Solar power in Germany – output, business & perspectives

Quick facts

Number of solar arrays installed: 5 million (April 2025)

Total capacity installed: 104 GWp (April 2025)

Newly added capacity in 2024: ca. 17 GWp

Projected expansion: 215 GWp (2030)

Output: 74 TWh (2024)

Share in gross power production: 15 % (2024)

Employment: 84,100 (2022 est.)

(Sources: BSW Solar, UBA, AGEB)

Output

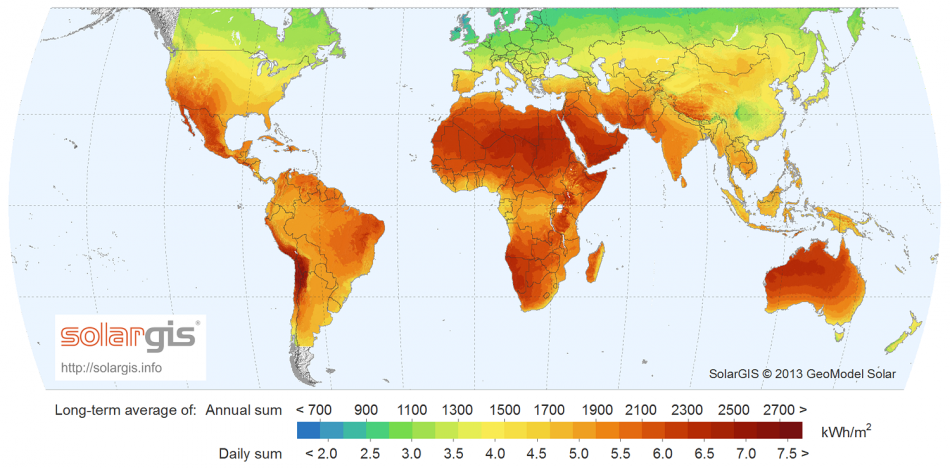

Despite being among the countries with the least sunshine hours, Germany is one of the largest solar power producers in the world. After leading the field for several years, the country ranked 5th globally in installed capacity in the International Renewable Energy Agency’s (IRENA) global ranking in 2024. At the end of 2024, the country boasted a capacity of about 100 gigawatt peak (GWp), according to figures by solar PV industry group BSW Solar.

In contrast to conventional energy systems focused on big and centralised producers, tens of thousands of small solar panel operators have become an important part of the German energy system. Even if climatic changes have let sunshine hours increase significantly in recent years, Germany’s location in northern central Europe mean it receives less sun than many other countries around the world. However, the country’s solar PV systems fed 74 terawatt hours (TWh) of electricity into the grid in 2024, accounting for a 14.9 percent share of total electricity production. Meanwhile, solar power’s global share in power generation stood at about 4.5 percent in 2022, according to the International Energy Agency (IEA).

Solar arrays can contribute a much greater share to the German power mix during particularly sunny times. In July 2024, Germany recorded its monthly record solar power output level to date of 10.1 terawatt hours (TWh) – despite sunshine levels being lower than the previous year. Solar power accounted for around 43 percent of the 23.6 TWh of electricity generated from renewables in that month, according to data from the economy ministry (BMWK).

High solar PV output, both in the short-term around midday and in the long-term during summer, is offset by a reciprocally lower or non-existent output during the winter and at night, respectively, highlighting the need for reliable storage technology to complement renewables expansion. However, sunny weather and hot temperatures are not automatically leading to higher solar power output, as solar modules lose electric tension when they become hot, which brings down their capacity despite the stronger radiation.

Fraunhofer ISE says solar panels achieve up to 980 full load hours per year in Germany, equalling about ten percent of the year - or less than half of the amount that wind power can deliver. The researchers estimate that 1,030 full load hours are possible in the country. However, this is still far below the nearly 6,600 full load hours that lignite plants ran in 2016.

Adding more capacity also acts as a check against oscillating solar power production levels due to weather effects. Despite experiencing a comparatively cloudy summer but thanks to capacity expansion, solar PV installations between January and August 2021 generated roughly the same amount as in the much sunnier previous year.

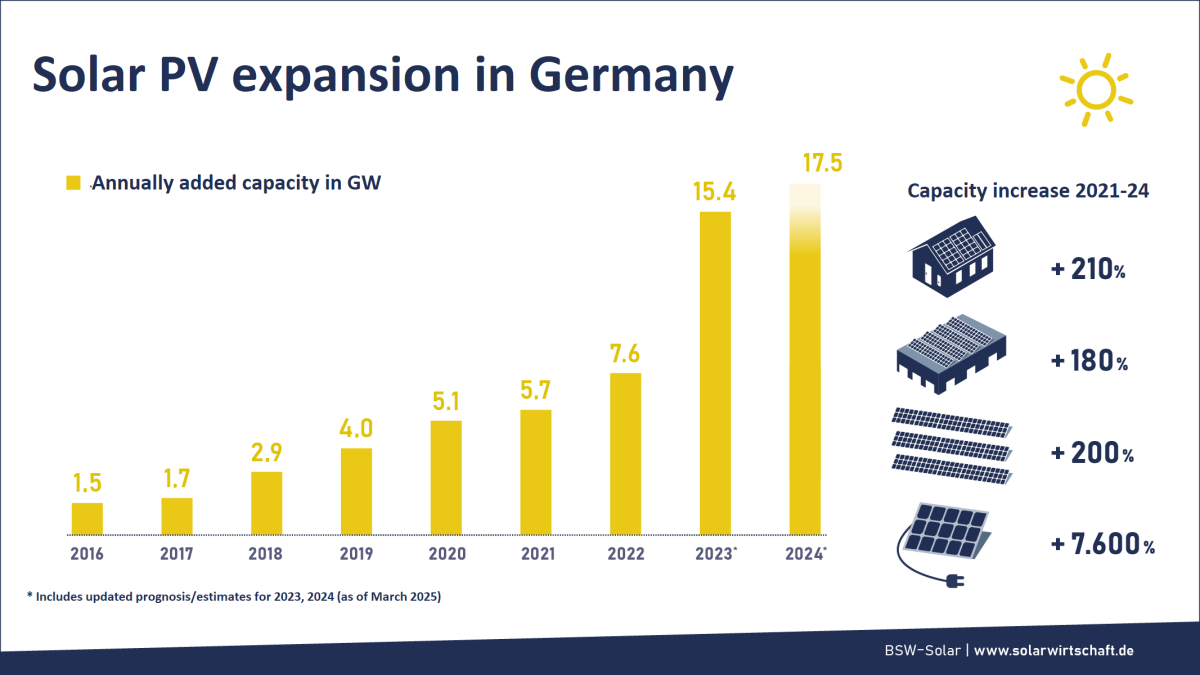

Expansion

The large-scale roll-out of solar power installations began around the year 2000 and peaked for a first time in 2012, with annual additions reaching more than 7 GW. Expansion then fell off a cliff, reaching less than 2 GW between 2015 and 2017, but since has steadily increased again. The German solar industry reached a milestone at the start of the year, as the total capacity of all installed solar power systems surpassed 100 gigawatts (GW), according industry association BSW Solar. Around a million photovoltaic systems with a peak output of 17 GW began operation on rooftops and in open spaces in 2024, up 10 percent on the previous year.

While already leading in Europe in terms of total installed capacity, Germany also topped the ranking in terms of solar PV expansion in 2024, according to consultancy Rystad Energy.

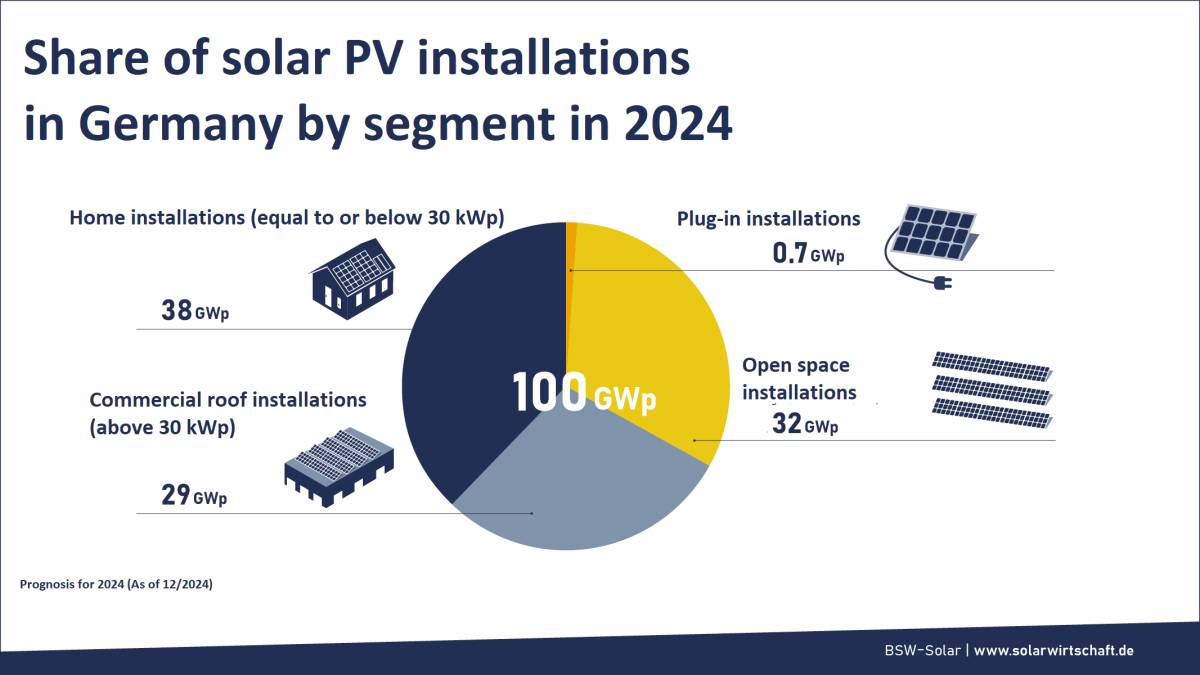

By April 2025, the country had passed the “milestone” of five million PV installations. This means that 104 GW of installed solar power capacity were in operation; 38 percent on roofs of private homes; 29 percent on company roofs; and 32 percent in open spaces. Just under one percent was installed on balconies, according to BSW Solar.

As a key component of the country's push for greater energy independence following Russia's invasion of Ukraine, interest in the technology grew rapidly after February 2022. In April of the same year, the government released its "Easter Package" of renewable energy policy reforms, aiming for a share of renewables in electricity production of 80 percent in 2030 and 100 percent in 2035. This means average annual expansion volumes must exceed 20 GW to reach the target of 215 GW installed capacity by the end of the decade.

Industry groups generally have lauded the efforts that the previous government of chancellor Olaf Scholz has taken to accelerate solar PV expansion since taking office in late 2021. A sustained high investor interest in the technology backed this assessment: With some auctions being nearly twice oversubscribed in 2024 and also in early 2025, the industry can expect expansion levels to remain high.

In 2022, two German states implemented a solar-PV obligation for certain construction projects and more states followed suit with similar legislation. But Renewable electricity provider LichtBlick found that solar energy expansion in major German cities is picking up speed, as roof-mounted installations become more widespread also without mandatory construction. Across the EU, rooftop solar is thriving due to new strategies and regulatory changes adopted by the bloc since 2022, according to NGO Climate Action Network (CAN) Europe. The rooftop solar market grew by 54 percent in 2023 compared to the previous year as the EU accelerated the roll-out of renewables.

The solar sector can expect support from individual consumers in the coming years: Nearly every third house owner in Germany (29%) plans to install a solar power system in the coming two years, according to a survey by energy company E.ON from early 2024. Reasons given by respondents for the planned investment were the desire to reduce their electricity costs (82%) and to protect the climate (56%). This is followed by increasing the value of the property (46%), self-sufficiency (37%) and the desire to supply heat pumps (32%) and electric cars (28%) with cheap electricity. A separate survey conducted by price comparison website Verivox found that almost one third of all residents in Germany want to install or have already installed a plug-in solar system, often known as a balcony power plant. It took until 2024 for the German government to simplify rules for installing and operating them

However, flaws in Germany's tenant electricity scheme that is meant to let non-owners benefit from solar power installations as well mean that vast solar PV potential remains untapped across the country, according to the German Economic Institute (IW). The institute found that 14.3 million rented properties, covering 1.9 million buildings, could in theory benefit from tenant electricity models. As of April 2024, there were only 9,000 photovoltaic systems on apartment buildings in Germany. Reasons given include a lack of economic viability and bureaucratic processes.

Beyond increasing the rollout of rooftop solar arrays, Germany could also increase the space that is suitable for the renewable power technology by dedicating more farm land for so-called agri PV, researchers from Forschungszentrum Jülich and RWTH Aachen University found. Agri PV would largely exceed the potential of other so far unconventional PV technologies – such as floating PV or facilities covering parking lots – as well as the potential of rooftop PV and open-field PV and thus "make a major contribution to Germany’s target of 400 GW(p) of PV for achieving greenhouse gas neutrality in 2045.” However, the agricultural industry lobby group German Farmer’s Association (DBV) has warned that the demand for new space for solar power installations could create acceptance problems among landowners.

An analysis by the Institute for Applied Ecology (Öko-Institut) found that Germany already has significantly more potential for the expansion of ground-mounted photovoltaic (PV) systems on open spaces than is needed under current requirement estimates for a completely renewable electricity system. Moreover, a report by the Federal Highway Research Institute (BASt) found that spaces alongside German highways could be utilised better to build solar energy systems. The report commissioned by the transport ministry suggested a potential capacity of up to 48 gigawatts (GW) of solar power panels along highways, plus up to 4.2 GW for installations on sound barriers and up to 1.2 GW for car parks alongside federal roads.

The country’s solar power market was kick-started with the Renewable Energy Act (EEG) in the year 2000: The number of solar panel producers and service companies skyrocketed, as investors rushed to reap the benefits of the large-scale technology support under the EEG, which gave feed-in precedence to renewable energy sources and allowed investors guaranteed remuneration for a 20-year-period. Between 2008 and 2013, Germany saw its solar power capacity increase rapidly from about 6 GW to 36 GW, about 150,000 jobs in the country by 2011.

However, after its quick ascent to world leadership within less than a decade, the industry faced an even more rapid decline after 2012. Competitors from abroad, especially from China, offered solar panels at a much cheaper rate than German manufacturers, while support rates remained stable regardless of the panels’ country of origin. Consequently, many investors swapped domestic for foreign suppliers to maximise returns and left the freshly expanded German industry bereft of customers.

The effects on the German solar power industry were harsh: Many major players, such as Q-Cells, Solon and Conergy - which often had just invested large sums of money to ramp up production - were forced to close down. As a result, the number of jobs plummeted to just over 45,000 in 2016. SolarWorld, once one of the three biggest solar power companies in the world and the last major solar panel producer from Germany, finally succumbed to Chinese competition and filed for insolvency a year later. The industry initially secured protection from Asian competitors through the implementation of trade barriers by the European Commission in 2013, which imposed minimum prices on Chinese imports. But as it did not succeed in keeping European manufacturers afloat, the EU Commission abandoned trade limitations in 2018.

Many commentators in the past have lamented that the support policy effectively meant that German power customers subsidise Chinese producers. Domestic suppliers therefore were said to be unable to compete due to higher labour costs and stricter environmental regulation on panel production. Others lauded the combination of steady German investment support and cheap Chinese labour as a catalyst for cost reduction that helped boost capacity growth and paved the way for the technology’s competitiveness.

However, business confidence in the sector has steadily increased in the past years and was further bolstered by the government's 2022 announcement to aim for 100 percent renewables in the power system by 2035. As of 2022, the solar power industry employed about 84,000 people in the country, according to data by Germany’s Federal Environment Agency (UBA). In 2023, lobby group BSW Solar said it expects a “lasting solar boom” in Germany. However, a shortage of skilled labour for installing panels and several other factors could still hamper a quick growth of solar power.

While German solar power companies struggle to compete with Asian manufacturers, they retain an edge when it comes to research on the modules’ system integration and the implementation of innovative applications. Foreign market leaders are often focussed on large-scale projects that yield high returns but will likely only account for a part of future growth, where small-scale prosumers are expected to play an important role as well.

Despite the rapid and dynamic expansion of this technology across the country, the national solar power hardware industry has been plagued by difficulties in recent years. Although the demand for solar power systems is higher than ever, the supply of cheaper Chinese PV modules pushed prices down, making it more difficult for other players to compete. Swiss solar module maker Meyer Burger recently announced its intention to wind up panel production in Germany, citing “grave market distortion.” The downturn has already resulted in a number of plant closures and bankruptcies in the sector, including Meyer Burger and Solarwatt, one of the largest remaining German panel producers. Meyer Burger initially planned around a new support scheme by the German government, but this was scrapped following the budget crisis of Scholz’s coalition.

The financial restraint by the government was meet with frustration by industry representatives. While industry lauded a reform package adopted in April 2024 that was expected to boost the use of solar energy in Germany by removing red tape, a "resilience bonus" scheme that would have rewarded customers for buying European-made solar products, was dropped from the package at the last minute. BSW Solar head Carsten Körnig in 2024 warned that the government could have missed what is “perhaps the last chance for a renaissance of Germany’s solar industry,” given the stiff competition on international markets.

Only about two percent of the solar PV modules installed in the EU in recent years were produced domestically, while the vast majority of installations has been imported. European solar power companies have called for a full-fledged renaissance of the sector, arguing environmental and labour standards in China often are far less strict and some producers appeared to even take advantage of forced labour. Policymakers from German states in early 2024 backed industry demands for more political support and called for the implementation of so-called "resilience bonuses or auctions." This would mean, for example, that higher feed-in tariffs would be paid for solar systems that are primarily produced in Europe.

At the time, Germany’s treasury argued that solar PV is “not high tech” and that supporting large-scale production of established technology should not be supported by the state. However, this is exactly what German and other European producers argued China was doing to prop up its national industry and establish dominance in manufacturing of solar panels and other future technologies at a global scale. Former chancellor Olaf Scholz addressed the issue at a visit to China in 2024, which prompted the Chinese government to reject the “theory about Chinese overcapacities,” arguing it failed to apply a wider perspective and that the world still needs “massively more” solar PV installations on its path to carbon neutrality.

However, provisions for onshoring solar power production in Europe under the EU’s Net-Zero Industry Act have led to optimism in the industry that lost ground can be regained. The act “creates a dedicated market for EU solar products, giving much-needed relief to European solar manufacturing,” Solar Power Europe CEO Dries Acke said in May 2025. He added that member states are encouraged “to effectively implement the resilience principles” and launch first auctions that include non-price criteria in the following year.

Also, tighter rules for supply chain management introduced in Germany and the EU could tilt the balance in favour of European producers who can offer advanced life-cycle emissions reduction for their products and also provide more sustainable solutions regarding raw material sourcing and disposal. However, there are also concerns that luring hardware production to Europe risked slowing the technology’s expansion due to higher costs.

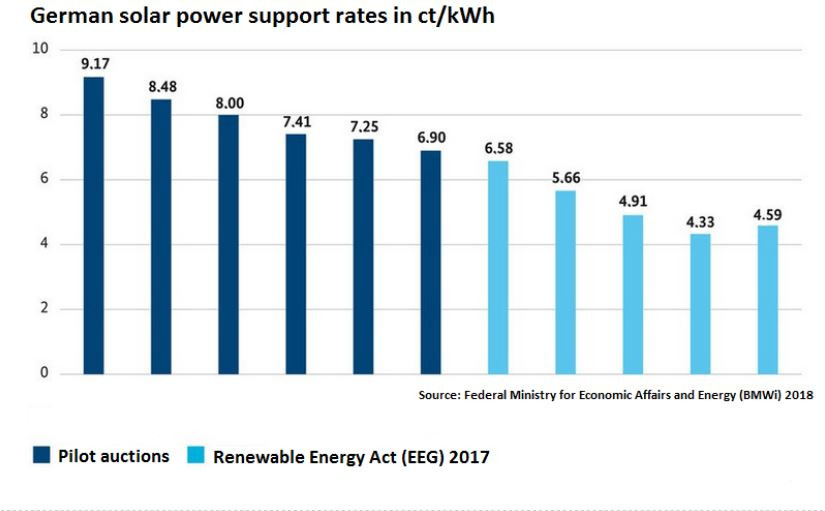

The cost curve for solar PV has been sloping downward constantly in the past years and in 2020, the International Energy Agency (IEA) declared that the technology allows to produce the “cheapest electricity in history.” Between 2013 and 2023 alone, costs for solar PV have fallen by 87 percent, and the cost of battery storage by 85 percent, an analysis Mercator Research Institute on Global Commons and Climate Change (MCC) showed.

According to research institute Fraunhofer ISE, solar power has become the cheapest mode of power generation also in Germany. Depending on the type of installation and sunshine intensity at a given location, generating one kilowatt hour (kWh) with solar panels may cost no more than 3.7 eurocents, Fraunhofer ISE found. In Germany’s first solar power auction in 2025, successful bids averaged at 4.76 ct/kWh.

The strong expansion of solar power in Germany did not lead to increased support costs set under Germany's Renewable Energy Act (EEG), which researchers at the Institute of Energy Economics at the University of Cologne (EWI) expected to decrease in 2025. The EEG guarantees feed-in tariffs for many renewable operators, paying them the difference between the market value of the electricity and a pre-agreed amount per kilowatt hour. This means that the lower the market price, the higher the support payments are.

However, support payments for existing and new solar power installations still carry substantial costs for German power customers: Until mid-2022, the renewables levy (EEG Umlage) paid by power customers as part of their electricity bill was used to finance the difference between guaranteed remuneration levels and sales revenues for renewable power installations. According to Germany’s economy and energy ministry (BMWK), these amounted to over 10.3 billion euros in 2018 alone. In 2021, renewable power operators received a direct state subsidy for the first time, amounting to 10.8 billion euros before the renewables levy was abolished entirely in 2022, after which all costs were covered directly from the state budget.

But many solar power users install their panels also without participating in auctions: According to the Federal Network Agency (BNetzA), just under 3.8 GW out of a total solar PV expansion of more than 5.2 GW in 2021 were installed outside of the tendering process. Of the new installations added, large parts were mounted on the roofs of private investors. Solar arrays with a capacity rating below 10 kWp accounted for over 60% of Germany’s total installations in 2021, many of which were installed by households and small businesses seeking to become more independent of market power prices.

Energy market analysts have said they expect Germany’s solar power boom to cut power prices significantly in the next years, possibly also leading to an increased incidence of negative power prices at times of high feed-in. At times of negative prices, large producers pay for their electricity to be fed into the grid. Experts have suggested a range of options for solving the issue, including grid feed-in control from smaller photovoltaic systems, creating more incentives to increase demand when a lot of green electricity is available, and making demand more flexible.

Companies have begun to offer integrated solutions that allow to store surplus solar energy at home and to share or trade electricity it with neighbours and other prosumers around the clock. As prices for home storage technology have fallen sharply over the past years, they are set to benefit from a trend towards self-supply and decentralised production, making them less reliant on support rates.

However, falling panel prices that have been a large driver in the latest surge in solar power expansion may hit a plateau. This would allow other factors, such as greater productivity, sustainability and flexibility, gain in importance for researchers and investors. Regardless of future breakthroughs in panel development, German citizens already embrace solar power as their favourite form of renewable energy generation.

As the volume of solar power infrastructure grows, end-of-life costs of installations are becoming increasingly important. According to a report by the International Energy (IEA), better recycling procedures are needed for discarded solar panels in Germany. Estimated waste streams in 2030 range between 400,000 and 1 million tonnes, with other estimates putting the amount of PV waste at three million tonnes by 2035, and increasing significantly in the following years.

With the growing importance of solar power in Germany’s energy system, the technology’s specific risks and vulnerabilities are becoming a more tangible political issue. Solar power’s fast growth in recent years already has led to concerns over the electricity system’s ability to absorb millions of new scattered power production facilities across the country, as Germany struggles to bring grid expansion to scale. Grid operators and energy industry representatives in Germany in early 2025 called on the government to approve immediate measures to better control small solar installations to avoid threats to grid stability at peak feed-in times.

Reforms to the Energy Industry Act (EnWG) that passed through parliament at the end of January brought regulations that reduce risk, industry association BSW Solar said. Grid integration was optimised and distribution grid operators will be obliged to regularly check the controllability of photovoltaic systems, the association argued. However, a wider debate about the particular challenges of managing millions of solar power installations have already begun. With Easter 2025 identified as a possible risk moment due to expected high renewables output and low consumption during the public holiday, only cloudy weather conditions alleviated fears by grid operators in Germany over challenges for transmission grid stability.

Cuts to solar power output in spring 2024 caused by dust blown in from the Sahara Desert in northern Africa to central Europe served as another reminder of the new disturbances the energy system is faced with as it transitions towards renewables. Fluctuating quantities of solar electricity over the course of the day and year generally could lead to temporary bottlenecks, especially at the distribution grid level, economic research institute DIW warned. Increasing periods of negative prices on the wholesale electricity market had shown the need for more and improved use of storage capacity, the DIW argued.

The challenge of integrating Germany’s fast-growing stock of solar panels and other renewable power sources into the electricity system while maintaining a parallel buildout of transmission grid and storage capacities led the country’s new energy minister, Katherina Reiche from the conservative Christian Democrats (CDU) to call for a “reality check” of Germany’s renewables expansion. “The blackout on the Iberian Peninsula showed how vulnerable an electricity system can be,” Reiche said, arguing that “we must prepare ourselves for minimising risks of this kind.”

Besides the fluctuating nature of solar power, the decentralized nature of the technology, which increasingly relies on smart grids to allow greater flexibility, also poses risks regarding third-party interference. The Federal Office for Information Security (BSI) in early 2025 warned of a “substantial risk” that imported solar PV hardware opens the door to Chinese interference in Germany’s power supply. Many of the inverters for solar panels used in German homes are made by producers from China and the Asian country’s government or other actors might be able to directly access the devices that are connected to the internet and influence the electricity system, the security agency warned.