Putting a price on emissions: What are the prospects for carbon pricing in Germany?

For an in-depth discussion on how carbon prices generally could be used to meet Paris Climate Agreement CO2 mitigation pledges, read a paper by the International Monetary Fund (IMF).

For a running update on the various parties' positions on carbon pricing see our article "Tracking the CO2 price debate in Germany".

Germany, like all EU member states, participates in the European Emissions Trading System (EU ETS; established in 2005) which sets an overall limit on all CO2 emissions from power stations, energy-intensive industries (e.g. oil refineries, steelworks, and producers of iron, aluminium, cement, paper, and glass) and civil aviation.

The system includes more than 12,000 power plants and factories across the 28 EU member states plus Iceland, Liechtenstein and Norway, and covers around 45 percent of the EU’s greenhouse gas emissions and around 50 percent of Germany’s. Other energy-consuming sectors, such as transport, agriculture and heating of buildings, are not included in the EU ETS.

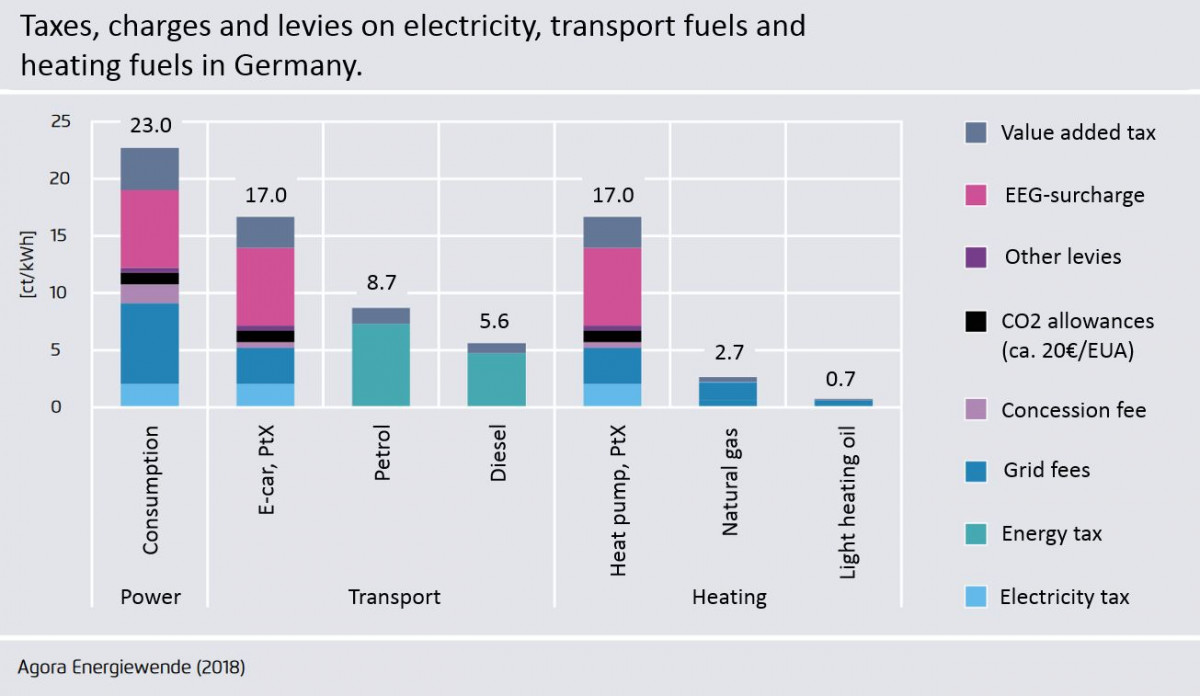

The German state also taxes energy commodities such as heating oil, natural gas, petrol and diesel, as well as electricity. A complex system of taxes, levies and exemptions is used to make certain energy sources more expensive. For example, there’s a higher tax on petrol than diesel, but vehicle tax is higher on diesel cars than on petrol ones.

Household electricity bills are dominated by state-determined levies, which make up more than half of what consumers pay. These include grid fees, the renewables surcharge, concession fees, value-added and electricity taxes, making the grid and tax component of German power bills among the highest in Europe.

Germany’s airlines and busses are exempt from the tax on mineral oil, while trains pay a reduced tax on electricity and the full tax on diesel. Energy-intensive businesses may be (partially) exempt from taxes and levies on electricity.

The last tax rise on energy sources was 15 years ago, when the government introduced an “eco-tax” that made energy more expensive while lowering taxes on non-wage labour costs.

There are – or were – various reasons for the different taxes, levies and exemptions, but they are not set according to the relative carbon-intensity of different energy sources and do not reflect electricity becoming increasingly climate friendly (the share of renewables in power consumption rose from 7.7% in 2002 to 36.2% in 2017).

1. A floor price in the existing EU ETS

The EU ETS, designed for the power generation sector, European aviation and energy-intensive industry, has failed to make fossil-fuelled electricity or carbon-intensive industrial processes more expensive. A surplus of ETS allowances (EUA), millions of which were given out for free to protect companies from “carbon leakage” – i.e. competition from countries without carbon pricing – saw the price for EUAs stagnate at around 4 to 7 euros per tonne of CO2 for many years.

Some European countries have introduced a carbon floor price (UK; pending in The Netherlands) or a general carbon tax (Denmark, Sweden, Finland, France, Ireland).

There are various designs for carbon floor pricing.

In the UK, power producers have to pay the difference (called carbon price support, or CPS) between the expected EUA price and the UK carbon floor price. The CPS is set three years in advance, based on predicted ETS prices.

Both market-oriented economic researchers and energy transition-focused think tanks have suggested that a carbon floor price in a group of European countries – a “coalition of the willing” – could be implemented in a similar way, introducing a tax on primary energy that would be adjusted each year according to the current EUA price.

Another way to set a minimum price for European emission allowances would be with an “auction reserve price”, similar to the Californian model, which sets a lower limit for EUAs sold at auction. If an auction ends without all allowances sold at, or over, the floor price, excess allowances are deleted (or first moved into the MSR and then deleted). Such a model could only be implemented across the entire EU ETS.

Proponents argue that a floor price would give the carbon market stability, increase predictability for industry and traders, and ensure that prices are reliably high enough to actually trigger CO2-saving investments.

German business associations argue that introducing a carbon floor in just some EU countries would put their industries at an economic disadvantage compared to other European states, since electricity would become more expensive. This could potentially create carbon leakage within the EU. However, those proposing a floor price among willing countries say existing exemptions and rebates for energy intensive industries would be retained, and that only a floor price that covered most central and western European countries (CWE) would be feasible.

In Germany, many NGOs, researchers and think-tanks have proposed a carbon floor price in ETS sectors. But the idea hasn’t made it on to the official agenda of Chancellor Angela Merkel’s CDU/CSU-SPD government. The French government has been pushing the idea, supported by other European countries including the Netherlands, Sweden and Spain, who signed a joint call to “strengthen and extend carbon pricing in Europe” in December 2018. Germany did not to sign the document.

2. A price on carbon in the transport and heating sectors

Germany’s heating (mainly of buildings) and transport sectors are largely fuelled by fossil energy commodities, i.e. heating oil, natural gas, gasoline and diesel. Between them, these sectors are responsible for around 33 percent of Germany’s greenhouse gas emissions (2016) and are not subject to any carbon trading or CO2-oriented tax scheme. Since 1990, building sector emissions have fallen 38 percent, but those from transport have gone up 1.8 percent (by 2016).

Germany's government parties have long shied away from the debate, often for fear of upsetting voters or German business and industry. However, a drought in the summer of 2018 and the Fridays for Future student climate protests have pushed climate action to the forefront of the political debate and increased pressure to debate carbon pricing as one measure to mitigate global warming.

By July 2019, many major parties and research institutes had pitched their ideas for a carbon price, whether in the shape of a CO2 tax or a trading scheme.

A carbon price in the transport and heating sectors could cap greenhouse gases in line with Germany’s CO2 reduction targets and/or encourage consumers and businesses to invest in less carbon-intensive technologies such as electric vehicles, heat-pumps (instead of oil or gas fired heating/cooling systems) and efficiency measures (e.g. insulation), by making oil and gas more expensive.

There are different approaches and theories as to what kind of carbon pricing scheme in the transport and heating sectors would be most efficient.

2.1 Quantity-based market solution (trading scheme)

Researchers and political parties strongly affiliated with market-oriented economic policy (e.g. RWI, FDP) generally suggest that fossil fuels in the heating and transport sectors be brought into a carbon market, similar to the EU ETS. A quantity of emission allowances would be set, auctioned and traded, providing for both a cap on emissions and technology-neutral incentives to use less emissions-heavy fuels and processes.

In a so-called downstream approach (used in the EU ETS), allowances have to be bought by the final emitter of CO2. In the case of the transport and heating sectors, this would mean a great number of final energy consumers, i.e. the drivers of cars and owners of houses and flats, would have to start providing emissions certificates according to their energy use.

In an upstream approach, those who produce and/or sell fossil fuels – producers, traders, importers, refineries, petrol stations – would be obliged to buy carbon certificates according to the CO2-intensity of the fuel. This model is generally seen as more feasible and easier to implement.

The EU ETS could be expanded to include heating and transport emissions (also in combination with an upstream approach) but since this would require a reform with the consent of member states, it isn’t an option that could be implemented in the very near future (German government advisors have proposed the integration as a long term goal).

However, current EU rules do provide for the possibility that a single country or a group of member states includes new sectors in the ETS. So, a coalition of the willing (see above) could push for such a scheme in some countries – but Germany is not currently part of this group frontrunners. Instead, chancellor Merkel has floated the idea of a European coalition of the willing on CO2 pricing which could be in form of a new emissions trade system outside the ETS.

Critics warn that the current ETS system suffers from many imperfections, such as an excess of allowances, which could also affect newly included sectors and limit real emission reductions.

Another option would be to establish a new scheme for Germany alone, which would involve new bureaucracy but could also use existing trading infrastructure of the German Emissions Trading Authority (DEHSt). In a closed, national system of this kind, the government would set the cap according to energy-transition and emission-reduction targets.

Any new pricing scheme would also have to take into account existing taxes on fossil fuels into account, or reform them accordingly.

Proponents of a quantity-based trading scheme for CO2 emissions in the heating and transport sectors argue that it’s the only model to actually set a definite limit on emissions. They also highlight that politically set emission standards – e.g. for car fleets – and e-car targets, would be unnecessary if a cap-and-trade system set a technology-neutral incentive to produce low-emission vehicles. The system would also include all existing cars and not just new models.

Quantity based trading systems are favoured by market-oriented research institutes and the business-friendly FDP, which is currently in opposition but seen as a possible coalition partner for the conservative CDU and/or the Green Party after the next federal elections.

2.2 Carbon tax

Another way of pricing carbon in the transport and heating sectors would be to adjust existing taxes and levies on energy products according to their CO2 intensity. This would make fossil fuels like heating oil – which is very cheap in Germany, compared to other European countries – more expensive, while lowering electricity prices, a recent report by think tank Agora Energiewende* suggests.

Since this approach wouldn’t involve setting an overall cap on emissions, reductions would be achieved purely through an (annually increasing) price on CO2, set by government. If a minimum price were set in the EU ETS sectors, the energy taxes on heating oil, natural gas, petrol and other fossil fuels could be set accordingly. The electricity tax, meanwhile, would be lowered since it is not connected to the CO2 intensity of the power mix.

Since electricity will play an increasingly important role across all sectors (see more on the future integrated energy system or sector coupling here) through electric mobility, heating and power-to-x, it would make sense to reduce other taxes and levies on power, too, Agora Energiewende argues.

Proponents of a CO2 tax argue it would be relatively easy to implement nationally, without new bureaucracy, and allow exemptions for energy-intensive industries that are subject to international competition.

German environment minister Svenja Schulze, as well as energy-transition and climate-oriented researchers at Öko-Institut, FÖS and Agora Energiewende generally favour a CO2 tax. Industry association BDI also suggests that taxes on energy should be adjusted according to emission intensity and that, as of 2030, the transport sector could become part of a CO2 pricing scheme.

Which system is better, and how to protect consumers against rising costs?

In its analysis to inform the climate cabinet's debate (with English summary), researchers from the Berlin climate research institute MCC (Mercator Research Institute on Global Commons and Climate Change) and the Potsdam Institute for Climate Impact Research (PIK) look at the different options and weighed advantages and disadvantages.

. Graph shows options and hurdles for different ways of reaching climate targets in sectors currently not covered by the EU Emissions Trading System (ETS). Source: MCC.](/sites/default/files/styles/paragraph_text_image/public/paragraphs/images/mcc-howgermanycanreachco2goals-nonets_0.jpg?itok=eE7Kzle1)

They say that - from a technical point of view - both a carbon tax or a separate national emissions trading system can have the same effect, as long as the respective instrument is structured appropriately. “In principle, both options are expedient, so a war of opinions would be unnecessary”, emphasises Edenhofer, “especially since both are interim solutions. After all, the point of convergence for German and European climate policy is the politically demanding Europe-wide inclusion of the transport and heating sectors in the EU ETS, supplemented by a minimum price for emission certificates.” According to the MCC-PIK expert report, overall the carbon tax option stands a higher chance of swift implementation from an administrative perspective compared to creating a separate emissions trading scheme.

. Graph shows sequencing options for carbon pricing in non-ETS sectors in Germany and Europe. Source: MCC.](/sites/default/files/styles/paragraph_text_image/public/paragraphs/images/mcc-germany-co2pricing-options-longterm_0.jpg?itok=2aYye1zK)

Professor Kai Hufendiek, managing director of the Institute of Energy Economics and Rational Energy Use at the University of Stuttgart, says that whether CO2 was taxed or traded, the impact would be very similar. It’s only deep in economic theory that the differences become evident. “Quantity control is more efficient at first sight, but since we have to take decisions about the future, we won’t get all parameters exactly right, regardless of whether we determine the price or the quantity of emission allowances. Our models show that there would probably be a smaller deviation in the price estimate [i.e. a carbon tax] than in the quantity estimate,” he told Clean Energy Wire.

There is a general consensus that any kind of carbon-pricing system will require measures to alleviate the cost burden on consumers, particularly those with limited financial means. This could be done by reducing taxes on other energies (e.g. electricity), or by using part of the revenue from the pricing scheme to offer refunds to households. The new funds could also be used to pay for renewable energy development, home insulation programmes and heating system refurbishments.

Politicians and parties: Who wants what?

The debate in Germany is very active and proposals focus on versions of carbon trade system, a CO2 tax, the ETS integration or mixtures of these options. Many organisations, associations, politicians and government advisors have presented recommendations to influence the decision-making process in the "climate cabinet". Chancellor Merkel has set up this round of ministers to find ways on how Germany can ensure reaching its 2030 targets and the cabinet has put CO2 pricing on its agenda as one possible measure. The climate cabinet has promised key decisions by September 2019.

Environment Minister Svenja Schulze (SPD): Has long called for carbon pricing, not yet decided on a specific model, but says a CO2 tax is the “most practicable” way.

Energy and Economy Minister Peter Altmaier (CDU): Long said carbon pricing is not part of the coalition treaty and therefore not part of his work programme. Economy ministry advisors recently recommended introducing emissions trading systems for the transport and building sectors to meet climate targets and promote international cooperation on climate action.

Social Democrats (SPD): Party remains vague, now generally supports reform of German energy taxes and levies, but finance minister Olaf Scholz, for example, has been hesitant in backing up his party colleague Environment Minister Svenja Schulze on this.

Christian Democrats (CDU/CSU): Some MPs oppose carbon pricing outside the EU ETS; at the start, the CDU leadership and ministers had shown little interest in pursuing the topic. Now, parties deeply split on issue, with some calling for emissions trade, others for CO2 tax, yet others for reform of existing energy taxes and levies.

Green Party (opposition): Supports a carbon floor price in the EU ETS and a carbon tax in non-ETS sectors.

Free Democrats (FDP; opposition): Supports a cap-and-trade system, calls for integration of transport and buildings into ETS; opposes a carbon tax.

*Agora Energiewende and Clean Energy Wire are both funded by Stiftung Mercator and the European Climate Foundation.