Key challenges of a halt to Russian fossil gas imports

Content

1. Intro

2. How much natural gas does Germany use and what for?

3. Where does Germany’s natural gas come from?

4. How does the government plan to reduce gas imports from Russia?

5. Challenge 1: Turning around Germany’s gas supply routes

6. Challenge 2: Keeping up the pressure

7. Challenge 3: Creating an LNG infrastructure from scratch

8. Challenge 4: Storing enough gas for (this) winter

9. Challenge 5: Reducing domestic consumption with limited harm to industry

10. Additional challenges – supply availability, prices

Intro

Since Russia launched its war against Ukraine in February 2022, the consequences for Germany's Russian gas supply has been one of the most contested issues in the country. As one of Russia’s main customers, German traders are paying billions of euros to Russian gas producers every year. At the same time, Germany’s import dependence on Russia and general dependence on gas means that stopping Russian supplies could severely damage German industry, lead to businesses leaving the country for good, cause mass unemployment and even lead to social unrest, researchers and the government have warned. Other researchers have calculated that the overall impact on the German economy would be manageable, even in the event of a sudden embargo on Russian gas.

How much natural gas does Germany use and what for?

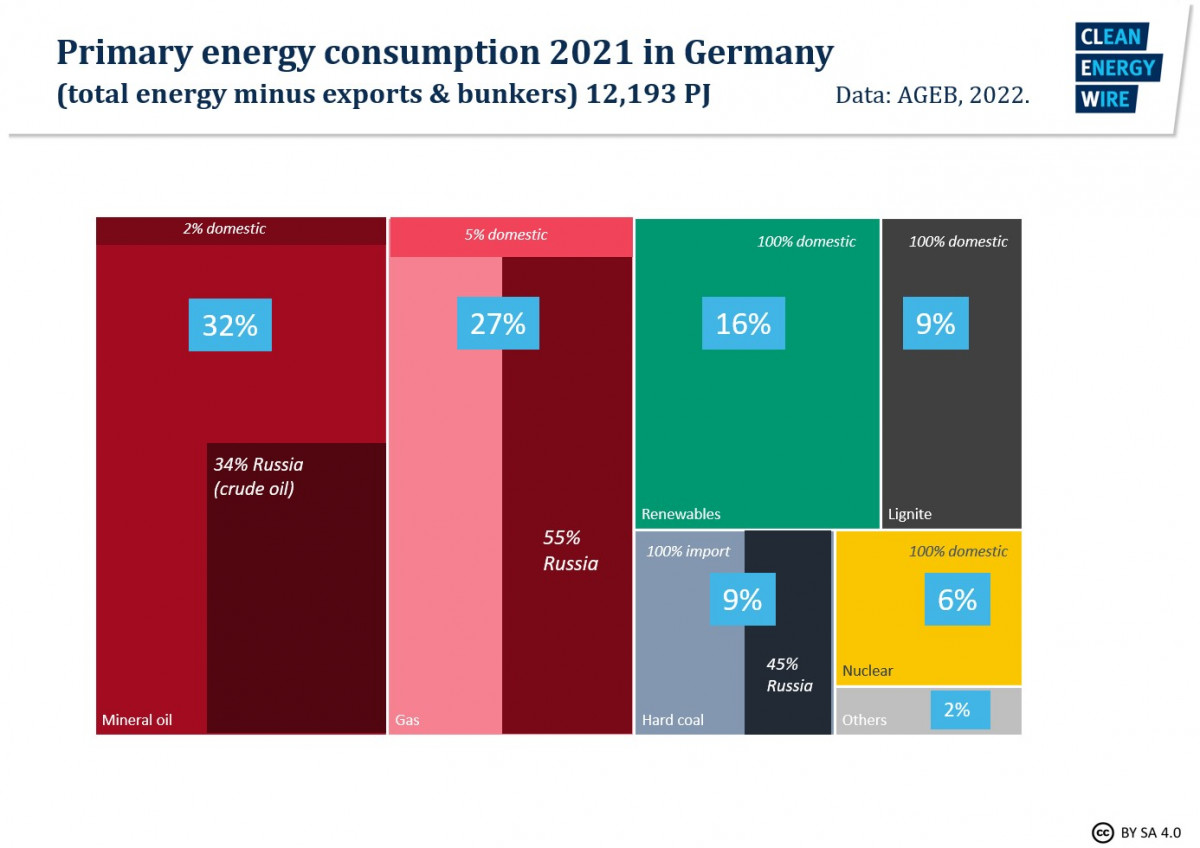

Germany is Europe’s largest economy and covers more than 60 percent of its energy consumption with imported fossil fuels. Natural gas makes up about a quarter of the country’s energy consumption (26.7% in 2021) and is mostly used for heating and in industry.

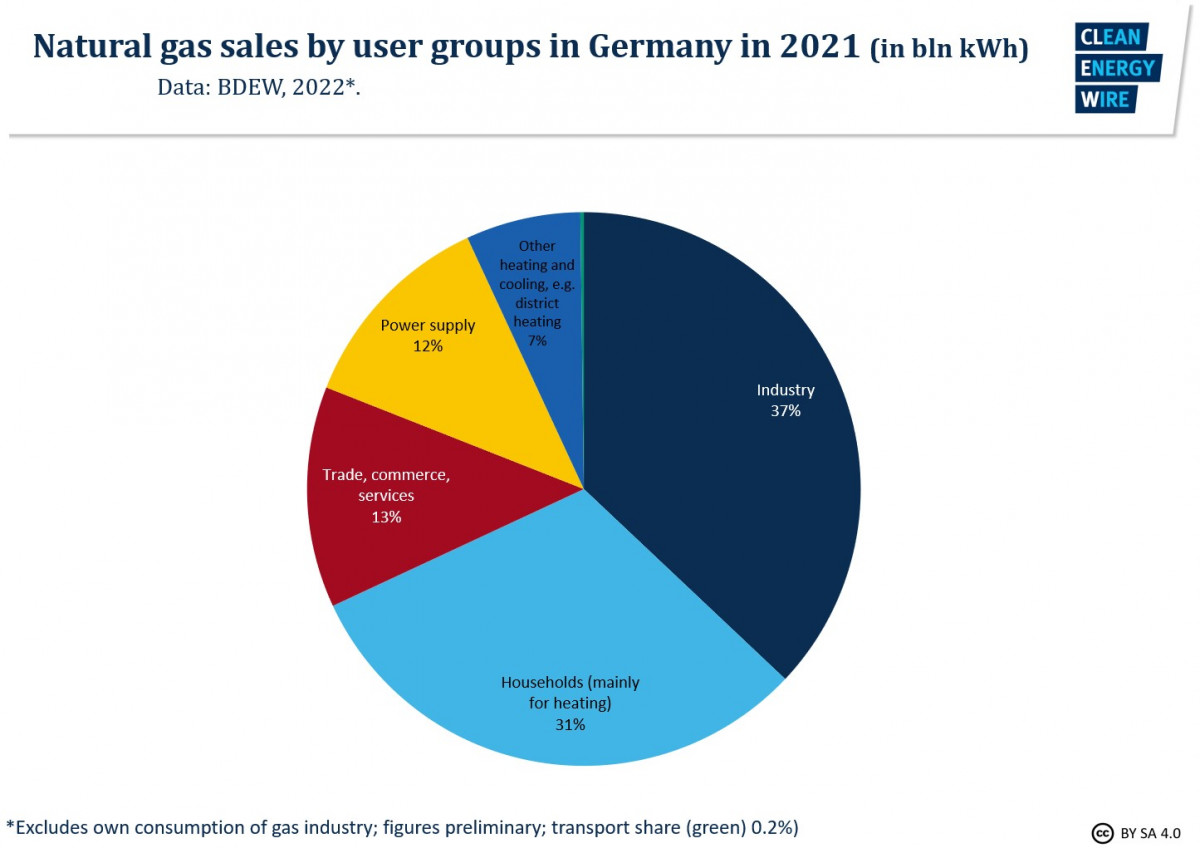

Germany’s gas consumption amounted to 1,000 billion kilowatt-hours in 2021. The biggest consumer was industry (37%), followed by households (31%) and commerce/trade/services (13%). Only a rather small share (12%) was used to produce electricity. The majority of natural gas is used for heating processes, either to generate high temperatures needed for industrial processes, or for room heating. In the power sector, gas is often used in combined heat and power plants, supplying not only electricity but also heat for cities’ district heating networks. Some gas is used as feedstock in industry.

Where does Germany’s natural gas come from?

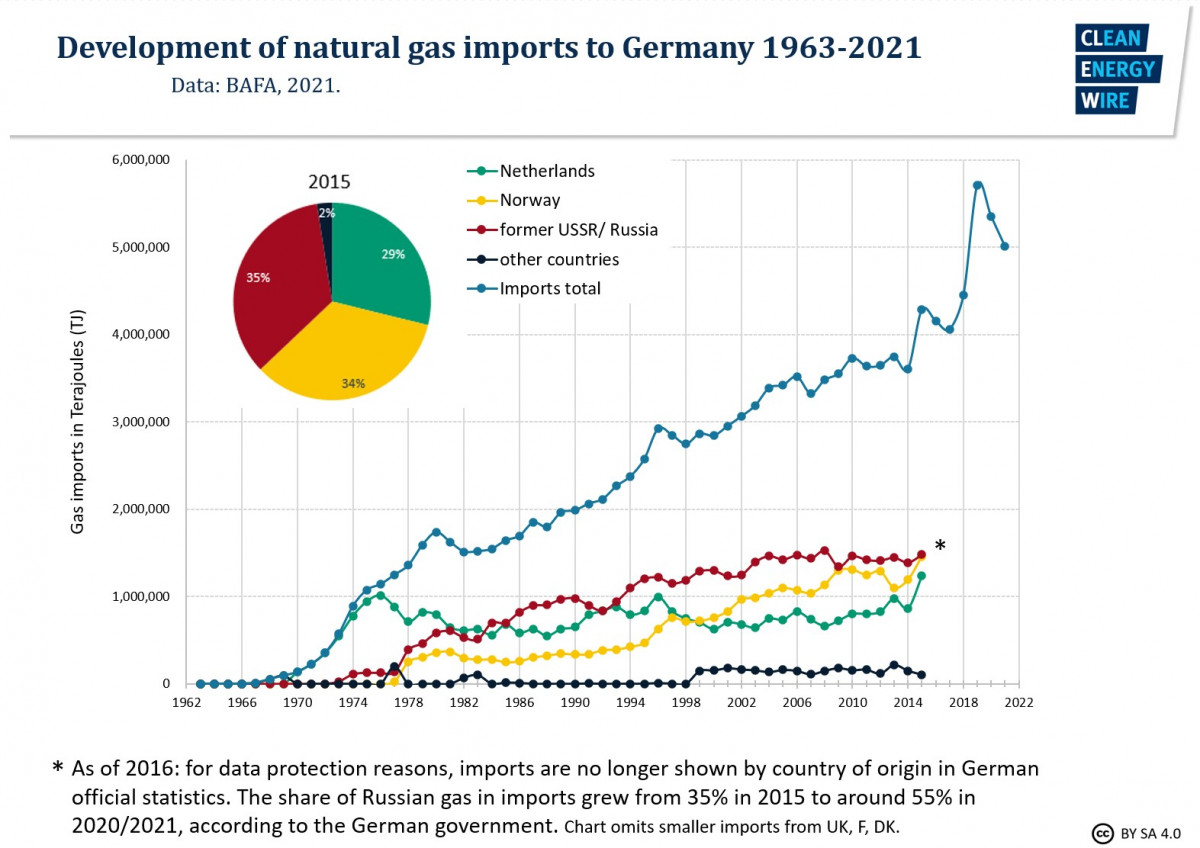

The vast majority of the natural gas used in Germany is imported (95% in 2021), as there is little domestic production and existing fields are nearing depletion. Germany’s main suppliers traditionally have been Norway (30% in 2021), the Netherlands (13%) and Russia, with the Russian share in gas imports to Germany growing from around 40 percent in the first half of the 2010s to around 55 percent in 2021.

How does the government plan to reduce gas imports from Russia?

By late May 2022, there had been no serious negotiations at EU level concerning a possible embargo on Russian gas imports.

As part of the ‘RePowerEU Plan’, the European Union aims to reduce demand for Russian gas by two-thirds by the end of the year and end Europe’s dependence on Russian energy well before 2030. First details about RePowerEU released in mid-2022 include energy savings, diversification of energy supplies and an accelerated rollout of renewable energy to replace fossil fuels in homes, industry and power generation.

While the government in May 2022 said Germany is now ready to support an import embargo on Russian oil (despite the practical challenges), its plan for doing without Russian gas is more long-term. In the beginning of May 2022, the government said in its energy security update that Russia’s share of German gas imports fell from 55 percent in 2021 to 35 percent by mid-April 2022. Through energy efficiency, energy savings and electrification by businesses and households, the share could decrease to 30 percent by the end of the year, said the economy ministry. With a “joint effort,” “massive” renewables expansion and a fast ramp-up of hydrogen, it could come down to 10 percent by 2024, the ministry added.

Several practical challenges have to be overcome to make this possible, such as delivery infrastructure, gas storage as well as buying and possibly also rationing of natural gas during the diversification of supply.

Challenge 1: Turning around Germany’s gas supply routes

So far, Germany has received practically all its natural gas via pipelines, reaching the country mainly from the East (Russia), as well as from the North (Norway and the Netherlands). There are no national ports that can receive shipments of liquefied natural gas (LNG) but Germany is well-connected via pipeline to LNG terminals in neighbouring countries. The transmission pipeline network is about 40,000 kms long. At the centre of Europe, the German gas market has developed into a leading trading hub.

“As with the Autobahn for truck freight traffic, Germany is also a European hub for gas,” says Frank Graf, head of Division Gas Technology at the DVGW Research Center at Engler-Bunte-Institut of Karlsruhe Institute of Technology (KIT). “We pass on almost the same amount we consume to our European neighbours.”

Thus, Germany always has to keep supply of its European neighbours in mind when making decisions gas flows. The prevailing direction of flow in and through Germany has been from the north-east to the south-west. Without deliveries from Russia, the system would have to be turned around to a certain extent. A majority of LNG ports are in the west of Europe and gas would have to be transported eastward to and through Germany, for which so-called reverse-flow capacity is needed.

, retrieved 25/05/2022. Map shows major gas piplines in Europe. Source: ENTSOG TP.](https://www.cleanenergywire.org/sites/default/files/styles/paragraph_text_image/public/paragraphs/images/entsog-transparency-map-major-gas-pipelines-europe-2022.jpg?itok=S7imX56_)

As part of network planning, grid operators are examining how a higher west-east usage could be achieved. “In addition to contractual restrictions (fixed marketed capacities), technical adaptation measures are required at one point or another in the network, for example for compressors, for an optimised operating mode,” said the association of transmission grid operators FNB Gas.

This is a challenge, says researcher Graf. “The transmission capacities from West to East are not sufficient. For example, compressor stations are often not built to operate in the other direction.” Graf cites projects in recent years to make the system more flexible. “There are border crossing facilities where gas can be transported in both directions, but these capacities are not enough to completely change the direction of Europe’s gas flows.”

According to FNB Gas, facilities like border crossing stations can be partially “turned around” with manageable effort. However, making them truly bidirectional requires complex conversion. Researcher Graf says this could take 2-3 years – especially due to permit procedures -- and current supply chain issues for necessary material must also be taken into account. He and other experts have called for a detailed calculation of flow needs, also to see where reverse flow capacities could be increased.

Another issue regarding reverse flow arises at the border between France and Germany. In Germany, transmission system operators are prohibited from passing on odorised gas to network customers in order to protect sensitive industrial processes, says the network of European transmission grid operators ENTSOG. Where odorisation is required, this is performed in the distribution networks, whereas in France, gas is odorised upon entry into the transmission network. Thus, there is currently no flow of (odorised) gas from France to Germany, and legal and technical provisions would have to be changed.

Challenge 2: Keeping up the pressure

The German gas transmission network is operating under a pressure of up to 100 bar to ensure that molecules move from point A to point B and all applications run smoothly. Compressors at regular intervals keep that pressure steady and change it according to the needs of the infrastructure – higher pressure for long-distance transport, lower pressure in distribution networks and when the gas arrives in households. Many applications and infrastructure components require a certain pressure to function properly.

In case of a supply disruption from Russia, the pressure in the network would decrease, unless measures are taken to counteract this, such as cutting off consumers. Once pressure drops below a certain threshold, re-starting the grid is a laborious process, especially in parts of the network that lack certain safety devices.

“If there really were a supply interruption, it would not be so easy to get the system up and running again, especially in distribution grids” says researcher Graf. “Local utilities might have to go into the cellar of every household customer, vent the systems and make sure that no explosive mixtures develop.”

Large industrial consumers, such as chemicals company BASF, require the highest operating pressure. The industry giant's facilities at the Ludwigshafen site are connected to both the regional distribution grid and the transmission network, the company told Clean Energy Wire. Up to a certain pressure threshold, all plants at the site could be operated without adverse effects. “If pressure drops, but remains above another threshold, emergency shutdown systems kick in that allow a few plants to move into a safe state,” said a spokesperson. After pressure has stabilised, these plants could be started up again. If pressure drops below the second threshold, more plants will move into a safe state and can be started up again once the pressure is stabilised.

Challenge 3: Creating an LNG infrastructure from scratch

There is some discussion about the extent to which new import infrastructure for liquefied natural gas (LNG) is necessary in Germany and across Europe, as the continent weans itself off Russian pipeline gas. Several EU countries plan to increase their import capacity, also with floating terminals (Floating Storage and Regasification Units, FSRUs). These floating units take at least several months to install, so their role in case of a sudden halt to Russian supplies is limited. Proper onshore terminals even take years to build and conncet to the system.

The German government is planning to install several floating LNG terminals in German ports as early as the winter of 2022/2023. The plan includes leasing four FSRUs, via which around 33 billion cubic metres (m3) could be landed by summer 2024 (in 2021, Germany purchased 46 billion m3 gas from Russia). Some 7.5 billion m3 could be made available via the terminals by the winter of 2022/23, the government says.

In the longer term, the installation of fixed LNG terminals is envisaged, with one facility at the northern German port of Brunsbüttel (8 bn m3 capacity) possibly ready for supply by 2026. To facilitate the terminals' installation, the federal economy and energy ministry has proposed an “LNG Acceleration Act,” temporarily easing planning procedure requirements, such as environmental impact assessments, to speed up the licensing process.

Expanded capacity in Germany's neighbour countries France, the Netherlands and Poland will probably be available before a first terminal goes into operation in Germany, said a group of researchers from leading German institutes in a background paper. “If, in addition, a corresponding expansion of transport capacities to Germany can also be achieved, this must be taken into account when planning German terminal capacities so as not to create capacities that contribute neither to security of supply nor to climate targets,” they wrote.

Challenge 4: Storing enough gas for (this) winter

Germany’s gas storages are the largest in Europe and the fourth largest in the world, with a total capacity of 23 billion m3, or around a quarter of the EU’s gas storage capacities. Gas storages function as buffers in times of high gas demand (on cold winter days, up to 60 percent of domestic consumption is covered from the storages) and are usually filled up over the summer when demand for heating is low.

Storage levels in Europe in early spring 2022 equalled the average of previous years, but varied widely from country to country – causing concerns for many governments that they might not be able to fill storages sufficiently for next winter.

Should there be a disruption of gas supply from Russia, European countries would face quite different types of repercussions, a recent outlook compiled by transmission grid operators showed. Storage levels in mid-May 2022 were much higher than on 1 April of that year, meaning that if supply had been disrupted at the time, especially eastern European countries would have missed annual gas storage targets by a wide margin.

Using alternative gas supply sources, Europe could fill storages to 50-60 percent by the deadline on 1 November, said the grid operators. “The EU is dependent on Russian gas to inject the remaining 30 percent necessary to meet the 90 percent target.” The bloc has agreed that member states will need to reach a minimum 80 percent gas storage level to protect against potential interruptions to supply. From 2023 on, the target will be raised to 90-apercent full gas storages. Germany has already passed legislation introducing the 90-percent target. However, analysts have warned that setting such targets is one thing, but actually obtaining the necessary gas to fill the stores is another.

Germany will continue to fill its storages in a market-based way, but if traders don’t use their booked storage space, it can be taken away from them and if necessary, tenders for gas options will be used to incentivise higher volumes. Trading Hub Europe GmbH, established as a cooperation of all gas pipeline operators in Germany, is responsible for buying extra gas if storage levels are still not reached.

Germany’s gas storage facilities are operated by around 30 different companies, which store the gas they trade with but which also rent out storage space to other traders. Some of Germany’s largest gas storages are operated by Astora, a subsidiary of Russian state company Gazprom. These storages were not filled sufficiently in 2021, before Putin launched his attack on Ukraine, leaving storage levels in Germany below the usual levels this winter and driving up prices. Like other Gazprom subsidiaries in Germany, Astora is now under the trusteeship of the German Federal Network Agency (BNetzA).

Challenge 5: Reducing domestic consumption with limited harm to industry

Industry representatives have already warned that a halt to Russian gas supply would put a lot of pressure on companies, as prices would rise even more and alternative supplies are hard to come by. However, there are also technical hurdles for the industry.

Gas is used year-round, either for processes requiring very high temperatures or as feedstock, for example for fertilizers or in the chemical industry. While renewables-based gases, such as green hydrogen, are set to replace fossil gas in the longer run, they are not yet available at the necessary volume and affordable prices. Thus, using fossil gas in industry processes cannot be substituted overnight. Companies can either try to run operations more efficiently, or lower/shut down production.

A sudden halt to gas supplies therefore could have dire consequences for certain businesses. Glass, for example, is processed at more than 1,000 degrees Celsius. It is more efficient to run these plants for years than to let them cool down. In addition, cooling units down could cause damage that may take months to repair.

So, many companies have written letters to the government insisting how “systemically relevant” they are, often highlighting their role in what could be a long line of production steps for crucial products. The assessment of how relevant a company is will influence the shutdown order the Federal Network Agency decides in case of a supply shortage. Private households, hospitals, schools, but also small businesses like bakeries and supermarkets, are among the “protected final consumers,” which would be given priority.

Additional challenges – supply availability, prices

Of course, there are other key challenges that are less technical. First and foremost, Europe and Germany would have to find sufficient alternative sources to fill the gap left by Russia. High gas prices due to supply shortages are a global phenomenon and key competitors for scarce resources like LNG include Asian countries like China or Japan.

In addition, European governments have emphasised that citizens – especially those with lower incomes – must be supported to cope with the burden of rising prices. Introducing an embargo on Russian imports would almost certainly cause a further rise in prices, with popular reactions to dwindling energy purchasing power being a major uncertainty. Germany already has introduced several relief measures, such as lowering petrol and public transport prices for several months.