Anxious carmakers forced to tread 'arduous' path to e-mobility in 2020

Stringent new EU emission limits, huge investments in electrification and autonomous driving, cooling global demand, plus the effects of trade disputes and Brexit: the challenges facing BMW, Daimler and VW are so numerous that 2020 has already been dubbed a "fateful year" for the German car groups.

"2020 will be a transitional year – but not this year alone. The problems will not go away in the coming years. I would even argue that the carmakers have entered a critical decade," Stefan Bratzel, director of the Center of Automotive Management (CAM) at the University of Applied Sciences (FHDW), told the Clean Energy Wire.

Most experts single out the EU's pollution limits as posing the greatest uncertainty for the sector. "The new rules have definitely opened a new chapter for the German carmakers," said Ferdinand Dudenhöffer, head of the Center for Automotive Research (CAR) at the University of Duisburg-Essen. "The key question for 2020 is the following: How will they manage to sell the electric cars necessary to stay below the EU limits?"

The average new car registered in the EU must not emit more than 95 grams of CO2 per kilometre, which corresponds to a fuel consumption of around 4.1 litres of petrol or 3.6 litres of diesel per 100 kilometres. The manufacturers can continue to sell more polluting vehicles, but must compensate these with low or zero emission models if they want to avoid hefty fines that could add up to billions of euros for major car groups.

"Stated briefly, we are dealing with a fundamental structural transition with extremely high investments at a time of weakening market dynamics. At many companies, the tension is palpable," said Bernhard Mattes, president of the German Association of the Automotive Industry (VDA). "The path will be steep, rocky and arduous [...] The competition will be harsher, the headwind rougher."

The new EU regulation has already had unintended consequences: a flurry of registrations in the final weeks of 2019 helped BMW, Daimler and VW defy expectations to reach the highest number of annual orders in a decade, as manufacturers rushed to rid themselves of gas-guzzling vehicles ahead of the new EU limits, according to a Financial Times report.

Lowering CO2 emissions in transport has become a focus of Germany's landmark energy transition. The country has failed to lower CO2 emissions in the sector over the last 30 years, as progress from more efficient engines has been eaten up by rising car numbers and the popularity of heavy SUVs. While Germany's total CO2 emissions decreased significantly in 2019, transport emissions have risen yet again.

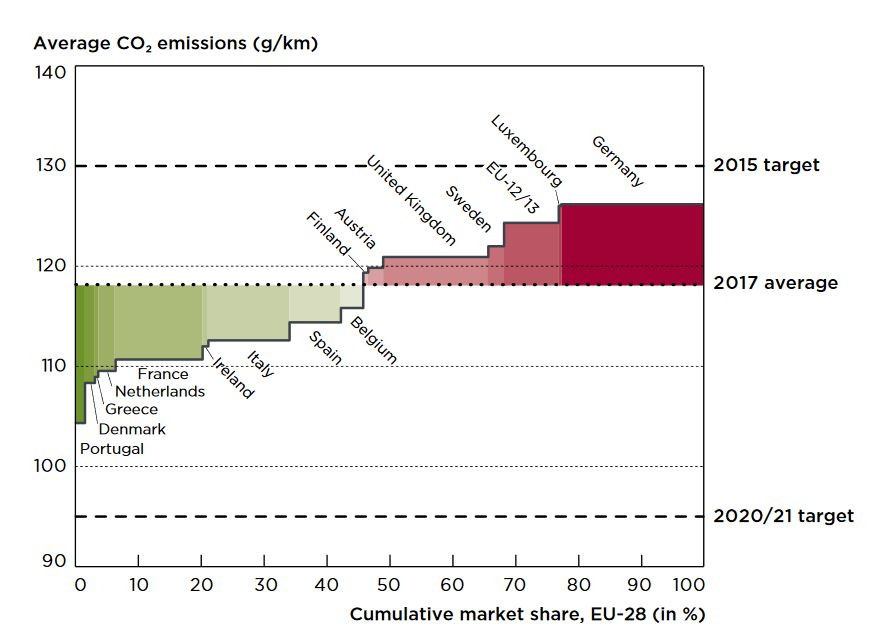

Partly as a result of its powerful car industry, which provides employment to more than 800,000 people, Germany is lagging behind many other countries in the shift to green mobility. The UK, France, Norway and Sweden have already committed to phasing out conventional cars by the end of the 2030s. The average emission level of Germany’s car fleet is the highest in Europe. (see graph).

Given the sector's huge importance for the economy as a whole, supporting the car industry's transition to sustainable mobility has become a top priority for German government. Following the decision to support mining regions financially during the country's coal exit, industry representatives and employees have already called for public funds to ease the shift in the car industry as well.

The CEO of automotive supplier Bosch, Volkmar Denner, said the new EU emission rules "mean the end of the classic internal combustion engine with corresponding effects on employment in the companies concerned." Following the announcement of around 3,500 job cuts in the company, Denner suggested Germany's car producing regions might require support for structural change. Despite the recent jobs cuts, Bosch has added jobs globally over the past few years to meet new demand from digitalisation and e-mobility.

The overall employment impact of the industry transformation remains highly contested in Germany, but many experts say that digitalised electric mobility will likely reduce the number of industry jobs in the longer run.

SUV boom could help ignite mass-market e-mobility

German carmakers are particularly affected by the new EU emission rules because of their strong position in the premium segment. Heavy luxury cars have comparatively high emissions if powered by a conventional engine – a problem amplified by the continuing trend towards SUVs.

But, according to Dudenhöffer, the SUV boom also adds pressure on the companies to shift to electric mobility, because it forces them to push clean alternatives in order to lower average fleet emissions.

"Curious as it may sound, but more SUVs are a chance to implement e-mobility in Germany," Dudenhöffer told the Clean Energy Wire.

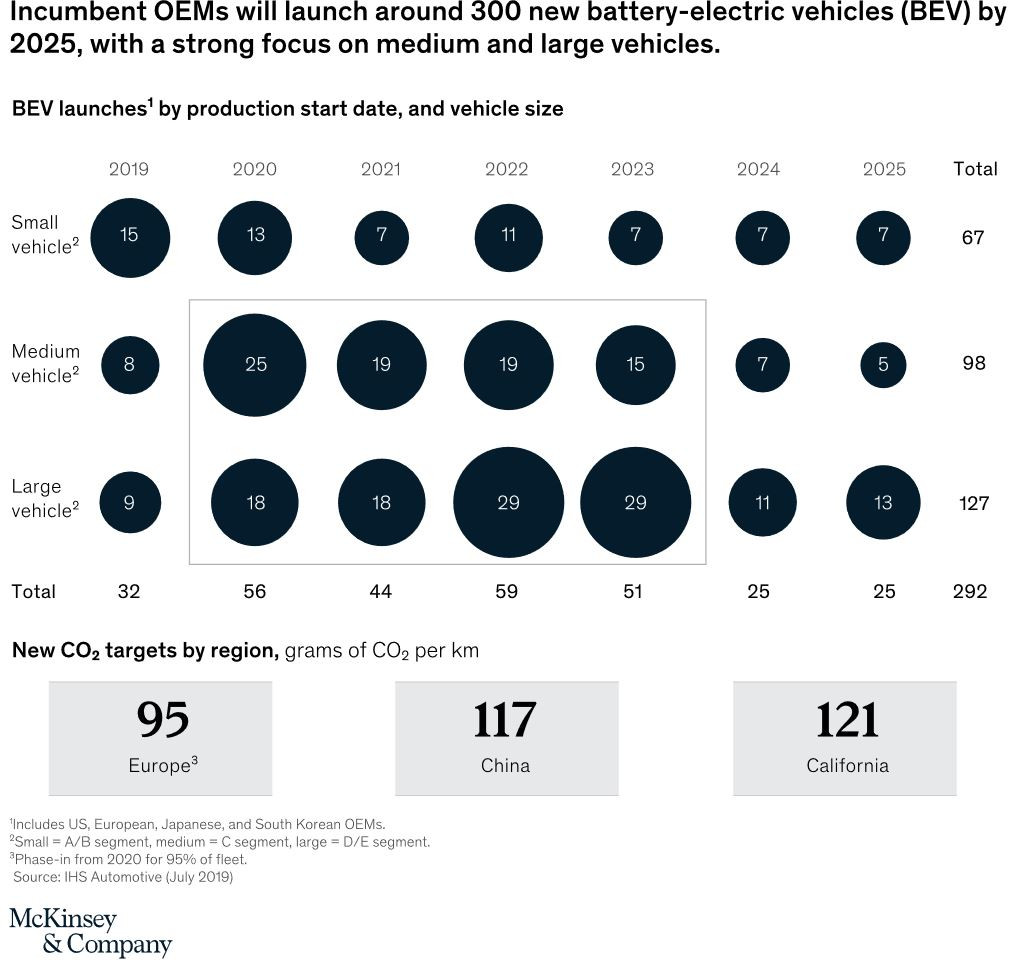

"Projections for Europe indicate that automakers would need to sell up to 2.2 million electric vehicle (EV) units in 2021 alone to meet their fleet CO2 targets," according to the business consultancy McKinsey. "That would be a steep ramp-up of EV sales in fewer than two years and equivalent to global EV sales in 2018. This is a big task not only for the automotive industry but also for the associated industries."

The carmakers also attempt to use the demand for SUVs to push electric mobility by offering electrified SUVs. Audi started selling the e-Tron in 2019 and Mercedes launched its EQC – both weighing around 2.5 tonnes when they are empty. BMW will sell an electric X3, also an SUV, in 2020.

But experts also warn against unrealistic expectations for the breakthrough of electric mobility in 2020. "The new EU limits don't apply in their pure form in 2020 yet. So we won't advance into electric mobility with the pedal to the metal yet," said Dudenhöffer.

"We will see a departure, but not a big bang. E-car sales are clearly pointing upwards, but they will also depend on whether carmakers will manage to deliver the necessary vehicles," he said, adding that progress in building a widespread charging infrastructure will also be crucial.

The number of public charging points in Germany rose 50 percent to around 24,000 in 2019, according to utility association BDEW. But the government plans to bring the number of public charging points to one million by 2030 and the number of electric vehicles to 7 to 10 million by 2030. To reach this target, it extended the buyer's premium for electric, plug-in hybrid or hydrogen/fuel cell cars.

But repeated production headaches suggest that producing a sufficient number of clean cars could also turn out to be a real challenge for the companies in 2020. "Up to now, e-car sales have been very sluggish, and launches have been beset by troubles and delays. After they were making fun of Tesla's problems, the Germans are now experiencing their very own 'production hell'," Bratzel said. "The episode shows that German companies also have to gain new expertise when it comes to making electric cars."

"We will see a departure, but not a big bang" in e-mobility in 2020

High hopes for VW's electric push

BMW, Daimler and VW all stepped up their plans for the sale of electric models last year. By 2023, German companies will have tripled their portfolio of e-models from 50 today to more than 150, according to the automotive association VDA. By 2024, they will have invested 50 billion euros in electric mobility, and on top of this come investments of 25 billion euros in digitalization.

But climate activists have highlighted an inconvenient truth: Germany’s world famous carmakers are betting heavily on polluting SUVs in order to finance tomorrow's clean alternatives.

Among the German carmakers, VW has made the most outstanding commitment to electric mobility. The world's largest carmaker pledged last year to transform itself from dieselgate pariah into e-mobility pioneer, and has committed dozens of billions of euros to the task.

In 2020, VW will launch the ID.3, its first fully electric model based on a new vehicle platform that forms the basis for its huge electric ambitions. Experts believe that VW's full entry into electric mobility could indeed turn out to be a game changer.

"We place a lot of hope in the ID.3. The model offers a real chance to catch up with Tesla, which is clearly still the benchmark. The ID.3 could really kick off e-cars' entry into the mass market," Bratzel said.

Volkswagen places massive EV bet to master green mobility shift

Reluctant Daimler shifts gear in race to sustainable mobility

Volkswagen appears increasingly optimistic that its electric bet will pay off. The company said in December that it expects to churn out one million battery-only cars by the end of 2023, two years earlier than previously planned.

Tesla's decision to set up camp in Germany by building a factory near Berlin will add further pressure on German carmakers to take the plunge into e-mobility.

"It's definitely a positive that Tesla has decided to build cars in Germany. The German carmakers need to feel the sting, and it will be more painful in their own stomping ground," Dudenhöffer said, adding that he believes that Tesla will be selling as many cars as Daimler within ten years.

"But Tesla will upskill our suppliers, which will ultimately also benefit German carmakers," he added.

Electric mobility is set to receive a further boost from the likely introduction of new diesel driving bans and other steps towards sustainable transport in German cities. "From “sticks” (such as parking fees, low- or no-emission zones and city tolls) to “carrots” (such as piloting new robo-taxi or shuttle service mobility solutions), it will be cities where the future of mobility will be decided," writes McKinsey with reference to the global transition. "And 2020 will likely see bold announcements by cities to change their mobility systems."

New kids on the block in trouble

Several German start-ups have also ventured into the e-car space in order to take market share from incumbents that were slow to embrace electrification. e.GO has started sales of its relatively cheap electric subcompact e.GO Life. It is headed by German e-car pioneer Günther Schuh, who has been compared to Tesla CEO Elon Musk. Another prominent example is Sono Motors, which was launched with a crowdfunding campaign and has developed an electric car covered in solar cells to extend its range that is scheduled to enter production this year.

But according to media reports, both companies have run into financial troubles that still need resolving. German news site Edison reported that e.GO only just escaped insolvency in October, and the company also struggles with delivery delays. Sono Motors had to launch another crowdfunding campaign to secure its financial survival after realizing that "the expectations of the classical investment world and our values in fact do not match." By 10 January, the company had collected more than 46 million euros, putting it well on the way to meeting its target of 50 million euros.