VW seeks e-car quota deal with China / Swedish-German power connection

Frankfurter Allgemeine Zeitung

Germany’s largest car manufacturer VW struggles to comply with China’s planned quota for e-cars, Frankfurter Allgemeine Zeitung (FAZ) reports. “The e-quota certainly is going to be a challenge,” a VW manager for China told journalists on Thursday in Beijing. The Chinese government last year announced carmakers will have to sell a certain share of their cars with electric engines as soon as 2018, thereby gaining “credit points” that they can sell to their competitors. According to FAZ, VW is now seeking to strike a deal with Chinese authorities that would allow the carmaker to gather “negative” credit points if it fails to meet the quota straight away. By exceeding the quota in later years, VW hopes to avoid being fined this way, FAZ writes.

For background, read the CLEW dossier The Energiewende and German carmakers.

Germany and Sweden will build a 300 kilometre-long, 700 megawatt direct current power line connecting storage-rich Scandinavia with wind- and solar-powered continental Europe. “The cable improves the integration of renewable energies in the transmission grid and thus supports climate-friendly and cost efficient power generation. The European Single Market helps us design the Energiewende at low costs,” said Rainer Baake, German state secretary in the economy ministry, according to a press release by 50Hertz. German and Swedish transmission grid operators 50Hertz and Svenska kraftnät signed a cooperation agreement detailing existing plans for the 600-million-euro investment. The interconnector is to be in operation by 2025/26.

Read the 50Hertz press release in German here.

For background, read the CLEW dossier The energy transition and Germany’s power grid.

Ahead project

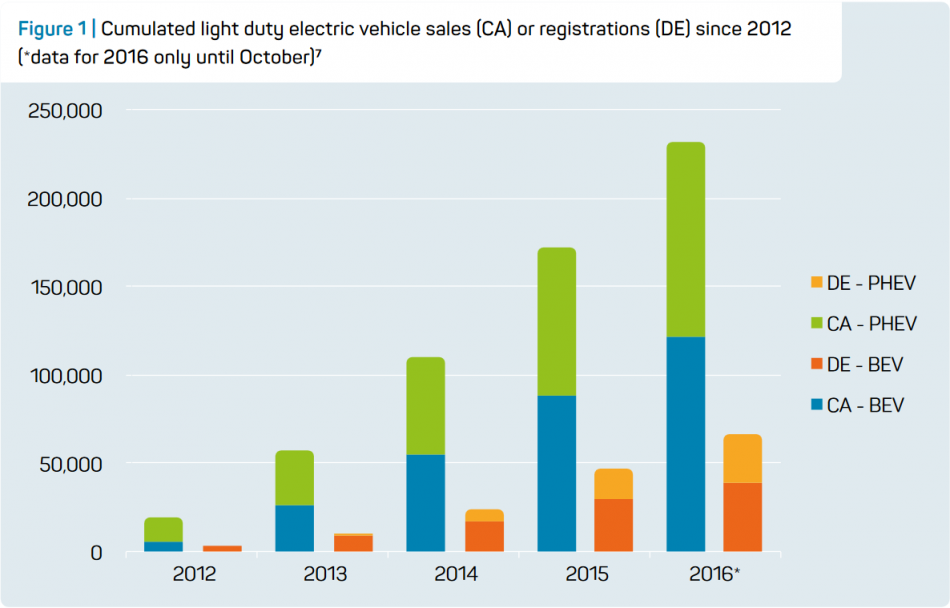

While the German and Californian transport transitions face common challenges, German lawmakers could derive valuable best practices from the US state’s “more advanced stage”, according to a report by the Ahead project, a joint initiative of the Potsdam Institute for Climate Impact Research (PIK), Resources for the Future, MCC and UC Berkeley. Elements of interest for German policy makers include the “centralised coordination of all public sector activities through a concrete action plan […], greater policy focus on the need and preferences of consumers [and] inclusion of disadvantaged communities.” Common challenges include vehicle-grid integration. The report compares the Californian and German electric vehicle markets and regulatory frameworks and aims to inform policy makers and stakeholders in both areas.

Find the full report in English here.

For background on German carmakers' struggle with the future of mobility read the CLEW dossier The Energiewende and German carmakers.

German Bundestag

The German car industry says that diesel technology is “at least in the mid-term” indispensable to reach climate targets, writes the German Bundestag in a press release. In a hearing before the parliament’s committee of inquiry for the diesel emissions scandal, Matthias Wissmann, president of the German Association of the Automotive Industry (VDA), said that gasoline engines emit 10 to 15 percent more CO₂ than diesel engines. Future Real Driving Emissions (RDE) standards at the European level were “incredibly hard”, but “just feasible”, said Wissmann in the hearing.

Find the Bundestag press release in German here.

For background, read the CLEW dossier The Energiewende and German carmakers.

Handelsblatt

The Energiewende must be steered more intelligently, and the key is a price tag for CO₂, writes Klaus Stratmann in an opinion piece in Handelsblatt. While it might be naïve to bet on this instrument – because it has been neglected over the past years – “it would be straight up crazy to add further questionable versions to all the contradictory, inefficient and costly instruments that are supposed to enforce the Energiewende”, writes Stratmann. He says that renewables support must be fundamentally changed in the next legislative period.

For background read the CLEW factsheet Understanding the European Union’s Emissions Trading System and the CLEW article Experts call for CO2 price tag to preserve Energiewende’s “credibility”.

European Climate Foundation (ECF)

An almost 12 percent increase in fuel oil prices in December 2016 compared to the previous month accelerated inflation in Germany, according to the European Climate Foundation (ECF). “If energy prices would have remained unchanged compared to the previous year, general inflation in Germany would have been only 1.4 instead of 1.7 percent,” writes ECF in a press release. Energy prices increased by 2.3 percent between November and December 2016.

Read the release in English here.

Süddeutsche Zeitung

Many climate scientists are worried that incoming US President Donald Trump’s administration will confound international negotiations, Michael Bauchmüller writes in Süddeutsche Zeitung. “There’s either a scenario Bush or a scenario crazy in store for US climate policy,” climate expert Susanne Dröge from the German Institute for International and Security Affairs (SWP) told the newspaper. According to Dröge, a scenario Bush would not mean that there suddenly are environmentalists in charge of the US administration, but it was also unlikely that the country would sabotage international climate diplomacy. “Scenario crazy, on the other hand, means only those negotiators would get appointed who try to block all talks,” she explains. Climate activists could only hope that businessman Trump will understand that for the US there is also money to be made with an eco-friendly transition, Bauchmüller writes.

Read the article in German here.

University of Stuttgart

A series of detrimental external factors and poor strategic reactions have led to a destabilisation of Germany’s electricity industry over recent years, a study conducted by the University of Stuttgart’s Institute for Social Sciences has found. Energy providers in the country faced “negative external pressures”, such as competing renewable energy sources, nuclear and coal exit debates and decreasing electricity prices. Also, the industry was destabilised by “two exogenous shocks”: the financial crisis and Fukushima accident, they explain. The researchers regard repeated poor decision-making by industry representatives, such as underestimating renewables and fighting for nuclear lifetime extension, as responsible for the scale of damage external developments inflicted on their companies: “Utilities underestimated the structural nature of their problems and engaged too late in strategic reorientation activities,” they conclude.

Read the study in English here.

For background, see the CLEW dossier Utilities and the energy transition.

Uniper / Welt Online

German utility Uniper has been legally authorised to finish construction of a hard coal plant that a court stopped in 2009, the company said in press release. Authorities in the state of North Rhine-Westphalia issued the permission after resolving questions concerning air pollution caused by the Datteln 4 plant near Dortmund. According to news website Welt Online, environmental organisation Friends of the Earth Germany (BUND) criticised the decision in favour of the company that split off from utility E.ON last year as a “genuflection to the coal lobby” and is considering filing a new lawsuit against the one-billion-euro plant.

Read the press release in German here and the article in German here.

For background read the CLEW factsheet E.ON shareholders ratify energy giant's split.

PwC

Germany’s electricity industry is at the cusp of a tide of transactions and new models of cooperation, a study by consulting agency PwC has found. Due to “dwindling profits and rising cost pressure”, market conditions for both larger private and smaller municipal utilities are “more difficult than ever before”, the authors say. Utilities reacted to these changes by conducting “a variety of specific acquisitions”, with digital service providers being the main target, according to PwC. The strategic turn is the result of a changing business model, in which utilities no longer primarily perceive themselves as power producers, but rather as service providers, the authors write.