Electricity storage is next feat for Germany’s energy transition

- Contents

- Storage in a renewable world

- The battery boom in German households

- Bad news for utilities

- Can storage become a stepping stone to exit coal?

- Batteries on wheels

- Side effects for people and planet

- Large batteries provide grid services

- Heat and seasonal storage

- Policymakers eye global demand for storage “Made in Germany”

The storage of intermittent renewable power has been called “energy’s next big thing,” the “holy grail,” and the “missing link” of the energy transition. In Energiewende home country Germany, where the share of green power already tops one third of consumption, hardly a week goes by without media reports on innovative storage projects.

Especially batteries have basked in the limelight of recent public attention. Fuelled by massive price drops, the technology has begun to spread fast: The country commissioned its 100,000th home solar battery in late summer 2018. The rising number of electric cars means an even larger wave of battery storage is rolling towards Germany and many other countries.

The boom of batteries and many other storage technologies will have a profound impact on Germany’s energy transition – the shift from fossil and nuclear power to a low-carbon economy. It will upend many existing business models in the energy world and beyond, and has triggered concerns about the availability of raw materials and the consequences of their procurement for people and the environment.

“The boom of storage in general and batteries in particular is not a surprise, but rather a logical consequence of the current phase of the energy transition,” explains Valeska Gottke, head of the market division at German energy storage association BVES. “The share of renewables keeps rising and requires a profound transformation from a strongly centralised energy system towards a decentralised, flexible and renewable system. Storage is a valuable option to provide the flexibility required for this shift.”

But the storage revolution’s impact on the energy transition might go further still, by becoming a key factor in the country’s coal exit. The government hopes to secure jobs in mining regions – a central obstacle in ongoing talks on how to phase out the CO2-intensive fuel – by attracting battery cell gigafactories or other storage projects to mining areas. Policymakers are also aiming to translate Germany’s lead in storage technologies into an export success in the global shift to a low-carbon future.

Storage in a renewable world

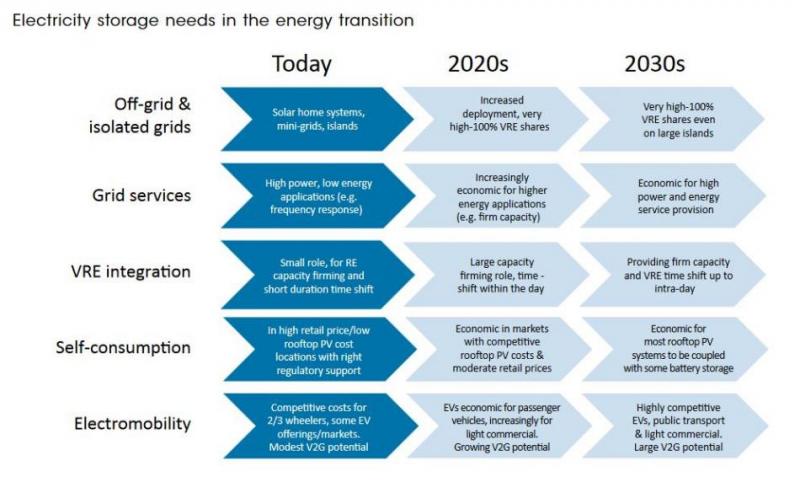

Storage will become key in the next phase of the energy transition. This will involve both a further increase of decentralised renewable power generation and the use of green electricity to decarbonise transport (electric vehicles), industry (replacing fossil-intensive processes), and buildings (heating with low-carbon energy sources) – a process referred to as sector coupling.

“This brings the role of electricity storage, and in particular battery systems, to centre stage,” argues Adnan Amin, head of the International Renewable Energy Agency (IRENA). “Storage – from the batteries in solar home systems to those in electric vehicles – will be crucial to accelerating renewable energy deployment.”

A traditional electricity system doesn’t require much storage, because power generation can be adjusted to match demand. This changes dramatically as the system uses more renewable energy, because power generation from wind turbines and solar PV systems depends on the weather. This is where storage comes into play. Put simply, the purpose of the technology is to store energy for later use – instead of the current system in which most electricity must be consumed as soon as it is generated.

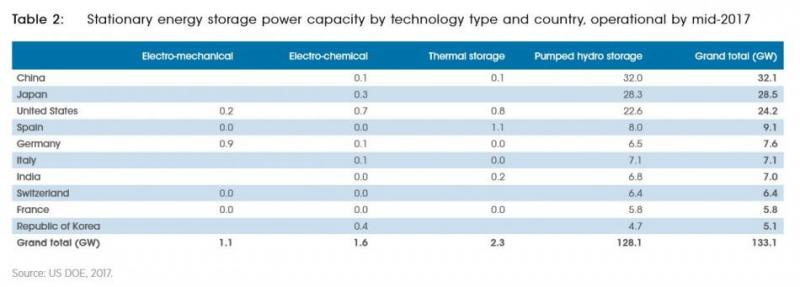

The principle of storage is nothing new and has been in use for many decades. The “classic” storage technology is to use electricity to pump water uphill into a reservoir, and generate electricity when it is flowing downhill. But in Germany, there is very little scope for additional pumped hydro installations, because there are few hilly regions, and there is strong public resistance to new projects.

This is why the search is on for alternative ways to store renewable power. The current excitement about batteries sometimes overshadows the fact that many other technologies will be needed to decarbonise the world’s fourth largest economy, because batteries simply cannot store energy for longer periods, and cannot store enough of it. This is why storing renewable energy in the form of heat, or as a gas or liquid fuel (power-to-heat, power-to-gas and power-to-liquid), will also be central to keeping on the lights and keeping warm during long periods without wind or sunshine.

The battery boom in German households

The main driver of the current battery hype is a sharp price decline in Lithium-ion (Li-ion) batteries due to their wide use in consumer electronics, and increasingly in electric cars. In less than five years, battery costs have more than halved in Germany, and there is no end in sight for further decreases.

“The total cost of energy-storage systems should fall 50 to 70 percent by 2035 as a result of design advances, economies of scale, and streamlined processes,” forecasts business consultancy McKinsey. IRENA even expects a price drop of 50 to 66 percent in installed battery storage by 2030.

Given these market forces and the increasing extension of the Energiewende into mobility and heating, German energy industry experts surveyed by the Centre for European Economic Research (ZEW) expect demand for power storage to increase substantially in the years to come. Over 70 percent said they believe batteries will be the fastest growing segment in the next ten years, while heat storage ranked second.

“Batteries will come. Deal with it,” says battery expert Kai-Philipp Kairies, director of technical consulting at RWTH Aachen University, one of Germany’s largest technical universities.

Private households in Germany have already started to embrace the technology. Around half of all new residential solar PV systems are now installed in conjunction with a battery. Perhaps surprisingly, economic considerations cannot account for the spread of residential battery systems, because they usually reduce the profitability of stand-alone solar panels, according to Aachen university researcher Kairies [read the full interview here.].

Instead, many buyers want to participate in the energy transition, and are keen to reduce their dependence on power companies – a desire fanned by residential battery makers such as Sonnen and Solarwatt.

One example is Rene Keller, who already had a solar PV system attached to the roof of his family home in the outskirts of Berlin. He added Germany’s 100,000th solar battery to collect the power generated during sunshine hours for use in the evening.

“It was both: I wanted to save money and become more independent,” Keller told the Clean Energy Wire. “I was fed up with my power company and never-ending price hikes. The PV system cut my power bill in half already, and the battery will cut it further still.”

The rapid adoption of residential batteries is set to continue apace in the coming years with further price declines that will shift the economics in their favour. Solar industry association BSW Solar expects the country to cross the threshold of 200,000 systems as early as 2020.

Beyond that, the spread of household batteries might accelerate further because hundreds of thousands of rooftop PV systems built in the early 2000s will reach the end of support payments (so-called feed-in tariffs) after running for 20 years. These systems will continue to generate electricity at near to zero cost – whereas power drawn from the grid costs around 30 cents per kWh [For details, read the factsheet What German households pay for power].

Bad news for utilities

The rapid spread of residential batteries poses a challenge to established utilities, many of which are already in turmoil caused by renewables and digitalisation. [See the dossiers Battered utilities take on start-ups in innovation race andDigitalisation ignites new phase in energy transition for details]

“This development is very bad news for companies in the business of selling power,” says Kairies. Owners of solar batteries like Keller can usually cover around 70 percent of their power demand with self-generated solar electricity. “Instead of one client, utilities only have 0.3 clients left,” says Kairies.

Additionally, some home battery owners opt to share their self-generated energy with other battery owners in virtual communities. This approach can eliminate the need for a conventional utility altogether, according to home battery maker Sonnen, a prominent advocate of this technology, both in Germany and abroad. The company plans to build the world’s largest network of residential batteries in Australia by linking up 40,000 households in a “virtual power plant.”

According to McKinsey, the spread of batteries will produce big winners and losers, as sources of value will evolve depending on how quickly costs fall, how utilities adapt, how nimble third parties are, and on regulation. “Utilities must start now to understand how low-cost storage is changing the future,” warns McKinsey. “In effect, utilities need to disrupt themselves – or others will do it for them.”

Some German utilities have already embraced the winds of change and now sell home storage themselves. A prominent example is EnBW, which offers clients a combination of PV and home storage that can also be supplemented with power drawn from a virtual community of other users. In early 2018 EnBW announced the purchase of battery maker Senec to become “a full-line distributor of the decentral energy transition” and “to extend our value chain and expertise in the area of intelligent energy management systems.”

“The shift to a decentral power supply is one of the major trends in the energy sector, and here power storage plays a central role,” EnBW spokesperson Heiko Willrett told the Clean Energy Wire. “This requires utilities to rethink. Only companies that do not develop new business models for a decentral energy supply need to worry, and rightfully so.”

McKinsey sees “tremendous potential for growth” for companies specialising in distributed energy like Sonnen, as well as technology manufacturers, and finance players. “All this will be treacherous territory to navigate, and there will no doubt be missteps along the way. But there is also no doubt that storage’s time is coming.”

Can storage become a stepping stone to exit coal?

The German storage industry already employs more than 12,000 people (thereof around 5,000 in batteries) - more than half the number of lignite industry jobs in the country. Total sales are expected to rise around ten percent in 2018 to 5.1 billion euros, according to the German Energy Storage Association BVES. The German government wants to put the growth of the industry to use during the coal exit currently being planned by the country’s coal commission, by attracting battery cell production to coal mining areas.

“The effects of batteries on the energy transition are an important issue for Germany’s coal commission, because the debate about a coal exit is mainly a debate about jobs,” says Harald Diaz-Bone, an international consultant on climate, energy, and transport, with reference to the powerful coal mining union IG BCE, a staunch defender of domestic coal power generation.

“Profiles of the new jobs created in so-called gigafactories are similar to those of the old jobs in lignite mining – and they would still be covered by the IG BCE. The union could keep their members, the jobs offer similar payment levels, and the affected workers wouldn’t even have to move. These compatibilities are being investigated thoroughly at the moment,” says Diaz-Bone, who has worked for IRENA, the UN, GIZ and many others.

Trade unions are a vocal stakeholder in the Energiewende, and they are concerned about lower payment levels, less job security, and lower levels of labour organisation in renewable industries compared to the conventional energy sector.

Negotiations with investors have already progressed quite far, according to economy state secretary Thomas Bareiß. “In the past weeks alone, I had discussions with three investment consortiums with very concrete ideas for a gigafactory and that want to make a specific investment. A lot is happening,” Bareiß said in late August 2018. Shortly after, Poland and Germany announced a cooperation on battery cell production in the eastern German lignite mining region Lusatia and western Poland. Economy minister Peter Altmaier announced in September that Germany will initiate a domestic battery cell production, without giving further details.

Tesla founder Elon Musk has publicly speculated that the American company may open its own battery gigafactory near the Franco-German border – which would place it near to Germany’s Rhenish mining district.

“I believe that attracting new battery cell production in Germany is one of the key issues for today’s industrial policy. We have to make sure that we build the products of the future – be it in zero-emission vehicles or electric power storage,” says Diaz-Bone.

Chinese battery maker CATL already agreed in July 2018 to build a gigafactory in the eastern state of Thuringia to supply German carmakers in their transition to low-emission mobility, because German car companies have so far been reluctant to invest in battery cell production.

The German Aerospace Center (DLR) has proposed an alternative approach to easing the coal exit using storage technologies. The researchers suggest to store heat produced with renewable energies in large tanks filled with liquid salt in disused coal power plants, and to use the existing steam generators and turbines to convert the heat back into electricity. Germany’s government coalition has already said it will examine the possibility of “using power plants that are no longer required for large-scale thermal storage.” If these projects come to fruition, around half of current coal power plant employees could keep their jobs, according to DLR.

Batteries on wheels

The main driver behind the push for battery cell production is the government’s desire to secure the future of Germany’s all-important car industry in the face of the looming shift to zero-emission mobility – and away from fossil-fuelled cars. From a power sector standpoint, electric cars are ‘batteries on wheels’ whose impact could quickly dwarf that of residential storage.

“The number of 100,000 home storage systems might sound impressive, but it’s only moderate if you consider the scale of electric mobility. We’re looking at millions of vehicles, each with a capacity of 40 to 100 kilowatt hours (kWh), five to ten times that of a typical home battery system,” says Diaz-Bone.

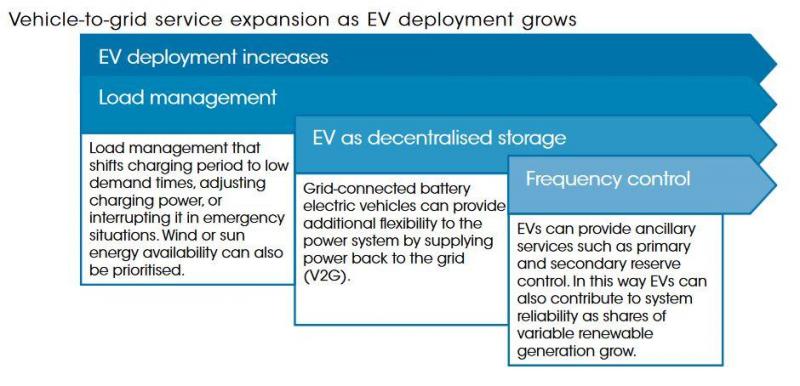

Like stationary home batteries, electric cars connected to a charger can not only store power, but also feed it into the grid if required. For example, an EV owner returning from work in the afternoon might tell her charging system that the car will have to be fully charged the next morning. The system can then allot the necessary time for charging and use the remainder for grid stabilisation. Batteries’ core strength – absorbing and discharging large amounts of power at short notice – make them an ideal tool for providing ancillary services to the power grid. They can smooth the flow of power to stabilise the grid, act as a backup power source to increase reliability, and enable a shift of power consumption to times when it is in plentiful supply and therefore cheap.

But it remains uncertain whether EVs will be available in large numbers for these services, because that will depend on the go-ahead from both car owners and carmakers.

“Resistance from car owners can be overcome – it’s simply a question of remuneration,” says Matthias Deutsch, storage expert at energy think tank Agora Energiewende, with reference to business models involving paying EV owners for making their batteries available for grid stabilisation. “Car companies can be a bigger problem – for example, if they withdraw product guarantees if batteries are integrated into the grid.”

This so-called bi-directional charging is already being tested in pilot projects. Virtual power plant operator Next Kraftwerke has teamed up with Dutch smart charging provider Jedlix to use car batteries to stabilise the grid.

Electric cars will not cause large increases in Germany’s power demand by 2030, but they will likely reshape the electricity load curve by increasing evening peak loads as people plug in their cars after work, according to McKinsey. While the power system can likely absorb the expected minor effects on a national scale, the consultancy says peak loads will increase significantly in some EV penetration hot spots, such as suburban areas, requiring upgrades of local transformers.

“Alternatively, energy players can deploy more local solutions, such as co-locating an energy-storage unit with the transformer that charges the unit during times of low demand […] as the cost of batteries continues to decline rapidly, using energy storage to smooth load profiles will become increasingly attractive,” writes the consultancy.

The German storage industry also says their products can help to lower expensive grid modernisations. “You can often hear complaints that EV charging will overburden the grid – but that’s not the case if you use a battery as a buffer,” says the storage association’s Gottke.

Looking further into the future, the number of EVs available to the power grid looks even more uncertain. If private car ownership falls and autonomous robo-taxis take over, as many mobility experts expect, they will be more or less permanently on the road. [For details, see the dossier BMW, Daimler, and VW vow to fight in green transport revolution]

Side effects for people and planet

The scale of things to come on the battery market has raised alarm bells regarding the raw materials required, and the side effects of battery production and disposal on people and the environment.

While key battery ingredients like lithium and cobalt are available in sufficient quantities to enable the battery boom, their extraction is inherently associated with environmental and social problems, according to a study by clean mobility think tank Agora Verkehrswende*. “Sustainability means much more than just ‘long-term availability’. It also means ensuring environmental standards and viable conditions for workers across the entire supply chain.”

“The problems in this area are multifarious and include the high energy consumption of mining operations, acid mine drainage, water conflicts between mining companies and indigenous peoples, and poor working conditions in mines,” says the study.

Especially the inhumane conditions in small-scale Congolese cobalt mines, where workers dig for the raw material with bare hands, have attracted recent media attention. Mining for nickel and lithium also comes at high environmental costs.

The disposal of used car batteries can also pose important environmental problems, but a nascent industry is creating an aftermarket.

A prominent example are carmakers who give batteries a new lease on life in large stationary bundles. Various German carmakers have already combined hundreds of used EV batteries to form large buffers for the power system, to help keep electricity supply and demand in balance. Daimler, the maker of Mercedes cars, opened its third large battery storage facility composed of used EV batteries with a total capacity of around 10 MWh in July 2018. BMW is involved in similar projects.

Large batteries provide grid services

The price drop in batteries, whether used or new, has already made them a vital tool for grid stabilisation. According to storage association BVES, the total capacity of large commercial batteries in Germany will almost double in 2018 to around 320 megawatts (MW), while the combined capacity of all home batteries will add up to around 380 MW.

The use case is even stronger in more isolated countries, such as the United Kingdom and Australia. “As an island nation, the UK has few international interconnections, and a huge windpower potential. Therefore, it should benefit from electricity storage in its grid,” says Diaz-Bone.

“The need for large grid storage is less pronounced in Germany, because we have a whole range of alternative flexibility options that might be cheaper – for example cross-border power trade. Therefore, Germany won’t rely on electro-chemical storage to the same extent.”

In contrast to Great Britain, Germany’s power grid can tap into hydropower plants in the Alps, and will soon even feed power generated by wind turbines into Norwegian hydropower stations using the underwater cable NordLink currently under construction. At times of low wind power production in Germany, Norwegian dams can feed power back into the German grid.

Large battery storage projects have also become a key tool in greening the energy supply of remote settlements that cannot rely on a centralised power grid.

Germany’s islands in the North Sea provide a perfect testing ground for these smart mini-grids involving storage. For example, the EU supports a pilot project on the island of Borkum that aims to replace fossil fuel power generation with solar panels and wind turbines connected to a smart grid equipped with a range of storage technologies.

German storage companies’ know-how is also in high demand abroad. For example, battery storage specialist Younicos provided an energy management system on the Portuguese island of Graciosa, located in the middle of the Atlantic Ocean, to replace diesel-generated electricity.

“In many rural areas of less developed countries, the possibilities offered by battery storage and renewables raise the question whether they leapfrog building a comprehensive national power grid altogether using decentralised smart and mini grids,” says Diaz-Bone.

Heat and seasonal storage

But batteries are no panacea for the massive storage that will be required at later stages of the energy transition. That’s because batteries are unsuitable for storing power for longer than a few days, and their capacities are nowhere near what will be needed for longer periods with little wind and sunshine. To put the dimensions into perspective: The world’s largest battery with a capacity of 129 megawatt hours (MWh), built by Tesla in Australia in 2017, could power the city of Berlin for about five minutes.

“All these discussion about batteries don’t answer the key question at all: Where do we get renewable power in the winter?” says Deutsch. “The key is seasonal storage – we will need to think about how we can store the summer’s solar power production for months.”

Many experts consider a stable energy supply during longer periods without wind or sun the central challenge for Germany’s Energiewende. This weather situation has been discussed so widely in the context of the energy transition that a new word for it has entered the German language: Dunkelflaute, a dark, dead calm.

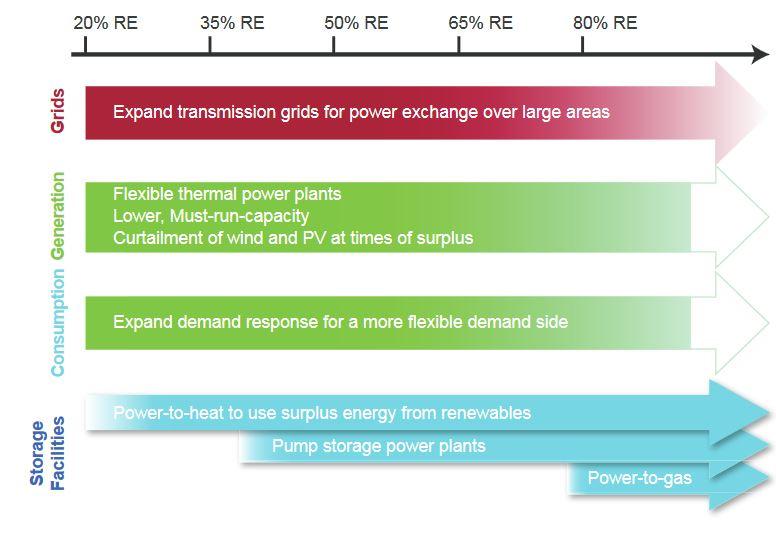

Most energy experts believe large-scale storage technologies won’t be needed for decades, because much cheaper flexibility options are available, such as demand response and power trade. “The development of wind and solar systems in Germany during the next 20 years does not require new power storage,” concludes an Agora study.

But the issue of large-scale storage remains controversial. Economist Hans-Werner Sinn, a vocal critic of Energiewende policies, recently argued that a full-blown transition to intermittent renewable energies is impossible because of huge storage requirements. But economists from the German Institute for Economic Research (DIW) countered that Sinn’s assumptions are unrealistic – for example, arguing that not every single watt of renewable power must be put to use - and conclude: “The need for power storage does not present an obstacle for the Energiewende’s progress.”

However, experts agree that large-scale storage will be key eventually [See factsheet How can Germany keep the lights on in a renewable energy future for details].

Suitable technologies are already available for this task, according to the German Association of German Engineers (VDI). “The storage technologies required to complete the energy transition exist already. They are in different stages of development, but from a technological standpoint, the storage problem can be solved.”

For example, electricity can be used to make hydrogen or other gases that can be stored indefinitely, and then be burned to generate electricity in conventional gas-fired power plants, or used to heat homes. But the technology is currently expensive, because a lot of energy is lost during the conversion. [For more details, read the factsheet Power-to-gas: Fix for all problems or simply too expensive?]

Another approach is to store energy on a large scale in the form of heat. “Power-to-gas is not the only option for seasonal storage. It’s simply a matter of insulation,” says Deutsch. “You can use the ground, for example in the form of large aquifer storage - in effect a huge thermos flask.”

The city of Hamburg has already concluded the trial phase of a massive subterranean aquifer heat storage system, which is supposed to replace a coal plant and can provide heat to 8,000 households in winter. Water is heated to 80 degrees Celsius and pumped into the ground to preserve the temperature, to be used later in the city’s district heating.

Policymakers eye global demand for storage “Made in Germany”

Government policy will be crucial for shaping the development of storage in Germany – regarding both domestic deployment, and establishing an internationally successful storage industry. The future of the various technologies “will largely depend on policy,” says Aachen University researcher Kairies. “There is a structural neglect of flexibility options in Germany, because the government refuses to overhaul the taxes on different forms of energy.”

Kairies and many other storage experts insist that a fundamental overhaul of energy taxes and levies is required to leverage crucial technologies such as power-to-gas. “Regulation makes it economically impossible because you lose a large part of the value if you use electricity to make gas, for example. High electricity prices are a serious barrier for the electrification of other sectors.”

The energy industry experts surveyed by the Centre for European Economic Research (ZEW) agree that the current political framework does little to promote the use of energy storage. Whereas Germany’s rapid renewables roll-out was boosted by an intricate system of lavish support payments, the battery revolution is rolling ahead largely without policy incentives, and policy needs to catch up.

“We now have 100,000 energy storage systems not because policymakers and regulators use the technology in a dynamic way to solve problems, but rather despite their actions,” says Detlef Neuhaus, CEO of solar PV and home battery maker Solarwatt [Read the full interview here]

“Storage is squeezed into an outdated and narrow regulatory framework, with the effect that many technologies cannot be operated profitably – for example because they have to pay levies several times,” explains the storage industry association’s Gottke. “The regulatory framework is lagging way behind technological developments.”

The government is aware that reforms are needed to boost the use of storage within the country, so the industry has a stepping stone for world markets, but it has shied away from tackling fundamental but difficult tax reforms.

“We need new business models and prices that provide an incentive to store electricity,” according to state secretary Bareiß. He said the government will have to become “very active” in the coming years, to help the storage industry “to remain competitive, and to offer products that are not only in demand within Germany, but worldwide.”

Powerful industry association BDI argues that Germany’s “vanguard role in climate protection represents a tremendous opportunity for promoting innovation and bolstering Germany’s economic competitiveness.”

The German storage industry, which is mainly comprised of small and medium-sized enterprises says it is already highly export-oriented, and insists it is well positioned to benefit from global sales growth, for example driven by demand for large grid batteries in the US and Australia, mini-grid and off-grid batteries in Africa.

The coalition government has already significantly increased the funding for battery research in its latest budget, and Bareiß suggested there is more to come. “The energy transition is also a technological project. We have to ask which technologies we can use in Germany to generate growth and prosperity in the years to come.”

“Germany is currently a technological leader in ‘renewables 2.0’,” says Neuhaus. “It would be a real scandal if we were forced to watch this leadership migrate towards Asia, while we’re still caught up in discussions.”

*Like the Clean Energy Wire, Agora Energiewende and Agora Verkehrswende are projects funded by Stiftung Mercator and the European Climate Foundation.