Coronavirus impact lays bare inflexibility of German power generation and demand

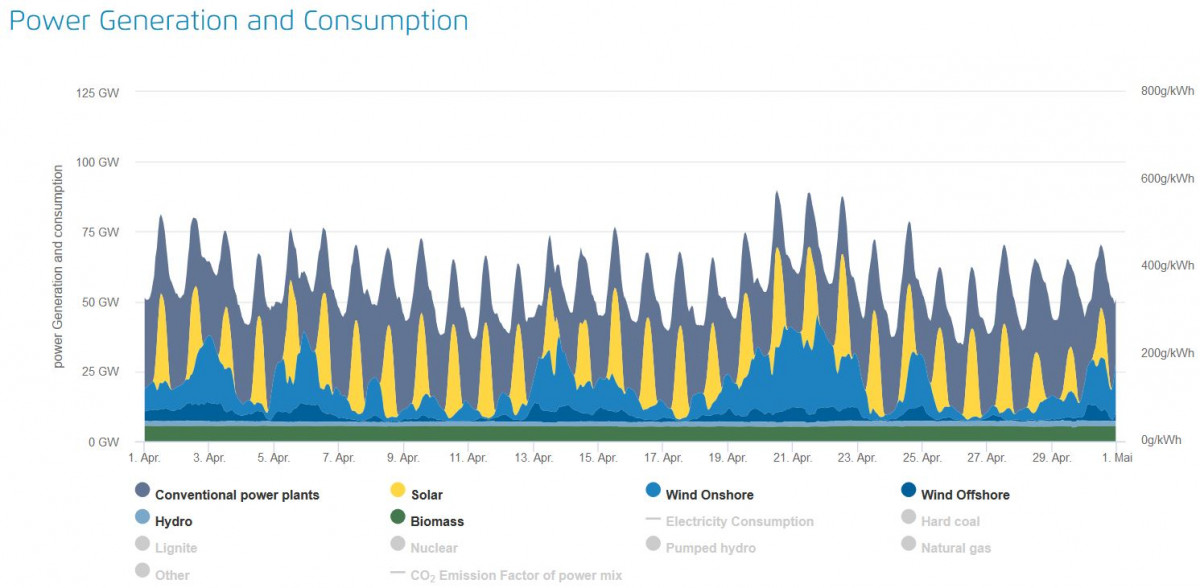

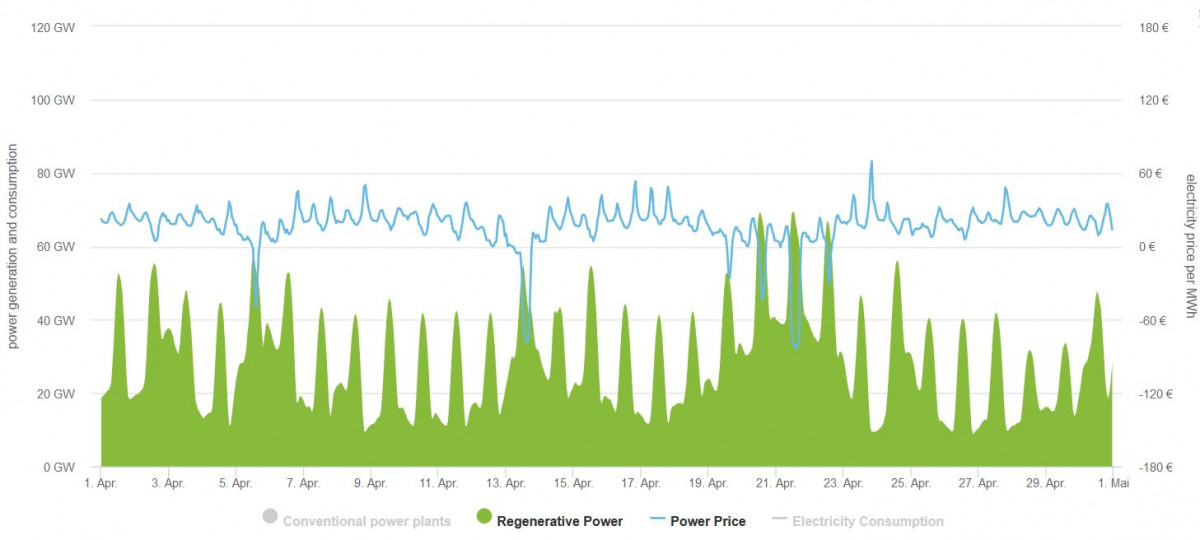

The coronavirus crisis subjected Germany's electricity system to an unplanned stress test in April. While power demand fell during the pandemic because much of the economy lay idle, sunny and windy weather led to strong renewable power production. This prompted wholesale power prices to repeatedly fall deep into negative territory -- meaning that electricity producers rather paid wholesale customers to use the power they generated than turning off plants because it was less costly -- revealing the inflexibility of the country's electricity generation and demand, experts say.

"Germany only saw half the electricity demand reduction that other countries saw, so one would think Germany got off lightly, but Germany was actually impacted more. That's because, for the first time, no-one else wants German electricity, they have enough of their own," electricity analyst Dave Jones from British climate think tank Ember told Clean Energy Wire. "So whilst electricity demand fell only 9 percent, electricity production fell 17 percent."

The episode underlines the need to make both conventional and renewable power generation more flexible to cope with a renewable share set to rise further in the years to come, according to Hanns Koenig of consultancy Aurora Energy Research. "Power prices turned negative because it was not possible or profitable for thermal plants to turn off, and because a lot of renewables that are in the system currently have no incentive to turn down when power prices turn negative," Koenig told Clean Energy Wire [read the full interview with Koenig here]. He referred to Germany's model of paying most renewable power operators fixed "feed-in tariffs" per kilowatt-hour of electricity generated, regardless of wholesale prices, in the framework of the Renewable Energy Act.

The strong renewable generation meant that Germany's electricity sector emitted much less CO2 in this period. “However, the low carbon intensity masks a greater problem in the Germany electricity market – negative pricing. This phenomenon has been a feature of the market for several years, but falls in demand has exposed generators to the issue much more intensely,” according to Tom Andrews, analyst at consultancy Cornwall Insight.

"Dysfunctional" and "inefficient"

The rising share of renewable power has made power prices much more volatile in Germany and negative prices have become a fairly common phenomenon. They occur when a high and inflexible power generation appears simultaneously with low electricity demand. Negative prices are not necessarily a bad thing, as they provide incentives to utilities to make their power stations more responsive to changing conditions on the power market, and offer companies new business opportunities by adapting demand.

But Jones said recurring strongly negative power prices are a "sign of a dysfunctional market" and could eventually result in electricity system instability. He added negative prices also translate into high costs especially for smaller electricity consumers such as households and small businesses, because they ultimately have to pay the difference between negative power prices and the feed-in tariffs fixed in advance for most renewable installations in auctions or other contracts. When grid operators order large installations like wind farms to stop electricity generation, affected renewable operators receive compensation payments, also resulting in additional costs for consumers.

While especially older and smaller renewable installations in Germany can't stop generating power at all, false regulatory incentives mean even many new and large installations will keep producing power regardless of the wholesale price. "It's simply inefficient to pay operators to produce power that is not needed," said Koenig, who added that future support mechanisms will have to be redesigned to overcome this problem.

The government already tweaked renewable support rules in 2014 to stop support payments to wind farm operators if wholesale day-ahead electricity prices go negative for more than six hours (called "six-hour rule"). But according to Koenig, many operators continue to generate power regardless because of the uncertainties involved.

But not all renewable energy proponents believe that inflexible solar and wind generation already pose a problem. Energy transition think tank Agora Energiewende* argues priority must be given to making demand much more responsive to prices, and also to throttling down fossil power generation, before thinking about making renewables more flexible. "At the moment, demand simply doesn't react to price signals," said spokesperson Christoph Podewils. He added that the falling cost of storage and international power trade would be preferable to lowering renewables' output.

At present, there is no broad debate about making renewable generation more flexible in Germany. "The problem will decline from the mid-2020s onwards anyway, because inflexible nuclear and coal plants will be decommissioned, and the most inflexible feed-in payments to the first generation of renewables will end after reaching the end of the 20 year support period," Koenig said.

Germany produced more than half of its electricity with renewable power in the first three months of 2020, the first full quarter in which renewables covered the majority of the country’s electricity needs. This trend continued in April, the first full month of Germany's limited pandemic lockdown. Meanwhile, the country experienced its sunniest April since records began in 1881.

Experts are predicting the coronavirus pandemic will cause a deep economic slump and lower carbon emissions in Germany. Projections now show that, depending on the length of the crisis, Germany could meet or even surpass its original 2020 target of reducing carbon emissions 40 percent below 1990 levels – a target the government had previously said it expected to miss by a wide margin.

According to Fraunhofer ISE, Europe's largest solar energy research institute, renewables covered slightly more than 60 percent of German power generation in April. The country plans to cover 65 percent of its electricity use – a slightly different metric – with renewables by 2030. But the renewables roll-out currently faces major obstacles as the expansion of onshore wind farms has slowed to a crawl, and the solar industry approaches a cap on government subsidies that it could reach within months.

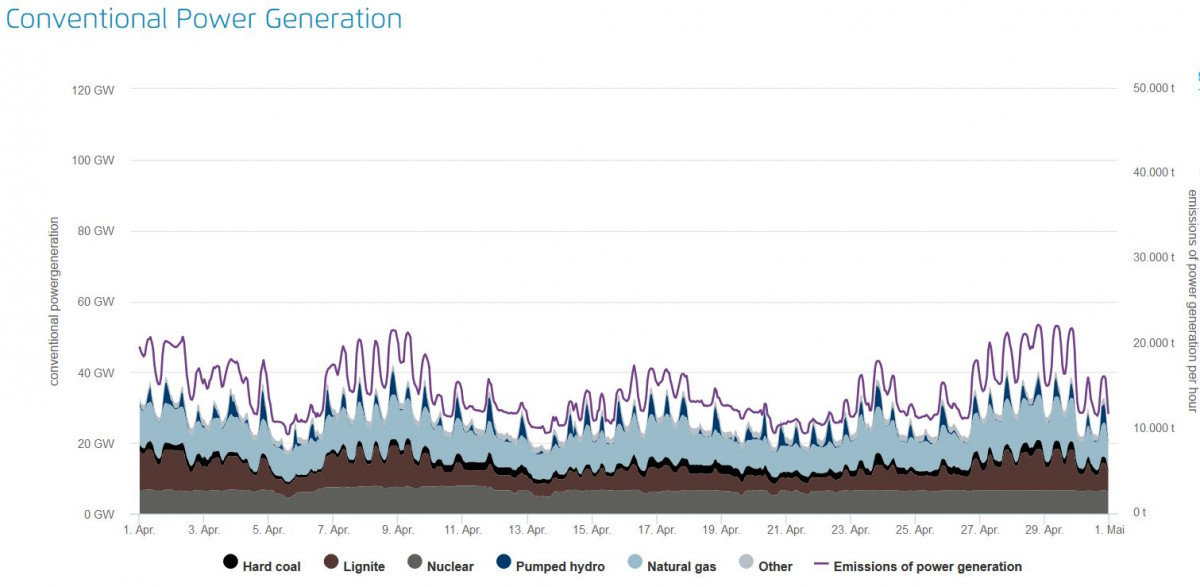

But even at times of peak renewables production and negative power prices, many fossil fuel power plants did not stop power production in April. The following graph shows conventional power generation running uninterruptedly throughout the months.

Even renewable generation will have to become more flexible

"There are still 2 to 3 gigawatts (GW) of lignite plants that won't turn off, no matter how negative prices are, and Germany's grid would be more flexible with them closed," said Jones. A complete shutdown of fossil fuel power plants and a complicated restart can cost operators more than continuing production at negative prices. Some plants also need to operate continuously to supply district heating. The power they generate adds to the downward pressure on prices.

Jones added that the country's renewable power production also had to become more flexible in order to react to fluctuating supply and demand, which also needs to become more controllable. Germany plans to phase out the use of coal for power production by 2038 at the latest.

"Although some onshore and offshore wind did reduce load with the prices, a lot did not. And it seems zero solar and biomass reduced load," Jones said. "Even renewables need to play a role in reducing generation - there will always be occasional windy and sunny days that overlap with low electricity, as happened on Easter Monday."

The negative power prices during the past months did not come as a surprise to many energy experts. For example, consultancy enervis had warned that the drop in electricity demand driven by the pandemic will likely lead to more hours of negative wholesale electricity prices in Germany, resulting in revenue losses for renewable power producers.

But Ember's Jones also says the past month has revealed some positive aspects about Germany's electricity system. "The lights have stayed on. The electricity system is more robust than many people think."

*Like the Clean Energy Wire, Agora Energiewende is a project funded by Stiftung Mercator and the European Climate Foundation.