Shutting down nuclear and coal – can Germany maintain supply security on renewables alone?

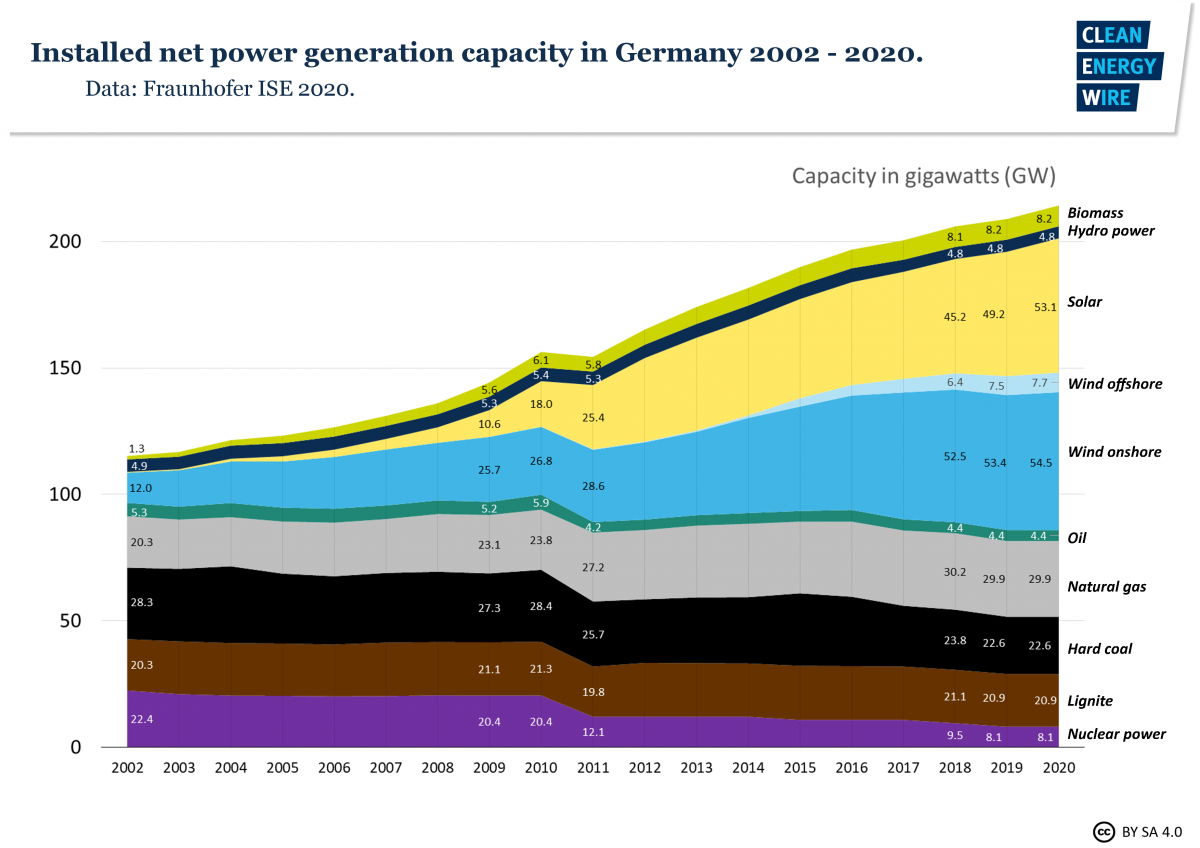

Germany’s conventional power generation capacity is beginning to dwindle. In December 2022, the country will have over 23 gigawatts (GW) less nuclear power capacity than ten years ago. By the end of 2022, some 13.9 GW of lignite and hard coal-fired power stations will be closed according the coal exit law. All this while the population and the economy grew and power consumption only fell slightly.

On paper, coal and nuclear capacities have been easily substituted by an unprecedented boom in renewable energy sources. The capacity of solar PV, wind and biogas installations increased from 12 GW in the year 2000 to 132 GW in 2020. As electricity generation from these sources is less constant and its distribution in Germany itself can be described as “lopsided” with the majority of green power coming from the windy North but is needed in the industrial centres of the West and South, much depends on the ability of the country’s 35,000 km transmission grid to transport the electricity. While some experts argue that only a fleet of gas-fired power stations could guarantee that the lights stay reliably on, others point to the existing reserves and future European interconnections as the reasons why electricity supply would remain stable.

In 2018, Germany’s influential energy industry association BDEW said that Germany would run into a “shortfall in secured capacity by 2023 at the latest”, and that the country shouldn’t rely on its neighbours to make up the difference. Three years later and a lot closer to the nuclear phase-out, BDEW head Kerstin Andreae says: “For a secure energy supply, we also need new gas-fired power plants, as this is the only way to obtain the required controllable power.”

However, so far with fewer fossil capacities in the system and a share of almost 45 percent renewables in power consumption, the power system is still running smoothly. “In the long term, domestic fossil fuel-based capacities will not be necessary if the integration of the European power grid and especially the interconnection and distribution of power from the vast offshore capacities in the North Sea are taken seriously,” Andreas Jahn of the Regulatory Assistance Project (RAP) told Clean Energy Wire. “And obviously we also need further renewables expansion and the right market mechanism so that flexible capacities are added”, he said.

Nevertheless, the fear of not having enough power – even in the immediate future – and of an ensuing instability of the grid and supply is hard to shake. By the end of 2022, Germany will have switched off its last 8.1 GW of nuclear power. Another 6.4 GW of coal capacity are scheduled for shuttering by 2023. Recent events and publications have given ammunition to those who fear a collapse of the system.

New fears after near-blackout event and auditors’ warning

On 8 January 2021, a cascading tripping of several transmission network elements, starting with a busbar coupler in the Ernestinovo substation in Croatia, led to a separation of the European transmission grid system into two areas, something that has been described as “one of the most critical near-blackout situations” since the last major blackout in Europe in 2006. Although quickly resolved and without a link to the growing renewable capacity in Europe, the incident prompted energy industry association VIK to echo the BDEW’s 2018 warnings.

A few months after this event, Germany’s Court of Auditors, which scrutinises the government’s adherence to its measures and goals during the energy transition, said that it was not at all satisfied with the energy ministry’s monitoring and predictions of future supply security. The auditors name the government’s plan to phase out coal and nuclear power while at the same time ramping up hydrogen production as having a “significant impact on the future security of supply.” They also said that the measures to alleviate grid bottlenecks were not sufficient and that the ministry had failed to account for a “worst case scenario” and to specify possible solutions for it.

So, can a large industrialised society like Germany run securely and smoothly on a power system largely fed by these intermittent renewable energy sources? In the end, the question is not whether it can, but how? By 2045, Germany wants to be climate-neutral, reaching emission reductions of 65 percent by 2030 and 88 percent by 2040. The government’s plan is to achieve this chiefly by electrifying all sectors, from transport through heating to industry, as much as possible with green power. Having decided against the use of nuclear power and due to a lack of naturally available hydro power, intermittent generation from solar plants and wind turbines is the technology of choice – and its share in (a rising) power consumption will have to exceed 65 percent by 2030 (up from around 45% in 2020).

The energy ministry is confident that – even in the difficult years just after the nuclear phase-out – this process will not endanger the power supply of companies and households. In a reply to parliamentarians, it wrote in March 2021: “All analyses of supply security known to the federal government and carried out in accordance with the latest scientific findings come to the conclusion that the secure supply of electricity in Germany will remain guaranteed at the current high level for the foreseeable future. The analyses also take into account the phase-out of nuclear energy and the end of coal-fired power generation.

Expectations are high that the new North-South wind power “highways” are going to solve the problem of less nuclear and fossil capacity in Germany’s power-hungry South. If all goes well, these should be completed by 2025, but the Court of Auditors doubts that this timeline is feasible.

Wind power highways threatened with delays

At the end of April 2021, the latest Network Development Plan (NEP), which outlines the future need for transmission lines in accordance with different energy supply and demand scenarios, featured alternative completion dates for five crucial direct current transmission lines, all two years later than originally planned. The four transmission grid operators said the original dates assumed “a very ambitious realisation largely without taking into account future risks,” while the new dates do take certain future risks into account. “In view of past experience, the later date corresponds to the expectations of the TSOs, but is subject to further uncertainties, so that a further delay of the stated date is as likely as its realisation,” the NEP says.

This assessment comes as a blow to federal energy minister Peter Altmaier, who declared grid expansion one of his priorities when taking office in 2018. After his predecessor had made - the much more expensive - underground cables mandatory to appease citizens’ opposition to overland lines, Altmaier wanted to streamline the planning process. In response to the latest NEP, his ministry published a list of accomplishments, which included the implementation of more efficient planning and approval procedures and an agreement between the states of Bavaria, Hesse and Thuringia, which had been at odds over the path of further power lines. There were some success stories when the route corridors for the major SuedLink and SuedOstLink lines were approved by the Federal Network Agency (BNetzA). However, for none of these direct current projects has the planning process reached the point where citizens could launch legal action – and herein lies the unknown risk of delays.

“My feeling is that public acceptance is growing, putting the lines underground has worked,” Stefan Kapferer, the CEO of German transmission grid operator 50Hertz, told Clean Energy Wire and other journalists. He said his company, who is running the transmission grid in Germany’s fomer coal mining hot-spot and windy North-East, will run a stable system with a 100 percent share of renewables by 2032. The current average share of renewables in the 50Hertz grid is at around 60 percent.

He said that completing the 540-km SuedOstLink from Saxony-Anhalt to Bavaria by 2025, which his company is partially responsible for, “is still a very challenging time target.”

To everyone who is involved in grid planning, the good news from the latest NEP is that no new, as yet unplanned large North-South connections will be needed until 2035, which means that future grid planning in general has taken the needs of the energy transition realistically into account – also including a higher share of renewable power due to the increased climate objectives.

Will the lights go off if the power highways aren’t completed in time?

The combination of less conventional power generation in the South and the (possible) delay in the construction of power lines that would deliver the much-needed wind power from the North has triggered calls for new gas-fired power stations to be used as a bridging technology. “There will be situations where we will need back-up from gas power plants,” Kapferer said. He said Germany would need some 40 GW of gas capacity in the medium to long-term (total peak load in Germany is currently at 80 GW; current gas capacity at 30 GW). The Federal Network Agency lists a total of 2.5 GW in new battery, pumped hydro and gas capacity to come online between 2021 and 2023.

The situation of gas plants in Germany is a difficult one. Existing gas power stations have long lain idle as they were outpriced by cheaper renewable, coal and nuclear electricity. A good example is the gas-fired plant at Irsching, once hailed as one of the most modern and efficient plants in the world and practically mothballed since before 2017. Only when the price for emissions under the European Emission Trading System (EU ETS) as well as the wholesale power price started rising in 2020 did some of these plants get back into the black.

This is still not enough reassurance for investors to think about building new plants, as critics of Germany’s Energy Only Market (EOM) have often stressed.

Investors are staying away from new gas plants as market gives few incentives

Kerstin Andreae of the BDEW therefore criticised the EU Commission’s recent draft for the taxonomy for sustainable finance, which excluded gas-fired energy generation from the list of sustainable investments. “We need to build these new power plant capacities now. Although they will initially run on natural gas, they are already capable of using hydrogen as an energy source in the future and will thus ultimately become climate neutral,” she said. But without a clear decision from the Commission „ important energy transition investments are at risk”, she said.

“Every investor thinks twice before investing in gas backup capacities in Germany,” Kapferer of 50Hertz said, adding that it was the lack of a capacity market that scared of investors. On the energy only market, only produced electricity is traded and power stations have to pay for their fuels and investments with the money they earn on the power exchange. When reforming the power market in 2016, the government decided against establishing a capacity market where the mere provision of capacities is traded and remunerated. “The electricity market can provide the necessary capacities and the solutions required to integrate renewable energies more cost-effectively,” the energy ministry said in a white paper.

In March 2021, the ministry said that enough combined heat and power (CHP) plants were being switched from coal to gas – something that is incentivised by the government – and that these capacities in combination with the European integration of energy systems and new powerlines would ensure supply security.

Andreas Jahn of RAP told Clean Energy Wire that the existing over-capacities in the German and European systems are more than enough to ensure supply security, if renewable energy investments are on track and wholesale and CO2 markets can provide required price signals. In this case, additional gas capacity will not be necessary at the moment. “If at all, we should look at using the existing plants not at investing in new ones,” he said.

Transmission grid operators, who have a keen interest in a balanced supply and demand structure because it makes their job of keeping electricity flows stable a lot easier, are also confident that they will continue to run a blackout-free system even without nuclear, coal and gas power. They have begun to invest in all the new technology and modernisations needed to run the power network without the stabilising effects of fossil-fuelled power stations. These include small backup gas plants in the South of Germany that will help stabilise the grid or the 180 million euro investment by TSO Amprion in the world’s largest Static Synchronous Compensator (STATCOM), which provides reactive power needed to regulate the voltage. While relatively relaxed in their own scenarios on the overall available power capacity to run a secure system, German TSOs are adamant that these grid stabilising technologies (besondere netztechnische Betriebsmittel – bnBm) are very much needed to compensate for the stabilising effects that used to be provided by large power stations.

Grid operators are well versed in dealing with bottlenecks and high renewables input

When it comes to dealing with future grid bottlenecks and reduced national capacity, grid operators have already perfected a range of measures, which – albeit costly – have so far ensured that Germany’s power supply remains one of the most reliable in the world despite the large share of fluctuating renewable power input in the system.

Contracting additional power generation in the South and reducing conventional production in the North when not enough of the Northern wind power can make it through the grid (re-dispatch) or curbing wind power input (feed-in management) are tested measures to stabilise the system. In 2020, the total costs for stabilising interventions by grid operators rose to 1.4 billion euros (up from 1.3 billion in 2019). Some 6,146 gigawatt-hours (GWh) of renewable electricity had to be curbed, five percent less than in 2019 thanks to new power lines in the North. Re-dispatch capacity increased from 13,521 GWh to 16,795 GWh. Capacity and costs for these interventions are expected to come down once the large North-South power connections are complete, scenarios in the new Network Development Plan show.

Although the government didn’t want a real market for controllable capacity, there is a fleet of backup power stations that are standing by to avoid shortfalls in power generation, e.g. during so-called “dark, dead calms,” when typically on non-sunny, non-windy winter days renewable generation is particularly low. Coal plants that want to cease operation are only permitted to do so after the Federal Network Agency (BNetzA) has verified that they are not necessary to ensure supply security. If they are, they have to stay on as backup.

Capacity and security reserves have never been used

Following the return of some of the Southern gas plants to the fleet due to the new favourable market conditions, the so-called “network reserve” used for re-dispatch measures will even be smaller in 2021/2022 and 2023/2024, the BNetzA announced in late April 2021. The provision and use of grid reserve power plants cost 283 million euros in 2020. Two other reserves -- the “capacity reserve,” for which grid operators tendered some 1,056 MW of capacity from eight power stations for the years 2020-2022, and the “security reserve” of mothballed lignite plants -- have never been used.

European network integration key to future system security

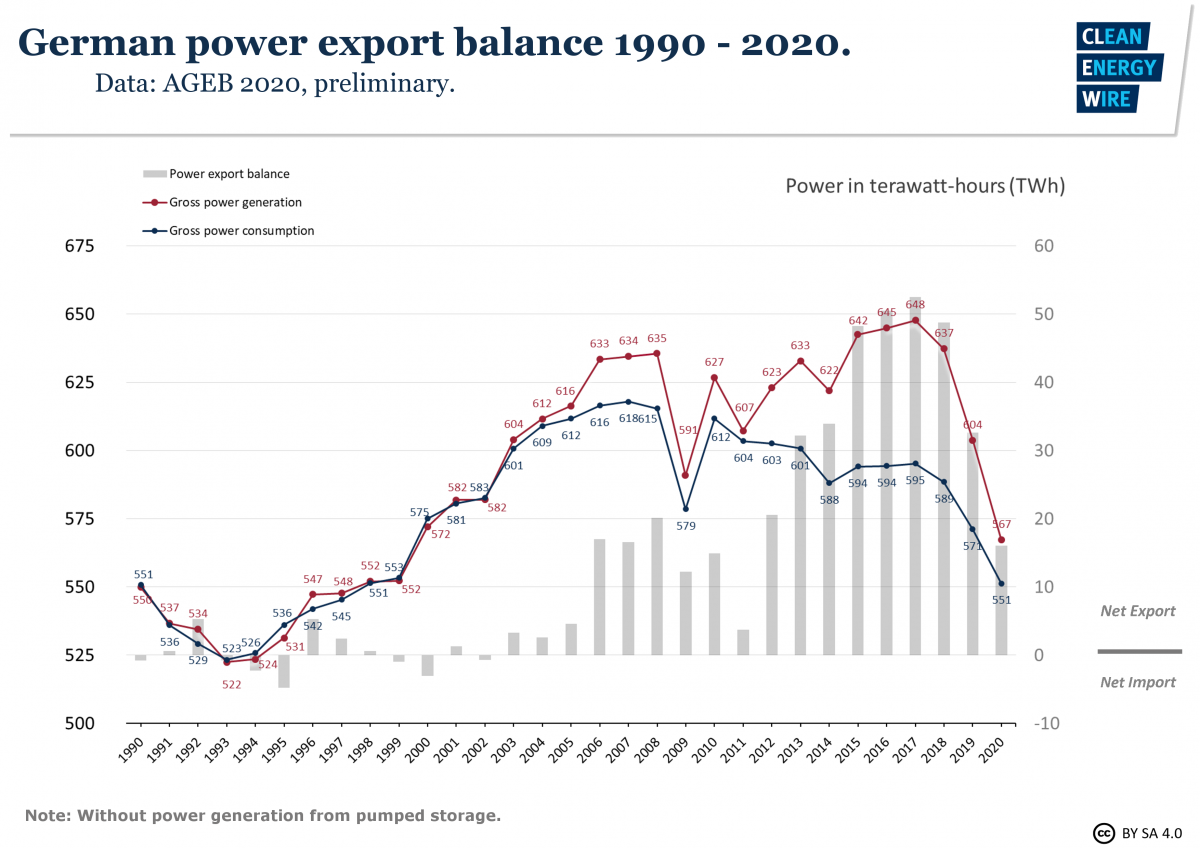

Although the energy ministry and grid operators as well as experts, such as Andreas Jahn, agree that a dangerous under-capacity is not in store for Germany, they all stress one important change that will be necessary to keep it that way: European power grid integration. Germany, still a net exporter of power, will have to import electricity more frequently. As its European neighbours are also transitioning to more renewables-based power systems, the countries will have to work together to support each other’s supply security. The energy ministry highlights that an integrated European system will save each member state from having to provide some extra 50 to 60 gigawatt in national capacity – and avoid the need to pay for it.

Critics say that the weather systems tend to affect many European countries and their renewable production simultaneously and that periods of high demand are also very similar across the continent, so they can’t serve as a backup for each other. But most projections show that the combination of fluctuating generation with controllable capacity, e.g. hydropower and in other countries nuclear power together with large amounts of offshore wind power and in the medium term also storage options in electric mobility and hydrogen will be sufficient to run a reliable power system. International connections, such as German-Danish “Combined Grid Solution” offshore project and “Mittelachse” as well as NordLink to Norway or Alegro to Belgium are a good start but Germany still lacks behind in achieving the European Union target of being able to transport 15 percent of its electricity production capacity across the national border by 2030 (15% electricity interconnection target).

The important prerequisite is that states stop to think only nationally about their energy system, Jahn said. “Instead of doing everything to shift large amounts of offshore wind energy to Bavaria, it would make much more sense for Bavaria to get hydropower from Austria,” he said. The whole idea of connecting offshore wind farms to the power system should be approached from a European point of view, he argued, connecting these offshore energy hubs in the North Sea with the power systems of several countries, instead of building single-line connections to one country per wind park.

Things are moving on this on a European level as well. The European Commission has published its offshore strategy in the end of 2020 and will propose a framework for long-term offshore grid planning, involving regulators and the member states in each sea basin. The European Union Agency for the Cooperation of Energy Regulators (ACER) has initiated a “European resource adequacy assessment” to be conducted by the association of European TSOs (ENTSO-E) and describes the expected supply security level for the next ten years. In April 2021, a group of seven European TSOs announced the “Eurobar” partnership for interconnecting offshore wind platforms.