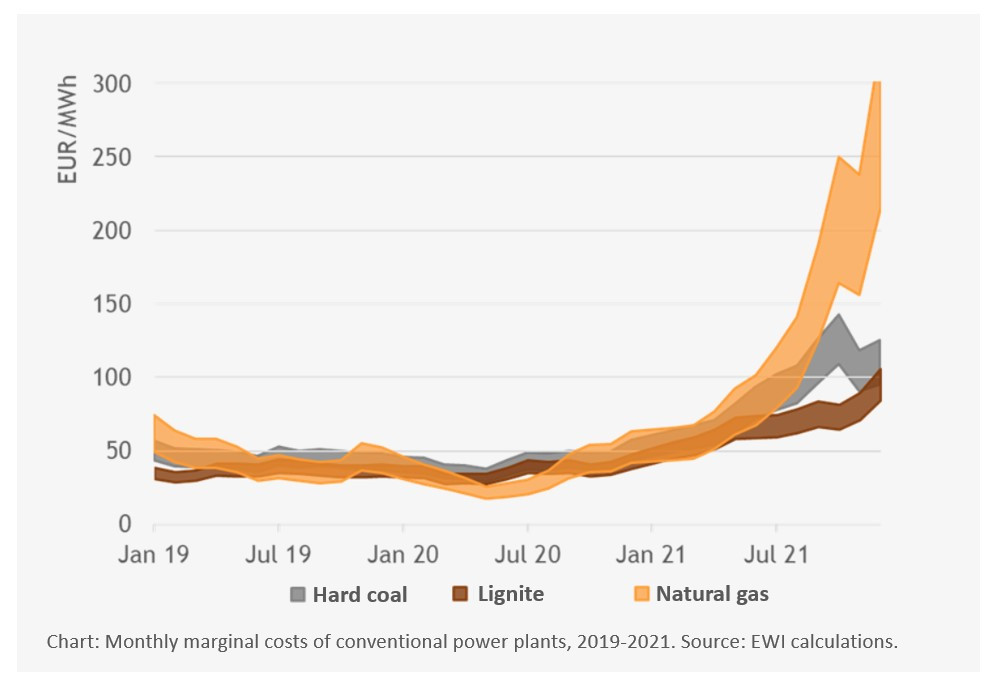

In Germany, the wholesale price for electricity (paid by power traders on the market) more than tripled in 2021 to an average of 97 euros per megawatt-hour (MWh) compared to the previous year, reaching the highest level in 20 years, the Institute of Energy Economics at the University of Cologne (EWI) finds in an analysis. While 2020 saw lower-than-normal demand for electricity, natural gas and hard coal, and therefore cheaper power, the economic recovery in 2021 sent energy prices skyrocketing. Natural gas in Europe cost as much as 150 euros/MWh. On average, gas prices in 2021 were approximately 49 euros/MWh higher and therefore five times as high as in 2020. Prices for imported hard coal also increased (to over 30 euros/MWh).

This means that between 2020 and 2021, the year-on-year increase in the price of electricity, gas and heating oil was the highest on record, comparison website Verivox has said. The price of gas climbed by almost 47 percent, meaning a household with an annual consumption of 20,000 kilowatt hours (kWh) paid more than 1,700 euros last year, up from about 1,160 euros in 2020. Electricity prices increased by more than 18 percent, meaning a household with a consumption of 4,000 kWh paid 215 euros more last year.

Some of the price increases look especially dramatic because of the comparison with 2020, the German state development bank KfW has said. “While part of this increase is due to the current bottlenecks in energy supply, the main part of the increase in (energy price) inflation arises from the comparison with the below-average prices of crude oil and energy in the previous year,” they write.

What explains the higher gas and electricity prices?

Bottlenecks in energy supply at a time when the economy picks up again after a year of lockdowns in 2020 are the main reason behind the high prices in Europe and Germany in 2021 and 2022. The main reason behind the for high electricity prices is the high gas price, both the EWI and the German government have said.

Fatih Birol, executive director of the International Energy Agency (IEA), wrote: “Unfortunately, we are once again seeing claims that volatility in gas and electricity markets is the result of the clean energy transition. These assertions are misleading to say the least. This is not a renewables or a clean energy crisis; this is a natural gas market crisis.”

Germany uses natural gas both for heating and to generate electricity. After the long, cold winter of 2020-2021, the country’s natural gas reserves were depleted more than usual. At the same time, economic recovery increased demand in Asia and deliveries through Russian pipelines to Europe were reduced, leaving Europe’s gas storage facilities at a lower-than average level before the winter of 2021-2022. Pre-winter gas storage levels in the EU were at 77 percent of capacity -- usually they stand at around 90 percent.

The political controversy over the Russian-German Nord Stream 2 pipeline adds to the problem. The pipeline has not received an operating permit in Germany and is used as a bargaining chip in the Russia-Ukraine conflict. Russian president Vladimir Putin and supplier Gazprom have said that they aim to honour all export contracts but that fewer orders had been placed. Recent years have indeed seen a trend towards (more risky) short-term procurement by gas suppliers as the liquidity of trading markets promised cost advantages. German energy company Uniper (which is part of the consortium that financed 50% of Nord Stream 2) says that its own analysis has not shown any reduction in Gazprom’s gas deliveries, and that the additional demand associated with the economic recovery and the drop in the deliveries of liquified natural gas (LNG) have caused the current difficulties.

But Putin also taunted the EU last year, saying that gas could flow much more abundantly to Europe if German regulators would approve Nord Stream 2. The IEA’s Fatih Birol has said that Russia “could increase deliveries by at least one-third” if it chose to do so.

Shipments of LNG have not been able to alleviate the problem, as most of those are also bound for China and can only be re-directed when traders pay a hefty premium of up to 25 percent. According to Kayrros LNG Flow Tracker, more than twice as many tankers (102) have delivered gas to Europe in January, with 12 having been redirected to Europe since 17 December 2021.

German MP Nina Scheer from the Social Democrats also points to “maintenance and repair work on pipelines and power plants that had been postponed during the pandemic must now be carried out, which further depresses the supply side.”

Prices for imported hard coal also increased (to over 30 euros/MWh) due to higher demand for coal-fired power and to supply bottlenecks, the EWI said. Hard coal prices were driven up by natural disasters in China, Australia and the U.S., by the increased demand as the economies recover, and by the high gas prices (coal is an alternative to gas in power generation), but decreased again towards the end of the year as China increased its mining capacities.

In addition, unfavourable weather conditions caused a drop in power production from renewable energy sources, in particular wind farms, in 2021.

In December 2021, Germany shuttered three out of its six remaining nuclear power plants with a combined capacity of four gigawatts, which also decreased the availability of cheaper power.

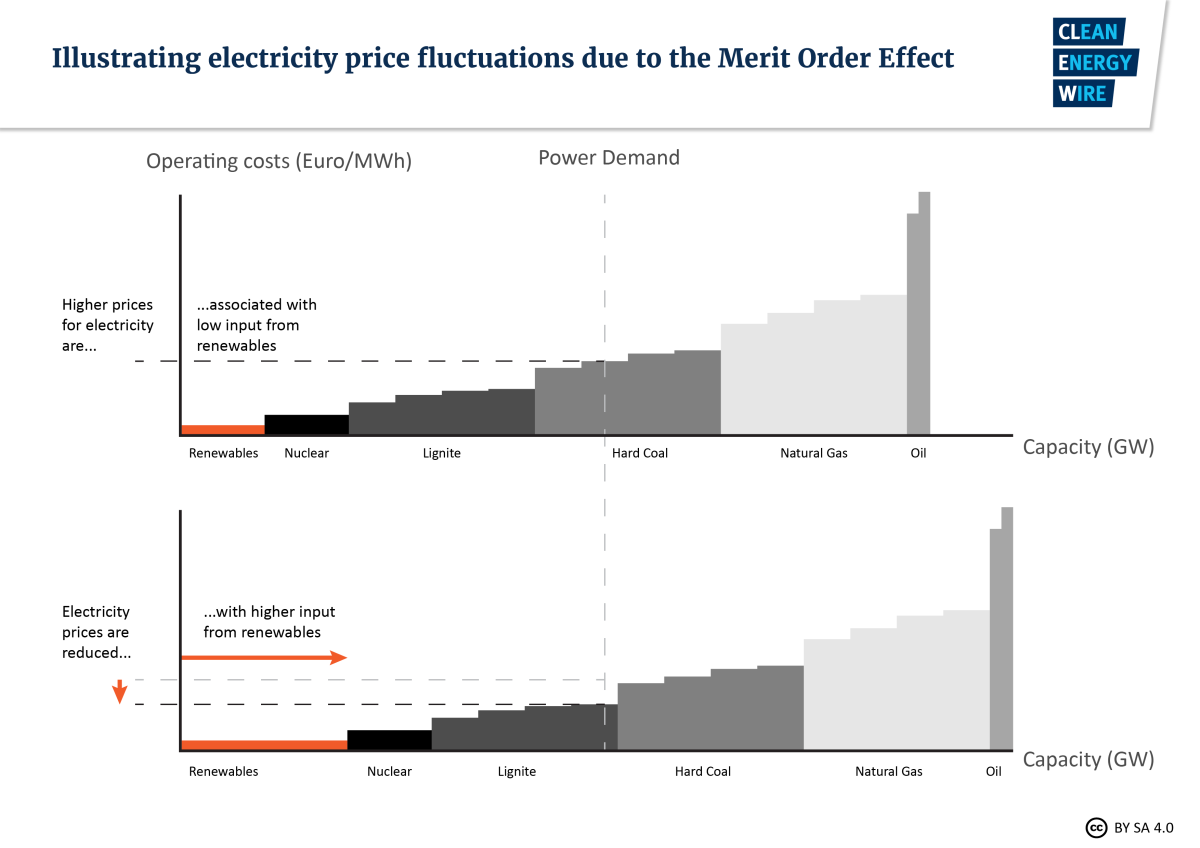

The reason why all these elements lead to a higher price for electricity are the complex workings of the European and German wholesale power markets. The price on the electricity exchange depends on the “merit order” of power plants. Demand and supply are matched at the exchange and the price varies depending on how much power is available from different kinds of sources and at what cost.

According to the merit order, the most expensive power station sets the price. In pre-pandemic times, the most expensive plants were either gas-fired or – thanks to a rising CO2 price under the European Emission Trading System (EU ETS) – coal plants. At times of high input from (cheap) renewables, this more expensive generation is pushed out of the market. This means that all electricity is expensive when the price is set by a natural gas plant or a hard coal-fired power plant – which happened more often in 2021 because of lower renewables generation and because it was even more expensive to operate gas-fired plants despite a rising CO2 price. The CO2 price in the EU ETS increased from around 33 euros per tonne to almost 90 euros in 2021.

“The [power] price rise mainly stems from the increase in the gas price. The influence from the CO2 price is marginal,” state secretary Patrick Graichen from the Ministry for Economy and Climate Action said at the Handelsblatt Energy Summit 2022 in Berlin. This is backed by the International Energy Agency (IEA), which wrote in January: “We estimate that the effect on European electricity prices of the sharp spike in natural gas prices is nearly eight times bigger than the effect of the increase in carbon prices.”

How do energy prices influence overall inflation?

Sharp increases in energy prices are one of the main drivers of inflation in the eurozone. Food and beverages cost 3.2 percent more than a year ago and overall inflation reached a new record level (since the introduction of the common currency) at the end of 2021, when it climbed to 5 percent in December, according to Eurostat, the EU’s statistical office. Excluding energy, food and beverages, the price level rose by 2.6 percent.

In Germany, producer prices increased by 24.2 percent year-on-year in December 2021, the highest rate ever recorded and an indication of a continuing trend of rising inflation. Producer prices, for products produced and sold in Germany, eventually also impact consumer prices and they influence the companies’ competitiveness on the global market. Any further inflationary impact will depend also on companies' ability to pass energy price rises on to consumers and in turn households ability to either pay higher prices (or limit consumption) and their bargaining power for higher wages.

The European energy price hike in the second half of 2021 is due in large part to the drop in prices caused by collapsing demand during the 2020 coronavirus pandemic, Germany’s public development bank KfW has said in an analysis. “Part of the increase is due to bottlenecks in energy supply, but the lion’s share of the energy price inflation is due to below-average crude oil and energy prices in the previous year,” KfW’s Jens Herold said. The so-called statistical basis effect has an impact on relative price increases and may distort the perception of actual price increases, as a peak in the price curve is exacerbated by an earlier bottom as the point of reference, the bank explained. Several aspects of the pandemic have had an impact on prices, Herold wrote. These include the collapse of crude oil prices in 2020 and the subsequent economic recovery; temporary tax cuts; the introduction of carbon pricing in Germany at the beginning of the year; and the closure of many shops due to the pandemic containment measures, which meant that customers could not benefit from sales offers. According to the bank, the influence of basis effects will subside eventually, as it did after similar instances in the past.